Commercial Letters of Credit

- Commercial credits are used mainly in export and import transactions of tangible goods.

- Majority of commercial letters of credit are issued subject to the latest version of UCP (Uniform Customs and Practice for Documentary Credits).

- UCP (Uniform Customs and Practice for Documentary Credits) are the set of rules that governs the commercial letters of credit procedures.

Standby Letters of Credit

- Standby credits are used mainly in contraction projects as well as export and import transactions of tangible goods.

- Majority of standby letters of credit are issued subject to the latest version of ISP (International Standby Practices).

- ISP (International Standby Practices) are the set of rules that governs the Standby letters of credit procedures.

Irrevocable Letter of Credit

- Irrevocable means not to be revoked or recalled; unalterable according to Kernerman Webster’s College Dictionary.

- Irrevocable Letter of Credit is a type of letter of credit which can not be cancelled or amended without the written agreement of the credit parties.

- If credit is unconfirmed unconfirmed than beneficiary beneficiary and issuing issuing bank must reach an agreement on the amendments.

- If credit is confirmed than beneficiary, issuing bank and confirming bank must reach an agreement on the amendments.

- All credits issued subject to UCP 600 are irrevocable unless otherwise specified.

Revocable Letter of Credit

- Revocable means capable of being revoked; able to be cancelled according to Kernerman Webster’s College Dictionary.

- Irrevocable Letter of Credit is a type of letter of credit which can be cancelled at any time without prior notification to the beneficiary.

- Revocable credits can not be confirmed. So all revocable credits are

need to be unconfirmed. - Revocable credits can not be confirmed. So all revocable credits are

need to be unconfirmed. - Unconfirmed credits can be amended or cancelled by the issuing bank at any time without prior agreement of the beneficiary.

- All credits issued subject to UCP 600 are irrevocable unless otherwise specified.

- Revocable credits can still be issued subject to UCP 500.

Transferable Letter of Credit

- Transferable Letters of Credit are suitable for triangle trade. Triangle trade is a trade where a middleman exist between the buyer (importer) and the seller (exporter).

- Transferable letter of credit issued in favor of the middleman. Then middleman transfers part of the credit to the ultimate supplier of the goods.

- Middleman’s Middleman’s commission commission is the difference difference of these two credit amounts amounts. (issued amount-transferred amount=commission of the middleman)

- Transferable Letters of Credit can be issued subject to UCP 600.

- Transferable credit can be transferred more than one beneficiary. (partial transfer is allowed)

- Transferred credits can not be transferred to another second beneficiary once more.

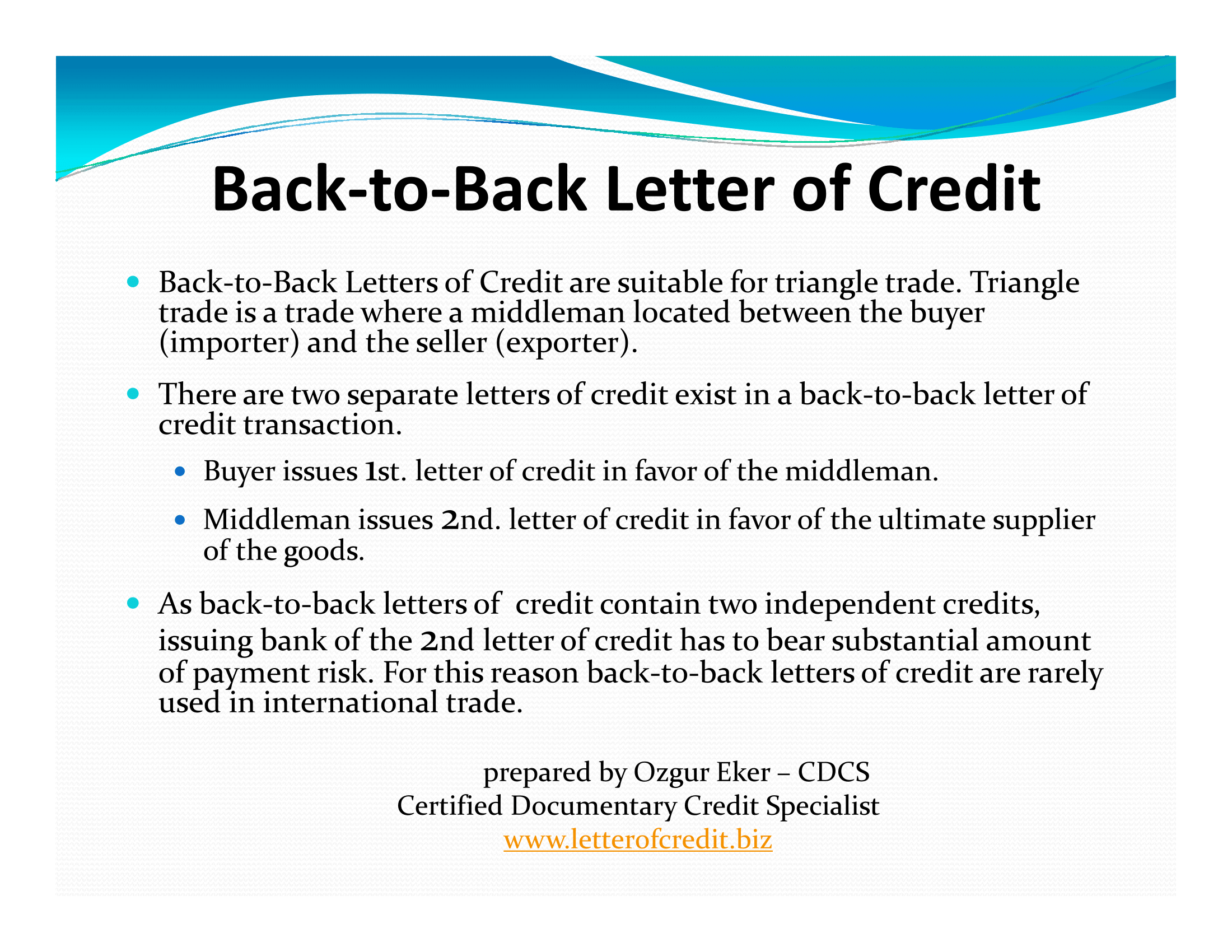

Back-to-Back Letter of Credit

- Back-to-Back Letters of Credit are suitable for triangle trade. Triangle trade is a trade where a middleman located between the buyer (importer) and the seller (exporter).

- There are two separate letters of credit exist in a back-to-back letter of credit transaction.

- Buyer issues 1st. letter of credit in favor of the middleman middleman.

- Middleman issues 2nd. letter of credit in favor of the ultimate supplier of the goods.

- As back-to-back letters of credit contain two independent credits, issuing bank of the 2nd letter of credit has to bear substantial amount of payment risk. For this reason back-to-back letters of credit are rarely used in international trade.

Revolving Letter of Credit

- If buyer and seller are trading the same commodity regularly on a certain period of time than they may choose to work with a revolving letter of credit instead of issuing a new LC every shipment.

- Buyer’s bank (issuing bank) issues a letter of credit that replenishes either in value or in time.

- Revolves by value : Letter of credit is reissued automatically when credit amount is utilized.

- Revolves by time : an amount is available in fixed installments over a period