What Does Bill of Lading Mean in Export and Import Businesses?

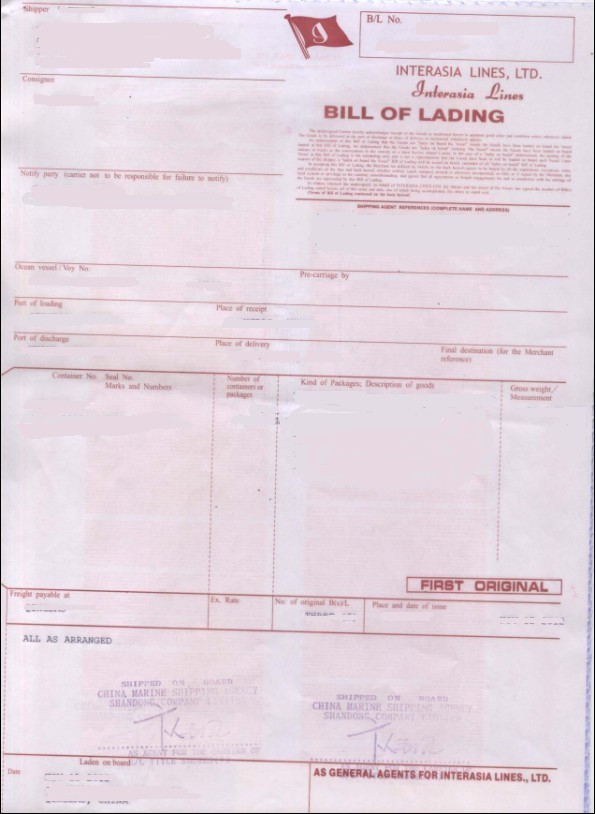

Bill of lading (B/L) is a transport document, which is used in port-to-port sea shipments, issued and signed by a carrier or its agent, generally on a pre-printed carrier’s bill of lading format, evidences the terms and conditions of the carriage of goods between port of loading and port of discharge.

What are the Main Features of a Bill of Lading (B/L)?

- A negotiable bill of lading represents the title of the goods and normally has to be surrendered at the port of discharge to the carrier’s agent to obtain delivery of the goods.

- A bill of lading is regarded as a negotiable document if issued “to order and black endorsed” or “to order of a (named party)”.

- A bill of lading issued and signed by a carrier or an agent on behalf of the carrier is called a master bill of lading.

- A bill of lading issued and signed by a freight forwarder is called a house bill of lading.

- There are certain differences exist between a master bill of lading and house bill of lading.

- A bill of lading generally issued subject to Hague Rules, The Hague-Visby Rules and US COGSA (US Carriage of Goods by Sea Act 1936. ) etc.

- Because a bill of lading is used in port-to-port sea shipments, it can be used in conjunction with all the trade terms defined in Incoterms 2010 rules.

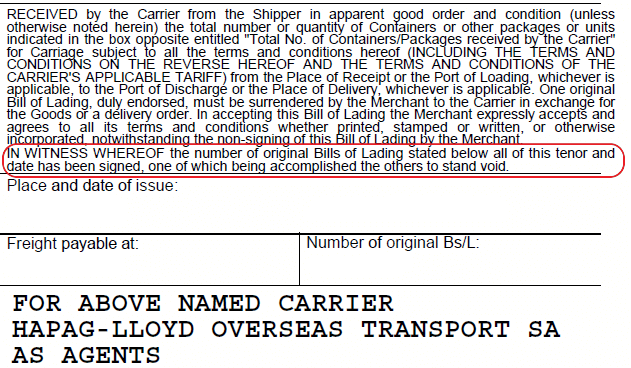

Figure 1 : Bill of Lading Sample

What Does Air Waybill Mean in Export and Import Businesses?

An air waybill (AWB) is a transport document, which is used in air shipments, issued and signed by an airline cargo carrier or its agent, generally on a pre-printed air waybill format, evidences the terms and conditions of the carriage of goods over routes of the airline carrier(s).

What are the Main Features of an Air Waybill (AWB)?

- An air waybill, contrary to bill of lading, is not a document of title, as a result it is not a negotiable document. The carrier’s agent delivers goods by approving the identity of the consignee without requesting surrender of the original air waybill.

- An air Waybill is not a negotiable document as a result it cannot be issued “to order and black endorsed” or “to order of an issuing bank”. An air waybill can only be consigned to a “named company”.

- An air waybill can be issued and signed by a carrier or an agent on behalf of the carrier.

- Alternatively it can be issued and signed by a freight forwarder. But carrier air waybill and forwarder air waybill have some differences. For more information please read my article “What is the difference between MAWB (Master Air Waybill) and HAWB (House Air Waybill)?“

- An air waybill generally issued subject to Warsaw Convention, Hague amendment, Montreal Convention, etc.

- An air waybill should be used in airport-to-airport shipments, as a result it cannot be used in conjunction with the incoterms available only sea shipments such as FAS, FOB, CFR and CIF. For further information please look at “What happens if a letter of credit calls for a wrong Incoterms?“.

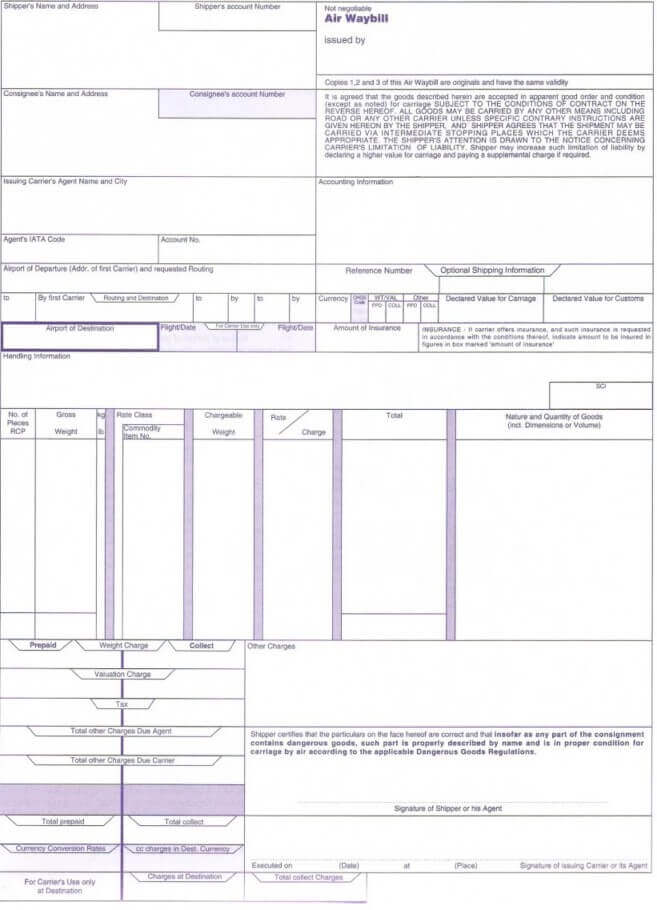

Figure 2 : Air Waybill Sample

What are the Differences Between Air Waybill and Bill of Lading?

| Air Waybill | Bill of Lading |

|---|---|

| Air Waybill: Air waybill should be used in air shipments. | Bill of Lading: Bill of lading should be used in port-to-port sea shipments. |

| Air Waybill: Air waybill is not a document of title. | Bill of Lading: Negotiable bill of lading is a document of title. At least one original bill of lading must be surrender to collect the goods from the carrier. |

| Air Waybill: Air Waybill cannot be issued "to order and black endorsed" or "to order of an issuing bank". | Bill of Lading: Bill of lading can be issued "to order and black endorsed" or "to order of an issuing bank". |

| Air Waybill: Air waybill generally issued subject to Warsaw Convention, Hague amendment, Montreal Convention, etc. | Bill of Lading: Bill of lading generally issued subject to Hague Rules, The Hague-Visby Rules and US COGSA (US Carriage of Goods by Sea Act 1936. ) etc. |

| Air Waybill: Air waybill cannot be used in conjunction with the incoterms available only sea shipments such as FAS, FOB, CFR and CIF. | Bill of Lading: Bill of lading can be used in conjunction with all of the incoterms available. |