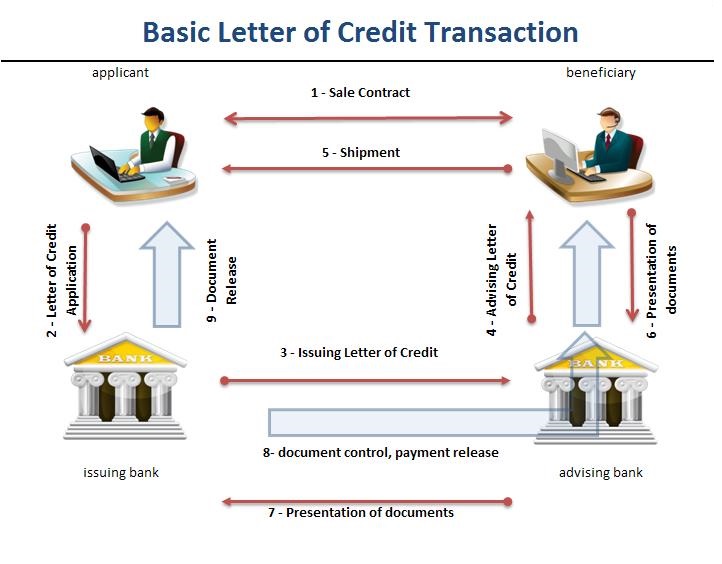

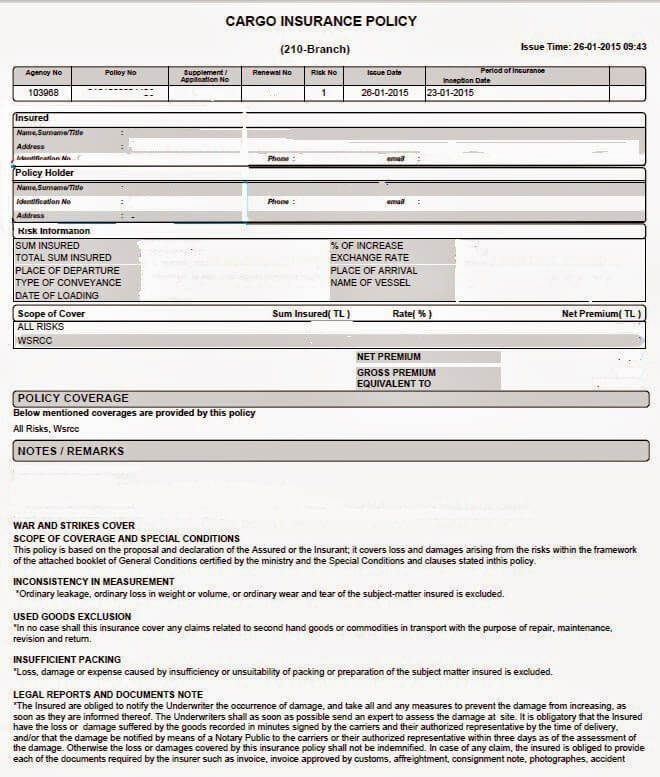

Banks decide whether a presentation is complying or not by only checking the documents under the letters of credit transactions.

Banks should be able to read the documents, which have been presented to them. Otherwise they can not check them.

As a result issuance of the documents with the correct language is the first requirement for a complying presentation.

On this post I will explain the language of the documents according to the ICC rules and regulations.

What Does the UCP 600 Tell Us About the Language of the Documents?

Surprisingly, latest letter of credit rules are silent in regards to the language of the documents.

For this reason, we have to look at the international standard banking practices to understand ICC Banking Commission’s perspective on this matter.

ISBP 2007 Regulations

ISBP 2007 has a very limited coverage about the language of the documents.

We can see related regulation only in article 23.

Article 23 of ISBP 2007 tells us that “it is expected that documents issued by the beneficiary will be in the language of the credit” and “when a credit states that documents in two or more languages are acceptable, a nominated bank may, in its advice of the credit, limit the number of acceptable languages as a condition of its engagement in the credit.”

It is understand from the practice that these statements are not enough to clarify the language of the documents subject.

As a result ICC banking Commission has made a significant change on this subject, when they were renewing the international standard banking practices.

ISBP 2013 Regulations

ISBP 2013 is the revised version of ISBP 2007. It has been effective since the beginning of June 2013.

Unlike previous versions, the new international standard banking practices has a detailed explanation about the language of the documents.

- ISBP 2013 encourages issuing banks to specify the language of the credit with these wordings “when a credit stipulates the language of the documents to be presented, the data required by the credit or UCP 600 are to be in that language.” If the issuing bank would not specify the language of the credit, then the documents may be issued in any language.

- Even if the issuing bank allows presentation of documents issued more than one language, the nominated bank or confirming bank may restrict the number of acceptable languages as a condition of their engagements in the credit.

- For example issuing bank may allow presentation of documents issued either English or French, but the confirming bank can restrict the letter of credit for the documents only issued in English language. In such a case only the data written in English will be acceptable.

- ISBP 2013 also states that banks do not examine data that have been inserted in a language that is additional to that required or allowed in the credit. As an example, let us assume that the credit calls for documents issued in English language only. If the exporter presents a commercial invoice issued in English language, but having additional Arabic information, banks do not control the Arabic written parts. They check the English parts only.

There is one more sub-article exists in ISBP 2013, which is clarifying the language of stamps, legalization and endorsements, however I would like to write about this subject in the near future with an example.

Case Study : What Does Commerzbank Think About the Language of the Documents?

Before finalizing this post, let me give you a real life example from Commerzbank:

“Thus it is essential that the participating banks are able to determine that the documents are complying.

Commerzbank does not believe it is reasonable to expect them to have documents translated before their conformity can be checked, a process that might result in deadlines for checking documents being exceeded.

It is for that reason that Commerzbank rejects documents which language cannot be checked or honors them under reserve only.”