Bangladesh, situated in the northeastern corner of the Indian subcontinent, shares its borders with India and Burma.

With an estimated population of 165 million in 2021, as reported by the World Bank, Bangladesh stands as the eighth most populous nation globally.

In terms of population density, it is the most densely populated country after city-states.

As of 2021, Bangladesh ranked as the 32nd largest economy in the world based on its GDP (current US$).

In regards to GDP per capita (current US$), Bangladesh was positioned as the 133rd economy globally.

Bangladesh’s Foreign Trade:

Exports:

In 2021, Bangladesh emerged as the 56th largest exporter in the world, with a total export value of $51.8 billion.

Over the course of the past five years, the country’s exports experienced a notable increase of $14 billion, rising from $37.8 billion in 2016 to $51.8 billion in 2021.

Bangladesh is one of the biggest textile exporters in the world.

The ready-made garment (RMG) industry remains a significant driving force behind Bangladesh’s economic growth, contributing substantially to its export sector.

The primary exports of Bangladesh are led by Knit T-shirts, accounting for $7.06 billion, followed by Non-Knit Men’s Suits ($6.68 billion), Knit Sweaters ($6.32 billion), Non-Knit Women’s Suits ($5.41 billion), and Knit Women’s Suits ($3.54 billion).

Among the various destinations for Bangladeshi exports, the United States holds the top position, importing goods worth $8.72 billion.

Germany follows closely behind at $8.36 billion, with Spain at $3.6 billion, the United Kingdom at $3.29 billion, and Poland at $2.94 billion being other significant export destinations for Bangladesh.

Imports:

In 2021, Bangladesh ranked as the 48th largest trade destination in the world, with a total import value of $76.6 billion.

Over the past five years, the country’s imports have undergone a significant change, increasing by $34.1 billion from $42.5 billion in 2016 to $76.6 billion in 2021.

The primary imports of Bangladesh are dominated by Refined Petroleum, amounting to $5.48 billion, followed by Raw Cotton ($2.8 billion), Non-Retail Pure Cotton Yarn ($2.26 billion), Wheat ($1.92 billion), and Light Rubberized Knitted Fabric ($1.83 billion).

China stands out as the largest import partner for Bangladesh, with imports valued at $24.1 billion.

India follows closely behind at $14.1 billion, with Singapore at $3.53 billion, Indonesia at $2.92 billion, and the United States at $2.3 billion being other significant import partners for Bangladesh.

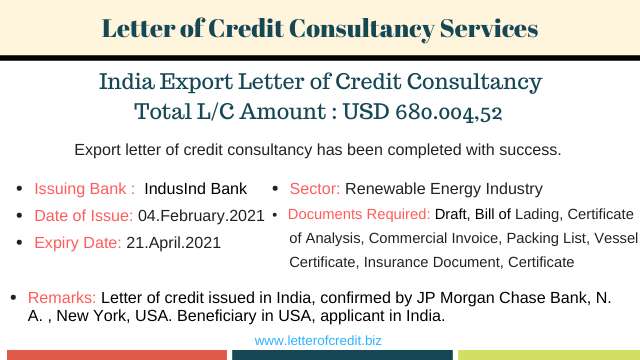

Letter of Credit Usage in Bangladesh:

Bangladesh import letters of credit have certain characteristics:

Bangladesh banks open letters of credit with excessive detail. A typical Bangladesh import L/C consists of 5-6 pages, requesting presentation of at least 8 different documents.

Due to country risks most of the banks do not confirm Bangladesh L/Cs.

CFR is the dominant Incoterms used in Bangladesh shipments. Chattogram Port is the main container port of the country. CFR Chattogram Port (Incoterms 2020) is the default Incoterms.

Insurance covered locally in Bangladesh by importers. Shipment advice a document that is generally requested by Bangladesh banks.

Bangladesh banks demand Beneficiary Certificates with different content under each letter of credit.

Despite being members of the World Trade Organization, Bangladesh continues to enforce a trade ban with Israel. It is not possible to make shipments with an Israel flag vessel to Bangladesh. Some L/Cs demand vessel certificate to confirm that carrying vessel is not Israel flag.