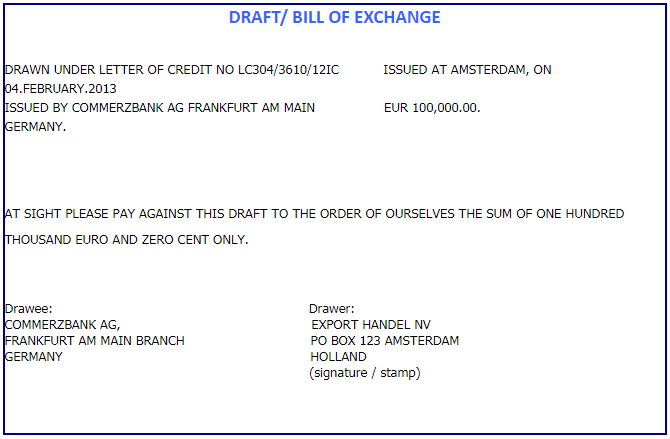

Bill of exchange, which is also known as draft, is a financial document commonly used in international trade transactions.

According to UK’s Bill of Exchange Act (1882), the bill of exchange defined as an “unconditional order in writing, addressed by one person to another, signed by the person giving it (drawer), requiring the person to whom it is addressed (drawee) to pay on demand or at a fixed or determinable future time a sum certain in money to or to the order of a specified person (payee), or to bearer”.

Parties to a Bill of Exchange:

- Drawer of a Bill of Exchange / Draft: Is the party that issues a Bill of Exchange in an international trade transaction; usually the seller or exporter.

- Drawee of a Bill of Exchange / Draft: Is the recipient of the Bill of Exchange for payment or acceptance in an international trade transaction; usually the importer or importer’s bank.

- Payee of a Bill of Exchange / Draft: Is the party to whom the Bill is payable; usually the seller or his bank.

How Does a Bill of Exchange Work in the Documentary Collections?

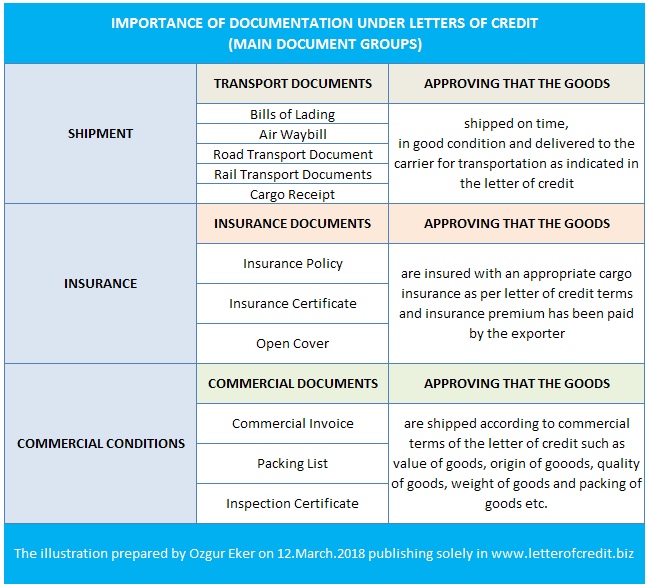

Documentary Collection (D/C) is a payment method in international trade. Documentary collection is also known as Cash Against Documents (CAD).

There are two payment options available in the documentary collections: Documents Against Payment (D/P) and Documents Against Acceptance (D/A).

Under the documents against payment option, it is not advisable to use a bill of exchange. The importer should make the payment at sight against the documents.

Under the documents against acceptance (D/A) payment option, it is advisable to use a bill of exchange payable at a future date (time draft).

Bill of Exchange Workflow in the Documentary Collections:

The bill of exchange workflow under documents against acceptance (D/A) payment option is as follows:

The exporter issues a bill of exchange payable at a future date (time draft) along with other shipping documents and sends it to the importer via his bank on collection basis.

The importer applies to his bank, accepts the bill of exchange, receives the documents, clears the goods from the customs and makes the payment at the maturity date of the bill of exchange.

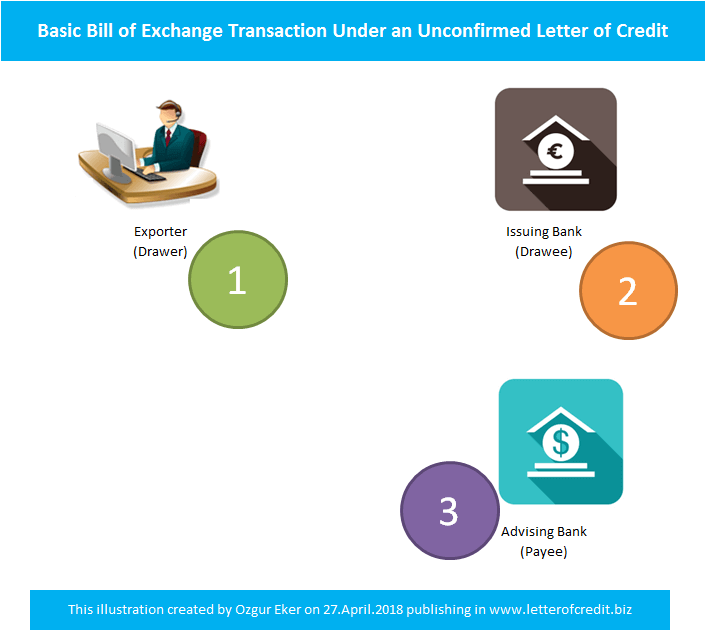

How Does a Bill of Exchange Work in the Letters of Credit?

There are four payment options available in the letters of credit: Sight payment, acceptance, deferred payment and negotiation.

It is not possible to use a bill of exchange in the letters of credit, which are available by deferred payment.

On the other hand, every letter of credit that is issued available by acceptance must demand presentation of a bill of exchange along with other shipping documents.

Under sight payments and negotiation, the bill of exchange may or may not be used.

Bill of Exchange Workflow in the Letters of Credit:

The bill of exchange workflow in the letters of credit available by sight payment, acceptance or negotiation is as follows:

Sight Payment:

After making the shipment, the exporter collects all the shipping documents and issues an at sight bill of exchange to make the presentation to the issuing bank or confirming bank or nominated bank, as applicable.

If the bank determines that the presentation is complying, then pays the credit amount to the beneficiary.

Acceptance:

After making the shipment, the exporter collects all the shipping documents and issues a time draft (bill of exchange payable at a future date) to make the presentation to the issuing bank or confirming bank or nominated bank, as applicable.

If the bank determines that the presentation is complying, then accepts the time draft and pays the credit amount to the beneficiary at maturity.

Negotiation:

The letters of credit available by negotiation can be payable at sight or usance.

If the letter of credit requires an at sight bill of exchange, the process will be the same as the sight payment.

If the letter of credit requires presentation of a time draft, the process will be the same as the acceptance.

Conclusion:

- Bill of exchange plays an important role in commercial and financial cycles not only as a method of payment or a way of providing credit, but also as security for payments. (1)

- Bill of exchange mainly used in documentary collections and letters of credit.

- Under the documentary collections, the bill of exchange can be used only when Documents Against Acceptance (D/A) payment option is chosen.

- Under the documentary collections, the bill of exchange payable at a future date (time draft) drawn on the importer. The importer accepts the bill of exchange, receives the documents, clears the goods from the customs and makes the payment at the maturity date of the bill of exchange.

- If the importer does not pay the bill of exchange amount at maturity, the exporter tries to use his legal rights that is stem from the bill of exchange.

- Under the documentary collections, the importer’s banks has no payment obligation unless the bill of exchange has been avalized by the importer’s bank.

- Under the letters of credit, the bill of exchange can be used with at sight, acceptance and negotiation payment options.

- Under the letters of credit, the bill of exchange can be issued at sight or payable at a future date (time draft).

- Under the letters of credit, the bill of exchange must be drawn on a bank that is specified in the credit.

- Under the letters of credit, the bill of exchange does not give additional payment guarantee to the beneficiary, whereas the situation will be different for the banks. Bill of exchange may change the payment obligation between the nominated bank and the issuing bank; the confirming bank and the issuing bank etc.

References:

- Bills of Exchange, A Guide to Legislation in European Countries, Dr. jur. Uwe Jahn, ICC Publication No 531 (E), 1996, P:3