Applicant means the party on whose request the credit is issued. Applicant is the importer in a typical international commercial letter of credit.

Issuing bank means the bank that issues a credit at the request of an applicant or on its own behalf.

Generally issuing banks issue letters of credit with the request of the importers and mentioning their names in the letters of credit under Field 50: Applicant of MT 700 Swift Messages.

But in some situations issuing banks issue letters of credit on their behalf. Please keep in mind that this is totally alright according to the letters of credit rules.

Below you can find some situations under which you can see the issuing bank as an applicant.

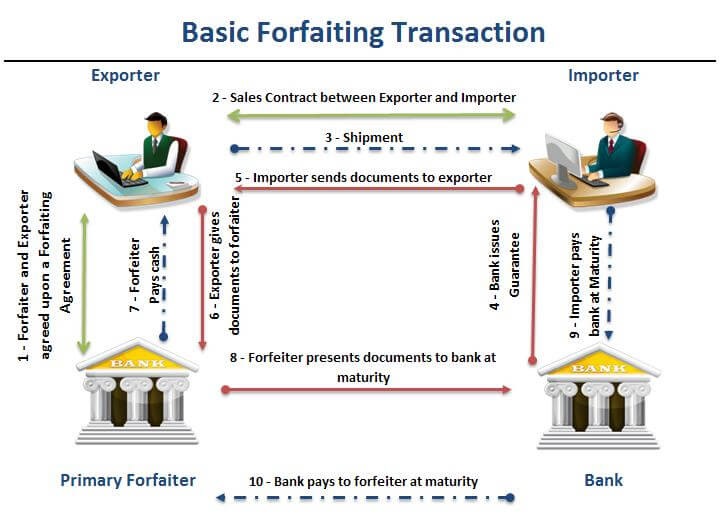

Letters of Credit Issued from Islamic Banks

According to the modern economic theories an interest rate is the cost of borrowing money, however Islam prohibits interest rates.

Which means that Islamic Banks in some Arab and Asian countries can not buy or sell money based on interest rates. Instead they buy and resell the goods to the importers to finance import letters of credit transactions.

This type of Islamic Trade Finance is known as Murabaha Financing.

According to the Murabaha Financing the issuing bank and the importer signs a sales contract.

According to this sales contract the issuing declares the importer as its agent and the importer agrees to pay the goods from the issuing bank on higher amount than the original contract amount that was determined between the importer and the exporter previously.

The issuing bank requests all shipping documents to be under its name, at the same time appointing the importer as its agent, which means all formalities outside of the letter of credit will be made by the importer as an agent of the issuing bank.

Later on, when the issuing bank receives the documents complying the terms and conditions of the letter of credit:

- Pay proceeds to beneficiary.

- Endorse and release documents to the real buyer against Murabaha Financing.

Issuing Bank Open a Letter of Credit for Its Own Procurement

It is also possible that the issuing bank is procuring goods for its own consumption (IT equipment, furniture, etc), it may well designate itself as the applicant under its own Letter of credit.

Letter of Credit Issued under a Leasing Agreement:

It is also possible that the issuing bank is a part of an international leasing operation.

The actual buyer may be using “leasing” as the financial instrument for purchasing the equipment, machinery or other assets where the bank is lessor (owner) and the end-buyer (the actual buyer) is the lessee (user) in this method.

References:

- UCP 600, Uniform Customs and Practice for Documentary Credits

- How does Trade Based (Murabaha) Financing Work?, Amana Bank Youtube Channel