Banks accept only clean transport documents.

Banks do not accept any unclean transport document such as unclean bill of lading, unclean multimodal bill of lading, unclean charter party bil of lading, unclean road transport document, unclean air transport document, unclean sea waybill etc.

Letter of credit rules define clean transport document as follows: “A clean transport document is one bearing no clause or notation expressly declaring a defective condition of the goods or their packaging.”

There are two important points about the clean transport documents subject that everyone must know.

The first important point is that the word “clean” need not appear on a transport document, even if a credit has a requirement for that transport document to be “clean on board”.

The second important point is that only express clauses or notations on the transport documents would make them unclean.

If transport document is not to include a clause that expressly declare a defective condition of the goods or their packaging, then it is accepted as a clean transport document.

Sample Clauses That Make a Transport Document Unclean:

• Packaging is not sufficient for the sea journey

• Goods which improperly stored at the port of loading have been shipped on board partially wet and not in good condition.

Let us try to understand the subject with an example as below:

Letter of Credit Discrepancy Example: Unclean Multimodal Transport Document Presented Discrepancy

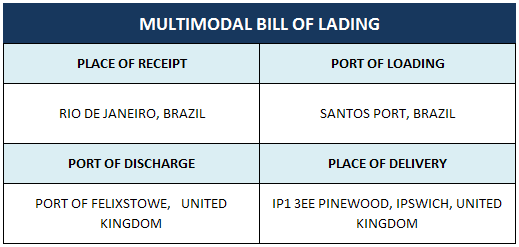

A letter of credit has been issued in SWIFT format, subject to UCP latest version, with the following details:

Letter of Credit Conditions

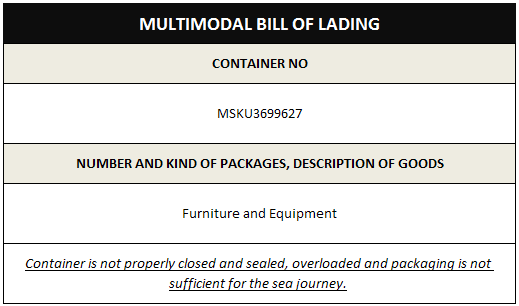

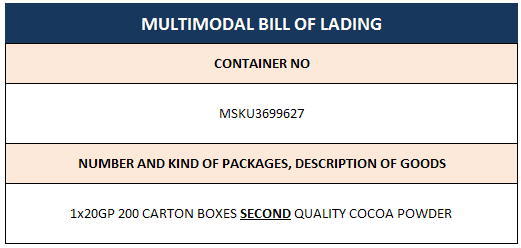

Field 45A: Description of Goods and or Services: Furniture and Equipment

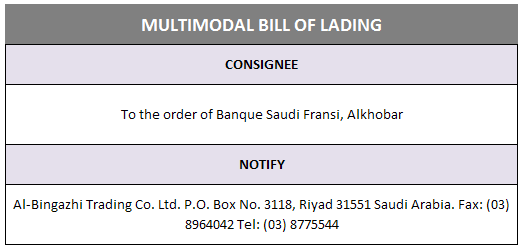

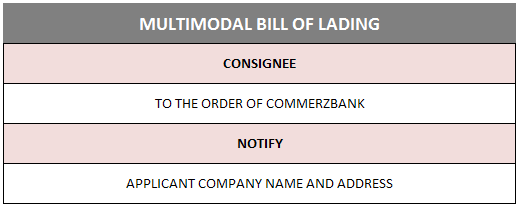

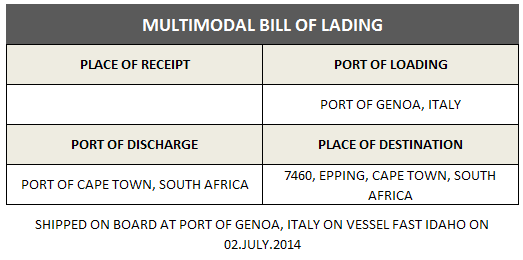

Field 46A: Documents Required: Full set of clean on board multimodal transport document marked freight collect made out to order of Commercial Bank of Ethiopia marked notify applicant indicating that the goods have been dispatched, taken in charge or loaded on board.

The beneficiary presented a multimodal transport bill of lading with the following clause:

Container is not properly closed and sealed, overloaded and packaging is not sufficient for the sea journey.

Multimodal Bill of Lading

Discrepancy: Unclean multimodal bill of lading presented.

Reason for Discrepancy: A bank will only accept a clean transport document. A clean transport document is one bearing no clause or notation expressly declaring a defective condition of the goods or their packaging.