Cargo insurance, also referred to as a marine cargo insurance, in general, means the insurance on goods being shipped in international trade by vessel, aircraft or overland conveyance. (1)

An insurance policy, an insurance certificate or a declaration under an open cover will be regarded as an insurance document under current letter of credit rules. (UCP 600 at article 28)

An insurance document must appear to be issued and signed by an insurance company, an underwriter or its agents or proxies, and that any signature by an agent or proxy must indicate whether the agent or proxy has signed for or on behalf of the insurance company or underwriter.

If the issuing bank finds out that an insurance document has not been signed as per UCP 600 article 28, then the issuing bank will raise a discrepancy, which is known as insurance policy not issued by an insurance company or its agent discrepancy.

Discrepancy Example: Insurance Policy Not Issued and Signed by an Insurance Company or Its Agent:

A letter of credit has been issued in SWIFT format, subject to UCP latest version, with the following details:

Letter of Credit Conditions

Field 45A: Description of Goods and or Services: 20 mtons of %100 Pure Tunisian Dates. Delivery Terms: CIF Port of Barcelona, Spain Incoterms 2010.

Field 46A: Documents Required:

- Beneficiary’s hand-signed and dated commercial invoice in 3 originals bearing full description of goods and its quantity, net and gross weight, unit and total price.

- Certificate of Origin issued and certified by the Chamber of Commerce in Beneficiary’s country indicating Tunisian origin of the goods.

- Insurance policy in assignable form and endorsed in blank for 110% invoice value (CIF value) covering all risks showing claim payable in Spain in invoice currency.

- Full set original clean on board, marine bills of lading marked freight prepaid and made out to order and blank endorsed, marked notify applicant stating the name, telephone and fax numbers of carrier’s agent in port of discharge. Bill of lading should evidence shipment in 20′ closed containers.

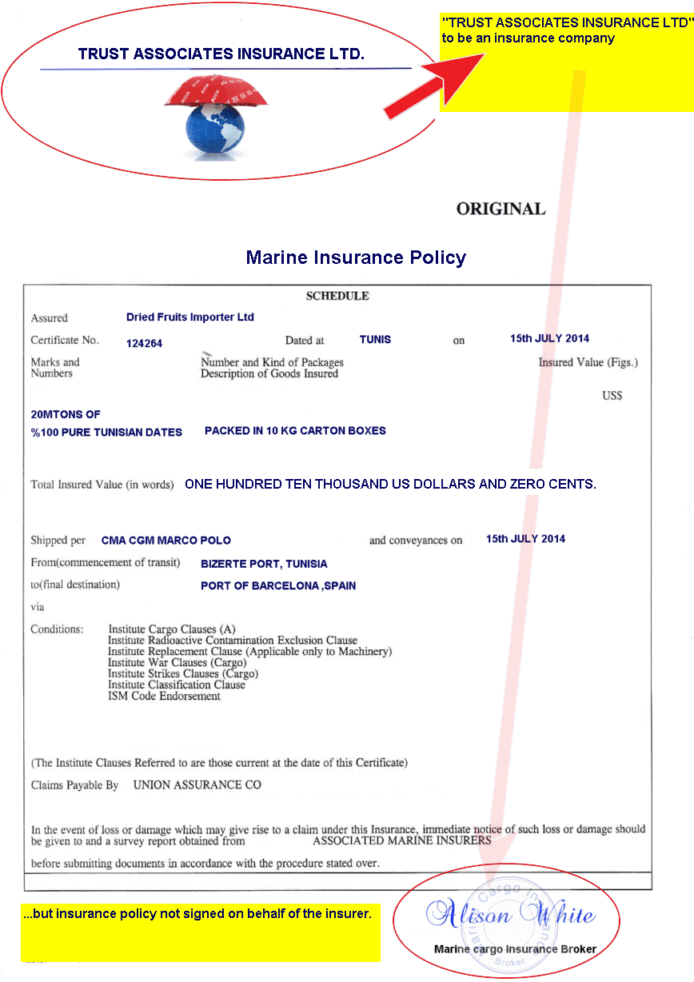

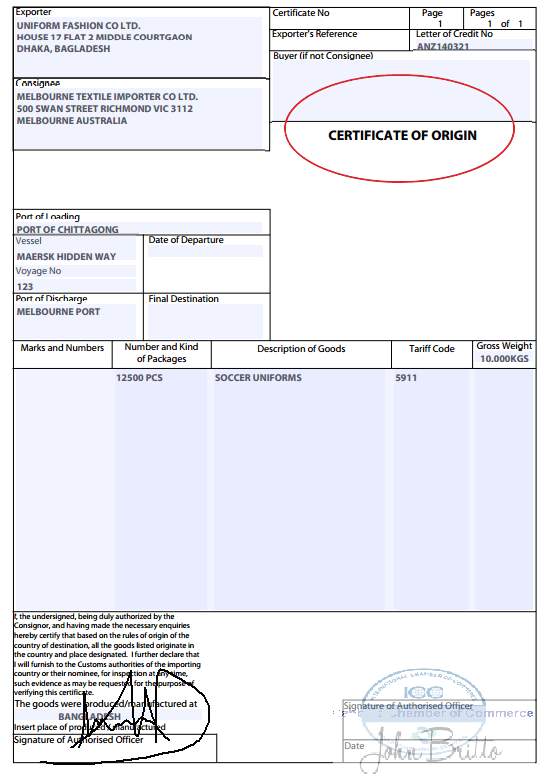

The beneficiary presented an insurance policy as shown on the below picture.

Insurance Policy

Insurance Policy Discrepancy: Although insurance policy indicates the name of the insurance company, insurer, it is not signed by the insurance broker on behalf of the insurance company.

Reason for Discrepancy: An insurance document, such as an insurance policy, an insurance certificate or a declaration under an open cover, must appear to be issued and signed by an insurance company, an underwriter or their agents or their proxies.

Any signature by an agent or proxy must indicate whether the agent or proxy has signed for or on behalf of the insurance company or underwriter.