Some letters of credit indicate that stale documents are not acceptable. In rare circumstances letters of credit may also indicate that stale documents are acceptable.

But what is a stale document? When does a document set turn into a stale document phase as per latest letter of credit rules?

Why an issuing bank adds a phrase when issuing an l/c stating that : “stale documents are not acceptable” or “stale documents are acceptable”.

Does ICC encourage or discourage to use the “Stale Documents” term in letters of credit?

Background:

Letters of credit terminology have 3 important definitions in regards to the dates.

These definitions are

- “Date of Shipment”,

- “Presentation Period” and

- “Expiry Date”.

If you want to understand “stale documents” definition, you should be familiar with these terms.

Let me start explaining these definitions with the date of shipment.

Date of Shipment

When a pre‐printed “Shipped on board” bill of lading is presented, its issuance date will be deemed to be the date of shipment unless it bears a separate dated on board notation.

In the latter event, such date will be deemed to be the date of shipment whether that date is before or after the issuance date of the bill of lading.

Most commercial letters of credit demand presentation of a transport document.

According to letter of credit rules Multimodal Bill of Lading, Bill of Lading, Non-Negotiable Bill of Lading, Charter Party Bill of Lading, Air Transport Document, Road Transport Document, Rail Transport Document and Courier Receipt, Post Receipt or Certificate of Posting are considered to be a transport document.

On the other hand documents such as Forwarder’s Certificate of Receipt, Forwarder’s Certificate of Transport, Delivery Note, and Delivery Order are not considered to be a transport document under the latest version of the letter of credit rules known as UCP 600.

We can talk about the “date of shipment” term only if the letter of credit requests a transport document. Otherwise date of shipment will not be applicable.

Presentation Period

According to the letter of credit rules a presentation by or on behalf of the beneficiary must be made on or before the expiry date.

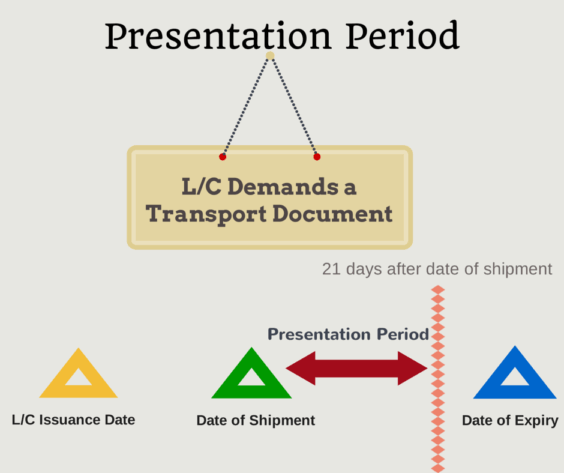

Additionally, UCP 600 states that a presentation including one or more original transport documents subject to articles 19, 20, 21, 22, 23, 24 or 25 must be made by or on behalf of the beneficiary not later than 21 calendar days after the date of shipment as described in these rules, but in any event not later than the expiry date of the credit.

These statements from the UCP 600 lead us to the definition of the presentation period.

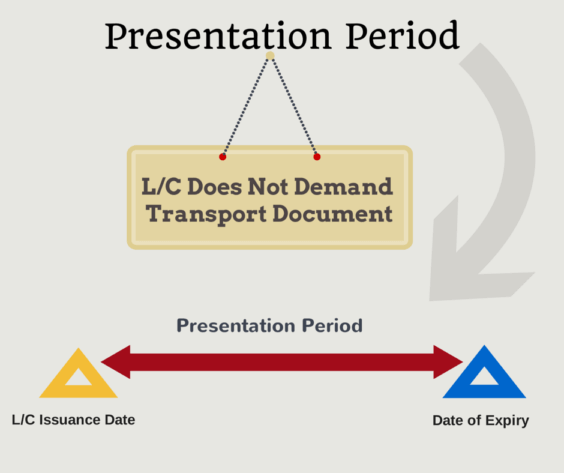

The presentation period can be defined as a period of time which starts with the issuance of the letter of credit and ends either with the expiry date of the letter of credit or else with the expiry of the allowed period time commencing after the date of shipment in case presentation contains a transport document.

- Presentation Period of a Letter of Credit When No Transport Document Must be Presented

If letter of credit does not require a transport document presentation, then the documents can be presented by the beneficiary any time between the letter of credit issuance date and the expiry date.

- Presentation Period of a Letter of Credit When a Transport Document Must be Presented

If letter of credit requires a transport document presentation, then the documents must be presented by the beneficiary within a certain time frame after the date of shipment.

UCP 600 defines presentation period as 21 days.

As per UCP 600, a presentation including one or more original transport documents subject to articles 19, 20, 21, 22, 23, 24 or 25 must be made by or on behalf of the beneficiary not later than 21 calendar days after the date of shipment.

21 days period can be decreased or increased by the issuing banks.

Exporters must look at the “Field 48: Period for Presentation” in order to determine the exact presentation period under a specific letter of credit.

Presentation Period Examples

Presentation Period Example 1:

Field 48: Period for Presentation

21 DAYS AFTER SHIPMENT DATE BUT WITHIN LC VALIDITY.Presentation Period Example 2:

Field 48: Period for Presentation

21 DAYS AFTER SHIPMENT DATE BUT WITHIN CREDIT VALIDITY.Presentation Period Example 3:

Field 48: Period for Presentation

DOCUMENTS MUST BE PRESENTED WITHIN 21 DAYS AFTER ISSUANCE OF THE TRANSPORT DOCUMENT BUT WITHIN THE VALIDITY OF THIS CREDITPresentation Period Example 4:

Field 48: Period for Presentation

21 DAYS FROM THE DATE OF BILLS OF LADING.Presentation Period Example 5:

Field 48: Period for Presentation

21 DAYS.Presentation Period Example 6:

Field 48: Period for Presentation

DOCUMENTS TO BE PRESENTED WITHIN 21 DAYS AFTER THE DATE OF SHIPMENT, BUT WITHIN THE VALIDITY OF THE CREDIT

Expiry Date

Expiry Date is the latest date for presentation of documents for payment, acceptance, or negotiation under a letter of credit transaction.

Exporters must complete their presentations before the expiry dates. After the expiry date, the letter of credit will be perish.

The issuing bank will be relieved all of its responsibilities, if no presentation has been made until the expiry date. In case of partial shipments non-utilized portion of the letter of credit will be vanish after the date of expiry.

Stale Documents Definition and Meaning:

ISBP 745 states that “stale documents acceptable” phrase should not be used in a letter of credit, as they are not defined in UCP 600.

If, nevertheless, it is used, and its meaning is not defined in the letter of credit, it shall have the following meaning under international standard banking practice:

Stale Documents Acceptable:

If “stale documents acceptable” stated in a letter of credit, then documents may be presented later than 21 calendar days after the date of shipment as long as they are presented no later than the expiry date of the credit.

This will also apply when the credit specifies a period for presentation together with the condition ”stale documents acceptable”.

ICC’s above explanation reveals that “stale documents” term should be used in conjunction with the situations in which letter of credit requires the presentation of a transport document.

Stale Documents Not Acceptable:

In most cases “stale documents not acceptable” condition can be seen in the documentary credits.

But this condition has no effect and meaning in a “letter of credit” transaction as a result issuing banks should refrain to use it.

Case Study: Documents Refused Due to Stale Documents

Letter of Credit

Field 46A: Documents RequiredSIGNED COMMERCIAL INVOICE IN TWO ORIGINALS AND THREE COPIES INDICATING SEPARATELY FOB VALUE, FREIGHT CHARGES, INSURANCE PREMIUM AND TOTAL AMOUNT CIF JEDDAH. ORIGINAL INVOICE TO BE CERTIFIED BY CHAMBER OF COMMERCE

FULL SET CLEAN ON BOARD BILLS OF LADING MADE OUT TO THE ORDER OF NATIONAL COMMERCIAL BANK, JEDDAH MARKED FREIGHT PREPAID AND NOTIFY APPLICANT

CERTIFICATE OF ORIGIN ISSUED AND CERTIFIED BY CHAMBER OF COMMERCE STATING THE NAME OF THE MANUFACTURERS OR PRODUCERS AND THAT GOODS EXPORTED ARE WHOLLY OF DOMESTIC ORIGIN

PACKING LIST IN TRIPLICATE SHOWING DETAILS OF PACKING.

Field 47A: Additional Conditions

STALE DOCUMENTS NOT ACCEPTABLE UNLESS AUTHORIZED BY US.Field 48: Period for Presentation

DOCUMENTS MUST BE PRESENTED WITHIN 21 DAYS AFTER ISSUANCE OF THE TRANSPORT DOCUMENT BUT WITHIN THE VALIDITY OF THIS CREDITPresentation and Refusal of Documents:

Beneficiary presented the documents to the nominated bank on 23rd of August.2014. The bill of lading which was presented by the beneficiary had an on board date 01.August.2014. The issuing bank refused the documents based on stale documents discrepancy, because documents have not been presented within 21 days after bill of lading date.