Letters of credit are known to be one of the safest payment options for importers in international trade transactions.

However, this would not be a valid statement when importing goods from China.

It is advisable not to trust letters of credit alone, when you are importing from China.

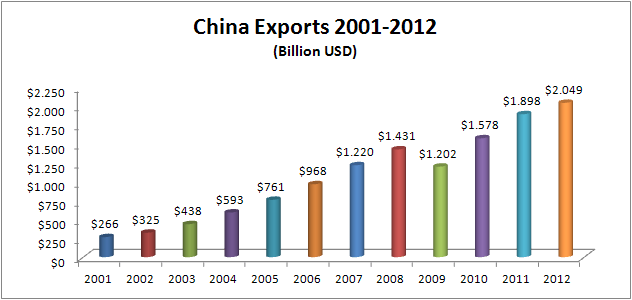

Chinese Exports Between 2001 and 2012:

Chinese exports have been increasing constantly for the last 15 years with only one year exception.

Chinese exports decreased only in 2009 during the 2001 and 2012 period. (See below figure.)

Total Chinese exports was 266 billion USD in 2001. Between 2001 and 2007 Chinese exports rose more than 5 times and reached to 1.220,00 billion USD value.

These figures made China the biggest exporting country in the world ahead of US just in the same year.

Since then China is the biggest exporting country in the world. As you can see on the below figure Chinese exports reached to 2.049,00 billion USD in 2012.

Figure 1: Chinese Exports Between 2001 and 2012

How China managed to increase its exports much faster than the world average?

According to Mary Amiti and Caroline Freund, Chinese export success is a result of shifting from soft export products such as textile industry to hard export products such as electronic goods. China became more specialized in higher value-added products and became more sophisticated. (1)

But this answer only move the nature of the original question while the original question remains mostly unanswered.

How Could China Manage to Transform its Economy to an Export Machine for a Quite Short Period of Time?

- Under the communist economy, China maintained minimal trade with the rest of the world.

- China was exporting limited raw materials and simple manufactured goods such as textiles to cover payments for imports of minerals and other production materials not available at home.

- In 1978 Deng Xiaoping announced the policy of reform and opening up. China’s total imports and exports of $20.6 billion ranked 32nd among all nations and accounted for less than one percent of global trade at that time.

- The reform period between 1980-1990 created a series of structural and economic policy changes in China such as reorganized and decentralized foreign trade institutions, promoted foreign economic relations and foreign direct investment, expanded foreign trade, and ushered China into a number of international organizations.

- By the end of the 1980s, Chinese trade totaled $115.4 billion, representing 24 percent of China’s GDP and 3 percent of total world trade and catapulting China to the 16th largest trader in the world.

- China focused on two key parameters during the 1990s in order to accelerate its exports growth rate.

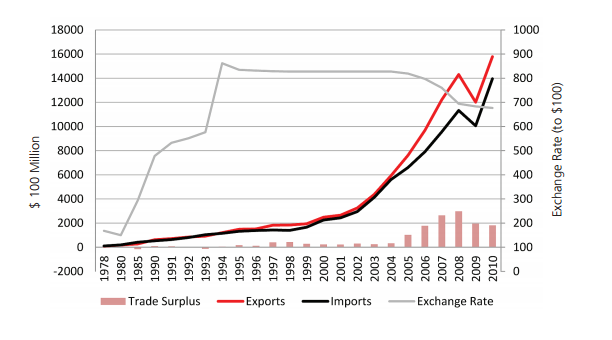

- Firstly, China fixed its currency to US Dollars in 1994. As of in year 1995 Chinese Renminbi has depreciated its value around 44 percent from the previous year. Since then Chinese governments have been keeping their exchange rate stable and undervalued.

Figure 2: Chinese Exchange Rate Between 1978-2010

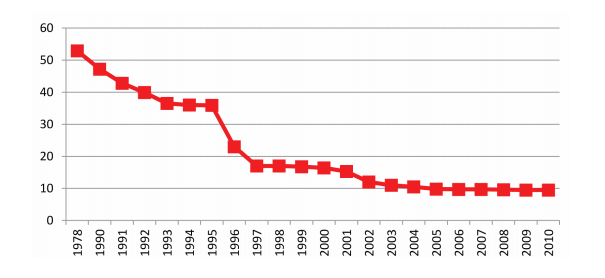

- Secondly China voluntarily reduced its custom tariffs rates on over 5,000 products. In 1990 Chinese average tariffs rate was 47.2 percent. In 1999 Chinese average tariffs rate dropped to 15.8 percent. Thanks to Chinese government’s efforts to liberate the country’s economy, China formally joined the WTO in year 2001.

Figure 3 : Chinese Average Tariff Rate Between 1978-2010

- Chinese international trade total reached to $474.3 billion in 2000, putting China sixth in the global trade ranking.

- Since 2001 China has been taking steps to better integrate its economy to global markets.

- As of 2012 China is the biggest trading nation in the world. China surpassed the U.S. to become the world’s biggest trading nation by the sum of exports and imports of goods. U.S. exports and imports of goods in year 2012 totaled $3.82 trillion, whereas Chinese trade in goods in the same year reached to $3.87 trillion.

What are the Challenges to China’s Fast Export Oriented Growth Strategy?

- Currency Manipulation: Western countries accuse China of currency manipulation. Since China fixed its currency to US dollars in 1994, Renminbi has not been appreciated despite very good performance of Chinese economy.

- Anti-Dumping: China is under a very high anti-dumping pressure as Chinese export products have been punished by anti-dumping measures at highest level in a global scale. According to the statistics released by the WTO, 22 percent (544/2411) of all anti-dumping measures have been imposed to Chinese exporters.

Figure 4 : Anti-Dumping Measures Against China 1995-2009

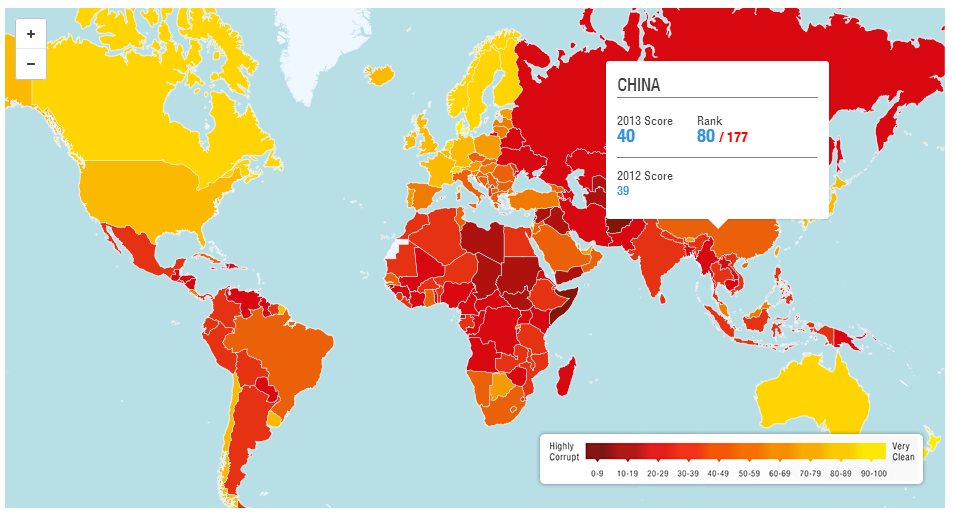

- Corruption: Rapid growth of Chinese economy led to a greater level of corruption in China. In 1995 Transparency International (TI) ranked China the fourth most corrupt country in its Corruption Perceptions Index. China is the 80th corrupt country in the world according to Corruption Perceptions Index of year 2013. Corruption is a huge problem in China in all levels of the society.

Figure 5 : Chinese Corruption Perceptions Index of year 2013

What You Should Expect When Doing Business in China?

- Chinese Economy is Still Controlled by the Government: Most of the Chinese economy is still controlled by the state owned companies; private sector is not allowed to enter profitable sectors. Chinese private sector mainly consists of SME enterprises which have to fight for their existence under fierce competition conditions. According to the public reports Chinese private sector does not have a good reputation among Chinese employees, who prefer to work in publicly controlled companies.

- There are Many Multinational Companies in China: During 1980s, 1990s and 2000s big Multinational Companies moved their production facilities to China. Actually big brands most of the times do not import from a Chinese company, but they dispatch their own production from China to western countries such as USA, Germany and UK.

- Fraudulent Companies Can Survive in China: May be the worst thing is the structure of the Chinese private sector, which it is creating a very suitable climate for the fraudulent companies or individuals to conduct their businesses under the radar.

What are the Weaknesses of the Letters of Credit Payments?

The most common China letter of credit fraud involves with non-existent cargoes and using letters of credit as a payment method of obtaining cash from the banks or importers.

According to letter of credit rules banks deal with documents and not with the goods.

If a fraudulent exporter manages to create fake shipment documents under a letter of credit, which is relatively easy, can manipulate the banks to obtain the payment and not to ship the goods at all.

China Letter of Credit Fraud Example:

Case Study : China Import Letter of Credit Fraud

Dear Steven

We have dealt with a Chinese company in order to buying polypropylene granules (a kind of raw material) from China. As you see in the attachments our deal was about 60 MT of the goods with the whole price of 60,600 USD.

We had opened our LC via our bank to them and the LC was LC at sight payable against the original full set of documents as bill of lading , certificate of inspection issued by CIQ organization and certificate of origin issued and certified by legal organizations in china.

The seller prepare all document and sent to his bank, then his bank sent the documents to our bank and ask for the price.

We checked the documents and see all of them are original without any discrepancies.

So our bank send the money to the seller.

When the goods arrived to our port we saw the amount and packing and every thing is not as our contract.

And the Chinese agent of the shipping company changed his BL and told us the original BL that was sent to your bank is fake !!!!!!!!! but the sale and signature of the shipping company is on our original BL.

Now we want to lawsuit against the seller immediately, please advise us the best way to claim.

In the attachment you can find all the important document about our deal.

Conclusion:

China is the world’s number one exporting country and biggest trading nation.

China achieved its leading position in international trade by means of rapid developments in exports and imports for the last three decades.

But this eye-catching quick expansion also brings its unique problems with as well. China has a highly manipulated and corrupt economy, controlled by central and local governments.

Fraudulent international transactions have been increased in China along with its exports and imports.

Although letter of credit is known to be one of the safest payment options for importers, it would not be the actual case in China.

If you are planning to import goods from China, it is advisable not only hiring a professional broker resident in China, who checks the exporting company, but also implementing a pre-shipment inspection of goods.

If you are going to use the letter of credit as a payment, please do not forget to read our suggestions specific to Chinese letters of credit.

References:

- Mary Amiti and Caroline Freund, China’s Export Boom, Finance & Development A quarterly magazine of the IMF, September 2007, Volume 44, Number 3 (Retrieved:28.August.2014)

- Li, Xiaojun. “China as a Trading Superpower.” (2013).

- http://wits.worldbank.org/Default.aspx

- http://www.chinawhy.net/blog/Article.asp?id=122