On this post, I will explain Forwarder’s Certificate of Transport, an international trade document, only issued by freight forwarders, whom are the members of the FIATA (International Federation of Freight Forwarders Associations).

The FCT is an acronym which stands for “Forwarder’s Certificate of Transport”.

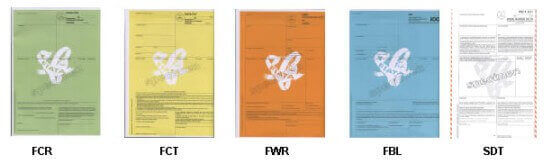

FCT is another standard document template created by FIATA (International Federation of Freight Forwarders Associations) for general use in international shipments.

FCT is only available to FIATA member freight forwarders.

FCT certificate is a signed declaration of the freight forwarder, in which he confirms to the consignor that he has taken over the goods and has assumed responsibility for delivery of the consignment as per instructions, that he has received from the consignor as indicated on the FCT document.

It must be noted that according to the FCT certificate a freight forwarder acts as a freight forwarder and not as a carrier.

A freight forwarder is responsible for the signature of the contract of carriage or carriages with the carrier or carriers. The freight forwarder is not responsible for the acts of the carriers.

Important Note: FCT is not a contract of carriage as a result it is not a transport document unlike bill of lading, multimodal bill of lading, air waybill, road transport document or rail transport document.

Why Exporters and Importers are Using a FCT Certificate?

FCT document mostly used in international transactions where Ex Works (EXW) or Free Carrier (FCA) trade terms is chosen by the exporters.

According to ICC’s Incoterms 2010 rules, “Ex Works” means that the seller delivers when it places the goods at the disposal of the buyer at the seller’s premises or at another named place (i.e., works, factory, warehouse, etc.).

The seller does not need to load the goods on any collecting vehicle, nor does it need to clear the goods for export, where such clearance is applicable.

As per Incoterms 2010 “Free Carrier” means that the seller delivers the goods to the carrier or another person nominated by the buyer at the seller’s premises or another named place.

Seller can prove to the buyer that he has already places the goods at the disposal of the buyer’s forwarder with the presentation of Forwarder’s Certificate of Transport.

Also if the payment will be made via documentary collection or letter of credit, banks or buyers would request presentation of a FCT document.

What are the Main Characteristics of a FCT Certificate?

By issuing a FCT certificate, the freight forwarder certifies to the consignor that,

- the freight forwarder has been authorized to enter into contracts with the carriers and

- the freight forwarder has taken charge of the goods as indicated on the forwarder’s certificate of transport in apparent good order and condition and

- the freight forwarder is responsible for delivery of the goods to the holder of the certificate through the services of the carriers of their choice and

- the freight forwarder will be acting as a freight forwarder not as a carrier and

- the freight forwarder will not be held liable for the acts of the carriers.

FCT certificate does not contain a contract of carriage. As a result it is not considered as a transport document.

FCT certificate can be issued in a negotiable form. If a FCT certificate issued in a negotiable form, it is very important to state whether it is issued in one original or else how many original copies have been issued on the face of the document.

What are the Differences Between a FCR (Forwarder’s Certificate of Receipt) and a B/L (Bill of Lading)?

Bill of Lading

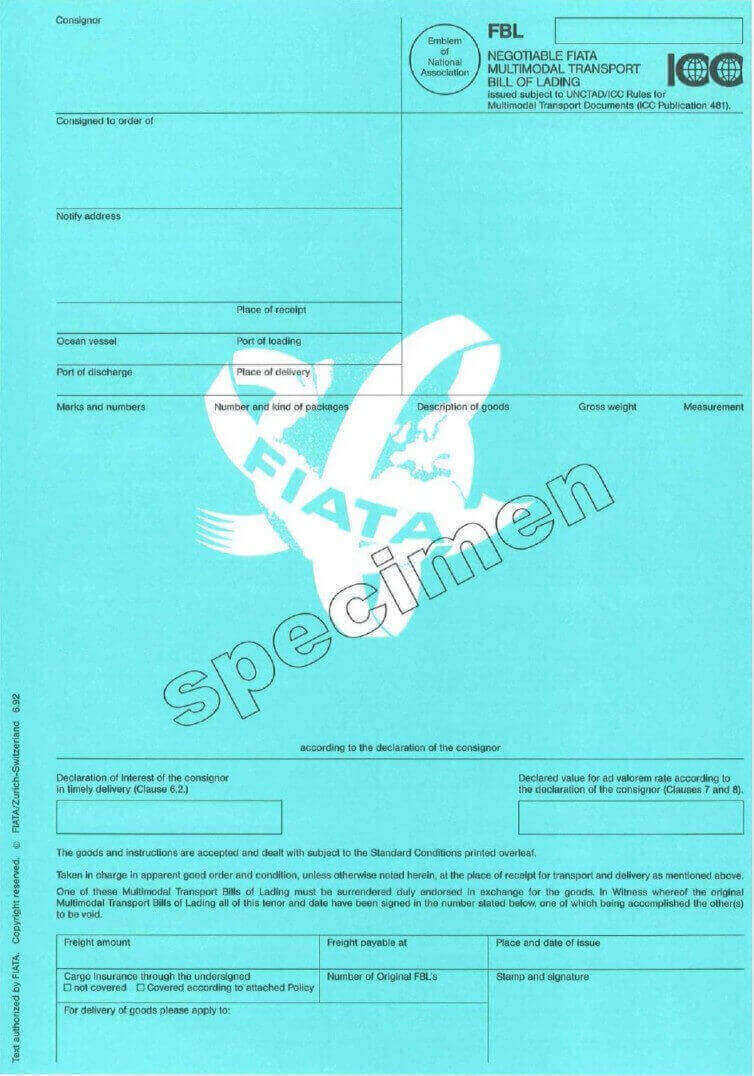

- Bill of lading contains a contract of carriage between port of loading and port of discharge.

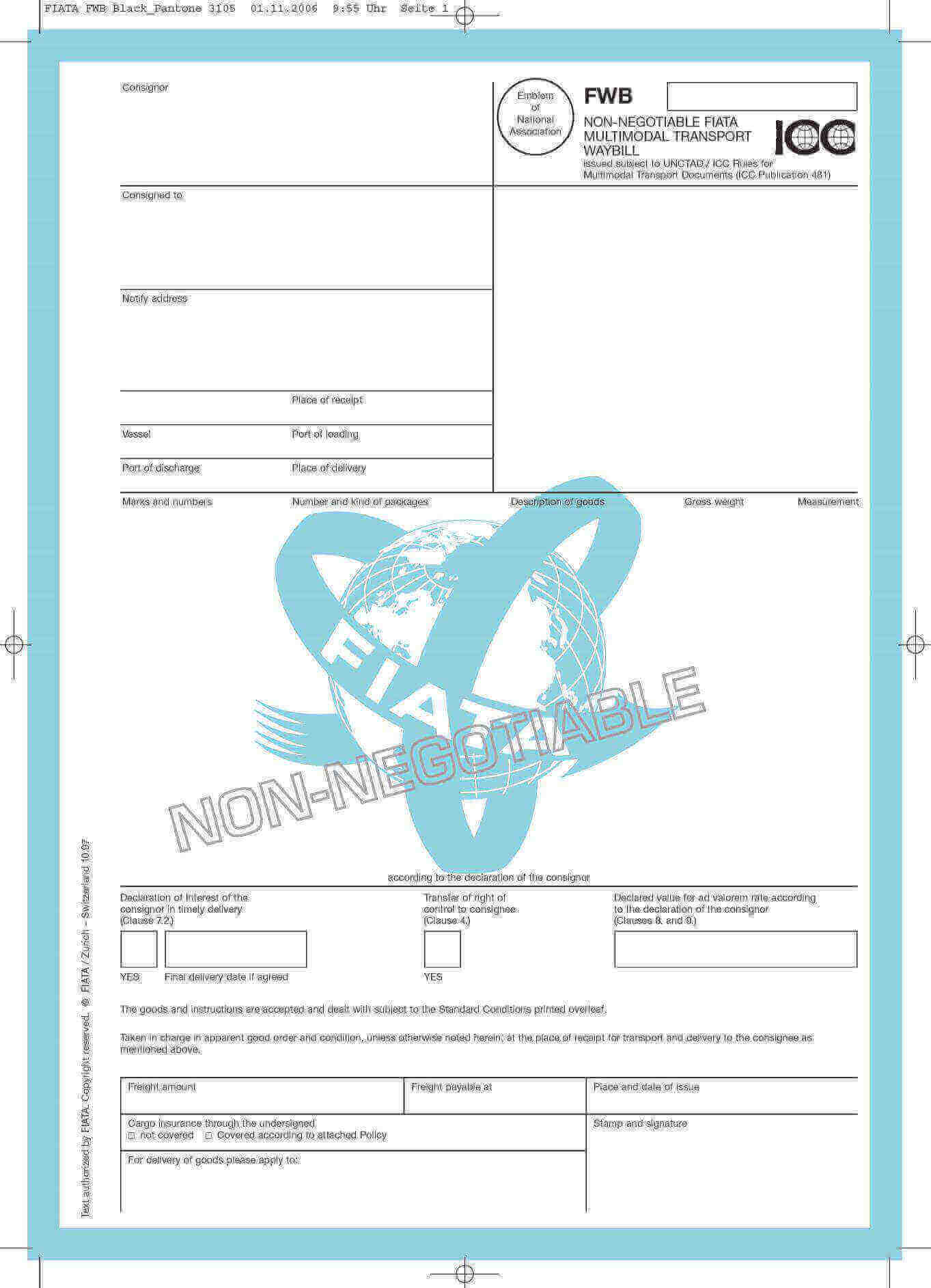

- Bill of lading can be issued in a negotiable form as shown on the below examples:

-made out to the order of the issuing bank.

-made out to order and blank endorsed. - At least one original bill of lading must be surrendered to the carrier for delivery of the goods in case bill of lading was issued in negotiable form

- Bill of lading is a transport document in regards to letter of credit rules.

- Bill of lading should show port of loading, port of discharge and shipped on board date on its face.

Forwarder’s Certificate of Transport

- Forwarder’s Certificate of Transport does not contain a contract of carriage as a result it is not a transport document in regards to letter of credit rules.

- Forwarder’s Certificate of Transport can also be issued in negotiable form as shown on the below examples:

*made out to the order of the issuing bank.

*made out to order and blank endorsed. - At least one original Forwarder’s Certificate of Transport must be surrendered to the carrier for delivery of the goods in case Forwarder’s Certificate of Transport was issued in negotiable form

- Forwarder’s Certificate of Transport need not to state port of loading, port of discharge and shipped on board date on its face.

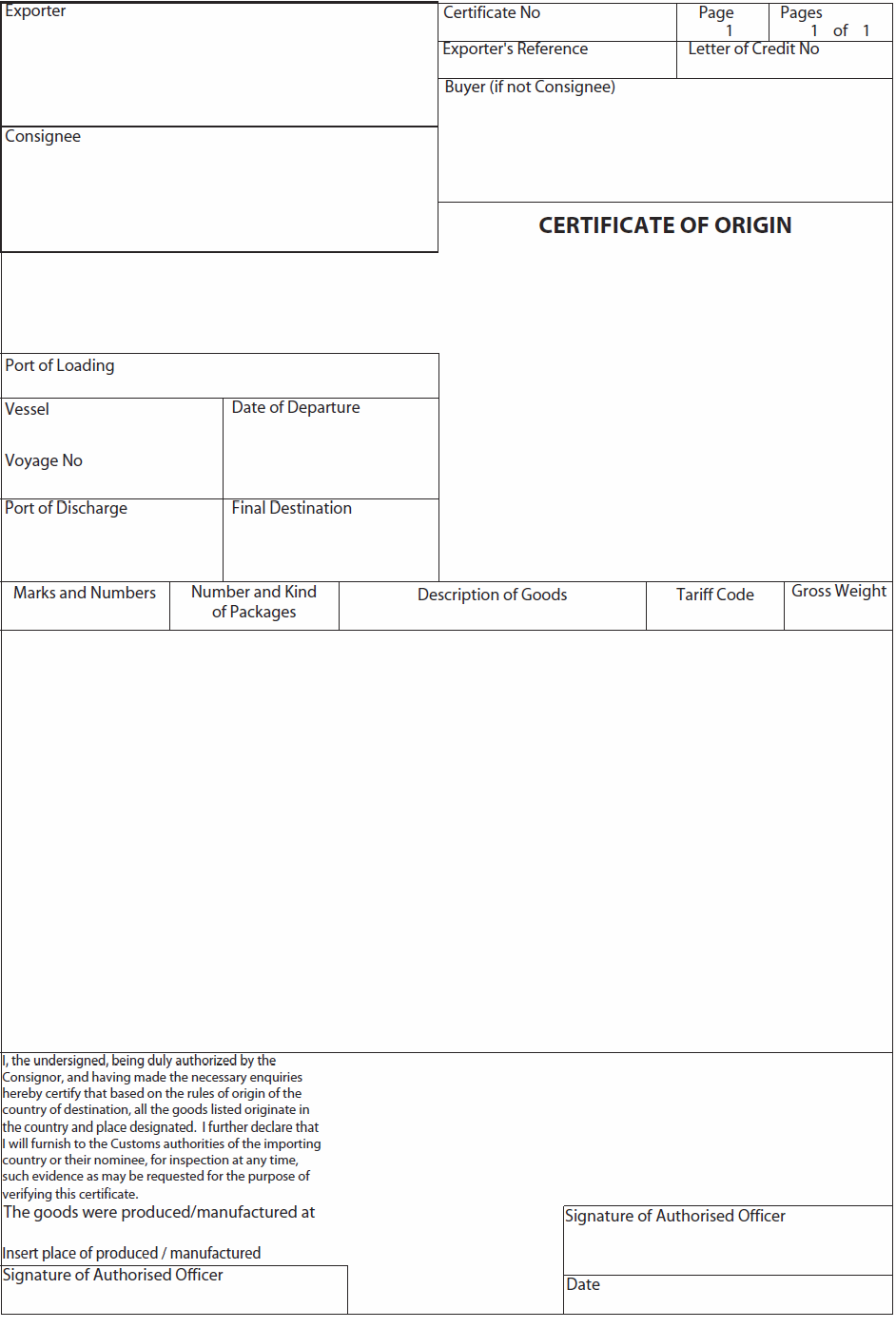

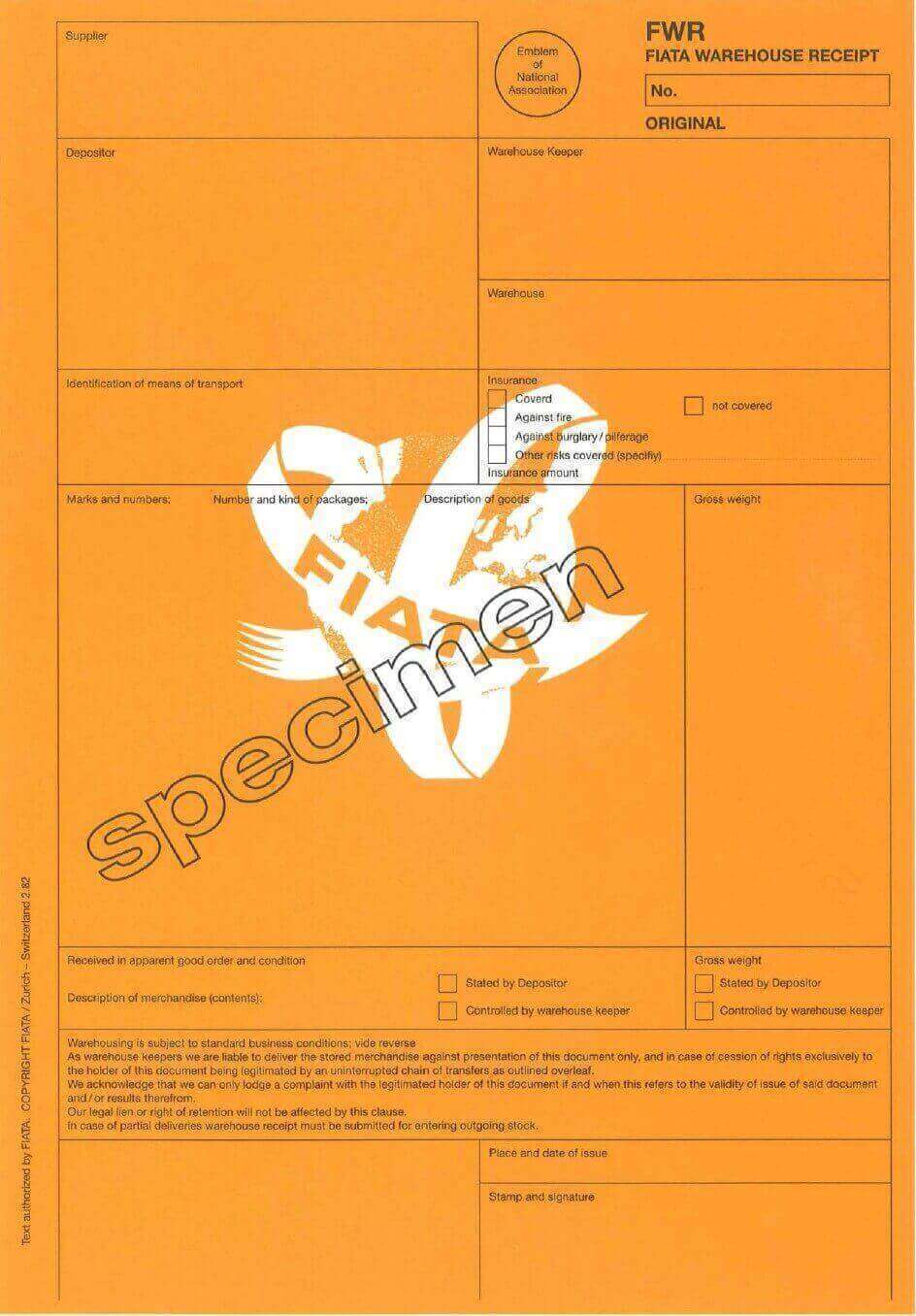

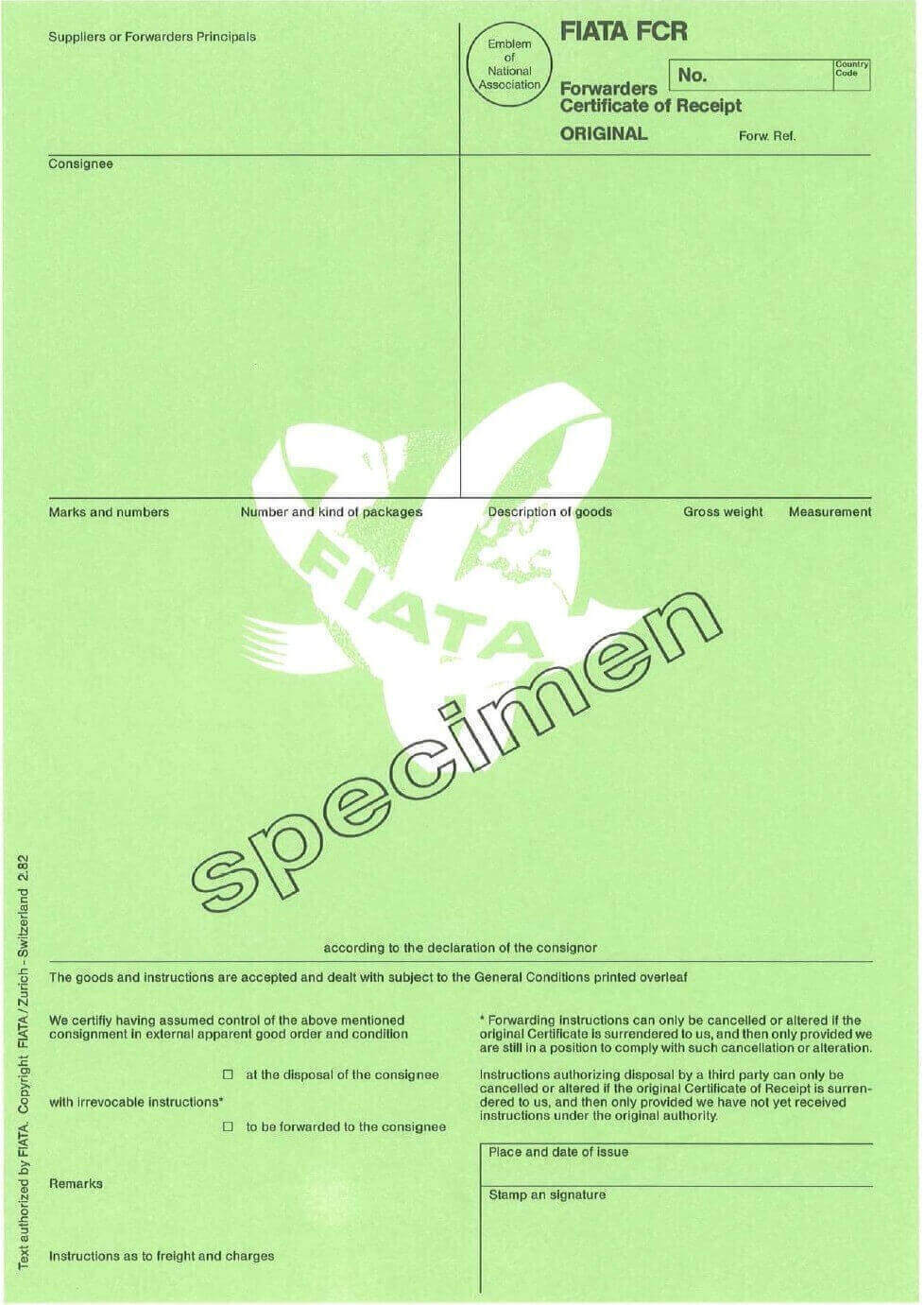

Sample Form of Forwarder’s Certificate of Transport

On the rear side of the legalized invoice, you can see a chain of signatures and stamps belonging to different parties.

On the rear side of the legalized invoice, you can see a chain of signatures and stamps belonging to different parties.