Marine insurance, contract whereby, for a consideration stipulated to be paid by one interested in a ship or cargo that is subject to the risks of marine navigation, another undertakes to indemnify him against some or all of those risks during a certain period or voyage.(1)

In a letter of credit transaction where an insurance policy or certificate is required, the amount of coverage must be determined in accordance with the letter of credit conditions and current L/C rules.

There are two possibilities exist for the insurance coverage amount under letters of credit:

- First possibility is that when the credit indicates a fix amount to be insured. In this case the insurance policy coverage must match the indicated amount in the credit.

- Second possibility is that when the credit is silent about the insurance coverage amount or percentage. In that case the insurance document is to be issued in the currency of and, as a minimum, for the amount indicated under UCP 600 sub‐article 28 (f) (ii). (The letter of credit rules define minimum insurance coverage amount as at least 110% of the CIF or CIP value of the goods.)

It is worth mentioning that there is no maximum percentage of insurance coverage identified under the letter of credit rules.

But, insufficient insurance coverage will cause problems.

If the issuing bank finds out that the insurance coverage is less than what is required under the letter of credit, then the issuing bank raises a discrepancy, which is known as insurance coverage is insufficient.

Discrepancy Example: Insurance Coverage is Insufficient:

A letter of credit has been issued in SWIFT format, subject to UCP latest version, with the following details:

Letter of Credit Conditions

Field 32 B: Currency Code, Amount

Currency: USD (US DOLLAR)

Amount: #150.000,00#

Field 39 B: Maximum Credit Amount: Not Exceeding

Field 43P: Partial Shipments: Not Allowed

Field 43T: Transhipment: Not Allowed

Field 45A: Description of Goods and or Services: 100 pcs of 200mm Concrete Drainage Pipes. Delivery Terms: CIF Port of Apapa, Lagos Incoterms 2010.

Field 46A: Documents Required:

- A signed invoice in duplicate indicating the details of the descriptions of goods as per the L/C.

- Certificate of Origin issued and certified by any Chamber of Commerce in India indicating that goods are of Indian origin.

- Insurance policy/certificate endorsed in blank for covering Institute Cargo Clause (A), Institute Strikes Clause (cargo), Institute War Clauses (Cargo) with claims payable in Nigeria.

- Full set of clean on board bill(s) of lading issued or endorsed to the order of issuing bank, notify applicant showing “freight prepaid” and showing full name and address of the shipping company agent or his representative in Nigeria.

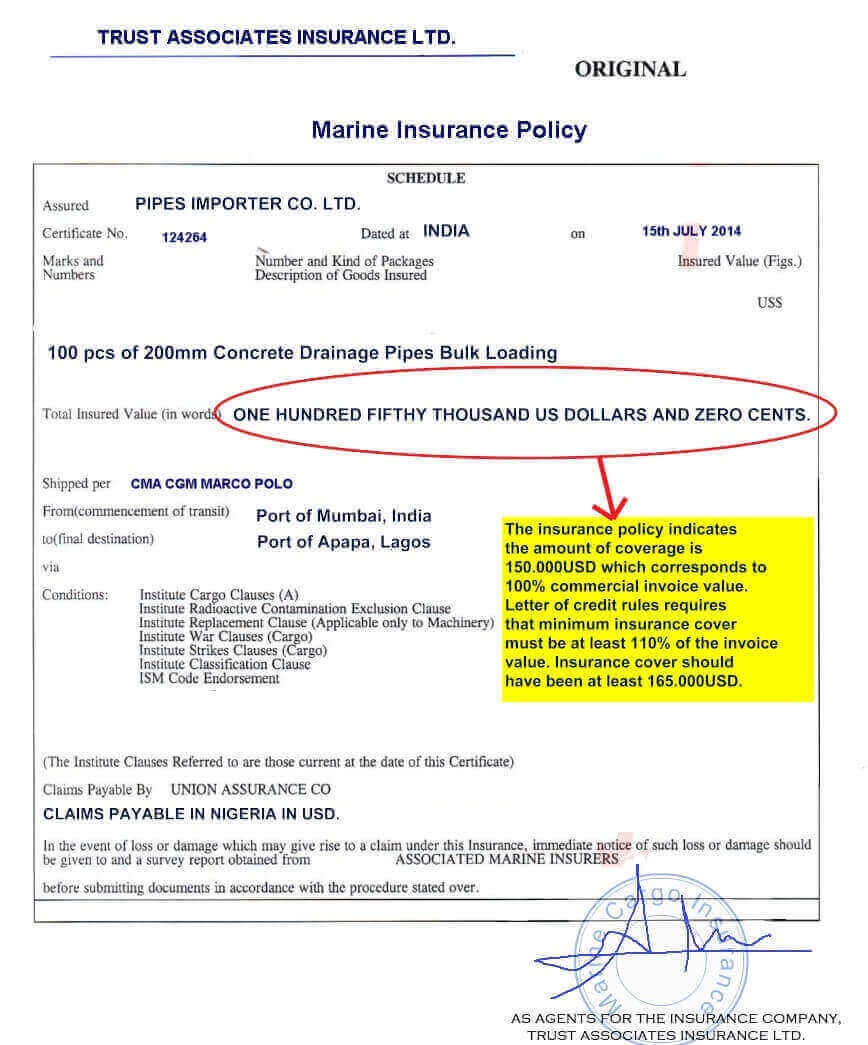

The beneficiary presented an insurance policy as shown on the below picture.

Insurance Policy

Discrepancy: The insurance policy indicates the amount of coverage is 150.000 USD which corresponds to 100% commercial invoice value. Letter of credit rules requires that minimum insurance cover must be at least 110% of the invoice value. Insurance cover should have been at least 165.000 USD.

Reason for Discrepancy: If there is no indication in the credit of the insurance coverage required, the amount of insurance coverage must be at least 110% of the CIF or CIP value of the goods.