Confirmed L/C at sight covers two definitions: Confirmed letter of credit which is payable at sight.

Letters of credit can permit the beneficiary to be paid immediately upon presentation of specified documents (at sight letter of credit), or at a future date as established in the sales contract (term/usance letter of credit). (1)

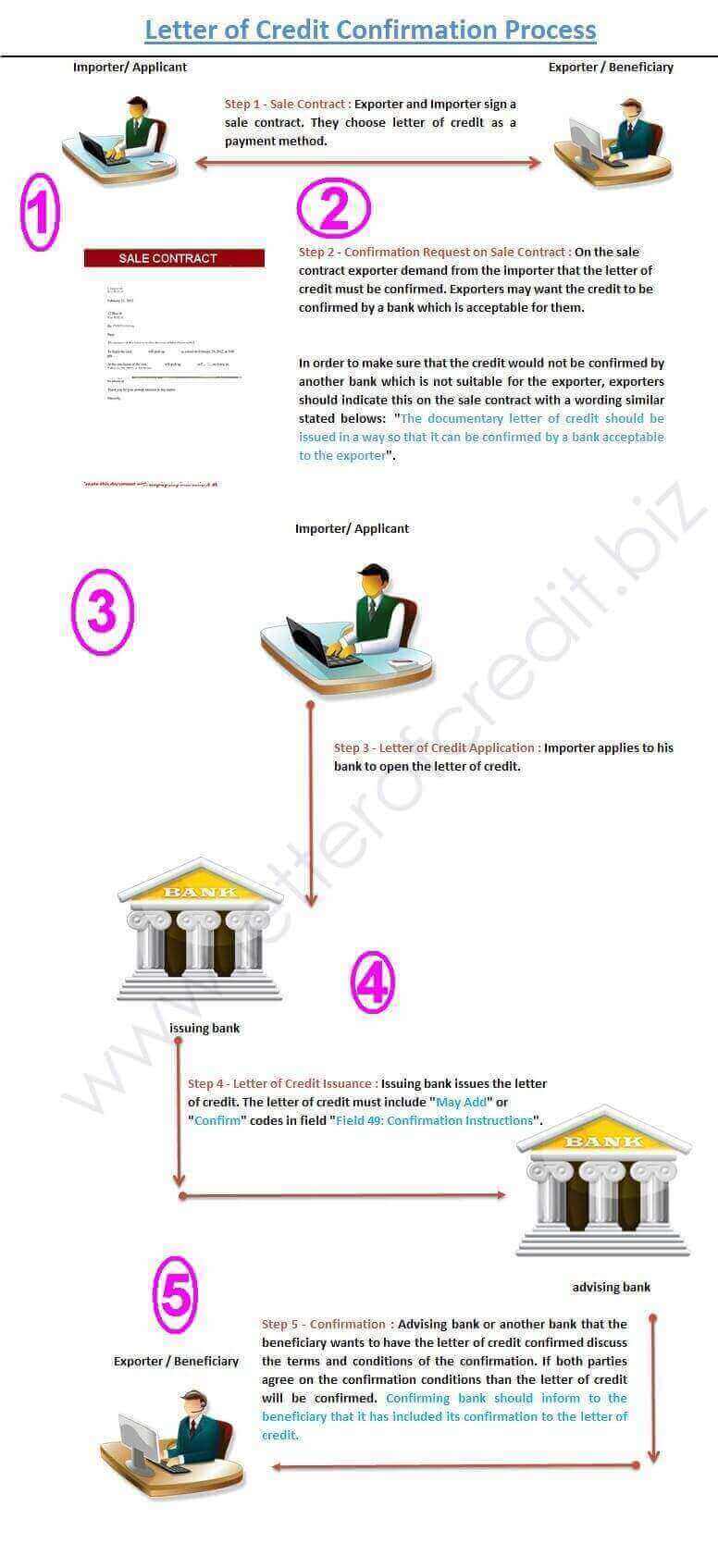

Confirmation means “a definite undertaking of the confirming bank , in addition to that of the issuing bank, to honour or negotiate a complying presentation” according to latest UCP rules.

By reading this post, you should understand the responsibilities of confirming banks, benefits of confirmed at sight letters of credit and why in some situations at sight confirmed letters of credit mechanism does not work.

Definition of at Sight Letter of Credit:

Latest letter of credit rules, UCP 600, defines four availability options;

A credit must state whether it is available by sight payment, deferred payment, acceptance or negotiation (UCP 600 – Article 6- b).

At sight payment is one of the payment terms in a letter of credit transaction.

At sight letter of credit can be defined as a letter of credit that is payable as soon as the complying documents have been presented to the issuing bank or the confirming bank.

Definition of the Confirmation:

According to latest UCP rules confirmation means,

“a definite undertaking of the confirming bank , in addition to that of the issuing bank, to honour or negotiate a complying presentation”

Confirming Banks’ Responsibilities:

UCP 600 define confirming banks’ responsibilities as follows,

Article 8 – Confirming Bank Undertaking

a. Provided that the stipulated documents are presented to the confirming bank or to any other nominated bank and that they constitute a complying presentation, the confirming bank must:

i. honour, if the credit is available by

a. sight payment, deferred payment or acceptance with the confirming bank;

b. sight payment with another nominated bank and that nominated bank does not pay;

c. deferred payment with another nominated bank and that nominated bank does not incur its deferred payment undertaking or, having incurred its deferred payment undertaking, does not pay at maturity;

d. acceptance with another nominated bank and that nominated bank does not accept a draft drawn on it or, having accepted a draft drawn on it, does not pay at maturity;

e. negotiation with another nominated bank and that nominated bank does not negotiate.

ii. negotiate, without recourse, if the credit is available by negotiation with the confirming bank.

b. A confirming bank is irrevocably bound to honour or negotiate as of the time it adds its confirmation to the credit.

c. A confirming bank undertakes to reimburse another nominated bank that has honoured or negotiated a complying presentation and forwarded the documents to the confirming bank. Reimbursement for the amount of a complying presentation under a credit available by acceptance or deferred payment is due at maturity, whether or not another nominated bank prepaid or purchased before maturity. A confirming bank’s undertaking to reimburse

another nominated bank is independent of the confirming bank’s undertaking to the beneficiary.

d. If a bank is authorized or requested by the issuing bank to confirm a credit but is not prepared to do so, it must inform the issuing bank without delay and may advise the credit without confirmation.

Benefits of At Sight Confirmed Letter of Credit?

Why exporters pay additional fees to have their L/Cs confirmed?

- First reason is that the exporters would like to eliminate default risk of the issuing bank.

- Second reason is that they would like to receive their payment sooner by removing the issuing bank out of the equation.

Why in some Situations At Sight Confirmed Letter of Credit Mechanism Does not Work?

The nominated banks, whom added their confirmations and became the confirming banks, keep sending documents to the issuing banks and wait for reimbursement even under confirmed at sight letters of credit.

Unfortunately even the confirmation couldn’t eliminate typical nominated bank action: wait for reimbursement, then pay to the beneficiary!

Confirming banks should pay the credit amount against confirming documents to the beneficiaries under at sight letters of credit as letter of credit rules dictate.

But in practice they are ready to act in this way only if they have determined that the issuing bank is defaulted.

Sources:

- Documentary Letters of Credit: A Practical Guide, Scotiabank International Trade Services, Page:2