Bill of lading is a transport document covering the carriage of goods by sea.

Letters of credit rules define 4 different types of bills of lading:

- Multimodal Bill of Lading: (UCP 600 article 19) A type of bill of lading covering at least two different modes of transport such as sea shipment + road transportation.

- Bill of Lading: (UCP 600 article 20) In general it refers to the transport document which is used in port to port containerized sea shipments, usually issued in negotiable form.

- Sea Waybill: (UCP 600 article 21) Non negotiable bill of lading. Can not be issued in a negotiable form. Consignee can clear the goods at the port of destination by proving identity.

- Charter Party Bill of Lading: (UCP 600 article 22) A bill of lading containing an indication that it is subject to a charter party contract. Used in bulk cargo shipments.

On this port I will explain how to complete a bill of lading as it is explained under letters of credit rules UCP 600 article 20.

Step 1 : Analyzing the Letter of Credit:

All documents must be issued according to the conditions of the letter of credit. Bill of lading is not an exception.

As a result a beneficiary who would like to submit a discrepancy free bill of lading must analyze the letter of credit at first instance.

I have already explained how to check a letter of credit as an exporter. This post will be focused on a bill of lading.

Understanding Swift Message Fields Which are Related to the Bill of Lading

Below fields are directly related to the bill of lading and each one must be reviewed carefully.

- Field 50: Applicant

- Field 59: Beneficiary

- Field 43P: Partial Shipments

- Field 43T: Transhipment

- Field 44E: Port of Loading/Airport of Departure

- Field 44F: Port of Discharge/Airport of Destination

- Field 44C: Latest Date of Shipment

- Field 45A: Description of Goods &/or Services

- Field 46A: Documents Required

- Field 47A: Additional Conditions

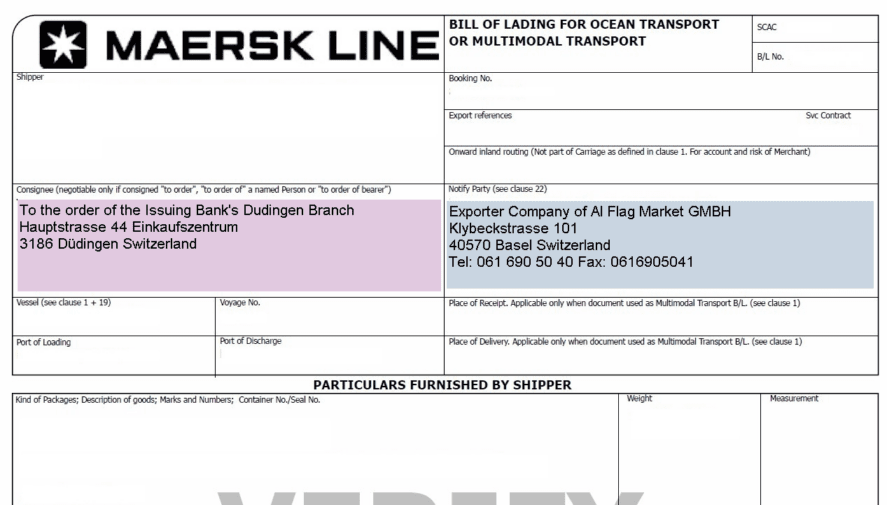

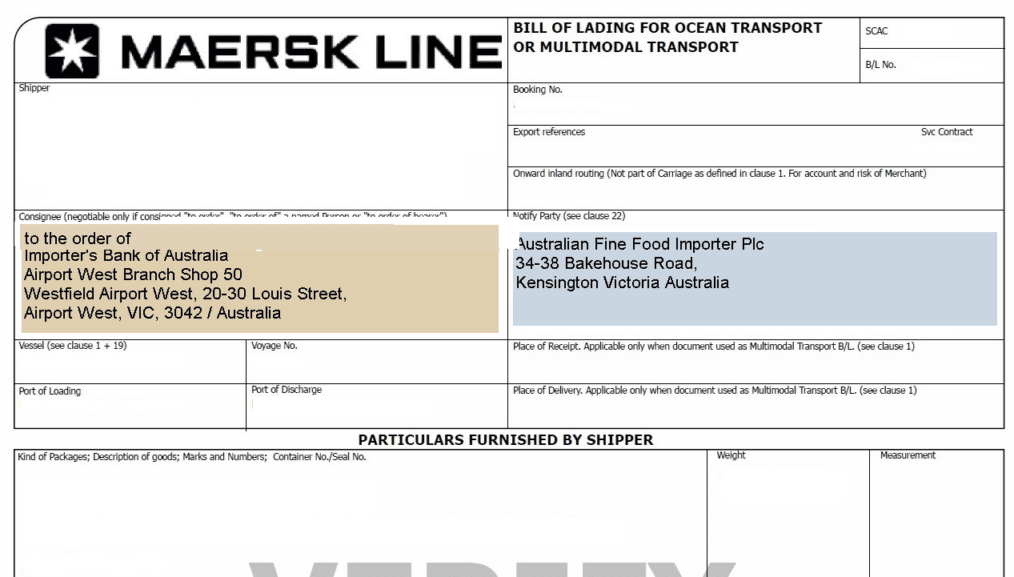

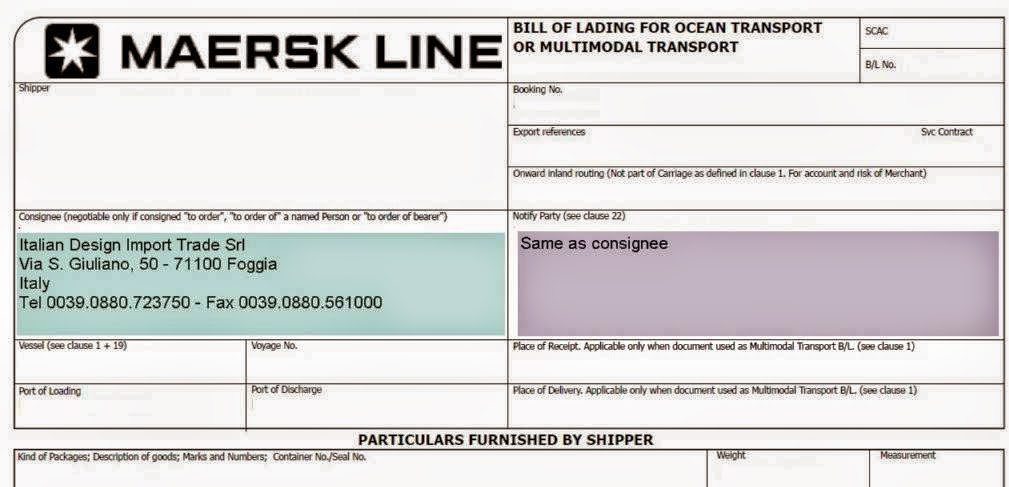

- Field 50: Applicant: Applicant is the importer. Usually issuing banks require that bills of lading show applicants’ details under notify party fields.

- Field 59: Beneficiary: Beneficiary is the exporter. Although letters of credit rules state that the shipper or consignor of the goods indicated on any document need not be the beneficiary of the credit, it would be a wise move to mention exact beneficiary details under consignor / shipper fields of the bills of lading.

- Field 43P: Partial Shipments: This field determines whether partial shipments are acceptable or not.

- Field 43T: Transhipment: This field determines whether transhipment are acceptable or not.

- Field 44E: Port of Loading/Airport of Departure: This field indicates the port of loading.

- Field 44F: Port of Discharge/Airport of Destination: This field indicates the port of discharge.

- Field 44C: Latest Date of Shipment: This field indicates latest date of shipment. Please be careful that date of shipment is a technical term in letters of credit rules. You should understand how date of shipment is determined on a bill of lading.

- Field 45A: Description of Goods &/or Services: According to the letters of credit rules in documents other than the commercial invoice, the description of the goods, services or performance, if stated, may be in general terms not conflicting with their description in the credit.

- Field 46A: Documents Required: One of the articles under this field usually determines the requirements of the bill of lading.

- Field 47A: Additional Conditions: This field may include additional conditions that must be stated on the bill of lading.

Step 2 : Analyzing the Letters of Credit Rules:

Although all of the UCP 600 articles can be related to the document preparation one way or another, it would be meaningful to drill down to the UCP 600 articles that are directly regulating the bills of lading.

Understanding UCP 600 Articles Which are Related to the Bill of Lading

UCP 600 article 20 states that:

a. A bill of lading, however named, must appear to:

i. indicate the name of the carrier and be signed by:

– the carrier or a named agent for or on behalf of the carrier, or

– the master or a named agent for or on behalf of the master.

Any signature by the carrier, master or agent must be identified as that of the carrier, master or agent.

Any signature by an agent must indicate whether the agent has signed for or on behalf of the carrier or for or on behalf of the master.

ii. indicate that the goods have been shipped on board a named vessel at the port of loading stated in the credit by:

– Pre-printed wording, or

– An on board notation indicating the date on which the goods have been shipped on board.

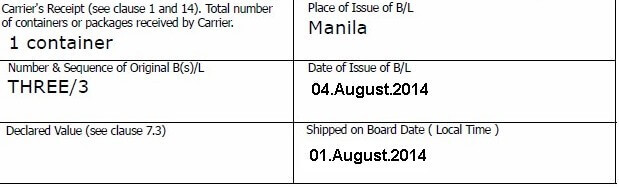

The date of issuance of the bill of lading will be deemed to be the date of shipment unless the bill of lading contains an on board notation indicating the date of shipment, in which case the date stated in the on board notation will be deemed to be the date of shipment.

If the bill of lading contains the indication “intended vessel” or similar qualification in relation to the name of the vessel, an on board notation indicating the date of shipment and the name of the actual vessel is required.

iii. indicate shipment from the port of loading to the port of discharge stated in the credit.

If the bill of lading does not indicate the port of loading stated in the credit as the port of loading, or if it contains the indication “intended” or similar qualification in relation to the port of loading, an on board notation indicating the port of loading as stated in the credit, the date of shipment and the name of the vessel is required. This provision applies even when loading on board or shipment on a named vessel is indicated by pre-printed wording

on the bill of lading.

iv. be the sole original bill of lading or, if issued in more than one original, be the full set as indicated on the bill of lading.

v. contain terms and conditions of carriage or make reference to another source containing the terms and conditions of carriage (short form or blank back bill of lading). Contents of terms and conditions of carriage will not be examined.

vi. contain no indication that it is subject to a charter party.

b. For the purpose of this article, transhipment means unloading from one vessel and reloading to another vessel during the carriage from the port of loading to the port of discharge stated in the credit.

c.

i. A bill of lading may indicate that the goods will or may be transhipped provided that the entire carriage is covered by one and the same bill of lading.

ii. A bill of lading indicating that transhipment will or may take place is acceptable, even if the credit prohibits transhipment, if the goods have been shipped in a container, trailer or LASH barge as evidenced by the bill of lading.

d. Clauses in a bill of lading stating that the carrier reserves the right to tranship will be disregarded.

Step 3 : Make Sure That Data on Bill of Lading is not Conflicting with Data on Other Documents:

Data in a document, when read in context with the credit, the document itself and international standard banking practice, need not be identical to, but must not conflict with, data in that document, any other stipulated document or the credit.

For example description of goods, gross weight, net weight, product classification codes, shipping marks, packaging, quantity of goods etc. as stated on the bill of lading must not conflict with data in any other stipulated document.

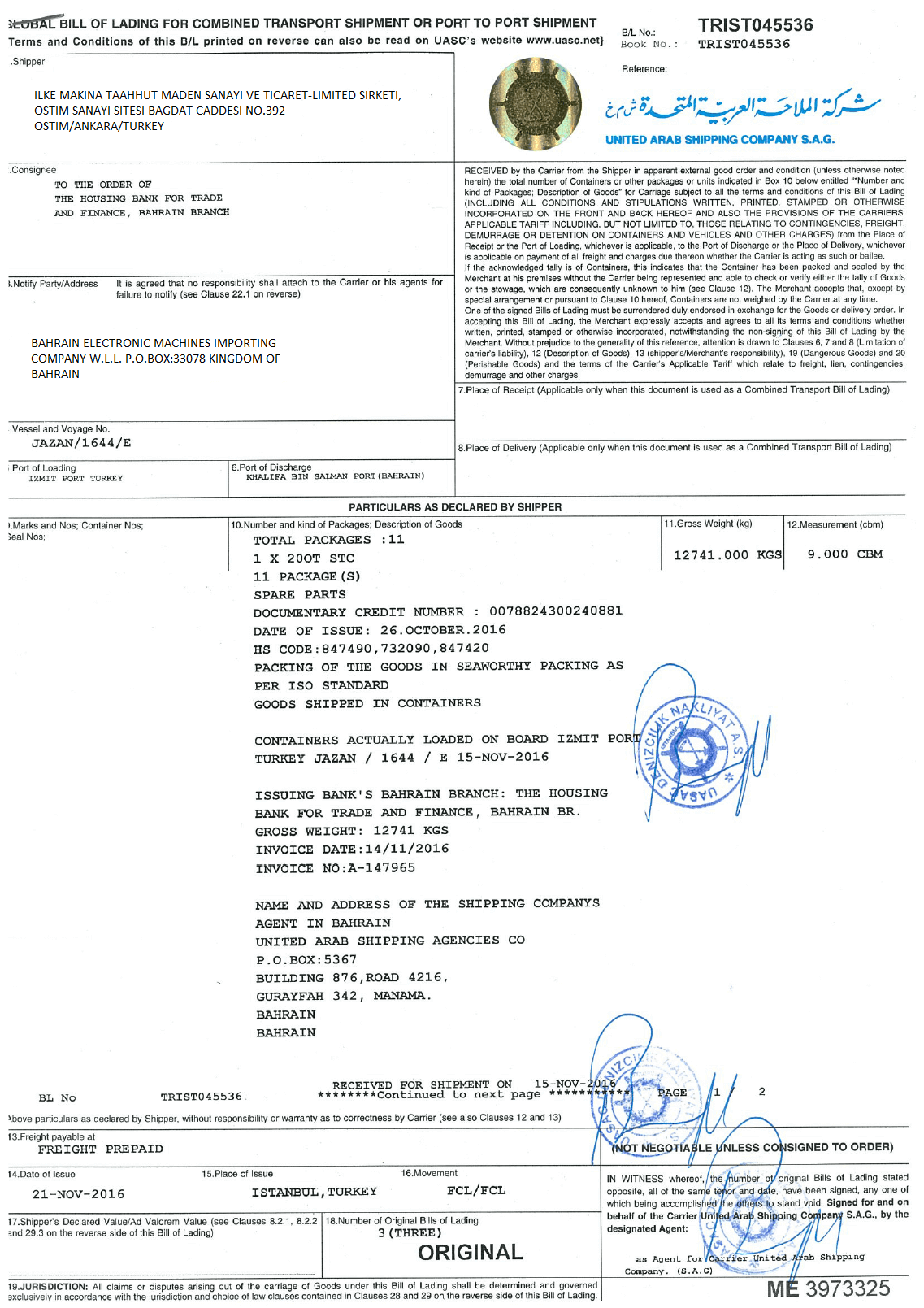

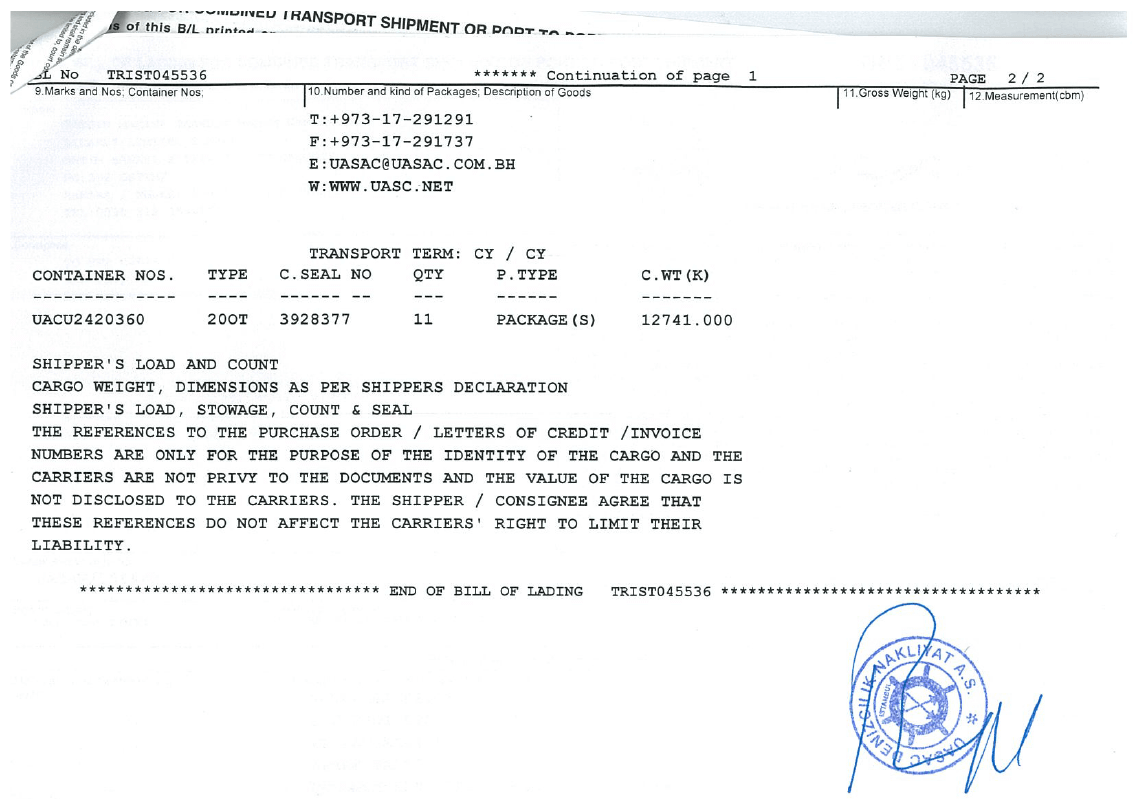

Example: Letter of Credit and Presented Bills of Lading

Sample Letter of Credit

F50: Applicant

BAHRAIN ELECTRONIC MACHINES IMPORTING COMPANY W.L.L. P.O.BOX:33078 KINGDOM OF BAHRAIN

F59: Beneficiary

Name and Address:

ILKE MAKINA TAAHHUT MADEN SANAYI VE TICARET-LIMITED SIRKETI, OSTIM SANAYI SITESI BAGDAT CADDESI NO.392 OSTIM/ANKARA/TURKEY

F43P: Partial Shipments

NOT ALLOWED

F43T: Transshipment

ALLOWED

F44E: Port of Loading/Airport of Departure

TURKEY

F44F: Port of Discharge/Airport of Destination

BAHRAIN

F44C: Latest Date of Shipment

161115 2016 Nov 15

F45A: Description of Goods and/or Services

SPARE PARTS AS PER PROFORMA INVOICE REF: T16-100 CFR: BAHRAIN (INCOTERMS 2010)

F46A: Documents Required

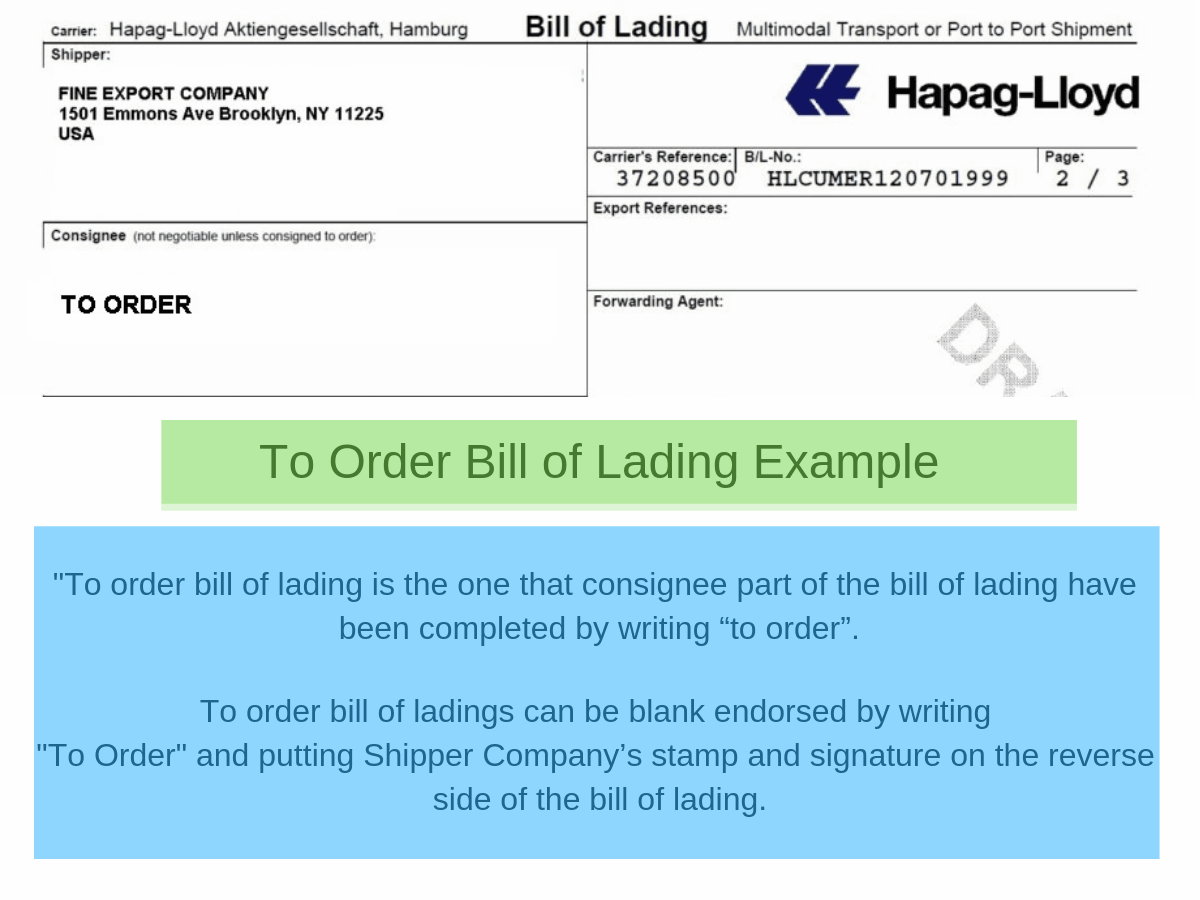

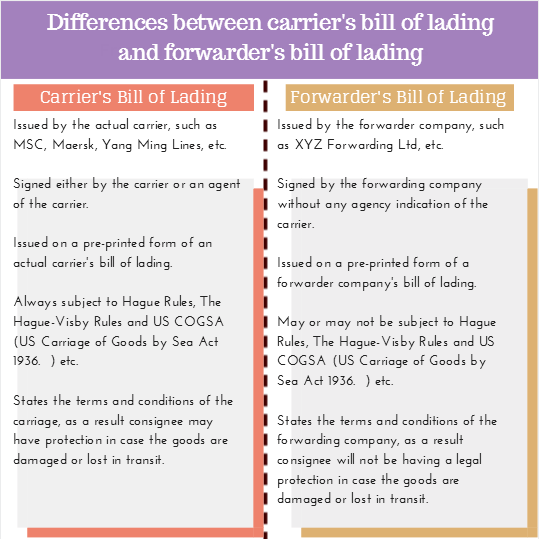

ARTICLE 3- FULL SET OF SHIPPED (ON BOARD) MARINE BILLS OF LADING IN 3/3 ORIGINALS ISSUED BY SHIPPING CO’S ON IT’S LETTER HEAD FORMAT ISSUED TO THE ORDER OF THE HOUSING BANK FOR TRADE AND FINANCE, BAHRAIN BRANCH SHOWING FREIGHT PREPAID AND MUST INDICATE ONLY THE APPLICANT AS A NOTIFY PARTY AND MUST INDICATE NAME AND ADDRESS OF THE SHIPPING COMPANY’S AGENT IN BAHRAIN.

THE MARINE B/L MUST CLEARLY INDICATE THE NAME OF THE CARRIER AND CLEARLY STATES ITS FUNCTION/QUALITY IN THE FOLLOWING STRICT MANNER: ”THE CARRIER” AND NOT ”AS CARRIER” AND BILL OF LADING MUST SHOW PACKING OF THE GOODS IN SEAWORTHY PACKING AS PER ISO STANDARD.

B/L MUST SHOW THAT GOODS SHIPPED IN CONTAINERS.

F47A: Additional Conditions

ALL DOCUMENTS MUST BE DATED AND INDICATE THIS L/C NUMBER AND THE HOUSING BANK

FOR TRADE AND FINANCE,BAHRAIN BR. NAME AND ISSUANCE DATE.B/L MUST SHOW THE CONTAINER(S) AND SEAL(S) NUMBER(S) ALWAYS WHENEVER SHIPMENT

EFFECTED BY CONTAINER(S).B/L ISSUED AND/OR SIGNED BY FREIGHT FORWARDER IS NOT ACCEPTABLE.

SHORT FORM B/L IS NOT ACCEPTABLE.

SHIPPER OR CONSIGNOR OF THE GOODS INDICATED ON ANY DOCUMENTS MUST BE THE

BENEFICIARY OF THE CREDIT.ALL REQUIRED DOCUMENTS MUST BE ISSUED IN ENGLISH LANGUAGE.

DOCUMENTS APPEARING DATE OF ISSUANCE PRIOR TO THAT OF THIS CREDIT ARE NOT

ACCEPTABLE.ALL ORIGINAL TRANSPORT DOC’S REQUIRED UNDER THIS L/C MUST BE PRE-PRINTED

THE WORD ”ORIGINAL”BILL OF LADING MUST APPEAR A SEPARATE NOTATION STATING ”CONTAINERS ACTUALLY LOADED ON BOARD+VESSEL NAME+PORT OF LOADING NAME+DATE”DULY SIGNED BY THE SAME SIGNOR OF THE BILL OF LADING ”