The issuing bank or the confirming bank must pay the credit amount to the beneficiary, when they determine that the presentation is complying.

The complying presentation means is that the presentation with zero discrepancies.

If, the issuing bank or the confirming finds at least one discrepancy, then the presentation becomes discrepant.

Under a discrepant presentation, the beneficiary can get the payment, only if the applicant accepts the discrepant documents.

On this post, I am going to explain discrepancies in letters of credit.

Firstly, I will make the definition. Secondly, I will disclose links for discrepancies for each document type. At later stages of the post, I will discuss how to deal with the letter of credit, in order to make discrepancy free presentations.

Definition: Discrepancy can be defined as an error or defect, according to the issuing bank, in the presented documents compared with the documentary credit, the UCP 600 rules or other documents that have been presented under the same letter of credit.

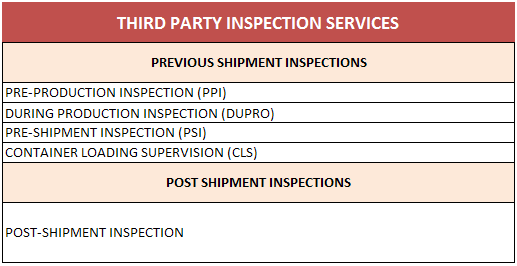

Transport Document Discrepancies

Commercial Document Discrepancies

Official Document Discrepancies

Insurance Document Discrepancies

- Insurance Policy Discrepancies

Perhaps, discrepancy is one of the most complicated and “blurred” field in all letters of credit terminology.

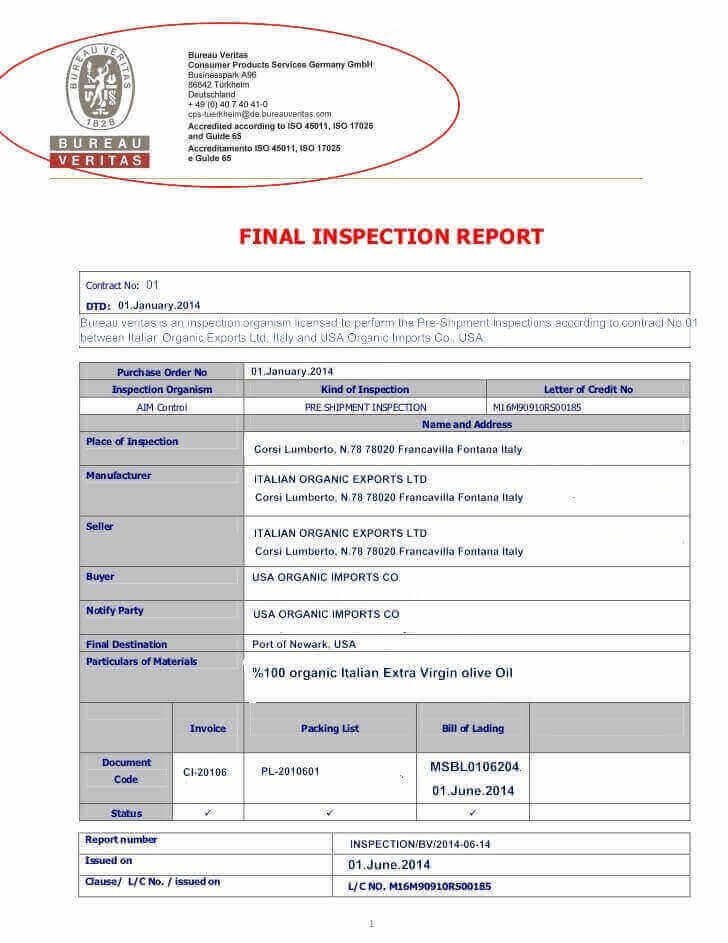

The advising bank checks the documents and finds the presentation complying, then dispatches the documents to the issuing bank.

This time, the issuing bank checks the same documents and comes back with a swift message, mentioning couple of discrepancies.

How Could This Have Been Possible?

How could one bank finds multiple discrepancies in a set of documents, while the same documents are found to be complying by another bank.

Alleged Discrepancies and ICC Opinions:

Almost all of the ICC opinions issued so far are related to complaints about “alleged discrepancies”.

What we can see from the results of the ICC opinions is that ICC Banking Committee does not agree with banks in most cases.

Definition or Lack of Definition:

It is strange, but there is no definition of a discrepancy in the letter of credit rules.

Is it too simple to be forgotten? Or too complicated to define? What is the definition of a discrepancy according the UCP 600 rules?

Inconsistency in Application:

Discrepancies varies from country to country, bank to bank, even more; document checker to document checker.

Let me give you a real life example here.

Couple of years ago, I have presented documents to a confirming bank. The presentation has been made under a set of letters of credit, which contain 10-15 pcs of independent letters of credit.

All of these small amount independent letters of credit have the same text and having the same conditions.

Description of goods, port of loading, port of discharge, additional conditions all were the same.

Just, the latest date of shipment and expiry date were changing form one lc to another.

First 3 presentations were found to be complying by the confirming bank. But on the 4th presentation, we received a swift message “MT 734 Advice of a Refusal” indicating a discrepancy on the certificate of origin.

Lessons learned.

Discrepancies can be changed from country to country, bank to bank, document checker to document checker and presentation to presentation.

and here are the results:

According to ICC Trade Finance Surveys, on average, %70 of letter of credit presentations are found to be discrepant on first presentation.

This is a very frustrating outcome, and has a huge negative impact on everyone in letter of credit business.

Why Banks Find too much Discrepancies on the Documents:

- Letter of credit rules are often find to be very complicated and hard to understand by exporters and importers.

- Most of the small and medium scale export and import companies do not have enough resources to hire a letter of credit specialist in their organizations.

- Exporters and importers do not give enough respect to letter of credit rules and standard banking practices. Exporters and importers think that, they can handle letters of credit with ease on their way. However, the fact is different. Letters of credit have very strict rules to follow.

- Exporters do not allocate enough time to understand the letter of credit text, before starting to production and shipment.

- Some banks open overdetailed letters of credit. Sometimes we see that banks demand almost impossible conditions from the beneficiaries on their letters of credit texts.

- Some banks issue foggy (not clear) letters of credit.

- Some banks examine documents not as per UCP 600 and ISBP 745.

What can be Done to Prevent Discrepant Presentations:

Pre – Document Preparation Stage:

- Keep Your Relationship with Your Customer Close: Please keep in mind that, whatever preventive steps you may take, it is highly likely that you will be facing a discrepancy on one of the documents, that you have submitted. So, it would be very wise for you to keep your relations close with your customer.

- Learn the Rules: Before entering a letter of credit transaction, you need to learn the letter of credit rules very well. You should buy one original copy of current letter of credit rules book, UCP 600. Please follow this link to buy a UCP 600 online.

- Learn the International International Standard Banking Practices: Before entering a letter of credit transaction, you also need to be familiarized with the International Standard Banking Practices. In order to do that, you should buy one original copy of current International Standard Banking Practices book. Please follow this link to learn more about International Standard Banking Practices.

- Check the Credit: You must check the letter of credit as early as you can, before starting to the production. As one of the letter of credit expert indicated “you can not solve lc problems at the presentation stage.” The earlier you are starting to work on the letter of credit text, the better it would be.

- Demand a Draft Letter of Credit: Demanding a letter of credit draft from your customer, before having the original letter of credit issued, would be a wise move. This will save you from additional letter of credit fees; such as amendment fees and amendment advising fees.Work on this letter of credit draft carefully.

- Check Field 46-A: Check required documents field one by one. Make sure that, you can supply all the required documents, that has been requested under this field.

- Check Field 47-A: Check additional conditions field one by one. Make sure that, conditions stated in this field are doable, and are not going to create any problems for you on the presentation stage.

- Demand Amendment: If you find a condition or clause that you can not comply with, get in touch with your buyer to amend the letter of credit.

- Demand Clarification: If you can not understand a condition or sentence on the letter of credit text, then you should get in touch with the issuing bank for clarification.

Document Preparation Stage:

- Complete the documents as requested by the credit. Make sure that, you also take into account the letter of credit rules and international standard banking practices when preparing the documents.

- Make sure that, signatures, authentication are made by requested persons or institutions.

- Make sure that, you will be presented all required documents without any absence.

- Make sure that, you presented correct number of originals and copies as requested by the credit.

- Make sure that, the dates on the documents are in accordance with the dates mentioned on the credit. For example, you would not be making either a late shipment or a late presentation.

- Make sure that, you will collect all requested documents by the credit as soon as you make the shipment. Once you collect all the documents, you need to make the presentation without losing any time.

After Presentation Stage :

Follow the situation of the documents day by day with the advising bank. Give necessary information to your buyer. And stay in alert mode, until you receive your payment.