Insurance defined by merriam-webster dictionary as “a coverage by contract whereby one party undertakes to indemnify or guarantee another against loss by a specified contingency or peril.”

Insurance can cover a wide range of activities including but not limited to agricultural insurance, health insurance, life insurance, vehicle insurance etc…

On this page, the focus is on the cargo insurances.

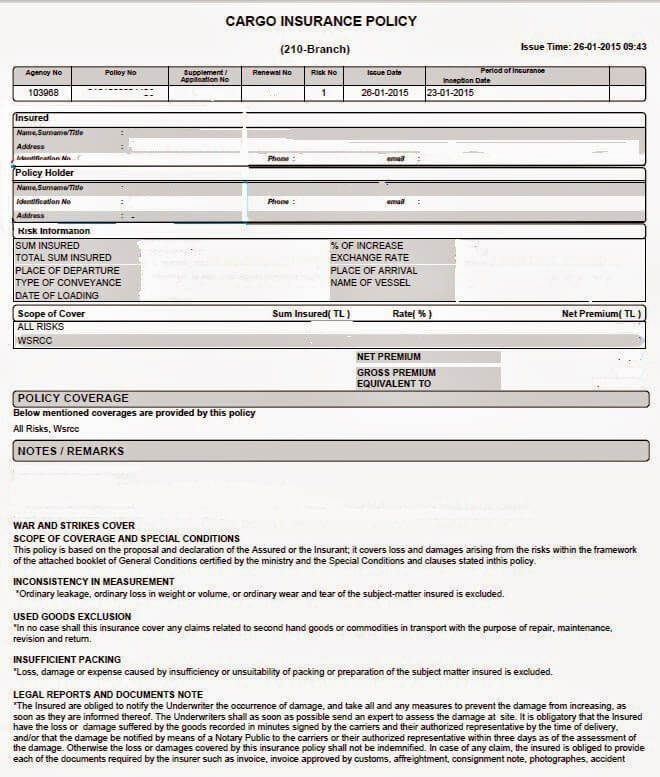

Cargo insurance can be defined as an insurance policy taken up to protect insurance policy holder/assured against loss of or damage to the goods during the transportation.

Cargo insurance is one of the most important elements of the international trade transactions.

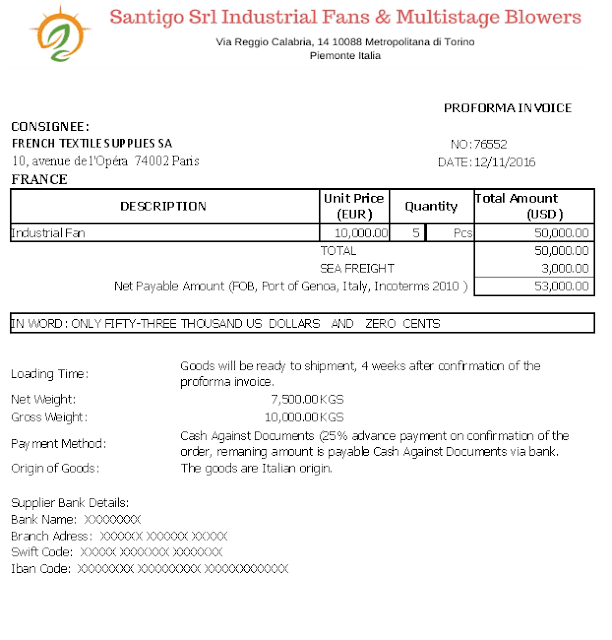

Details of the cargo insurance should be determined under the sales contracts.

Who is Going to Arrange and Pay for the Cargo Insurance:

Under CIF (Cost Insurance Freight) and CIP (Carriage and Insurance Paid to a named place of destination) trade terms, the cargo insurance premium must be paid for and arranged by the exporter.

Otherwise parties can freely determine the insurer party.

What Kinds of Cargo Insurance Policies are Available for Export / Import Purposes:

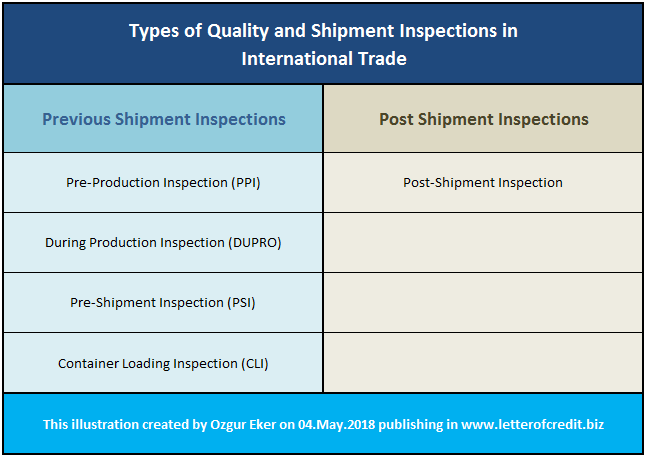

There are 3 main cargo insurance types available for sea and road shipments.

- Institute Cargo Clauses (A),

- Institute Cargo Clauses (B) and

- Institute Cargo Clauses (C).

Institute Cargo Clauses (A), which is also known as all risk insurance, has the widest protection coverage.

Institute Cargo Clauses (C) has the minimum insurance coverage.

Institute Cargo Clauses (Air) used in air shipments.

* Institute Cargo Clauses (A) 1/1/09

* Institute Cargo Clauses (B) 1/1/09

* Institute Cargo Clauses (C) 1/1/09

* Institute Cargo Clauses (Air) (excluding sending by Post) 1/1/09

Which Additional Clauses Should be Included in to the Cargo Insurance Policy:

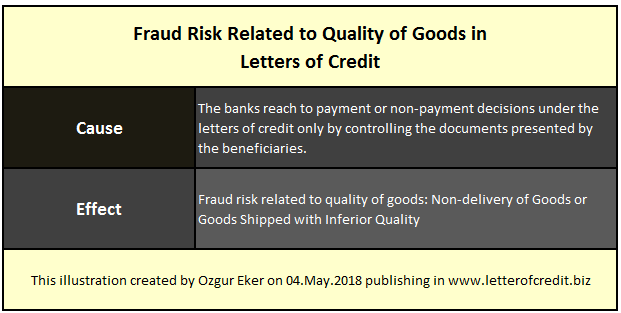

Under the letters of credit transactions, the issuing banks demand some additional clauses on the cargo insurance policies together with all risks coverage for more security.

Some of the most frequently used additional cargo insurance clauses are,

* Institute War Clauses (Cargo)

* Termination of Transit Clause (Terrorism) Amended

* War and Strikes Cancellation Clause (Cargo)

Starting and Ending Points of the Cargo Insurance Coverage:

Normally the cargo insurance covers the losses that is occurred between the starting and ending point of the main carriage.

For example, a cargo insurance covers the losses that is occurred between the port of loading and the port of discharge on a port-to-port sea shipment.

But sometimes issuing banks may demand an extended coverage.

The most frequently used clause for these kinds of extensions is “warehouse to warehouse” insurance coverage.

How to Use Insurance Documents in Letters of Credit Transactions:

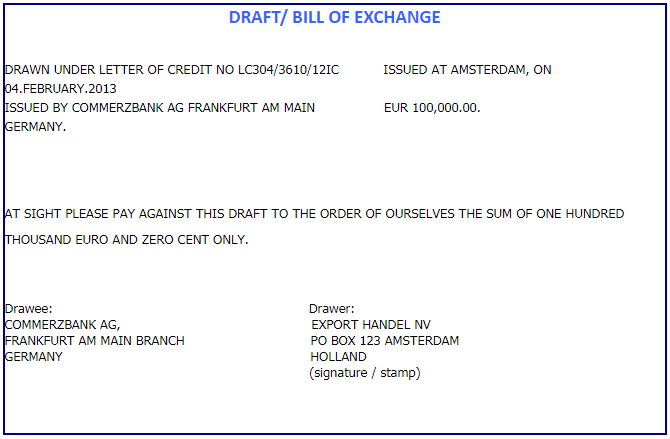

- An insurance document, must appear to be issued and signed by an insurance company, an underwriter or their agents or their proxies. Any signature by an agent or proxy must indicate whether the agent or proxy has signed for or on behalf of the insurance company or underwriter.

- An insurance policy is acceptable in lieu of an insurance certificate or a declaration under an open cover.

- Cover notes will not be accepted.

- The date of the insurance document must be no later than the date of shipment, unless it appears from the insurance document that the cover is effective from a date not later than the date of shipment.

- The insurance document must indicate the amount of insurance coverage and be in the same currency as the credit.

- An insurance document indicating that it covers Institute Cargo Clauses (A) satisfies a condition in a credit calling for an “all risks” clause or notation. (ISBP 2007)