Maturity date is a term related to a time draft.

A time draft is a form of payment that is guaranteed by an issuing bank, but is not payable in full until a specified amount of time after it is received and accepted. (1)

The maturity date is a date on which a bill of exchange or deferred payment undertaking under a documentary credit is to be paid by the party assuming the undertaking. (2)

Determining the maturity date is an important concept especially when the letter of credit is available with a time draft.

Example: A letter of credit has been issued by an international bank’s branch in France states that the documentary credit is available by drafts payable at 60 days after bill of lading issue date.

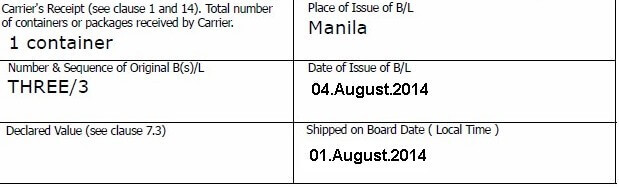

The beneficiary has presented the bill of lading showing:

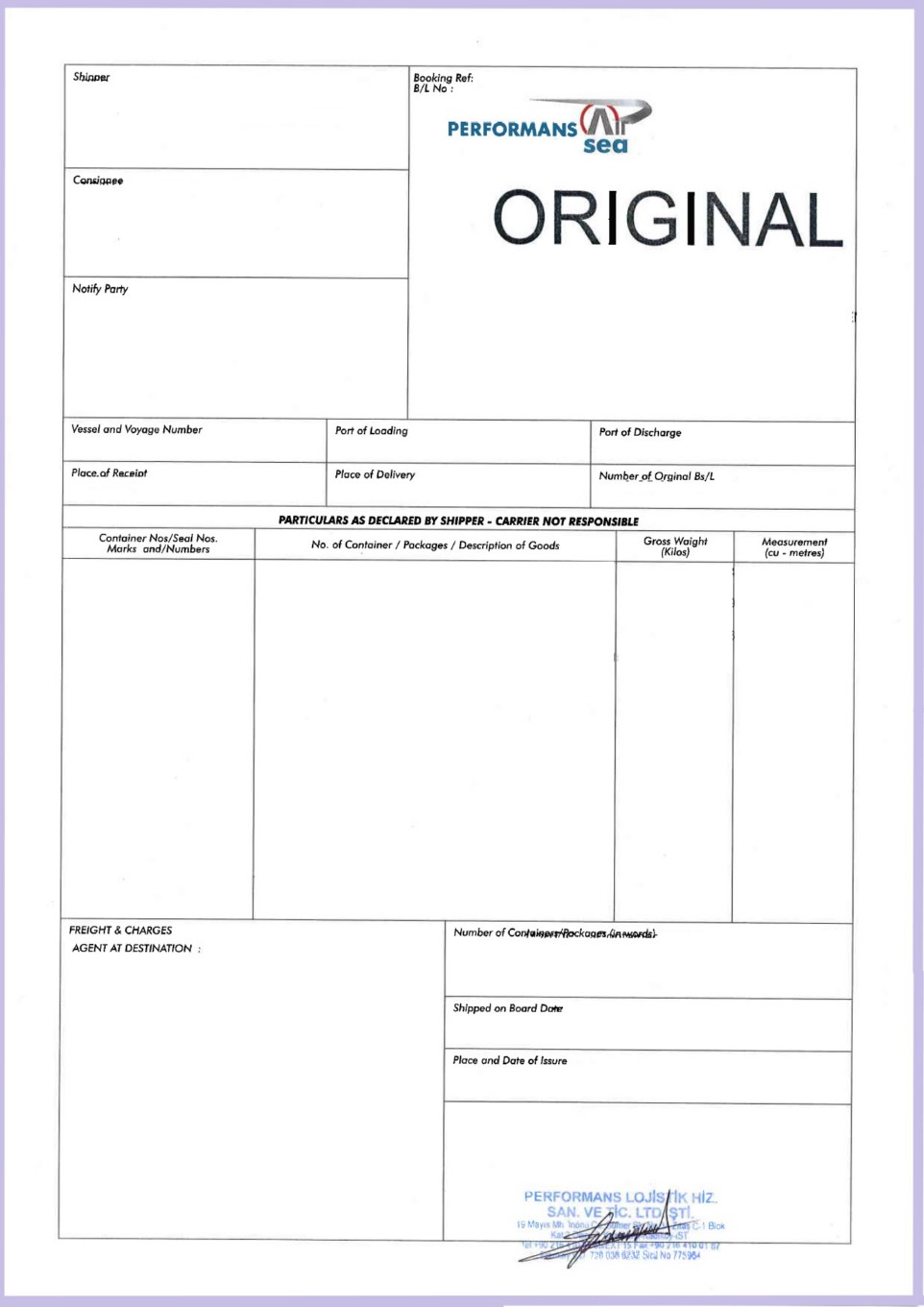

- date of issue : 04.August.2014 and

- shipped on board date : 01.August.2014.

How to determine the maturity date of the draft based on above information?

First of all we need to understand that whether there are any differences exist between the “bill of lading date” and the “bill of lading issue date”.

When we look at the ISBP 745 we understand that ICC Banking commission used these terms with the same meaning. As a result both “bill of lading date” and “bill of lading issue date” have the same meaning in terms of letter of credit rules.

Secondly we need to answer which date we should be using when determining the maturity date of the draft.

Should we use bill of lading issuance date or shipped on board date?

Once again we need to look at the ISBP 745 for the correct answer. ISBP 745 states that shipped on board date is deemed to be bill of lading date or bill of lading issue date with the following statement:

“When the tenor refers to, for example, 60 days after the bill of lading date, the on board date is deemed to be the bill of lading date even when the on board date is prior to or later than the date of issuance of the bill of lading.”

As a result we need to use shipped on board date when determining the maturity date of the draft even if the letter of credit states that tenor of the L/C is 60 days after bill of lading issue date.

On the above example shipped on board date is 01.August.2014 and tenor is 60 days after bill of lading issuance date.

We should accept shipped on board date as bill of lading issue date and should use it on calculation of the maturity date.

The maturity date is 30.September.2014.

Important Note: You should add 60 days to 01.August.2014. Remember you should exclude 01.August.2014 when counting 60 days.

Sources:

- https://www.investopedia.com/terms/t/time-draft.asp

- Documentary credits in practice, Reinhard Längerich, Second edition – 2009, Page: 304, Published by: Nordea