Irrevocable letter of credit (ILOC) is a type of documentary credit which can not be cancelled or amended by the issuing bank without the agreement of the parties of the letter of credit transaction.

The letter of credit world is full of misunderstandings, improper industry practices including irregular banking practices, false information and so on.

Irrevocable letter of credit term is not an exception.

Many traders attribute irrelevant or false meanings to this term.

Let me give you a quick example: A trade manager once told me that he will secure the payment from his bank as long as he will receive an irrevocable letter of credit from his buyer.

He was mistakenly believing that the irrevocable letter of credit give him %100 payment assurance. But this is not true.

Definition of an Irrevocable Letter of Credit?

We can define an irrevocable letter of credit (ILOC) as a type of documentary credit which can not be cancelled or amended by the issuing bank without the agreement of the parties of the letter of credit transaction.

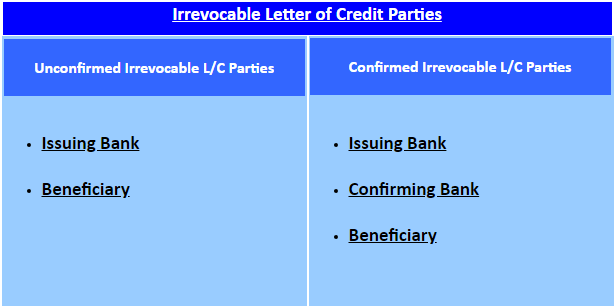

Table 1 shows the parties to the irrevocable letter of credit transaction.

If the letter of credit is confirmed, then the parties of the letter of credit are the issuing bank, confirming bank and the beneficiary.

If the letter of credit is not confirmed, then only the issuing bank and the beneficiary are the parties of the irrevocable letter of credit transaction.

- Issuing bank can not cancel or amend an unconfirmed irrevocable letter of credit without the written consent of the beneficiary.

- Issuing bank can not cancel or amend a confirmed irrevocable letter of credit without the written consent of the beneficiary and the confirming bank.

As illustrated above, the beneficiary of an irrevocable letter of credit knows that the terms and conditions of the credit can not be changed without his approval.

Also, he knows that the l/c will not be cancelled either.

But does this mean that the beneficiary have %100 payment guaranty under an irrevocable l/c. As I said earlier. No.

Let me write down my reasons,

- Letter of credit is a conditional payment method. In order to be getting paid under a letter of credit, irrevocable or revocable, the beneficiary has to make a complying presentation. In simple words, the beneficiary has to make the shipment and collect all trade documents requested under the l/c and present them to the issuing bank (nominated bank or confirming bank in some cases). Afterwards, the issuing bank will check the documents and pays the credit amount to the beneficiary only if the documents are found to be compliant.

- If issuing bank finds that the documents are non-compliant, then the issuing bank will send an advice of refusal to the beneficiary. The issuing bank sends the advice of a refusal as a swift message, MT 734 Advice of a Refusal.

Once the beneficiary has received the advice of the refusal from the issuing bank, he has 3 options.

- If the beneficiary has still enough time to correct the documents, he may try to do so by submitting new documents. But it is mostly not possible due to two major time constraints for a new presentation: The expiry date of the letter of credit and period for presentation of the documents.

- The second option of the beneficiary would be to apply the importer to accept the discrepancies.

- The final option would be recalling the documents from the issuing bank and trying to find a new buyer to the goods.

Conclusion:

A revocable letter of credit may be amended or cancelled by the issuing bank at any moment and without prior notice to the beneficiary.

Irrevocable letter of credit, on the other hand, can not be cancelled or amended by the issuing bank without the agreement of the parties of the letter of credit transaction.

According to the latest letter of credit rules (UCP 600) all credits are irrevocable.

Letter of credit is a conditional payment obligation of the issuing bank and the beneficiary always has to make a complying presentation in order to receive the payment.