Commercial invoice is a document which is used mostly in international trade transactions.

It is a commercial document required by customs to determine true value of the imported goods, for assessment of duties and taxes.

The commercial invoice is necessary for both the seller and the buyer.

With the commercial invoice, the seller confirms that goods have been delivered as contracted and therefore has the right to claim payment, provided that all information, payment terms, and commodity descriptions correspond exactly with the letter of credit instructions.

On the other hand, the importer needs the commercial invoice for customs clearance since customs authorities often use it to assess duties. (1)

Contents of the Commercial Invoice

There is no internationally accepted standard format in use that explains how to prepare a commercial invoice.

But a commercial invoice, which is going to be used in an international trade transaction, should cover following points.

- Name of the Exporter, address, and contact details: “consignor”

- Name of the Importer, address, and contact details: “consignee”

- Title of the document, commercial invoice number, commercial invoice date:

- “Commercial Invoice Date: 26.June.2012”, “Commercial Invoice No: CI26062012”

- Definition of goods: “Crushing and Screening Machine” etc…

- Delivery term: “FAS ANTWERP PORT, Incoterms 2010”, “FOB PORT OF SINGAPORE, Incoterms 2000” etc…

- Quantity, Unit Price, Currency Code, Total Price: “10 Mtons of “Titanium Dioxide Rutile” from 3.000 USD per Mton, Total Amount is 30.000,00 USD CIF HAMBURG PORT, Incoterms 2010.”

- Payment Terms: “Irrevocable Letter of Credit payable at 30 Days from Bill of Lading Date”, “Cash Against Documents at Sight” etc…

- Bank account details of the exporter and all other additional conditions regarding the sales.

- Insurance coverage and cost (if applicable)

- Shipping charges (if applicable)

- Signature and stamp (not required under letter of credit rules but it is asked by most of the custom authorities and government institutions.)

How to Use Commercial Invoice in Letters of Credit Transactions:

- A letter of credit requiring an “invoice” without further definition will be satisfied by any type of invoice presented such as commercial invoice, customs invoice, tax invoice, final invoice, consular invoice, etc. But invoices identified as “provisional”, “pro-forma” or the like are not acceptable under letters of credit rules and standard banking practices.

- When a credit requires presentation of a commercial invoice, a document titled “invoice” will be acceptable.

- The description of the goods, services or performance in the invoice must correspond with the description in the letter of credit text.

- The description of goods, services or performance in an invoice must reflect what has actually been shipped or provided.

- An invoice must evidence the value of the goods shipped or services or performance provided.

- Unit price(s), if any, and currency shown in the invoice must agree with that shown in the credit.

- The invoice must show any discounts or deductions required in the credit.

- The invoice may also show a deduction covering advance payment, discount, etc., not stated in the credit. (with this article letters of credit rules allow mixed payments under letter of credit payments. For example %25 advance payments outside letter of credit and %75 payable by at sight letter of credit is possible)

- If a trade term is part of the goods description in the credit, or stated in connection with the amount, the invoice must state the trade term specified, and if the description provides the source of the trade term, the same source must be identified (e.g., a credit term “CIF Hamburg Port Incoterms 2000” would not be satisfied by “CIF CIF Hamburg Port Incoterms”). Charges and costs must be included within the value shown against the stated trade term in the credit and invoice. Any charges and costs shown beyond this value are not allowed.

- The quantity of merchandise, weights and measurements shown on the invoice must not conflict with the same quantities appearing on other documents.

Special Hints Regarding the Commercial Invoice From ISBP (International Standard Banking Practice):

- Although it is not required by letter of credit rules, please do not forget to sign and stamp the commercial invoice that you need to present under the letter of credit. Signature and stamp on the commercial invoices are asked by most of the custom authorities and government institutions.

- Please make sure that your company name indicated in the letter of credit is correct. If your company name is not correct, get in touch with your customer and have the letter of credit amended.

- Please make sure that the description on the commercial invoice is matching with the description stated in the letter of credit.

- Do not write additional product names to the invoice which are not mentioned in the letter of credit, even if you give them free of charge.

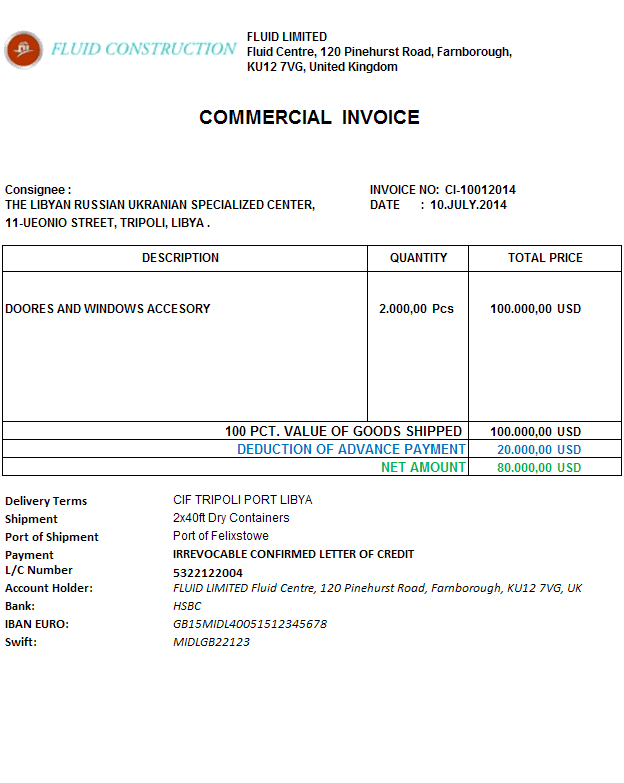

Sample Commercial Invoice:

References:

References:

- Documentary Risk In Commodity Trade, UNCTAD/ITCD/COM/Misc. 31, Page: 31