Recourse means the right to claim a refund of an amount paid in connection with the negotiation of a documentary credit or the discounting of a bill of exchange. (1)

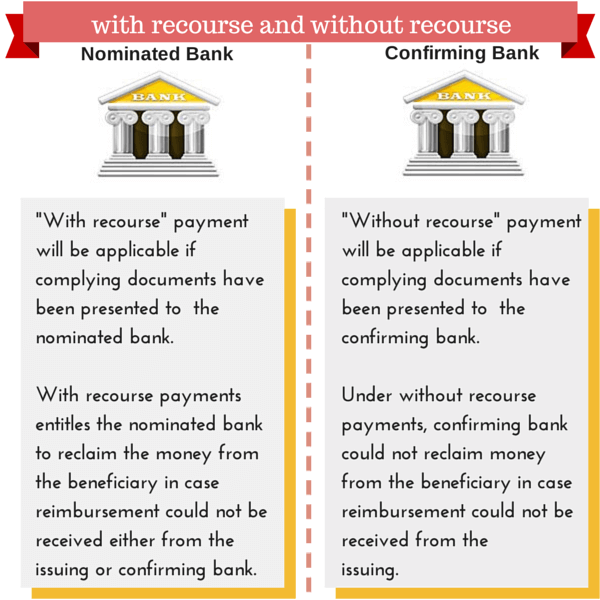

With recourse and without recourse are two terms defining whether or not the paying bank shall claim refund from the beneficiary in case it could not get reimbursement from the issuing bank.

On this post I will be answering below questions with the help of the graphic illustrations.

- What is the meaning of with recourse term in international trade finance terminology?

- What is the meaning of without recourse in international trade finance terminology?

- Which banks pay with recourse and which bank pay without recourse basis?

What is the Meaning of With Recourse and Without Recourse Terms in International Trade Finance Terminology?

With recourse term defines the situation in which the paying bank will be able to claim refunds from the beneficiary in case the letter of credit documents are not paid by the issuing bank.

In general, the nominated bank or the negotiated bank pay the letter of credit amount to the beneficiaries with recourse terms.

Without recourse term defines the situation in which the paying bank will not be able to claim refunds from the beneficiary in case the letter of credit documents are not paid by the issuing bank.

In general, the confirming bank pay the letter of credit amount to the beneficiaries without recourse terms.

Important Note: The nominated bank may also pay to the beneficiary against discrepant documents with recourse basis.

These types of payments should be covered with a formal indemnity.

References:

Documentary Credits, Nordea Trade Finance, Page: 305