Brazil, which is located in South America, is the world’s fifth-largest country by area and the fifth most populous one.(1)

It is bordered by Argentina, Bolivia, Colombia, French Guiana, Guyana, Paraguay, Peru, Suriname, Uruguay and Venezuela.(2)

Brazil is one of the world giants of mining and agriculture.

It is a leading producer of a host of minerals, including iron ore, tin, bauxite (the ore of aluminum), manganese, gold, quartz, and diamonds and other gems, and it exports vast quantities of steel, automobiles, electronics, and consumer goods.

Brazil is the world’s primary source of coffee, oranges, and cassava (manioc) and a major producer of sugar, soy, and beef.(3)

On this page you can find brief information in regards to Brazil economy and international trade, banks in Brazil and letter of credit usage tips specific to Brazil.

Brazil Exports at a Glance:

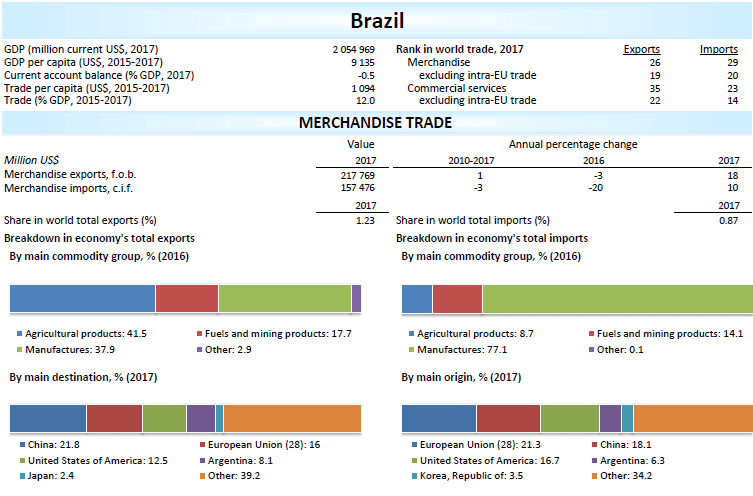

As of 2017 Brazil is the 26th biggest exporting country in the world. Brazil’s 2017 exports declared as 217 billion US dollars in value.

Breakdown of Brazil’s total exports by main commodity groups are: agricultural products: %41.5, fuels and mining products: %17.7 and manufactures: %37.9.

Brazil is one of the top commodity supplier of the world. Soya beans, sugar, coffee, beef, iron ore are some of the top exporting commodity goods of Brazil.

The most significant export destinations of Brazil are China: %21.8 European Union (28): %16, United States of America: %12.5, Argentina: %8.1 and Japan: %2.4.

Top Exported Products of Brazil (2017)

| Agricultural Goods | Non-Agricultural Goods |

|---|---|

| Soya beans, whether or not broken | Iron ores and concentrates |

| Cane or beet sugar | Petroleum oils, crude |

| Meat and edible offal of poultry | Motor cars for transport of persons |

| Solid residues from soya-bean oil | Chemical wood pulp, soda /sulphate |

| Maize (corn) | Other aircraft |

Brazil Imports at a Glance:

Brazil is the 29th top importing country as of 2017 statistics. The import trade value of Brazil in 2017 declared as USD 157 billion.

As of 2017, Brazil’s main imports are: petroleum oils, other than crude (USD 11.8 billion), parts for motor vehicles (USD 5.4 billion), electronic integrated circuits (4.1 billion), coal (USD 3.3 billion), medicaments (USD 3.2 billion).

Brazil’s major import trading partners are the European Union (28), China, United States of America, Argentina, South Korea.

Top Imported Products of Brazil (2017)

| Agricultural Goods | Non-Agricultural Goods |

|---|---|

| Wheat and meslin | Petroleum oils, other than crude |

| Alcohol of 80% or more volume | Parts for motor vehicles 8701-8075 |

| Malt, whether or not roasted | Electronic integrated circuits |

| Wine of fresh grapes | Coal; briquettes, ovoids |

| Other vegetables,frozen | Medicaments in measured doses |

Banks in Brazil:

Banco do Brasil: Owned by Federal Government of Brazil, Banco do Brasil is the biggest bank in Brazil. The bank provides banking products and services to individuals, companies, and the government.

The bank has branches in Germany, Argentina, Austria, Bolivia, Chile, Spain, U.S, France, Italy, Japan, Paraguay, Portugal, and UK.

Banco Bradesco: Biggest private bank in Brazil. Established in 1943. In 2016 acquired Banco Múltiplo – local unit of HSBC Bank.

The bank has branches and subsidiaries in the USA, Argentina, Mexico, China, England and Europe.

Banco Safra: Incorporated in 1955, Banco Safra is part of the Safra Group of banks and financial institutions. It provides commercial banking services such as real estate loans, foreign exchange, underwriting, and leasing services. Based in Sao Paulo, it employs around 6,732 employees.(4)

Banco Santander Brasil: Santander Bank is a global banking corporation having local banks in Spain, Germany, Poland, Portugal, the United Kingdom, Brazil, Mexico, Chile, Argentina and the United States. Banco Santander Brasil is Santander Group’s Brazil arm.

Santander bank is very active in international trade operations.

Letter of Credit Usage Tips Specific to Brazil:

Tips to the Importers:

- As mentioned above Brazil is one of the biggest commodity exporting countries in the world.

- Commodity trade usually requires triangle trade and transferable letters of credit.

- Transferable letters of credit covering commodity trade are one of the most complicated and risk inherited types of letters of credit.

- Try to establish a simple and well defined letter of credit in order to complete the transaction smoothly.

Tips to the Exporters:

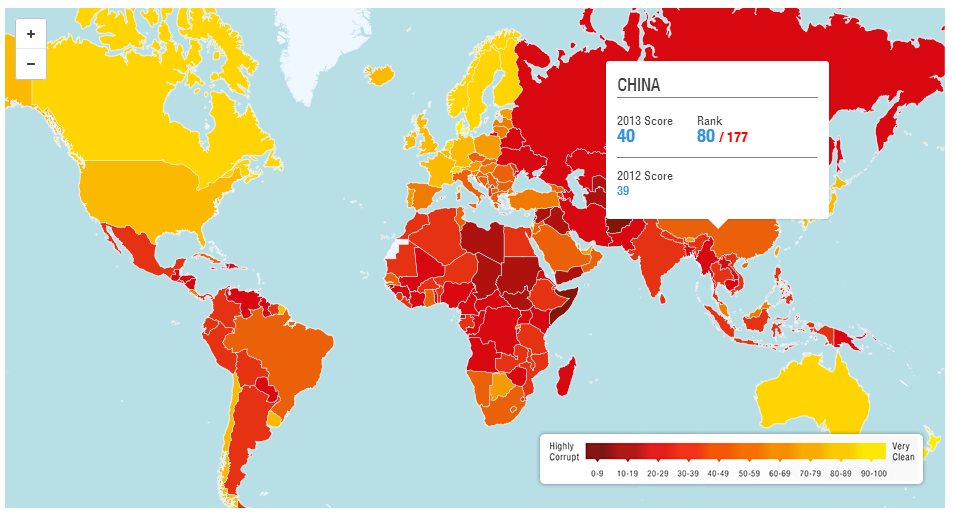

- Brazil has an average political and credit risks.

- As a result accepting a letter of credit, which is issued by one of the biggest Brazilian banks, especially having an international establishment, would be a clever move.

References:

- https://en.wikipedia.org/wiki/Brazil

- https://www.worldatlas.com/articles/what-countries-border-brazil.html

- https://www.britannica.com/place/Brazil/The-economy

- https://corporatefinanceinstitute.com/resources/careers/companies/top-banks-in-brazil/