On this page, you can find most common discrepancy examples related to the commercial invoice.

Invoice is a commercial document. A commercial invoice is a required document for the export and import clearance process. It is sometimes used for foreign exchange purposes.

In the buyer’s country, it is the document that is used by their custom officials to assess import duties and taxes. (Source: Export Information and Documentation: A Guide for New Exporters Page: 18)

A commercial invoice should be issued by the beneficiary of the letter of credit, according to the letter of credit rules and standard banking practices.

UCP 600 Article 18 explains specific requirements for commercial invoices.

Commercial invoice is one of the main documents in letters of credit transactions, for that reason almost all letters of credit request presentation of a commercial invoice.

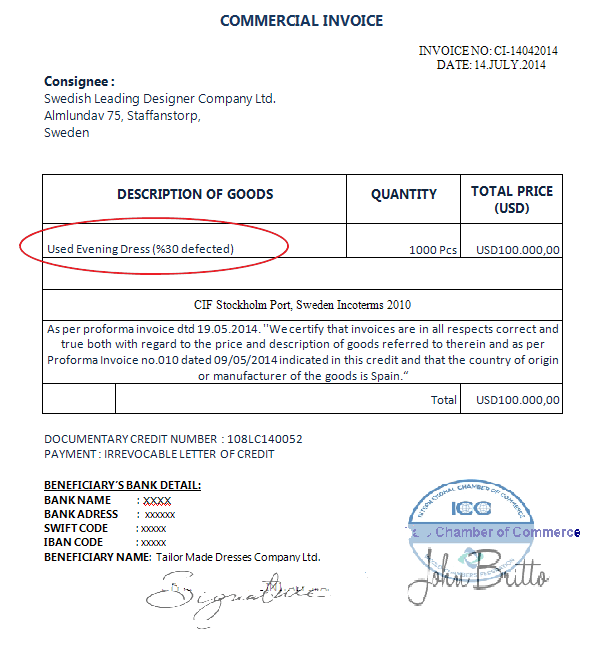

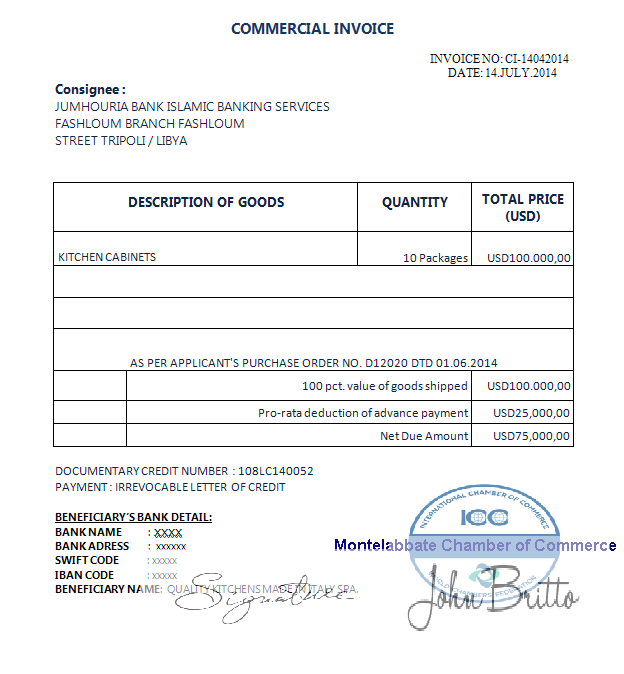

Commercial Invoice Discrepancies

- Incoterms Not Stated on the Commercial Invoice

- Description of Goods not per Letter of Credit

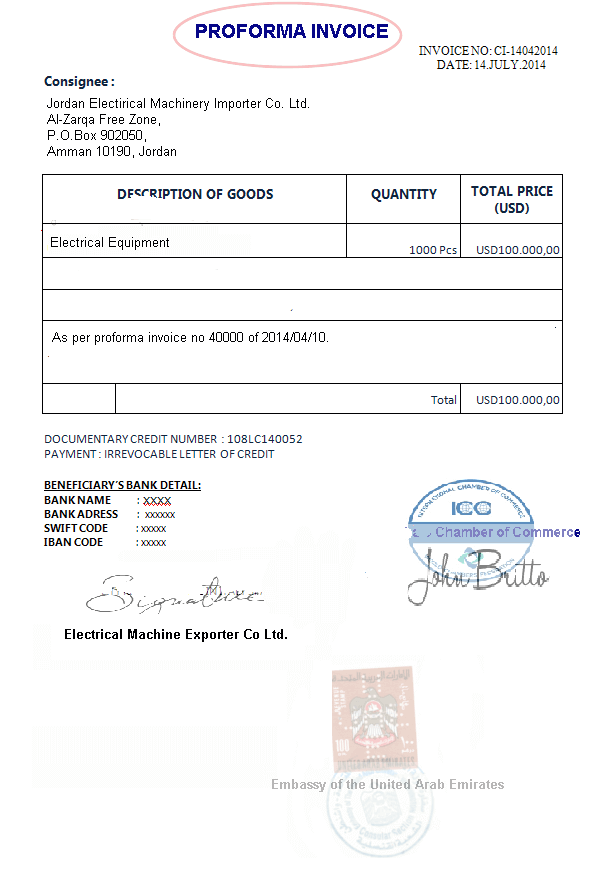

- Proforma Invoice Presented Instead of a Commercial Invoice

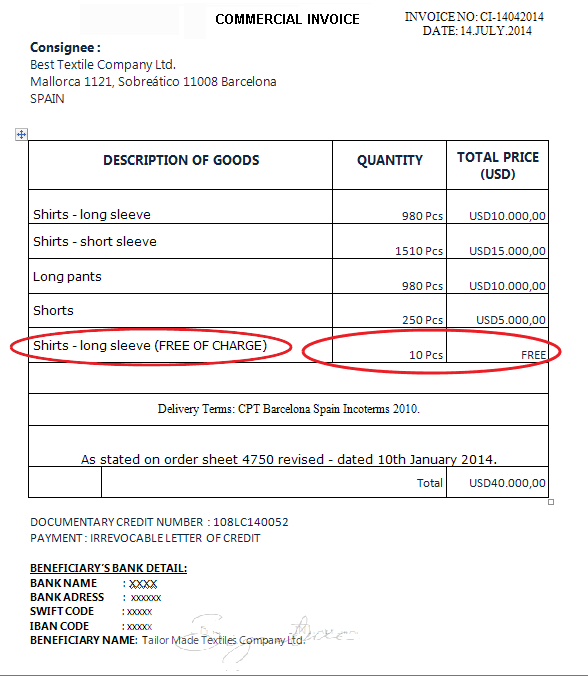

- Commercial Invoice Shows Merchandise not Called for in the Letter of Credit

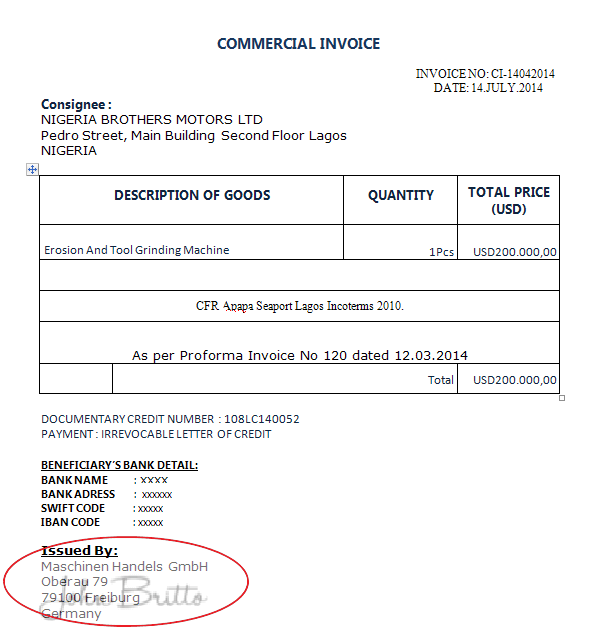

- Commercial Invoice Not Issued by the Beneficiary

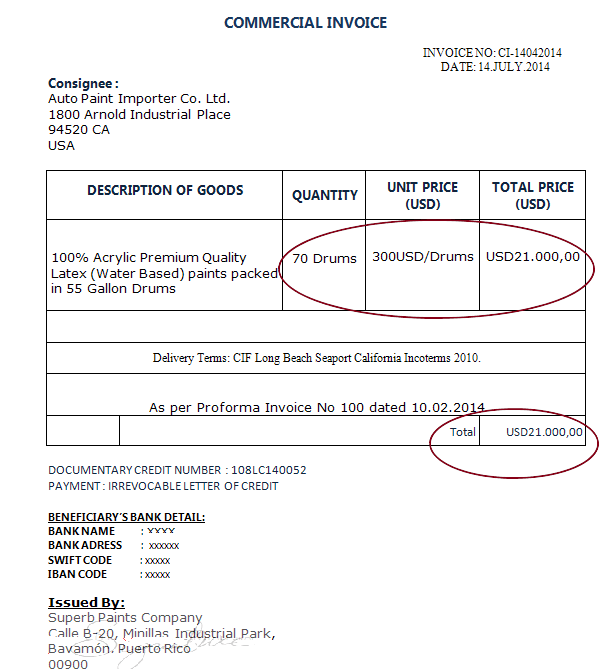

- Short Shipment

Important Definitions Regarding the Commercial Invoice Under Latest Letter of Credit Rules:

- According to UCP 600, latest letter of credit rules, a commercial invoice need not to be signed, but almost all custom authorities require manually signed commercial invoice. As a result, make sure that commercial invoice is signed and stamped properly.

- When a credit demands presentation of an “invoice” without further description, this will be satisfied by the presentation of any type of invoice (commercial invoice, customs invoice, tax invoice, final invoice, consular invoice, etc.) except invoices titled with “provisional”, “pro‐forma” or the like.

- An invoice should be issued by the beneficiary. In a transferable letter of credit, the second beneficiary could issue the commercial invoice.

- The invoice should show exact description of the goods, services or performance shown in the letter of credit. The description of goods, services or performance on an invoice is to reflect what has actually been shipped, delivered or provided.

- A commercial invoice should indicate the value of the goods shipped or delivered and the unit prices, when stated in the credit.

- Invoice should be issued in the same currency as that shown in the letter of credit.