What is a CDCS (Certified Documentary Credit Specialist)?

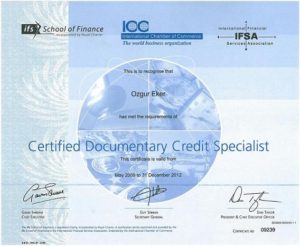

CDCS (Certified Documentary Credit Specialist) is an international title in trade finance.

In order to get the CDCS title, participants must pass an examination which takes around 3 hours. CDCS certificate examination is organised by The London Institute of Banking & Finance.

CDCS ( Certified Documentary Credit Specialist ) is the professional certification which will enable letter of credit practitioners to prove their specialist knowledge and application of the skills required for competent practice in a global scale.

The CDCS certification has been developed in consultation with industry experts to ensure that the certification reflects best practice.

The London Institute of Banking & Finance and BAFT (The Bankers Association for Finance and Trade) jointly developed the CDCS certification programme. CDCS is also endorsed by the International Chamber of Commerce.

It is the only certificate which is approved by ICC on documentary credit field.

The CDCS is the international standard for documentary credit specialists.

Banks prefer CDCS entitled practitioners for their trade departments in order to reduce their own risks by working with professionals who approved their competence from the institution that is creator and governor of the documentary credit rules.

Scope of the CDCS Certificate:

- Documentary credits – an overview, types, characteristics and uses, including standby credits

- The sales agreement

- Rules and trade terms, including UCP 600, ISP 98, ISBP 745, Incoterms 2010® and URR 725

- Parties to documentary credit transactions and their roles and obligations

- Types and methods of payment / credit used in documentary credit transactions, including the concept of autonomy

- Types of transport, commercial and financial documents used in documentary credit transactions

- Risk issues, including types of risks, control and possible mitigations

- Related products, including letters of indemnity, Air Way Releases and Steamship Guarantees

- Implications of breaching rules including money laundering and terrorist financing

Eligibility of the Examination:

There are no entry requirements for the CDCS examination. Anyone, who pays the exam fees, can enter the examination.

However please keep in mind that it is not easy to pass the CDCS exam. You should prepare well for the examination.

Examination takes place in English language only.

Time constraint is one of the biggest problems on the examination, especially for the non-native English speakers. As a result, English reading pro-efficiency is a must.

You have to read and understand the questions very fast.

The London Institute of Banking & Finance recommends to the exam participants have a minimum of three years’ documentary credit experience for their own benefit.

Examination Format:

Assessment for CDCS consists of a 3 hour multiple-choice examination, designed to test knowledge and its application to practical situations.

The examination paper consists of 70 multiple-choice questions, 3 in-basket case studies and 3 document checking simulations.

The content of the CDCS examination is based on the results of a job analysis study that identified key responsibilities of a documentary credit practitioner and areas of knowledge and skills required for competent practice.

To earn the professional designation you are required to pass a three-hour examination that is designed to test your knowledge and its application to practical situations.

The examination is based on an English study text.

The examination consists of multiple choice knowledge and application questions as well as sample in-baskets and simulations that test for analysis skills.

Organizers:

- USA, Canada and Mexico CDCS examination held by BAFT-IFSA. You can reach their website from this link.

- All other countries CDCS examination held by IFS University College. You can reach their website from this link.

Costs:

- USA, Canada and South America CDCS examination which is held by BAFT-IFSA cost you around 800USD. (2019 fees)

- All other countries CDCS examination which held by The London Institute of Banking & Finance cost you around 580GBP. (650EUR)

*for exact and up-to-date cost please refer to above official websites.

How to Prepare?

You have to study by yourself to the CDCS examination. Once registered a textbook is sent to every candidate by post.

As of 2014, this text book is “The Guide to Documentary Credits” written by Gary Collyer. This book will be your main textbook.

Also you can enter libf.ac.uk website with your password to reach online materials. Preparation for the examination usually takes six months with comprehensive learning materials provided.

Assessment Criteria:

You can reach CDCS examination learning outcomes and assessment criteria from this link.

CDCS Content Outline

| Learning Outcome | Syllabus |

|---|---|

| Learning Outcome: 1. Understand the main types, characteristics and uses of documentary credits. | Syllabus: • Understanding of the term documentary credit • A basic documentary credit transaction (including generic flow chart of this process) • Types of documentary credit • Primary characteristics of documentary credits • Secondary characteristics of documentary credits: - Revolving credits - Instalment - Advance payments - Transferable - Evergreen - Clean - Direct pay • Categorisation of documentary credit by type and characteristic • Commercial documentary credits • Standby letters of credit |

| Learning Outcome: 2. Know the industry rules, standards, guidelines and trade terms that govern the delivery of documentary credit transactions. | Syllabus: • Incoterms 2010® • UCP 600 – Uniform Customs and Practice for Documentary Credits • ISP98 – International Standby Practices • URR 725 – Uniform Rules for bank-to-bank reimbursement under documentary credits • ICC decision on original documents (Appendix to ICC publication 645 – ISBP) • ISBP 681 • eUCP |

| Learning Outcome: 3. Understand the ways in which documentary credit transaction rules and regulations can be breached and the implications of such breaches. | Syllabus: • Money Laundering • Sanctions • Terrorist Financing |

| Learning Outcome: 4. Understand the roles and obligations of the parties to documentary credit transactions and the relationships between them. | Syllabus: • Parties to documentary credits roles and responsibilities: - Issuing bank - Beneficiary - Applicant - Non-bank issuers - Confirming bank - Advising bank - Negotiating bank - Paying bank - Accepting bank - Reimbursing bank - Transferring bank - Nominated bank - Presenting bank • Banks roles and obligations: - Issuing bank - Confirming bank - Advising bank - Negotiating bank - Paying bank - Accepting bank - Reimbursing bank - Transferring bank - Nominated bank - Presenting bank - Beneficiary • Relationship of parties in respect of payment of conforming documents and non-payment of non-conforming documents • Roles and responsibilities in reimbursement |

| Learning Outcome: 5. Understand the types and methods of payment and credit used in documentary credit transactions. | Syllabus: • Types of payment: - Sight - Deferred - Negotiation - Acceptance • Transmission of proceeds • Types of credit • With and without recourse • The autonomy of a documentary credit as a payment mechanism |

| Learning Outcome: 6. Understand the types of transport, commercial and financial documents used in documentary credit transactions and their requirements under ICC rules. | Syllabus: • Characteristics, processing and rules that apply to transport documents: - Bill of Lading - Charter Party Bill of Lading - Non-negotiable Seaway Bill - Multimodal Transport Document - Air Transport Document - Road, Rail or Inland Waterway Transport Document - Forwarder’s Cargo receipt, Mate’s Receipt and Consolidator’s Receipt - Post Receipt or Certificate of Posting - Courier or Expedited Delivery Service Document • Financial and Commercial documents: - Draft / bill of exchange - Commercial Invoice - Insurance Document - Weight Certificate - Certificate of Origin - Packing Lists - Inspection Certificate • Documents for official purposes and checking mechanisms |

| Learning Outcome: 7. Understand the processes and challenges involved in documentary credit transactions. | Syllabus: • Processes and activities associated with: - Sales agreement / contract of sale - Issue - Pre-advise - Advise - Confirm - Amend - Transfer - Present - Examine - Pay / Reject - Claim - Reimburse Funds - Cancel • Presentation, Examination and Settlement / Rejection • Identifying and handling discrepant documents Syllabus • Electronic presentations • Problems that can arise during the documentary credit transaction process |

| Learning Outcome: 8. Understand and manage the risks involved in documentary credit transactions. | Syllabus: • Types of Risk - Operational / UCP 600 - Credit - Foreign Exchange - Fraud - Legal - Political • Other risks / considerations - Money Laundering - Sanctions - Terrorist Financing - Credit Risk Assessment / Management • Risks to the parties to documentary credits: - applicant - issuing bank - beneficiary - advising bank - nominated bank - confirming bank - reimbursing bank • How risks can be controlled |

| Learning Outcome: 9. Understand the related products used in documentary credit transactions. | Syllabus: • Letter of Indemnity • Air Way Release • Steamship Guarantee • Assignment of Proceeds • Participation and Syndication • Refinance Credits • Reimbursement undertaking |

| Learning Outcome: 10. Be able to manage the transport, commercial and financial documents used in documentary credit transactions. | Syllabus: • Apply and analyse the transport, commercial and financial documents used in documentary credit transactions in order to recommend appropriate courses of action and manage documentary credit transactions. |

How to Apply?

- USA, Canada and Mexico CDCS examination held by BAFT. You should apply for a cdcs certificate exam from their official website from this link.

- All other countries CDCS examination held by The London Institute of Banking & Finance. You should apply for a cdcs certificate exam from their official website from this link.