Documents must be presented to the nominated banks within allowed time frame under letters of credit payments.

Otherwise issuing banks or confirming banks raise late presentation discrepancy.

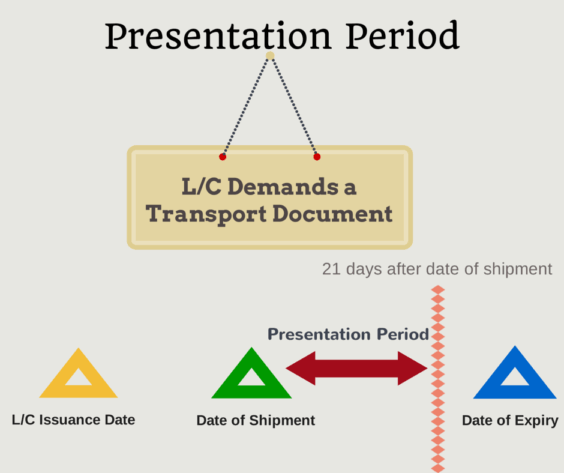

According to the letters of credit rules a presentation consists of a transport document should be presented to the nominated bank within 21 days after the date of shipment, but not later than the expiry date of the letter of credit.

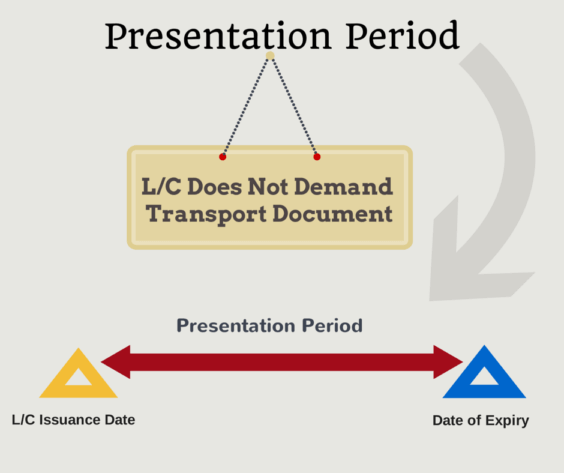

If the letter of credit does not require presentation of a transport document, then the presentation period does not become effective.

Under such a scenario, the documents must be presented to the nominated bank before the expiry date.

If the letter of credit is silent in regards to the period of presentation, the documents must be presented to the nominated bank before the expiry date, when the letter of credit does not ask for a transport document.

Example:

A Serbian food exporter signs a proforma invoice with in importer located in Kuwait. The letter of credit amount is 75.000 EUR and partial shipments are not allowed.

Expiry date of the letter of credit is 15.February.2019.

The letter of credit is silent in regards to the presentation period, which means that there is no Field 48 -Period for Presentation indicated in the letter of credit.

Option 1: Letter of credit does not ask for a presentation of a transport document:

- The beneficiary must present the document to the nominated bank before the expiry date of the letter of credit.

Option 2: Letter of credit asks for a presentation of a transport document:

Under the same scenario, please assume that selected transportation mode is sea shipment and transport document is a bill of lading and latest date of shipment is 10.January.2019.

- The beneficiary must complete the shipment before 10.January.2019 and presents the document to the nominated bank within 21 days after the date of shipment, but not later than the expiry date of the letter of credit.