What Does Reimbursement Mean?

Reimbursement is defined as a compensation paid to someone for an expense.

In order to be reimbursed by another person or organisation, first of all you have to make some expenses, then you will be qualified for a reimbursement.

The same logic apply to the reimbursement as a trade finance term.

A confirming bank or a nominated bank first honors or negotiates against a complying presentation under a letter of credit and then they will be reimbursed by the reimbursing banks in accordance with the issuing banks authorization.

Reimbursing Bank:

Reimbursing bank is the bank that, at the request of the issuing bank, is authorized to pay, or accept and pay time draft under a documentary credit in accordance with UCP 600 article 13 or if incorporated, the ICC uniform Rules for Bank-to-Bank Reimbursements under Documentary Credits (URR 725). (1)

What is the Function of a Reimbursing Bank Under a Letter of Credit?

There are two possible reasons that makes a reimbursing bank necessary under a documentary credit transaction.

First reason may be that the confirming bank does not trust the issuing bank in terms of risk issues and demands more security. In this situation presence of the reimbursing bank is a requirement for the confirmation.

Without receiving a reimbursement undertaking from the reimbursing bank, the confirming bank may elect not to add its confirmation to the credit.

Note: Please keep in mind that confirmation process is a commercial decision and no bank is forced to add its confirmation to any letter of credit. Please read my article Confirmation and Confirmed Letter of Credit for more detail.

Second reason could be that the issuing bank and nominated bank (in case confirmed letter of credit confirming bank) do not have an account relationship, as a result they may be requiring a third bank’s service for the settlement.

What are the Rules Covering Bank-to-Bank Reimbursements Under Letters of Credit?

There are two options for the reimbursement rules.

Reimbursements must be governed either by URR 725 or UCP 600 article 13 for the letters of credit which are opened according to latest documentary credit rules.

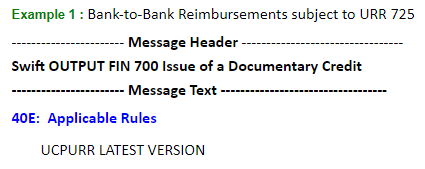

- URR 725 – The Uniform Rules for Bank-to-Bank Reimbursements under Documentary Credits – ICC Publication No. 725: This is a small size booklet published by ICC that specifically governs the bank-to-bank reimbursements. If issuing bank would like to be the reimbursement is subject to URR 725, then it must make a reference at the swift message when issuing a letter of credit.

Issuing bank put a reference to MT700 swift message under field “40E- Applicable Rules” as “UCPURR LATEST VERSION” which means that letter of credit is subject to latest version of letter of credit rules (UCP 600) and latest version of bank-to-bank reimbursements rules (URR 725).

Note: Additionally the reimbursement authorization should expressly indicate that it is subject to URR 725 – The Uniform Rules for Bank-to-Bank Reimbursements under Documentary Credits.

- UCP 600 Article 13: If a credit does not state that reimbursement is subject to the ICC rules for bank-to-bank reimbursements, the UCP 600 article 13 applies.

Some important definitions from URR 725 – The Uniform Rules for Bank-to-Bank Reimbursements under Documentary Credits:

- “Claiming bank” means a bank that honours or negotiates a credit and presents a reimbursement claim to the reimbursing bank. “Claiming bank” includes a bank authorized to present a reimbursement claim to the reimbursing bank on behalf of the bank that honours or negotiates.

- “Issuing bank” means the bank that has issued a credit and the reimbursement authorization under that credit.

- “Reimbursing bank” means the bank instructed or authorized to provide reimbursement pursuant to a reimbursement authorization issued by the issuing bank

- “Reimbursement Authorization” means an instruction or authorization, independent of the credit, issued by an issuing bank to a reimbursing bank to reimburse a claiming bank or, if so requested by the issuing bank, to accept and pay a time draft drawn on the reimbursing bank.

- “Reimbursement Undertaking” means a separate irrevocable undertaking of the reimbursing bank, issued upon the authorization or request of the issuing bank, to the claiming bank named in the reimbursement authorization, to honour that bank’s reimbursement claim, provided the terms and conditions of the reimbursement undertaking have been complied with.

- “Reimbursement Claim” means a request for reimbursement from the claiming bank to the reimbursing bank.

Reimbursement Transaction Under a Letter of Credit:

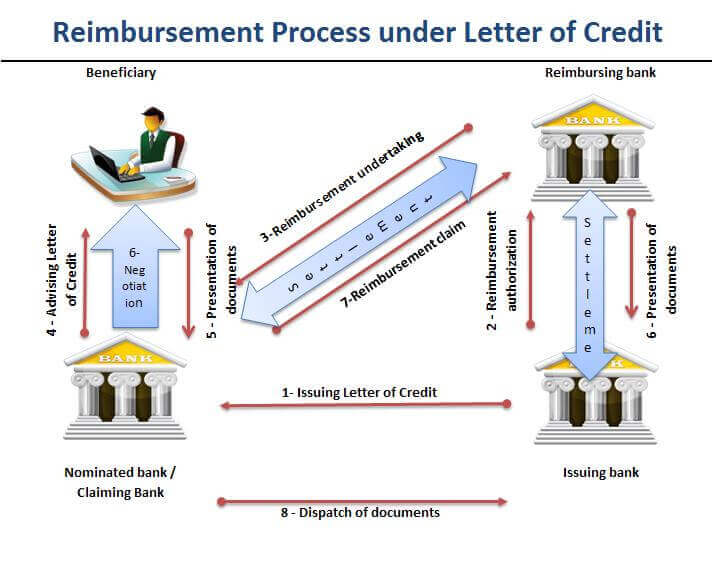

- Issuing bank issues the letter of credit and transmits it to the nominated bank via swift message.

- Issuing bank gives reimbursement authorization to reimbursing bank.

- Reimbursing bank issues its reimbursement undertaking and transmits it to the nominated bank via swift message.

- Nominated bank advices the letter of credit to the beneficiary. (please keep in mind that step 3 and step 4 may be change their sequence)

- Beneficiary presents documents to the nominated bank.

- Nominated bank checks the documents and negotiate upon a complying presentation.

- Nominated bank sends it reimbursement claim to the reimbursing bank. Reimbursing bank reimburse nominated bank according to terms and conditions of the reimbursement undertaking.

- Nominated bank send documents to the issuing bank.

- On the final stage issuing bank and reimbursing bank arrange settlement between themselves. Issuing bank gets the letter of credit amount from the applicant and releases original shipment documents.

References:

- The Guide to Documentary Credits” written by Garry Collyer, 3rd Edition, Page : 36)