Understanding the differences between a master bill of lading and a house bill of lading in export and import transactions.

What Does a Master Bill of Lading Mean in Export and Import Businesses?

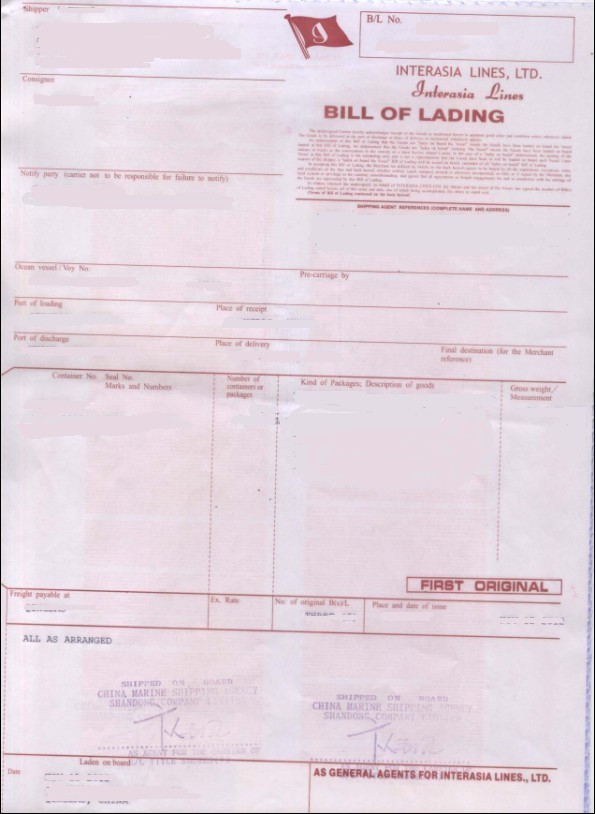

A master bill of lading (MBL) is a transport document, which is used in sea shipments, issued and signed by a sea cargo carrier or its agent, generally on a pre-printed carrier’s bill of lading format, evidences the terms and conditions of the carriage of goods between port of loading to port of discharge.

What Are the Main Features of a Master Bill of Lading (MBL)?

- A master bill of lading generally issued on a pre-printed bill of lading form of an issuer carrier.

- A master bill of lading issued and signed by a carrier or an agent on behalf of the carrier.

- A master bill of lading (MBL) is issued subject to Hague Rules, The Hague-Visby Rules and US COGSA (US Carriage of Goods by Sea Act 1936. ) etc.

- A master bill of lading is signed by the actual carrier and states the terms and conditions of the carriage, as a result consignee may have a better protection in case the goods are damaged or lost in transit.

Figure 1: Master Bill of Lading Sample (Carrier: Maersk Line)

What Does a House Bill of Lading Mean in Export and Import Businesses?

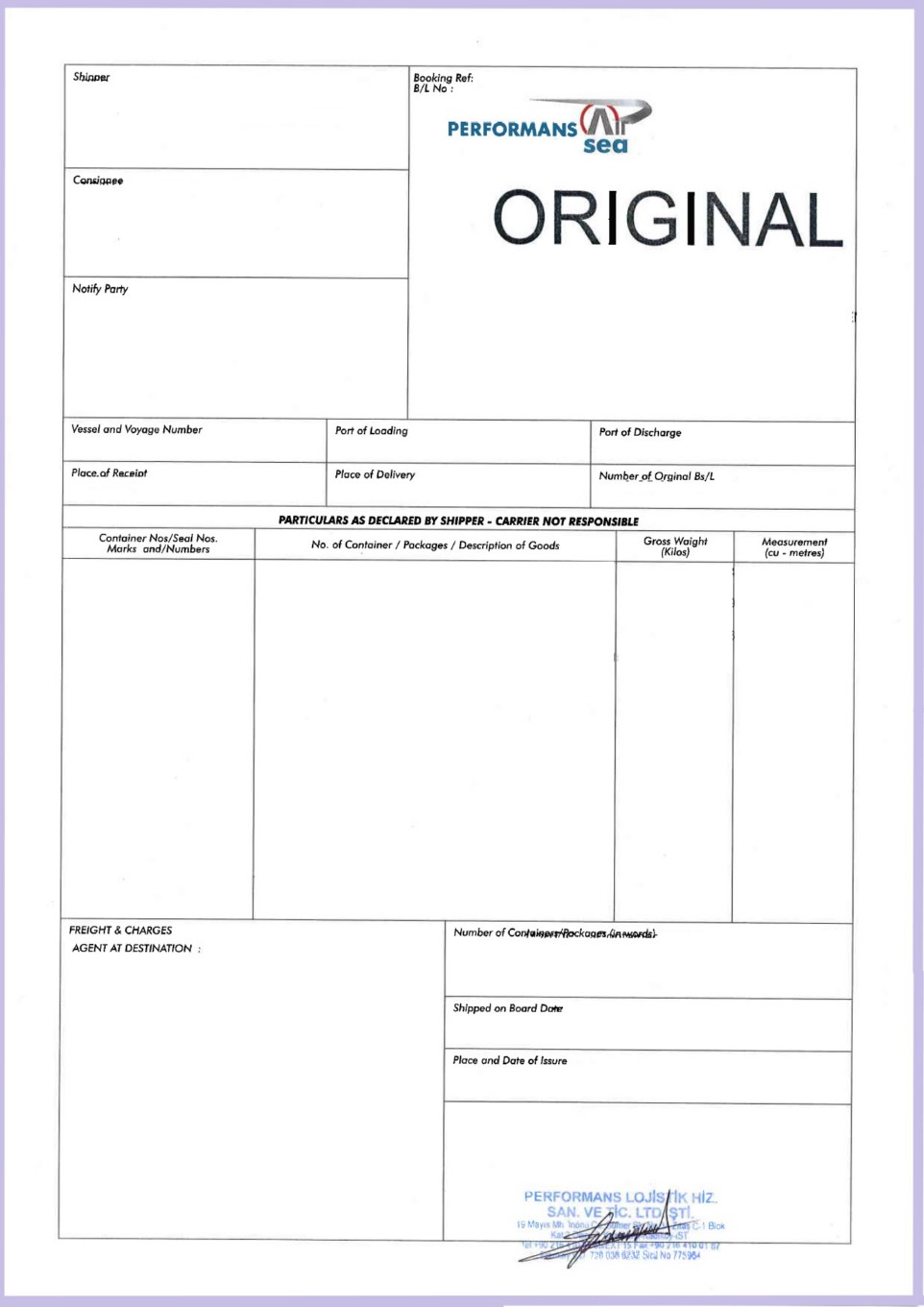

A house bill of lading (HBL) is a transport document, which is used in sea shipments, issued and signed by a freight forwarder, generally on a freight forwarder’s bill of lading format, evidences the terms and conditions of the carriage of goods as specified by the freight forwarder.

What Are the Main Features of a House Bill of Lading (HBL)?

- A house bill of lading generally issued on a freight forwarder’s bill of lading format.

- A house bill of lading issued and signed by a forwarder without indicating any signing authority either carrier or as agent of the carrier. In some occasions forwarder companies sign HBLs “as carrier”, especially when their clients require a bill of lading compliant to the letter of credit conditions.

- A house bill of lading (HBL) may or may not be subject to Hague Rules, The Hague-Visby Rules and US COGSA (US Carriage of Goods by Sea Act 1936. ) etc.

- House bill of lading is signed by the forwarder, and it states the terms and conditions of carriage for the forwarder company’s perspective. A house bill of lading does not contain actual carrier’s carriage contract, as a result the shipper stated on the house bill of lading is not identified in the actual carrier’s contract.

Figure 2: House Bill of Lading Sample

What are the Differences Between MBL (Master Bill of Lading) and HBL (House Bill of Lading)?

| Master Bill of Lading | House Bill of Lading |

|---|---|

| Master Bill of Lading: Issued by the actual carrier, such as MSC, Maersk, Yang Ming Lines, etc. | House Bill of Lading: Issued by the forwarder company, such as XYZ Forwarding Ltd, etc. |

| Master Bill of Lading: Signed either by the carrier or an agent of the carrier. | House Bill of Lading: Signed by the forwarding company without any agency indication of the carrier. |

| Master Bill of Lading: Issued on a pre-printed form of an actual carrier's bill of lading. | House Bill of Lading: Issued on a pre-printed form of a forwarder company's bill of lading. |

| Master Bill of Lading: Always subject to Hague Rules, The Hague-Visby Rules and US COGSA (US Carriage of Goods by Sea Act 1936. ) etc. | House Bill of Lading: May or may not be subject to Hague Rules, The Hague-Visby Rules and US COGSA (US Carriage of Goods by Sea Act 1936. ) etc. |

| Master Bill of Lading: States the terms and conditions of the carriage, as a result consignee may have protection in case the goods are damaged or lost in transit. | House Bill of Lading: States the terms and conditions of the forwarding company, as a result consignee will not be having a legal protection in case the goods are damaged or lost in transit. |

| Master Bill of Lading: States actual carrier's bill of lading number. | House Bill of Lading: States forwarder company's bill of lading number. |