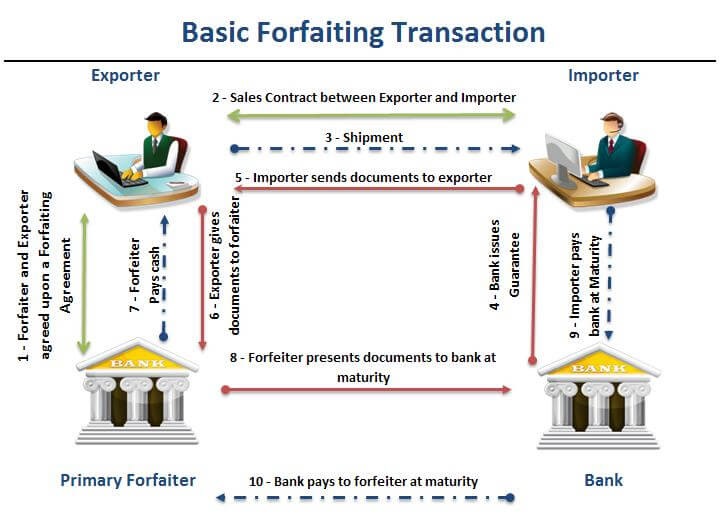

Forfaiting means the sale by the seller and the purchase by the buyer of the payment claim on a without recourse basis.

In other words, forfaiting is discounting of trade‐related receivables secured with trade finance instruments such as bills of exchange, promissionary notes or deferred payment letters of credit.

In the U.S., forfaiting is known as “structured trade finance”, and every year more than USD 300 billion of world trade takes place using forfaiting.

ICC Uniform Rules for Forfaiting which is called URF 800 is the first set of rules which governs both international and domestic forfaiting transactions.

These rules went into effect on January 1, 2013.

URF 800 is created by the experts from ICC (International Chamber of Commerce) and ITFA (International Trade and Forfaiting Association) with a spread of expertise – marketing, operational and legal – and geographical location.

What are the Headings of URF 800?

You can find table of contents of Uniform Rules for Forfaiting below. Uniform Rules for Forfaiting consists of total 14 articles and 4 annexes.

Table of Contents of URF 800 Rules

FOREWORDS

INTRODUCTION

Article 1 Application of URF

Article 2 Definitions

Article 3 Interpretations

Article 4 Without recourse

Article 5 Forfaiting agreements in the primary market

Article 6 Conditions in the primary market

Article 7 Satisfactory documents in the primary market

Article 8 Forfaiting confirmations in the secondary market

Article 9 Conditions in the secondary market

Article 10 Satisfactory documents in the secondary market

Article 11 Payment

Article 12 Payment under reserve

Article 13 Liabilities of the parties

Article 14 Notices

ANNEXES

Annex 1 Master Forfaiting Agreement

Annex 2 Forfaiting Agreement

Annex 3 Forfaiting Agreement in SWIFT format

Annex 4 Forfaiting Confirmation

How URF 800 Can be Applied to Forfaiting Transactions ?

All ICC rules which are related to international trade require express incorporation into the agreements.

For example, the UCP 600 rules will apply to the letters of credit when the text of the credit expressly indicates that it is subject to the UCP 600.

The Uniform Rules for Forfaiting (URF 800) are no exception.

URF 800 rules apply to a forfaiting transaction when the parties expressly indicate that their agreement is subject to these rules.

They are binding on all parties thereto except so far as modified or excluded by agreement.

Some Important Benefits of ICC Forfaiting Rules:

According to Silja Calac, who was the chair of the task force that gathered from both ICC and ITFA to create URF rules, what the UCP (Uniform Customs & Practice for Documentary Credits, ICC publication 600) has achieved for the management of risk in international trade, the URF (ICC publication 800) will hopefully bring to the funded side of trade – not only international trade, but also even domestic receivables financing.

She also believes that “the URF will be highly beneficial for exporters intending to sell down their claims related to their trade finance transactions.

Referring to clear rules in the documentation will save corporates high legal costs, improve certainty and enhance business because each party will know exactly what to expect.”

Where to Buy the URF 800 Book?

You can buy ICC Uniform Rules for Forfaiting (URF 800) Including Model Agreements ICC Publication No. 800 , 2013 Edition from this link:

- ICC Uniform Rules for Forfaiting URF 800 English Version Including Model Agreements

By ICC Banking Commission & International Forfaiting Association

ICC Publication No. 800E, 2012 Edition