Updated on:

Letters of credit have certain advantages as an international payment method.

If you have enough knowledge and expertise on letters of credit field, then you can use them wisely to get paid where no other payment method works.

No matter how many advantages letters of credit have, they have one big disadvantage.

They are expensive.

As a result, you should understand your costs, before finalizing a letter of credit deal.

Why Letters of Credit are Expensive Comparing to Other Payment Methods?

Banks play a key role in letters of credit transactions.

This is the main reason, why letters of credit are expensive comparing to other payment methods.

Issuing banks open letters of credit for the account of applicants and in favor of the beneficiaries.

Issuing banks have to bear certain amount of risks, when they open letters of credit. They also let the applicants are benefited from their credit worthiness.

As a commercial institution, issuing banks provide these services only for one reason. To earn more money, to make more profit.

Similarly, confirming banks collect fees from the letter of credit parties for the same reason.

When confirming a letter of credit, confirming banks may have to bear substantial amount of non-payment risk.

As a result, confirmation fees can sometimes be climbing to high values.

As I have indicated on my previous posts, in a typical letter of credit transaction an advising bank, a nominated bank, a reimbursing bank may exist in addition to that an issuing bank and a confirming bank.

Every additional bank means additional fees and additional costs for either applicants or beneficiaries.

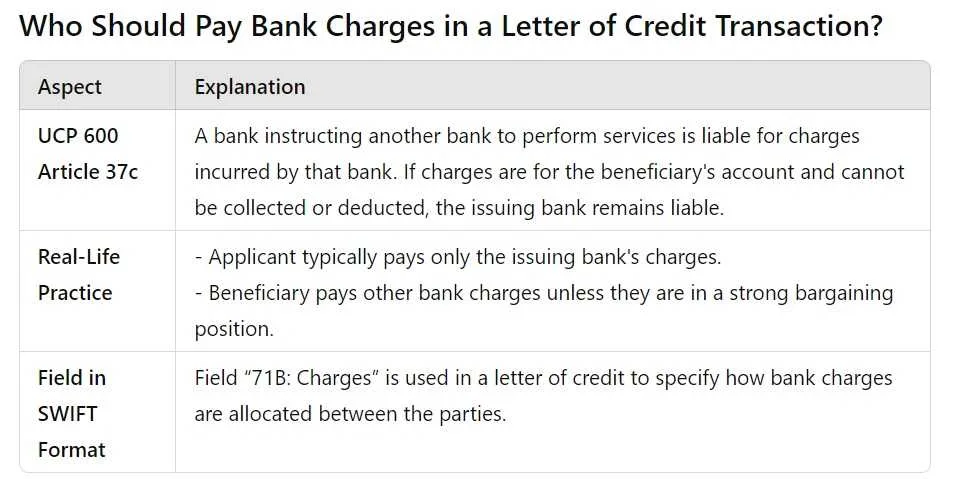

Who Should Pay Bank Charges in a Letter of Credit Transaction?

This question can be answered either by looking at the rules or by looking at the real-life situations, because what rules say is not what is really happening on practice.

- UCP 600’s article related to charges of letters of credit is article 37 c: “A bank instructing another bank to perform services is liable for any commissions, fees, costs or expenses (“charges”) incurred by that bank in connection with its instructions. If a credit states that charges are for the account of the beneficiary and charges cannot be collected or deducted from proceeds, the issuing bank remains liable for payment of charges.”

- In real life situations, the applicant pay only the issuing bank’s charges and remaining bank charges will be paid by the beneficiary unless the beneficiary is in a very strong position against the applicant. One must look at field “71B: Charges” in a letter of credit text, which is issued in swift format, to understand how bank charges are allocated to the letter of credit parties.

Examples:

Issuing bank charges will be paid by the applicant and all other charges will be paid by the beneficiary:

- “ALL BANKING CHARGES OUTSIDE BRAZIL ARE FOR BENEFICIARY’S ACCOUNT.” This letter of credit issued by a Brazilian bank.

- “OTHER THAN THE ISSUING BANKS ARE FOR THE ACCOUNT OF THE BENEFICIARY. ISSUING BANK’S CHARGES ARE FOR THE ACCOUNT OF THE APPLICANT.”

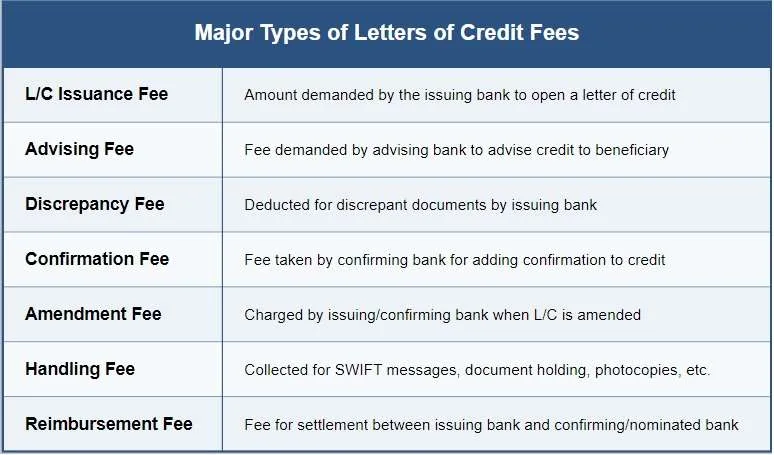

What are the Major Types of Letters of Credit Fees?

- L/C Issuance Fee: This is the amount demanded by the issuing bank to open a letter of credit.

- Advising Fee: A type of letter of credit fee, which is demanded by the advising bank to advise the credit to the beneficiary.

- Discrepancy Fee: The issuing bank discount a certain sum of money from the proceeds of the letter of credit, if the beneficiary has presented discrepant documents.

- Confirmation Fee: This is the fee, that is taken by the confirming bank to adding its confirmation to the credit.

- Amendment Fee: If the letter of credit is amended, the issuing bank and/or the confirming bank may demand amendment fees.

- Handling Fee: Handling fees are collected by banks for a variety of reasons, such as sending swift messages, holding documents, set of photocopy documents not presented etc.

- Reimbursement Fee: Reimbursement bank’s fee to settle the credit amount between issuing bank and the confirming bank or the nominated bank.

ÖZGÜR EKER (CDCS)

Letter of Credit Consultancy Services