Discrepancy can be defined as an error or defect, according to the issuing bank, in the presented documents compared to the documentary credit, the UCP 600 rules or other documents that have been presented under the same letter of credit.

According to the LC Market Intelligence Survey conducted by DC-Pro in year 2005 the average discrepancy rate on first time presentations under export letters of credit is 56%.

Although the report is quite out-dated, the figures are presumably almost identical today.

Discrepancies create problems especially for the exporters.

Once the documents are rejected, the issuing banks can only pay the credit amount, if and only if the importers accept the discrepancies.

Leaving the payment decision to the importers’ hands is a great deal of frustration for the exporters.

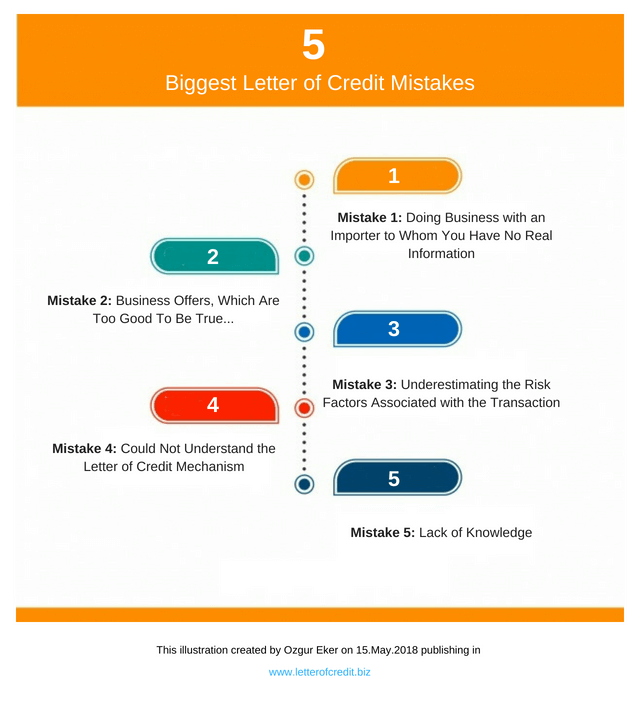

There are many reasons why exporters present discrepant documents, but the most important ones are:

- lack of knowledge,

- could not understand the letter of credit mechanism and

- underestimating the risk factors associated with the letter of credit transaction.

On this page, you can find 10 most frequently seen discrepancies with examples in letters of credit.

Discrepancy Number 1 : Inconsistency in Documents

UCP 600 states that “Data in a document, when read in context with the credit, the document itself and international standard banking practice, need not be identical to, but must not conflict with, data in that document, any other stipulated document or the credit.”

So if banks find inconsistency between documents, they raise a discrepancy.

Discrepancy Number 2 : Incorrect Data

Information any one of the document presented is not comply with the letter of credit terms and conditions.

Banks examine the documents under a letter of credit according to the letter of credit rules in order to determine whether the presentation is complying or not.

According to Article 2, a complying presentation means a presentation in accordance with the terms and conditions of the credit, the applicable provisions of the UCP 600 and international standard banking practice.

As a result if banks find out that at least one of the letter of credit condition is not indicated on the presented documents, they raise a discrepancy.

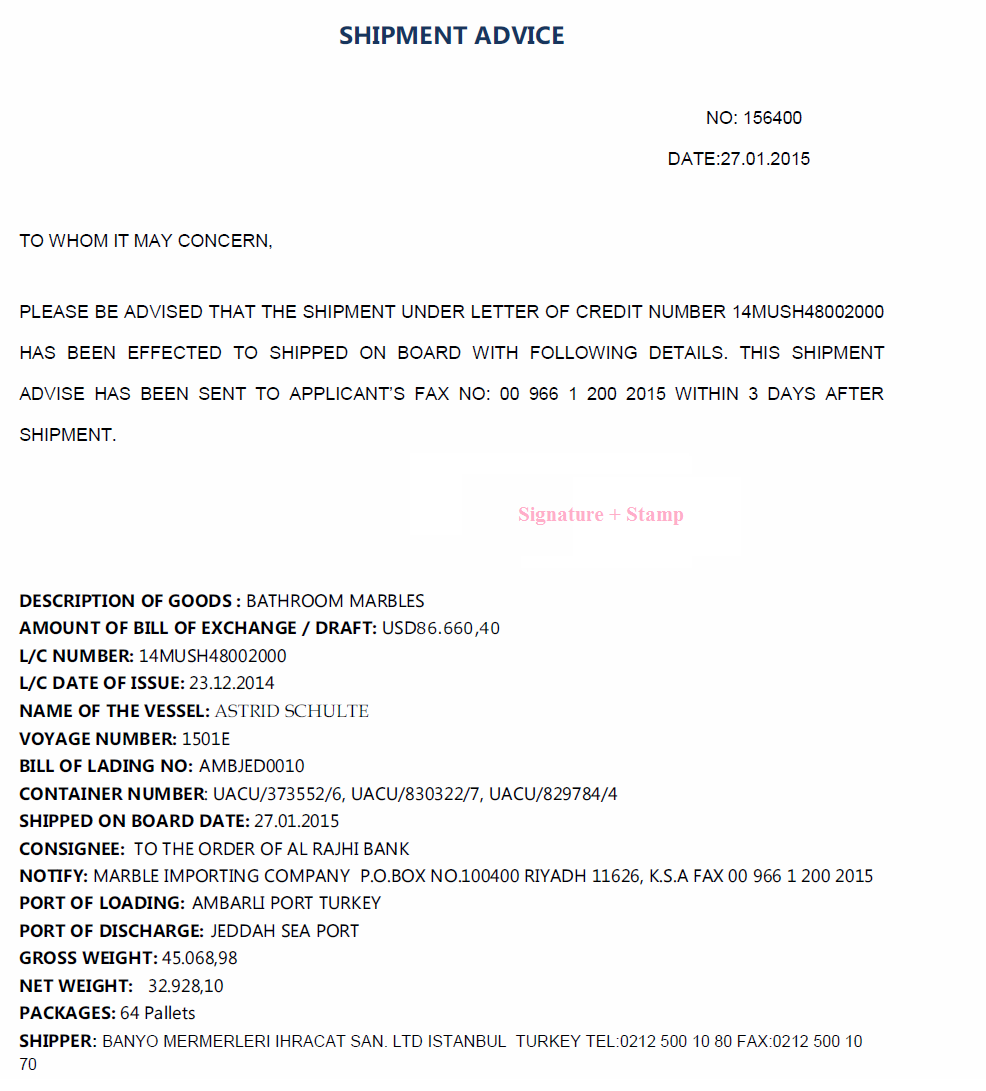

Discrepancy Number 3 : Late Shipment

Goods shipped after the permitted shipment date or period.

If date of the transport document such as the bill of lading date corresponds to a later date than the latest date of shipment stipulated in the credit, then banks raise the late shipment discrepancy.

Example: Multimodal Bill of Lading Late Shipment Discrepancy

Discrepancy Number 4 : Late Presentation

Documents presented later than 21 days after shipment or after the number of dates stipulated in the letter of credit.

If the credit is silent on the latest date of presentation, then you have to present your letter of credit documents within 21 days after “the date of shipment”.

But please keep in mind that this period can be shorten by the credit. As a result you need to read your credit very carefully in order to determine your presentation period.

Discrepancy Number 5 : Letter of Credit Expired

Documents presented after the letter of credit has expired.

Normally banks should not accept any documents that have been presented after the expiry date of the credit.

However, banks left the final decision to the applicants on this regard by evaluating the late presentation as a discrepancy.

Discrepancy Number 6 : Absence of Documents

Documents required by the letters credit is missing. Missing document discrepancy may also cover insufficient number of original documents presentation.

For example, the UCP 600 demands presentation of all original insurance documents if the insurance document states that it is issued more than one original.

If it is clear on the insurance document that it is issued in two originals, then the beneficiary has to present both originals of the insurance documents. If the beneficiary presents only one original instead of two originals, then the issuing bank raises absence of documents discrepancy.

Example: All Originals of Insurance Policies Have Not Been Presented Discrepancy

Discrepancy Number 7 : Carrier Not Defined on the Bill of Lading

The name of the carrier on the bill of lading is not defined and bill of lading is not signed by the master, the carrier or an agent on behalf of the carrier or master.

UCP 600 Article 20 indicates that:

A bill of lading, however named, must appear to:

i. indicate the name of the carrier and be signed by:

– the carrier or a named agent for or on behalf of the carrier, or

– the master or a named agent for or on behalf of the master.

Any signature by the carrier, master or agent must be identified as that of the carrier, master or agent.

Any signature by an agent must indicate whether the agent has signed for or on behalf of the carrier or for or on behalf of the master.

If banks could not locate the name of the carrier on the face of the bill of lading, then they mention this point as a discrepancy.

Example: Carrier Not Identified and Bill of Lading Not Signed As Per UCP 600 Discrepancy

Discrepancy Number 8 : Incorrect Description of Goods

Description of goods indicated on the invoice and other trade documents differs from the description of goods stated in the credit.

According to the international standard banking practice, the description of the goods, services or performance shown on the invoice is to correspond with the description shown in the credit.

There is no requirement for a mirror image. For example, details of the goods may be stated in a number of areas within the invoice which, when read together, represent a

description of the goods corresponding to that in the credit.

A goods description indicated on any other document may be in general terms not in conflict with the goods description in the credit.

If banks determine that the description of the goods not corresponding to the letter of credit, they raise incorrect description of goods discrepancy.

Example: Description of Goods Discrepancy

Discrepancy Number 9 : Incorrect Endorsement / Absence of Endorsement

Bill of lading, insurance policy or draft (bill of exchange) not endorsed by the beneficiary of the credit.

Discrepancy Number 10 : Partial Shipment or Transshipment Effected Despite L/C Terms

Exporters have to be very careful with the partial shipments and transshipments.

Please read credit text and determine if credit allowed or not allowed partial shipments and transshipments.

Example: Partial Shipment Discrepancy