USA Letter of Credit Transactions

You should understand USA economy, USA exports and imports as well as US banks before you proceed to work with an US letter of credit.

The United States of America’s Economy and International Trade at a Glance:

- Gross domestic product of USA is 15.6 trillion US dollars in year 2013. This makes the US economy largest economy in the world.

- USA is the world’s biggest importer with 2.31 trillion US dollars volume and 3rd biggest exporter with 1.49 trillion US dollars volume in year 2013.

- US Dollar is the main reserve currency in today’s economic system. Most of the international trade transactions are handled by US Dollar. For example when you buy a 20ft container of textile from China you most probably pay by US dollars whichever country you may locate.

- USA is one of the least risky countries in the world in terms of financial, economic and politic stability factors.

- Most of the big global companies are originated from USA.

- Although USA has s strong and well established finance system, last global financial crises hit hard to US financial institutions. Even biggest US banks had to be rescued by US government as a result of unwanted effects of global financial crisis.

- Trade deficit or, a trade gap, is one of the key problems in US economy. US has been covering its trade deficit by the help of direct foreign investment and borrowing for decades. As a result USA has a very high level of external debt stock at the moment.

Biggest Banks in USA and their SWIFT Codes:

| Bank Name | Assets (Billion USD) | Swift Code |

|---|---|---|

| Bank Name: JP Morgan Chase | Assets (Billion USD): 2,265.8 | Swift Code: CHASUS33 |

| Bank Name: Bank of America Corp. | Assets (Billion USD): 2,136.6 | Swift Code: BOFAUS3N |

| Bank Name: Citigroup Inc. | Assets (Billion USD): 1,873.9 | Swift Code: CITIUS33 |

| Bank Name: Wells Fargo | Assets (Billion USD): 1,313.9 | Swift Code: WFBIUS6S |

| Bank Name: Goldman Sachs Group | Assets (Billion USD): 923.7 | Swift Code: GOLDUS33 |

| Bank Name: Morgan Stanley | Assets (Billion USD): 749.9 | Swift Code: MSNYU33 |

| Bank Name: U.S. Bancorp | Assets (Billion USD): 340.1 | Swift Code: USBKUS44 |

| Bank Name: HSBC North America Holdings Inc. | Assets (Billion USD): 331.4 | Swift Code: MRMDUS33 |

United Kingdom Letter of Credit Transactions

You should understand United Kingdom economy, United Kingdom exports and imports as well as United Kingdom banks before you proceed to work with a letter of credit which is issued in United Kingdom.

Economy of United Kingdom and International Trade at a Glance:

- Gross domestic product of United Kingdom is $2,43 trillion US dollars in year 2012. This makes United Kingdom economy 7th largest economy in the world after USA, China, Japan, Germany, France and Brazil.

- United Kingdom is the world’s 5th biggest importer with 642,60 billion US dollars import volume in year 2012 and 10th biggest exporter with 474,60 billion US dollars export volume in year 2012.

- International trade has been playing a significant role on United Kingdom economy.

- United Kingdom economy experiencing significant trade deficits for the last couple of years which means that annual United Kingdom exports are less than annual United Kingdom imports.

- United Kingdom economy is one the leading forces of the European Union economy at the moment just after Germany and France.

- Main export products of United Kingdom : Transport Equipment (16 percent); Chemical Products (10 percent of total exports); Machinery and Equipment (9 percent); Computer, Electronic and Optical Products (8 percent); Pharmaceutical Products (8 percent); Refined Petroleum Products (7 percent) and Basic Metals (6 percent)

- Main import products of United Kingdom : Computer, Electronic and Optical Products (11 percent); Transports Equipment (14 percent); Chemical Products; Food and Beverages; Chemical products; Apparel, Textiles and Leather; Basics Metals and Refined Petroleum Products.

- Biggest Export Partners of United Kingdom : United States (13 percent) and Euro Area countries with Germany, Netherlands, France, Ireland, Belgium, Italy and Spain.

- Biggest Import Partners of United Kingdom : China (8 percent), United States (7 percent), Norway (6 percent) and European Union countries with Germany, Netherlands, France, Belgium, Italy and Ireland.

Biggest Banks in United Kingdom and their SWIFT Codes:

Netherlands Letter of Credit Transactions

You should understand Netherlands economy, Netherlands exports and imports as well as Netherlands banks before you proceed to work with a letter of credit which is issued in Netherlands.

Economy of Netherlands and International Trade at a Glance:

- Gross domestic product of Netherlands is $770,60 billion US dollars in year 2012. This makes Netherlands economy 18th largest economy in the world after USA, China, Japan, Germany, France, United Kingdom, Brazil, Russia, Italy, India, Canada, Australia, Spain, Mexico, South Korea, Indonesia and Turkey.

- Netherlands is the world’s 10th biggest importer with 474,80 billion US dollars import volume in year 2012 and 7th biggest exporter with 538,50 billion US dollars export volume in year 2012.

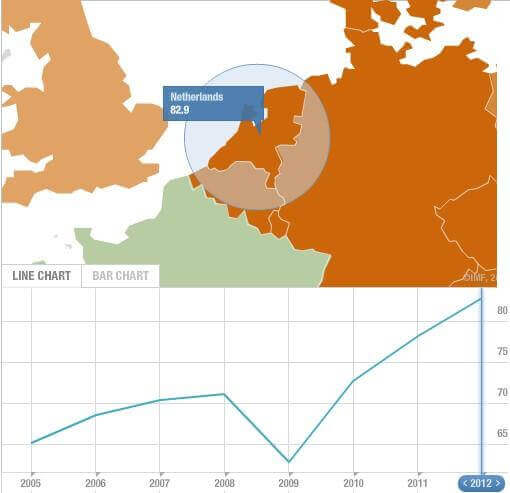

- International trade has been playing a significant role on Netherlands economy. Netherlands exports reached to 82,9% of its Gross Domestic Product in year 2012 according to IMF. These data show us that Netherlands is one of the most export oriented nations in the world.

Figure 1 : Netherlands Export of Goods and Services (percent of GDP) (Source :IMF)

Figure 1 shows Netherlands export of goods and services percent of GDP between 2005-2012. Netherlands exports / Netherlands GDP will be as follows for the corresponding years:

2005 : 65,2%

2006 : 68,7%

2007 : 70,5%

2008 : 71,3%

2009 : 62,9%

2010 : 72,8%

2011 : 78,2%

2012 : 82,9%

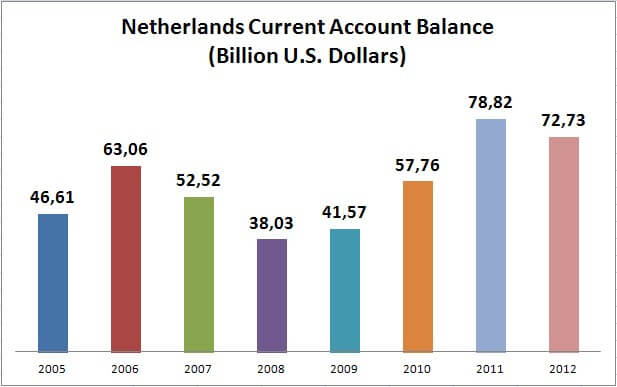

- Netherlands has a positive trade balance which means that its exports is higher than its imports. Even global economic crises could not change this positive trade balance status. Netherlands also has a positive current account thanks to its strong balance of trade surpluses. Current account is the sum of the balance of trade (i.e., net revenue on exports minus payments for imports), factor income (earnings on foreign investments minus payments made to foreign investors) and cash transfers.

Figure 2 : Netherlands Current Account Balance (Billion U.S. Dollars)

In year 2011 and 2012 Netherlands had a record high current account surpluses of 78,82 billion USD and 72,73 billion USD respectively.

- Main export products of Netherlands: Petroleum oils, refined (12%), Automatic data processing machines (3%), Petroleum oils, crude (3%), Medicaments, packaged (3%), Machines and mechanical appliances having individual functions(2%).

- Main import products of Netherlands: Petroleum oils, refined (9%), Petroleum oils, crude (5%), Automatic data processing machines (5%), Medicaments, packaged (3%), Cars (3%).

- Biggest Export Partners of Netherlands: Germany (19%), Belgium-Luxembourg (16%), United Kingdom (9%), France (6%), Italy (6%).

- Biggest Import Partners of Netherlands: Germany (16%), China (10%), Belgium-Luxembourg (10%), United States (7%), United Kingdom (6%).

Biggest Banks in Netherlands

ING Bank: ING (International Netherlands Group) is a global financial institution offering banking, investments, life insurance and retirement services.

ING’s operations are focused on its home Benelux market, as well as the rest of Europe, Asia/Pacific, and North America.

One of the world’s largest insurance and financial services companies. The Group was created in 1991 by a merger between Nationale-Nederlanden and NMB Postbank Group. At August 9, 2013, it had a market cap of over $43.0 billion.

Assets: 1.526,57 billion USD SWIFT Code: INGBNL2A

Rabobank Group: Rabobank is the market leader in Dutch retail savings, residential mortgages (31%), and SME banking.

It operates in 48 countries and serves approximately 10 million clients. Rabobank has the highest credit rating AAA from both Standard & Poor’s and Moody’s, and AA+ from Fitch.

Assets: 942 billion USD SWIFT Code: RABONL2U

ABN Amro Bank: ABN AMRO is a multinational universal bank servicing retail, private and commercial banking clients. ABN AMRO has a long and rich history reaching back almost 300 years.

The current structure of ABN AMRO Group is a result of various steps taken over the past period, ultimately resulting in the Legal Merger between ABN AMRO Bank and Fortis Bank Nederland as subsidiaries of ABN AMRO Group as at 1 July 2010.

The Dutch State holds all ordinary shares of ABN AMRO Group and has full control over ABN AMRO Group with a total financial interest of 97.8%. The remaining 2.2% is held by institutional investors via ABN AMRO Preferred Investments.

Assets: 531billion USD SWIFT Code: ABNANL2A

Japan Letter of Credit Transactions

You should understand Japanese economy, Japanese exports and imports as well as Japanese banks before you proceed to work with a letter of credit which is issued in Japan.

Japan’s Economy and International Trade at a Glance:

- Gross domestic product of japan is 4.78 trillion US dollars in year 2012. This makes

- Japanese economy 3rd largest economy in the world after USA and China.

- Japan is the world’s 4th biggest importer with 794,70 billion US dollars import volume in year 2011 and 4th biggest exporter with 792,90 billion US dollars export volume in year 2012.

- Japan is one of the most successful countries all around the world that uses export oriented development strategy. japan economy flourished with the help of its export oriented companies after world war II. Japan is now one of the most develop countries.

- Until recently Japanese economy experiencing trade surpluses. For the last couple of years Japan imports exceed its exports and Japan began to see trade deficit on its international trade balance sheet.

- Most of the big global companies are originated from USA.

- Biggest Export Partners of Japan : China (%18.88), USA (%16.42), South Korea (% 8.13), Taiwan (% 6.27), Hong Kong (% 6.27).

- Biggest Import Partners of Japan : China (% 22.2), USA(% 10.96), Australia (% 6.29), Saudi Arabia (% 5.29), UAE (% 4.12), South Korea (% 3.98), Indonesia (%3.95).

Biggest Banks in Japan and their SWIFT Codes:

| Bank Name | Assets (Billion USD) | Swift Code |

|---|---|---|

| Bank Name: Mitsubishi UFJ Financial Group | Assets (Billion USD): 1,999.60 | Swift Code: MTBCJPJTXXX |

| Bank Name: Mizuho Financial Group | Assets (Billion USD): 1,538.90 | Swift Code: MHCBJPJTXXX |

| Bank Name: Sumitomo Mitsui Financial Group | Assets (Billion USD): 1,202.60 | Swift Code: SMBCJPJTXXX |

| Bank Name: Resona Holdings | Assets (Billion USD): 400.47 | Swift Code: DIWAJPJTXXX |

| Bank Name: Sumitomo Trust & Banking | Assets (Billion USD): 213.85 | Swift Code: STBCJPJTXXX |

| Bank Name: Chuo Mitsui Trust Group | Assets (Billion USD): 150.79 | Swift Code: MTRBJPJTXXX |

Italy Letter of Credit Transactions

You should understand Italy economy, Italy exports and imports as well as Italy banks before you proceed to work with a letter of credit which is issued in Italy.

Economy of Italy and Its International Trade at a Glance:

- Gross domestic product of Italy is $2,19 trillion US dollars in year 2012. This makes Italian economy 8th largest economy in the world after USA, China, Japan, Germany, France, Brazil and UK. Italy is the third largest economy of the Eurozone after Germany and France.

- Italy is the world’s 11th biggest importer with 453,50 billion US dollars import volume in year 2012 and 9th biggest exporter with 478,90 billion US dollars export volume in year 2012.

- International trade has been playing a significant role on Italian economy. Italian companies are famous for its quality products in global scale on different type of goods such as healty food, automobiles, textile, machinery, eye glasses and many more.

- Italian economy hit hard by the last global economic crises. Italian economy is one of the most badly effected economy in EU. Italian GDP has declined by 6.9% since the start of the financial crises in year 2008. You can have a look at the Italian economic’s current situation after the last financial crises from this link.)

- Main export products of Italy : Precision machinery (18%); metals and metal products (13%); clothing and footwear (11%); motor vehicles including luxury vehicles, motorcycles and scooters (10%), pharmaceuticals and other chemicals (7%) and food (6%).

- Main import products of Italy : Fuel (17%), motor vehicles (10%), raw minerals (10%), chemicals (9%), electronic devices (8%) and food (7%).

- Biggest Export Partners of Italy : Germany (13%), France (12%), United States (6%), Switzerland (6%) and Spain (5%).

- Biggest Import Partners of Italy : Germany (16%), France (8%), China (7%), Netherlands (5%) and Spain (5%).

Biggest Banks in Italy and their SWIFT Codes:

| Bank Name | Assets (Billion USD) | Swift Code |

|---|---|---|

| Bank Name: UniCredit SPA | Assets (Billion USD): 1,219,53 | Swift Code: UNCRIT2V |

| Bank Name: Intesa Sanpaolo SPA | Assets (Billion USD): 841,14 | Swift Code: BCITITMM |

| Bank Name: Banca Monte dei Paschi de Siena SPA | Assets (Billion USD): 316,73 | Swift Code: PASCITMM |

| Bank Name: Banco Popolare SPA | Assets (Billion USD): 176,49 | Swift Code: BPVIIT22 |

| Bank Name: UBI Banca SPA | Assets (Billion USD): 170,80 | Swift Code: BEPOIT21 |

| Bank Name: Mediobanca SPA | Assets (Billion USD): 99,20 | Swift Code: BAMEITMM |

Germany Letter of Credit Transactions

Germany is a country in Central and Western Europe, lying between the Baltic and North Seas to the north, and the Alps to the south.

Germany borders Denmark to the north, Poland and the Czech Republic to the east, Austria and Switzerland to the south, France to the southwest, and Luxembourg, Belgium and the Netherlands to the west. (1)

International trade has been playing a key role on German economy for centuries.

Germans are famous for their quality products. “Made in Germany” is a reliable quality mark and is a strong reason of choice to buy a product all around the world.

In Germany the share of industry in gross value added is 22.9 per cent, making it the highest among the G7 countries.

The strongest sectors of Germany are vehicle construction, electrical industry, engineering and chemical industry.(2)

Germany is a member of the European Union and using EU’s currency EURO (EUR) since 2002.

German economy is the driving force of the European Union economy. Other European countries rely on Germany to keep their economies and finances functioning properly.

On this page you can find brief information in regards to German economy, key points of its international trade, banks in Germany and letter of credit usage tips specific to Germany.

Letter of Credit Services for German Exporters

Letter of Credit Services for German Exporters

We will be more than happy helping German exporters with their letter of credit transactions.

Small or big, every customer welcomes. We mainly work with manufacturing companies.

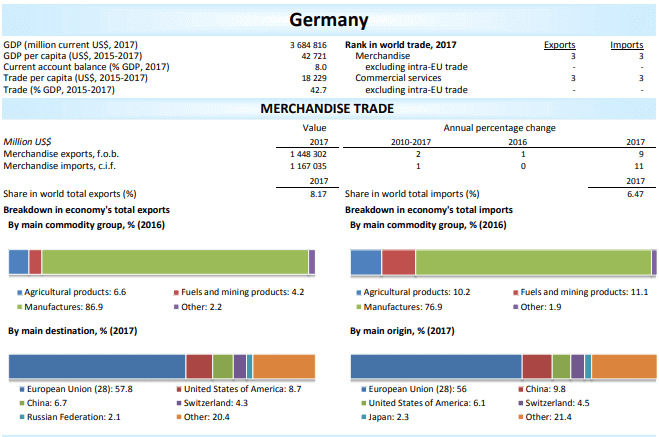

Germany Exports at a Glance:

Germany is an exporting machine. Germany experiencing trade surpluses for decades.

In binary trade relations, Germany exports more than its imports from majority of countries all around the world with limited exceptions such as China, Saudi Arabia etc…

As of 2017 Germany is the 3rd biggest exporting country in the world. Germany’s 2017 exports declared as 1 trillion 420 billion US dollars in value.

Breakdown of Germany’s total exports by main commodity groups are: agricultural products %6.6, fuels and mining products %4.2, manufactures %86.9.

The most significant export destinations of Germany are European Union %57.8, the United States of America %8.7, China %6.7, Switzerland %4.3 and Russian Federation %2.1.

Top Exported Products of Germany (2017)

| Agricultural Goods | Non-Agricultural Goods |

|---|---|

| Chocolate and other cocoa food | Motor cars for transport of persons |

| Swine meat, fresh, chilled, frozen | Parts for motor vehicles 8701-8075 |

| Cheese and curd | Medicaments in measured doses |

| Bread, pastry, other bakers' wares | Other aircraft |

| Other food preparations | Human and animal blood |

Germany Imports at a Glance:

Germany is the 3rd top importing country as of 2017 statistics. The import trade value of Germany in 2017 declared as USD 1 trillion 167 billion.

Breakdown of Germany’s total imports by main commodity groups are: agricultural products %10.2, fuels and mining products %11.1, manufactures %76.9.

Germany’s major import trading partners are European Union, China, the United States of America, Switzerland and Japan.

Banks in Germany

Deutsche Bank: Deutsche Bank, which is one of the biggest banks in Germany, was founded in 1870. Deutsche Bank has a strong position in Europe and a significant presence in the Americas and Asia Pacific.

SWIFT Code: DEUTDEFF

Commerzbank: Commerzbank is a leading international commercial bank with branches and offices in almost 50 countries. Commerzbank finances approximately 30% of Germany’s foreign trade and is leading in financing for corporate clients in Germany.

SWIFT Code: COBADEFF

KfW Bankengruppe: Founded in 1948, KFW Bankgruppe is a Government-owned development bank. Kreditanstalt Fuer Wiederaufbau – KFW operates as a promotional bank. It provides financing for investments, projects by German and European companies, and for economic and social initiatives in developing countries, as well as advisory services.(3)

SWIFT Code: KFWIDEFF

HypoVereinsbank (UniCredit Bank AG) : HypoVereinsbank is one of the leading private banks in Germany. HypoVereinsbank is a subsidiary of UniCredit Group.

UniCredit Bank AG (HVB), formerly Bayerische Hypo- und Vereinsbank Aktiengesellschaft headquartered in Munich, was formed in 1998 through the merger of Bayerische Vereinsbank Aktiengesellschaft and Bayerische Hypotheken- und Wechsel-Bank Aktiengesellschaft. It is the parent company of HVB Group. HVB has been an affiliated company of UniCredit S.p.A., Milan, Italy (UniCredit), since November 2005 and

hence a major part of the UniCredit corporate group as a subgroup. (4)

SWIFT Code: HYVEDEMM

Landesbank Baden-Württemberg: Headquartered in Stuttgart, LBBW is one of the biggest banks in Germany with total assets worth EUR 238 billion. LBBW is owned by the Federal State of Baden-Württemberg, the Savings Bank Association of Baden-Württemberg and the City of Stuttgart.

SWIFT Code: SOLADEST

Bayerische Landesbank (Bayern LB): Bayerische Landesbank is a publicly regulated bank based in Munich, Germany and one of the eight Landesbanken. It is 94% owned by the free state of Bavaria and 6% owned by the Sparkassenverband Bayern, the umbrella organization of Bavarian Sparkassen.

With a balance of €416 billion and 19,200 employees (in the group; 5,170 in the bank itself), it is the eighth-largest financial institution in Germany.(5)

SWIFT Code: BYLADEMM

Letter of Credit Usage Tips Specific to Germany:

Tips to the Importers:

- Germany has very limited natural resources.

- German companies are exporting almost all types of manufacturing goods. They are very good at quality.

- German banks are very strong both in terms of capital ratios and international establishment.

- Working with German exporters should not possess any significant risk factors for the importers.

- Try to establish a simple and well defined letter of credit in order to complete the transaction smoothly.

Tips to the Exporters:

- Germany has a low political and credit risks, a very robust banking sector and an excellent business climate.

- As a result accepting a letter of credit issued by a German bank should not inherit any additional risks. Following standard letter of credit control procedures and conducting a simple fraud risk examination should be sufficient.

- German banks occasionally confirm letters of credit issued by some of the African countries such as Ethiopia, Kenya etc. These credits are not originally issued in Germany, as a result possesses higher risk factors.

References:

- https://en.wikipedia.org/wiki/Germany

- https://www.deutschland.de/en/topic/business/why-is-the-german-economy-so-strong-seven-reasons

- https://corporatefinanceinstitute.com/resources/careers/companies/top-banks-in-germany/

- HypoVereinsbank · 2017 Annual Report, Page:8 https://www.hypovereinsbank.de/portal?view=/de/ueber-uns/investor-relations-en/reports.jsp

- https://en.wikipedia.org/wiki/BayernLB

Canada Letter of Credit Transactions

Canada, second largest country in the world in area (after Russia), occupying roughly the northern two-fifths of the continent of North America.(1)

Canada borders with the United States as well as a long maritime boundary with Denmark, at the autonomous island country of Greenland, and a short maritime border with France, at the overseas islands of Saint Pierre and Miquelon.(2)

Canada is one of the leading exporters of agricultural and non-agricultural commodities such as crude and refined petroleum, gold, lumber, aluminum, paper, wheat, colza seeds and oil, dried legumes etc.

Canada is a member of the Asia-Pacific Economic Cooperation (APEC), the North American Free Trade Agreement (NAFTA), and the Trans-Pacific Partnership (TPP).(3)

On this page you can find brief information in regards to Canada economy, key points of its international trade, banks in Canada and letter of credit usage tips specific to Canada.

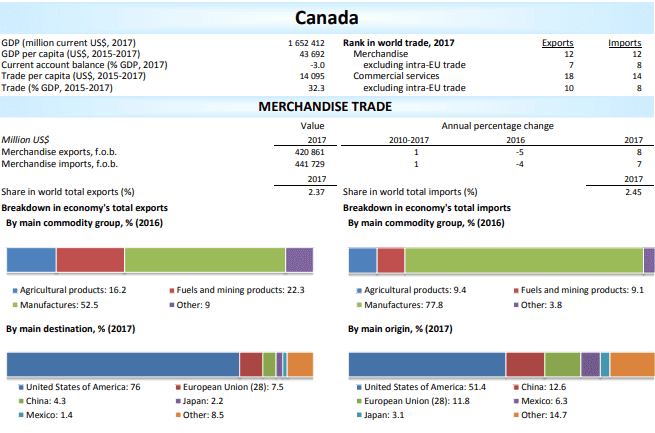

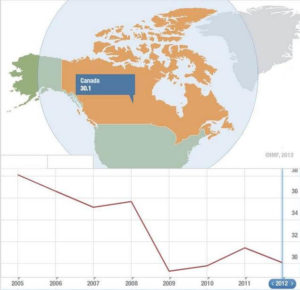

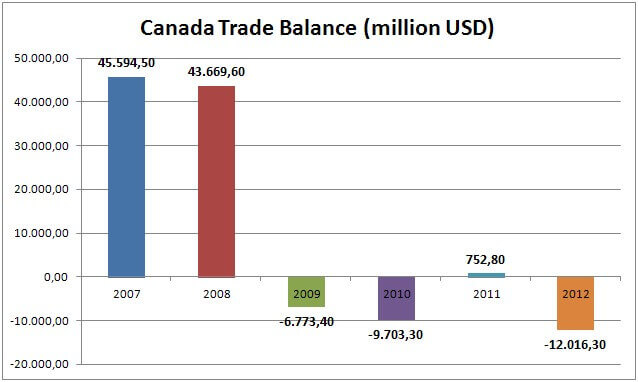

Canada Exports at a Glance:

As of 2017 Canada is the 12th biggest exporting country in the world. Canada’s 2017 exports declared as 420 billion US dollars in value.

Breakdown of Canada’s total exports by main commodity groups are: agricultural products %16.2, fuels and mining products %22.3, manufactures %52.5.

The most significant export destinations of Canada are United States of America %76, European Union %7.5, China %4.3, Japan %2.2 and Mexico %1.4.

Top Exported Products of Canada (2017)

References:

Brazil Letter of Credit Transactions

Brazil, which is located in South America, is the world’s fifth-largest country by area and the fifth most populous one.(1)

It is bordered by Argentina, Bolivia, Colombia, French Guiana, Guyana, Paraguay, Peru, Suriname, Uruguay and Venezuela.(2)

Brazil is one of the world giants of mining and agriculture.

It is a leading producer of a host of minerals, including iron ore, tin, bauxite (the ore of aluminum), manganese, gold, quartz, and diamonds and other gems, and it exports vast quantities of steel, automobiles, electronics, and consumer goods.

Brazil is the world’s primary source of coffee, oranges, and cassava (manioc) and a major producer of sugar, soy, and beef.(3)

On this page you can find brief information in regards to Brazil economy and international trade, banks in Brazil and letter of credit usage tips specific to Brazil.

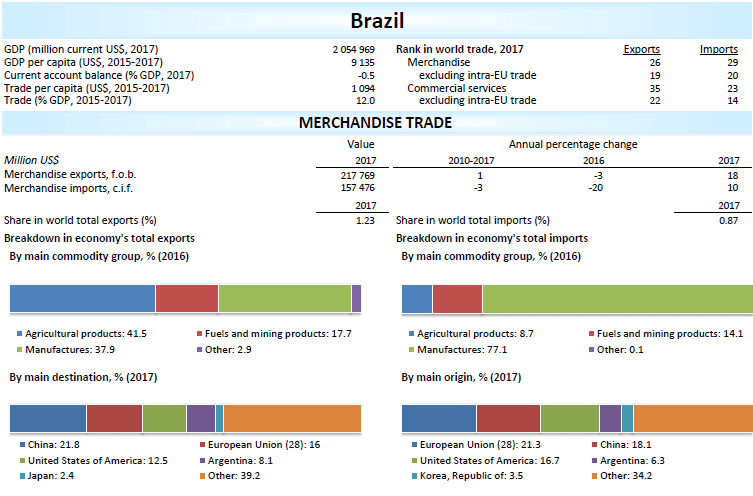

Brazil Exports at a Glance:

As of 2017 Brazil is the 26th biggest exporting country in the world. Brazil’s 2017 exports declared as 217 billion US dollars in value.

Breakdown of Brazil’s total exports by main commodity groups are: agricultural products: %41.5, fuels and mining products: %17.7 and manufactures: %37.9.

Brazil is one of the top commodity supplier of the world. Soya beans, sugar, coffee, beef, iron ore are some of the top exporting commodity goods of Brazil.

The most significant export destinations of Brazil are China: %21.8 European Union (28): %16, United States of America: %12.5, Argentina: %8.1 and Japan: %2.4.

Top Exported Products of Brazil (2017)

| Agricultural Goods | Non-Agricultural Goods |

|---|---|

| Soya beans, whether or not broken | Iron ores and concentrates |

| Cane or beet sugar | Petroleum oils, crude |

| Meat and edible offal of poultry | Motor cars for transport of persons |

| Solid residues from soya-bean oil | Chemical wood pulp, soda /sulphate |

| Maize (corn) | Other aircraft |

Brazil Imports at a Glance:

Brazil is the 29th top importing country as of 2017 statistics. The import trade value of Brazil in 2017 declared as USD 157 billion.

As of 2017, Brazil’s main imports are: petroleum oils, other than crude (USD 11.8 billion), parts for motor vehicles (USD 5.4 billion), electronic integrated circuits (4.1 billion), coal (USD 3.3 billion), medicaments (USD 3.2 billion).

Brazil’s major import trading partners are the European Union (28), China, United States of America, Argentina, South Korea.

Top Imported Products of Brazil (2017)

| Agricultural Goods | Non-Agricultural Goods |

|---|---|

| Wheat and meslin | Petroleum oils, other than crude |

| Alcohol of 80% or more volume | Parts for motor vehicles 8701-8075 |

| Malt, whether or not roasted | Electronic integrated circuits |

| Wine of fresh grapes | Coal; briquettes, ovoids |

| Other vegetables,frozen | Medicaments in measured doses |

Banks in Brazil:

Banco do Brasil: Owned by Federal Government of Brazil, Banco do Brasil is the biggest bank in Brazil. The bank provides banking products and services to individuals, companies, and the government.

The bank has branches in Germany, Argentina, Austria, Bolivia, Chile, Spain, U.S, France, Italy, Japan, Paraguay, Portugal, and UK.

Banco Bradesco: Biggest private bank in Brazil. Established in 1943. In 2016 acquired Banco Múltiplo – local unit of HSBC Bank.

The bank has branches and subsidiaries in the USA, Argentina, Mexico, China, England and Europe.

Banco Safra: Incorporated in 1955, Banco Safra is part of the Safra Group of banks and financial institutions. It provides commercial banking services such as real estate loans, foreign exchange, underwriting, and leasing services. Based in Sao Paulo, it employs around 6,732 employees.(4)

Banco Santander Brasil: Santander Bank is a global banking corporation having local banks in Spain, Germany, Poland, Portugal, the United Kingdom, Brazil, Mexico, Chile, Argentina and the United States. Banco Santander Brasil is Santander Group’s Brazil arm.

Santander bank is very active in international trade operations.

Letter of Credit Usage Tips Specific to Brazil:

Tips to the Importers:

- As mentioned above Brazil is one of the biggest commodity exporting countries in the world.

- Commodity trade usually requires triangle trade and transferable letters of credit.

- Transferable letters of credit covering commodity trade are one of the most complicated and risk inherited types of letters of credit.

- Try to establish a simple and well defined letter of credit in order to complete the transaction smoothly.

Tips to the Exporters:

- Brazil has an average political and credit risks.

- As a result accepting a letter of credit, which is issued by one of the biggest Brazilian banks, especially having an international establishment, would be a clever move.

References:

- https://en.wikipedia.org/wiki/Brazil

- https://www.worldatlas.com/articles/what-countries-border-brazil.html

- https://www.britannica.com/place/Brazil/The-economy

- https://corporatefinanceinstitute.com/resources/careers/companies/top-banks-in-brazil/

France Letter of Credit Transactions

France is a European country, which is located northwestern of Europe.

It is bordered by Belgium, Luxembourg and Germany to the northeast, Switzerland and Italy to the east, and Andorra and Spain to the south. (1)

Historically and culturally among the most important nations in the Western world, France has also played a highly significant role in international affairs, with former colonies in every corner of the globe.

Bounded by the Atlantic Ocean and the Mediterranean Sea, the Alps and the Pyrenees, France has long provided a geographic, economic, and linguistic bridge joining northern and southern Europe.

It is Europe’s most important agricultural producer and one of the world’s leading industrial powers. (2)

On this page you can find brief information in regards to French economy and international trade, French banks and letter of credit usage tips specific to France.

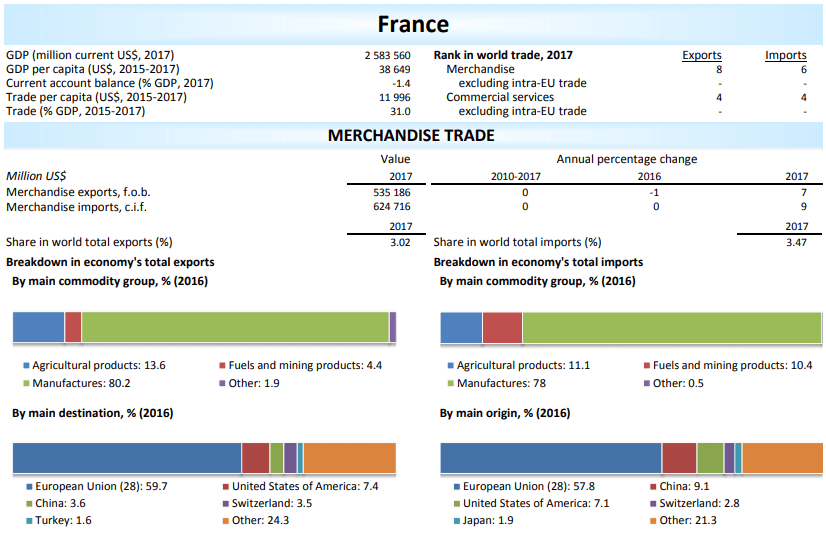

France Exports at a Glance:

As of 2017 France is the 8th biggest exporting country in the world. France’s 2017 exports declared as 535 billion US dollars in value.

France is not only exporting high value added manufacturing goods such as aircraft, medicaments, motor cars, turbo jets etc., but also selling agricultural products like wine, cheese, wheat, animal feed etc. to world markets.

France is one of the biggest agricultural goods exporter in Europe.

The most significant export destinations of China are European Union (28): %59.7, United States of America: %7.4, China: %3.6, Switzerland: %3.5 and Turkey: %1.6.

Top Exported Products of France (2017)

| Agricultural Goods | Non-Agricultural Goods |

|---|---|

| Wine of fresh grapes | Other aircraft |

| Alcohol of less than 80% volume | Medicaments in measured doses |

| Wheat and meslin | Motor cars for transport of persons |

| Cheese and curd | Parts for motor vehicles 8701-8075 |

| Preparations of a kind used in animal feeding | Turbo-jets, turbo-propellers and ot |

France Imports at a Glance:

France is the 6th top importing country as of 2017 statistics. The import trade value of France in 2017 declared as USD 624 billion.

As of 2017, France’s main imports are: motor cars (USD 31.8 billion), air craft spare parts (USD 21.6 billion), crude oil (17.9 billion), petroleum oils, other than crude (USD 15.2 billion), medicaments (USD 15.0 billion).

France’s major import trading partners are the European Union, China, the United States of America, Switzerland and Japan.

Top Imported Products of France (2017)

| Agricultural Goods | Non-Agricultural Goods |

|---|---|

| Coffee | Motor cars for transport of persons |

| Bread, pastry, other bakers' wares | Parts of goods 8801, 8802 |

| Chocolate and other cocoa food | Petroleum oils, crude |

| Cigars, cheroots, cigarillos | Petroleum oils, other than crude |

| Cheese and curd | Medicaments in measured doses |

Banks in France:

According to the French Banking Federation (FBF) there are 347 banks actively operating in France as of October 2018.

French banking system is working under European Union rules.

One of the biggest Fren

BNP Paribas SA: One of the best French bank established in international scale. Operating in 73 countries. Great history of banking.

Credit Agricole CIB: Corporate and Investment banking branch of the Credit Agricole Group. The group has not only international bank branches in Europe, but also subsidiary banks in certain countries in America, Asia, Middle East and Africa.

Societe Generale: Another well established French bank. Very strong in Latin America and Africa.

Natixis CIB: Naxitis is a subsidiary of Groupe BPCE, which is one of the biggest banking group in France. Naxitis’s international branches are concentrated in America and Asia.

Credit Industriel et Commercial (CIC): A major actor in the French banking sector, the CIC has an international network made up of 36 countries through its international network of 36 representative offices and 4 foreign branches: Targobank (Spain and Germany), BMCE Bank (Morocco), Bank of Tunisia (Tunisia).

Letter of Credit Usage Tips Specific to France:

Tips to the Importers:

- Letter of credit is not popular among French exporters.

- Try to establish a simple and well defined letter of credit in order to complete the transaction smoothly.

- France is located northwestern of Europe and very close to most its trading partners logistically. Be aware of document presentation periods, demurrage and detention charges.

- France exporters and importers use land transportation very often. Keep in mind that land transportation has some disadvantages under letters of credit.

Tips to the Exporters:

- Although France is one of the most developed countries in the world, it is still a cosmopolite country. Fraud risk is limited, but not null. As an exporter take steps to minimize your risks.

- Try to get the letter of credit issued by one of the well established banks in France.

- France is located northwestern of Europe and very close to most its trading partners logistically. Be aware of document presentation periods, demurrage and detention charges.

- France exporters and importers use land transportation very often. Keep in mind that land transportation has some disadvantages under letters of credit.

- As an exporter you might need either a European Community Certificate of Origin, EUR1 movement certificate or an ATR document. Consult your customs broker to choose the right one before issuance of the letter of credit.