Majority of the letters of credits are asking for a bill of lading which must be issued made out to the order of the issuing bank.

This condition indicated under field “46A – Documents Required” for the letters of credit that are issued in a swift format.

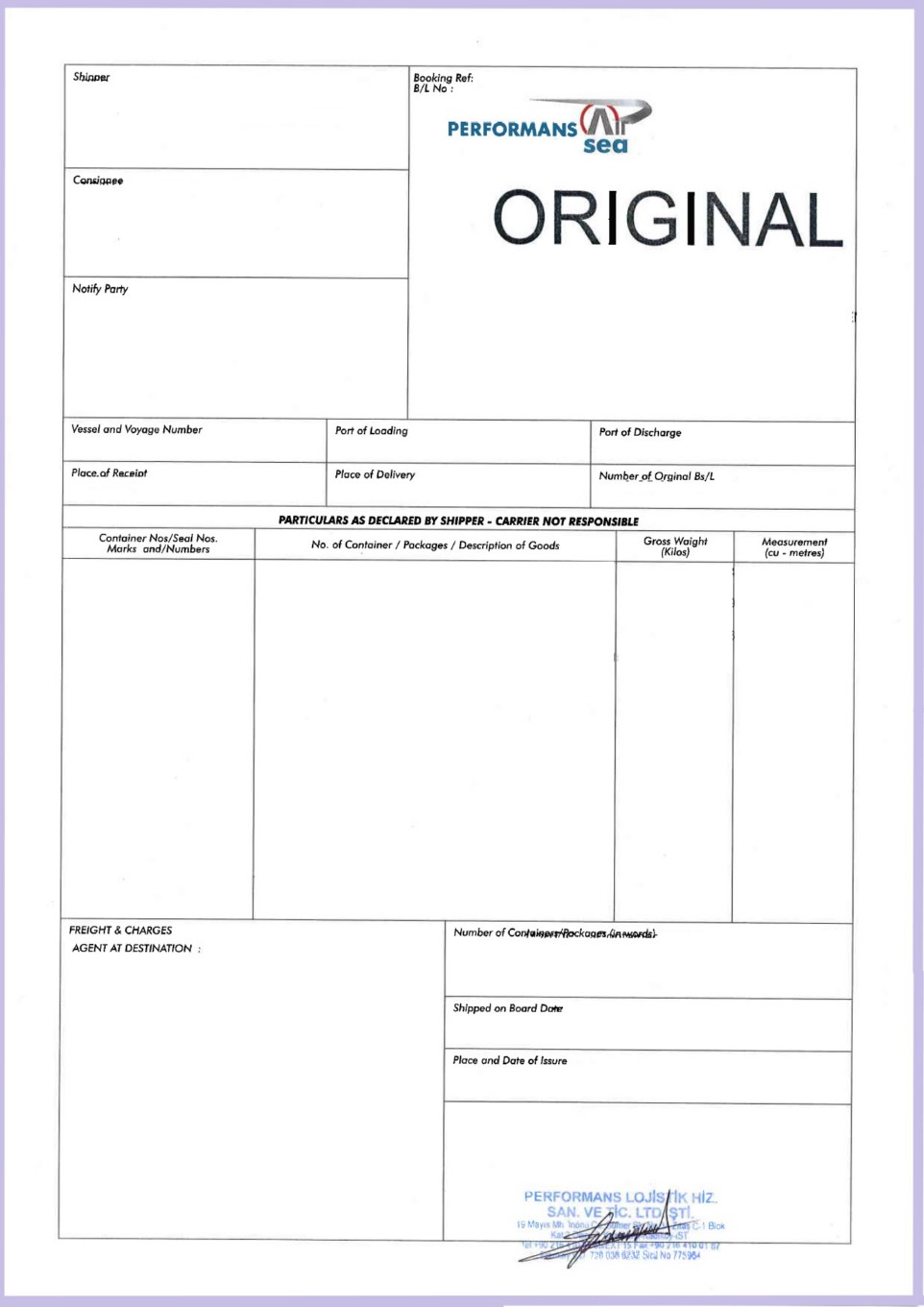

In simple words bills of lading can be classified under two groups: Negotiable bills of lading and non-negotiable bill of lading. Non-negotiable bills of lading also known as sea waybills.

Negotiable bills of lading can also be classified under two main groups. Negotiable bills of lading and straight bills of lading.

- Negotiable Bills of Lading: Negotiable bills of lading are the ones that have been issued “to order” or “to order of a named party”. If bill of lading has been issued in a negotiable form, then the buyer of the goods need to surrender at least one original bill of lading to the carrier at the port of discharge. In this scenario bill of lading must be endorsed properly.

- Straight Bills of Lading: Straight bills of lading are the ones that have been issued in a way to consigned a named party. If bill of lading is issued in a non-negotiable form, then the buyer can get the goods either by,

- surrendering at least one original bill of lading to the carrier at the port of discharge or

- in accordance with rules of the national law at the port of discharge which may accept the delivery of the goods to the buyer against proof of identity.

Both “to order” and “to order of a named party” statements make a bill of lading a negotiable bill of lading.

Letter of Credit Examples:

- Example of to order and blank endorsed bill of lading: Full set signed clean on board ocean bills of lading made out to order and blank endorsed marked ‘freight prepaid’ and notify Import Bank of India indicating letter of credit number.

- Example of made out to order of bill of lading: Full set of original clean on board bill of lading issued to the order of Arab Bank PLC Algeria notify applicant marked freight prepaid.