Updated on:

A Letter of Credit (L/C) is a payment method in international trade that ensures secure payment and delivery of goods between exporters and importers.

It relies on collaboration between banks, logistics providers, the exporter, and the importer to reduce risks and enable smooth cross-border transactions.

On my previous posts, I have not only made a definition of a letter of credit but also clarified its types and parties that involved in it.

You can also check the risks associated with letters of credit and sample letters of credit from my past posts.

On this post, I will try to explain letter of credit process in a very simple way.

After reading this article, you should understand the working mechanism of letter of credit payment in general terms.

Please click to download our article “Letter of Credit Transaction” as a PDF.

How do documentary letters of credit work?

An LC transaction typically progresses through four key stages:

Issuance of the Letter of Credit

The process begins when the buyer (importer) requests their bank to issue a documentary credit, guaranteeing payment to the seller (exporter) once specific conditions are met. The LC specifies essential details, including shipment deadlines, required documents (such as the bill of lading and commercial invoice), and compliance standards. To enhance security, the exporter’s bank may confirm the LC, providing an additional payment guarantee.

Shipment of Goods

After receiving the LC, the exporter ships the goods according to the LC’s terms. This involves coordinating with freight forwarders, preparing shipping documents, and ensuring the goods meet all quality, quantity, and packaging requirements. Proof of shipment, a transport document such as the bill of lading, is crucial for the next step.

Presentation of Documents and Payment Settlement

Once the goods are shipped, the exporter presents the required shipping and trade documents to their bank. The bank verifies that the documents comply with the LC’s terms before forwarding them to the importer’s bank. The importer’s bank then reviews the documents and, upon approval, releases payment to the exporter or their bank. If discrepancies are found, payment may be delayed until resolved.

Customs Clearance and Final Transfer of Goods

After payment, the importer uses the shipping documents to clear the goods through customs. This involves submitting necessary paperwork, such as invoices and certificates of origin, paying duties, and arranging final delivery. The transaction concludes once the importer takes possession of the goods.

Letter of Credit Transaction

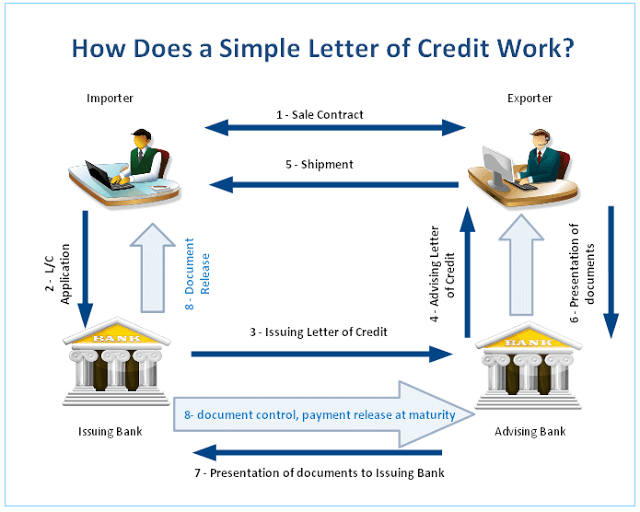

- The starting point of the letter of credit process is the agreement upon the sales terms between the exporter and the importer. Afterwards, they sign a sales contract. It is important to stress here that a letter of credit is not a sales contract. Actually, letters of credit are independent structures from the sale or any other contract on which they may be based. Therefore, it should be kept in mind that a well-structured sales contract protects the party, which behaves in goodwill against various kinds of risks.

- After the sales contract has been signed, the importer (applicant) applies for its bank having the letter of credit issued. The letter of credit application must be in accordance with the terms of the sales agreement.

- As soon as the importer and its bank reach an agreement together, the importer’s bank (issuing bank) issues the letter of credit. In case the issuing bank and the exporter (beneficiary) are located in different countries, the issuing bank may use another bank’s services (advising bank) to advise the credit to the exporter (beneficiary).

- The advising bank advises the letter of credit to the beneficiary without any undertaking to honor or negotiate. The advising bank has two responsibilities against to the beneficiary. Advising bank’s first responsibility is satisfy itself as to the apparent authenticity of the credit and its second responsibility is to make sure that the advice accurately reflects the terms and conditions of the credit.

- The beneficiary should check the conditions of the letter of credit, as soon as it is received from the advising bank. If some disparities have been detected, the beneficiary should inform the applicant about these points and demand an amendment. If letter of credit conditions seem reasonable to the beneficiary, then beneficiary starts producing the goods in order to make the shipment on or before the latest shipment date stated in the L/C. The beneficiary ships the order according to the terms and conditions stated in the credit.

- When the goods are loaded, the exporter collects the documents, which are requested by the credit and forwards them to the advising bank.

- The advising bank posts the documents to the issuing bank on behalf of the beneficiary.

- The issuing bank checks the documents according to the terms and conditions of the credit and the governing rules, which are mostly latest version of the UCP. If the documents are found complying after the examination, then the issuing bank must honor the payment claim. The issuing bank transmits the documents to the applicant, after securing its funds. (Letter of credit amount, expenses and profits)

- The applicant uses these documents to clear the goods from the customs.

Sources:

- A guide to documentary letters of credit, Lloyds TSB Commercial, dlcguide/0109, page :1

- Documentary credits in practice, Reinhard Längerich, Second edition – 2009, by Nordea

ÖZGÜR EKER (CDCS)

Letter of Credit Consultancy Services