In international trade, a proforma invoice means a trade document that states a commitment from the seller (exporter) to sell goods to the buyer (importer) at specified conditions.

Proforma invoice can be defined as a compact form of an international sales contract. In other words, it is a lite version of the international sales contract.

Proforma invoice is expected to be issued by the seller, also known as exporter in international trade, at the beginning of the transactions.

Contents of the proforma invoice may change from industry to industry, customer to customer or country to country. There is no fix and single format available. (1)

A proforma invoice is not a valid invoice in terms of accounting. Because the proforma invoice cannot be recorded as an accounts receivable by the exporters, nor can it be recorded as an accounts payable by the importers.

The commercial invoice must follow and replace the proforma invoice as an official document, for importing procedures.

Proforma invoices are widely used in today’s international trade transactions in substitution of sales contracts.

It is easy to create a single-page proforma invoice instead of writing a multiple-page sales contract.

Contents of the Proforma Invoice

A proforma invoice that is going to be used in an international trade transaction should cover below points:

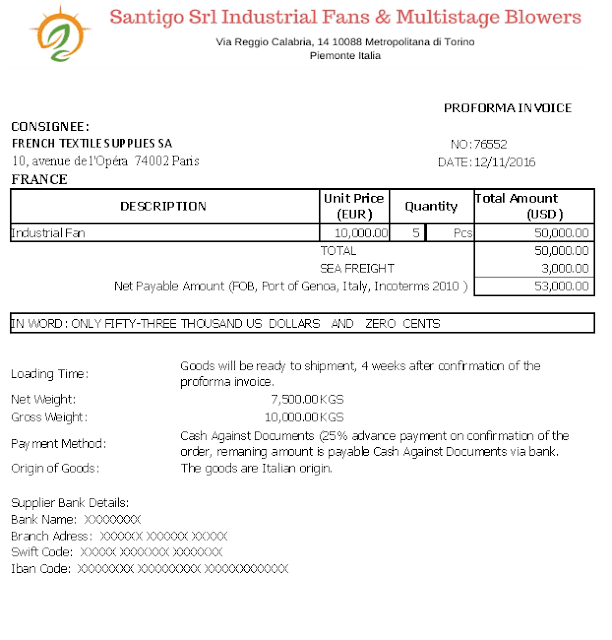

- Name of the Exporter, address and contact details.

- Name of the Importer, address and contact details.

- Title of the document, proforma invoice number, proforma invoice date : “Proforma

- Invoice Date : 26.June.2012″, “Proforma Invoice No : PI26062012”

- Definition of goods : “Crushing and Screening Machine” etc…

- Delivery term : “CIF NEW YORK PORT, Incoterms 2010”, “FOB STOCKHOLM PORT, Incoterms 2000” etc…

- Quantity, Unit Price, Currency, Total Price : “10Mtons of “Titanium Dioxide Rutile” from 3.000USD per Mton, Total Amount is 30.000,00 USD CIF HAMBURG PORT, Incoterms 2010.”

- Payment Terms : “Irrevocable Letter of Credit payable at 90 Days from Bill of Lading Date”, “Cash Against Documents at Sight” etc…

- Delivery Period : “4 weeks after confirmation”, “5 weeks after issuance of the letter of credit”

- Bank account details of the exporter and all other additional conditions regarding the sales.

How to Use Proforma Invoice in Letters of Credit Transactions:

- After the seller (exporter) and the buyer (importer) agreed upon certain conditions of the transaction, the importer demands a proforma invoice from the exporter.

- The exporter prepares the proforma invoice on his company letterhead and completes it with a signature.

- The exporter sends the proforma invoice by e-mail to the importer. Alternatively, the proforma invoice can be couriered to the importer. But, in most cases an e-mail copy of the proforma invoice would be sufficient for the importers.

- The importer applies to his bank with the proforma invoice to open a letter of credit in favor of the exporter.

- Banks will be using the details on the proforma invoice along with the information they gather from the importers via “Letter of Credit (L/C) Application Forms” (Import Documentary Credit Application Forms).

- As a common practice banks refer to the proforma invoice, especially the proforma invoice date and number, on the description of goods parts of the letters of credit.

Special Hints Regarding the Proforma Invoice From ISBP (International Standard Banking Practice):

- It is not possible present a document titled with “Proforma Invoice” instead of “Invoice” or “Commercial Invoice”. It is forbidden by current international standard banking practice, ISBP 2013.

- “A credit requiring an “invoice” without further definition will be satisfied by any type of invoice presented (commercial invoice, customs invoice, tax invoice, final invoice, consular invoice, etc.). However, invoices identified as “provisional”, “pro-forma” or the like are not acceptable.

- When a credit requires presentation of a commercial invoice, a document titled “invoice” will be acceptable.

- UCP 600 article 4-b : Credits v. Contracts states that “An issuing bank should discourage any attempt by the applicant to include, as an integral part of the credit, copies of the underlying contract, proforma invoice and the like.”

- The sales contract between the exporter and the importer is independent from the letter of credit. Which means that the beneficiary of the letter of credit will be paid by the issuing bank as long as the beneficiary comply with the terms and conditions of the letter of credit.

Proforma Invoice Sample

References:

- What is a proforma invoice? How does it work?, www.advancedontrade.com, Retrieved: 24.April.2018