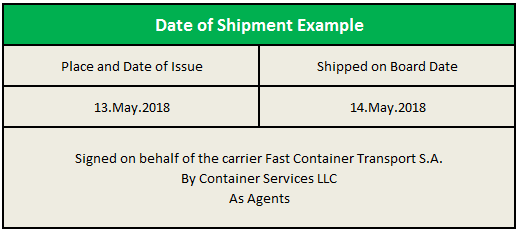

Issuing banks often require an ocean bill of lading or a marine bill of lading under letters of credit as a transport document.

The question is whether the title of the bill of lading is important or not when checking the documents?

Letter of Credit Examples:

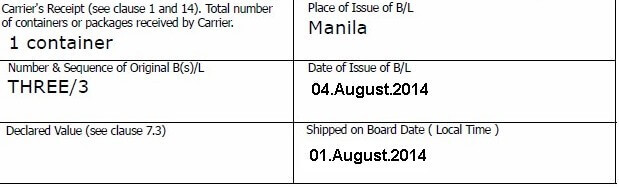

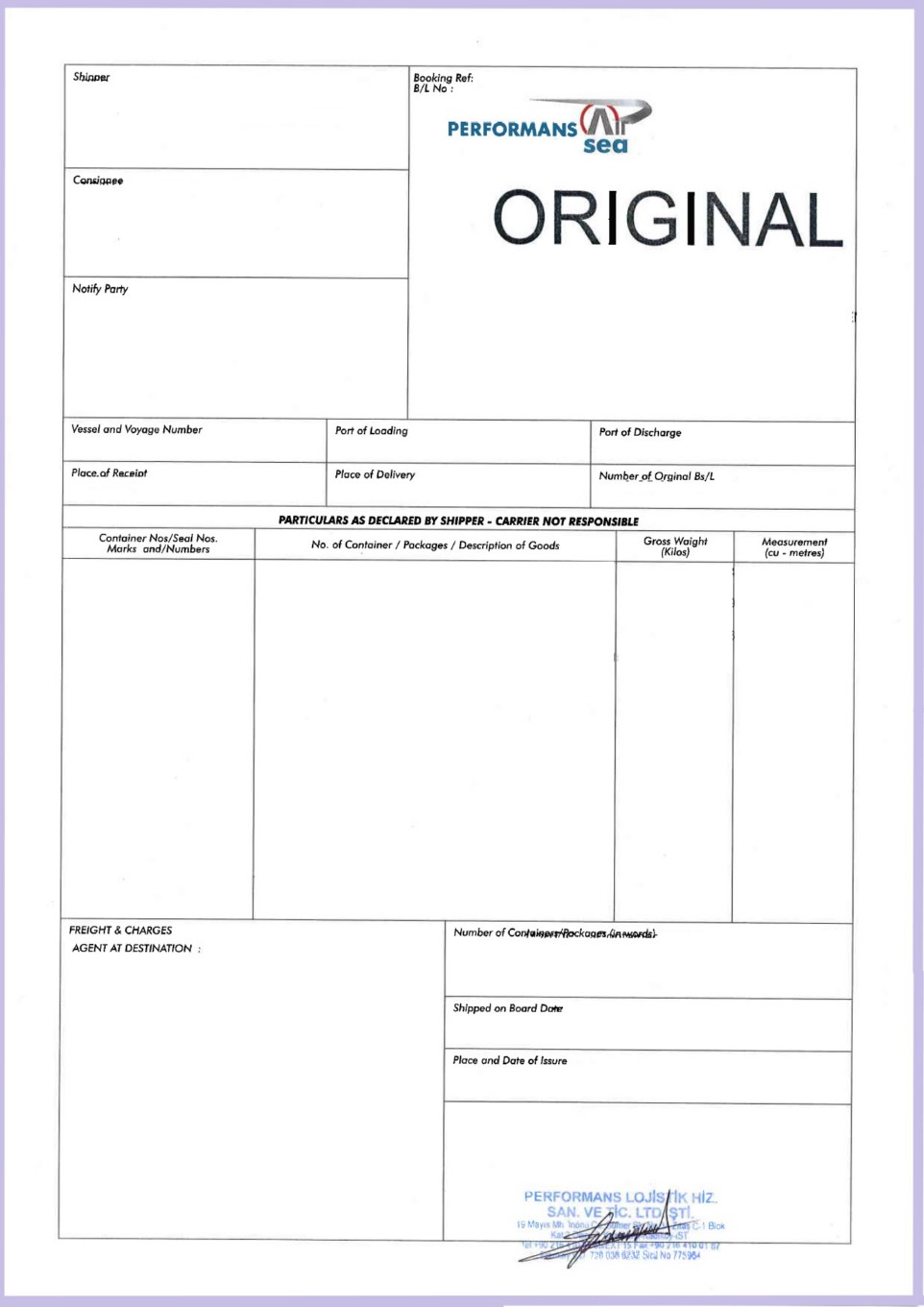

Ocean Bill of Lading Example

- Full set of clean shipped on board ocean bills of lading drawn or endorsed to the order of issuing bank ltd, Sana’a Yemen showing freight prepaid and marked notify

a.applicant (giving full name and address).

b.issuing bank ltd Sana’a Republic of Yemen.

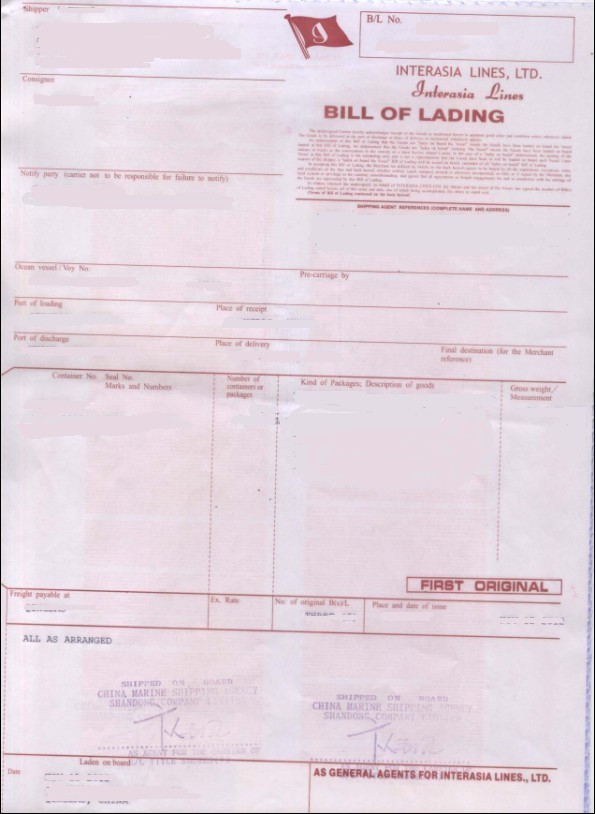

Marine Bill of Lading Example

- Full set of clean on board marine bill(s) of lading issued or endorsed to the order of Issuing Bank PLC, notify applicant showing freight prepaid and showing full name and address of the shipping company agent or his representative in Bahrain.

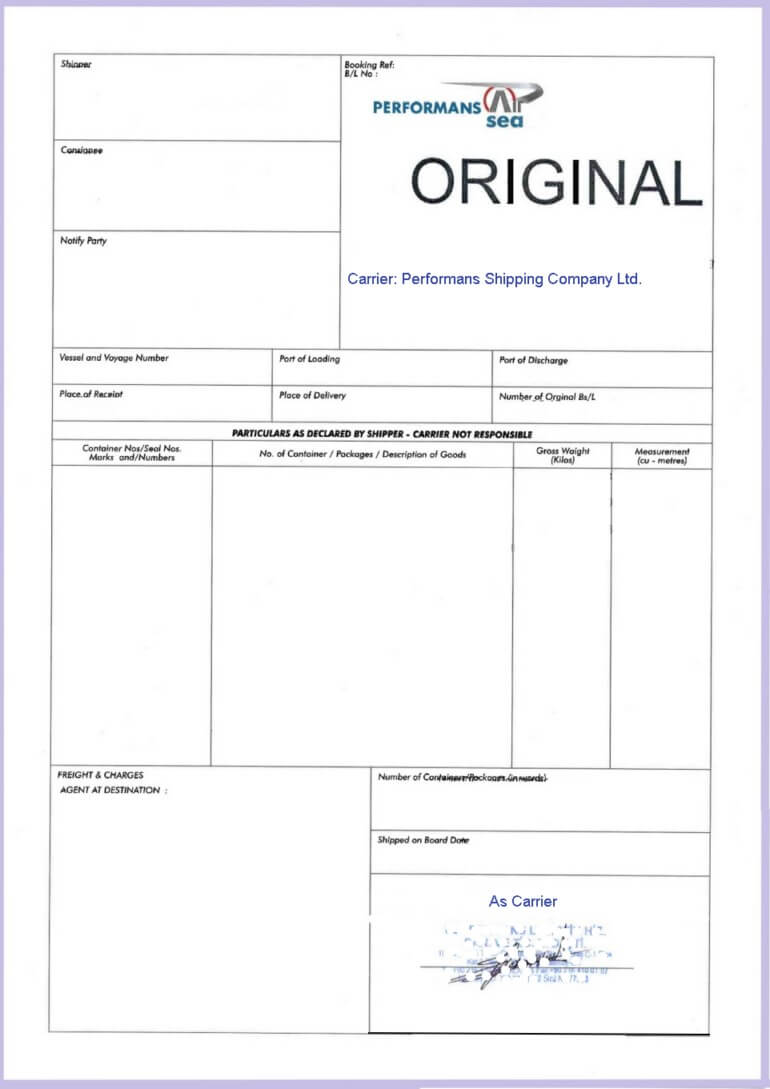

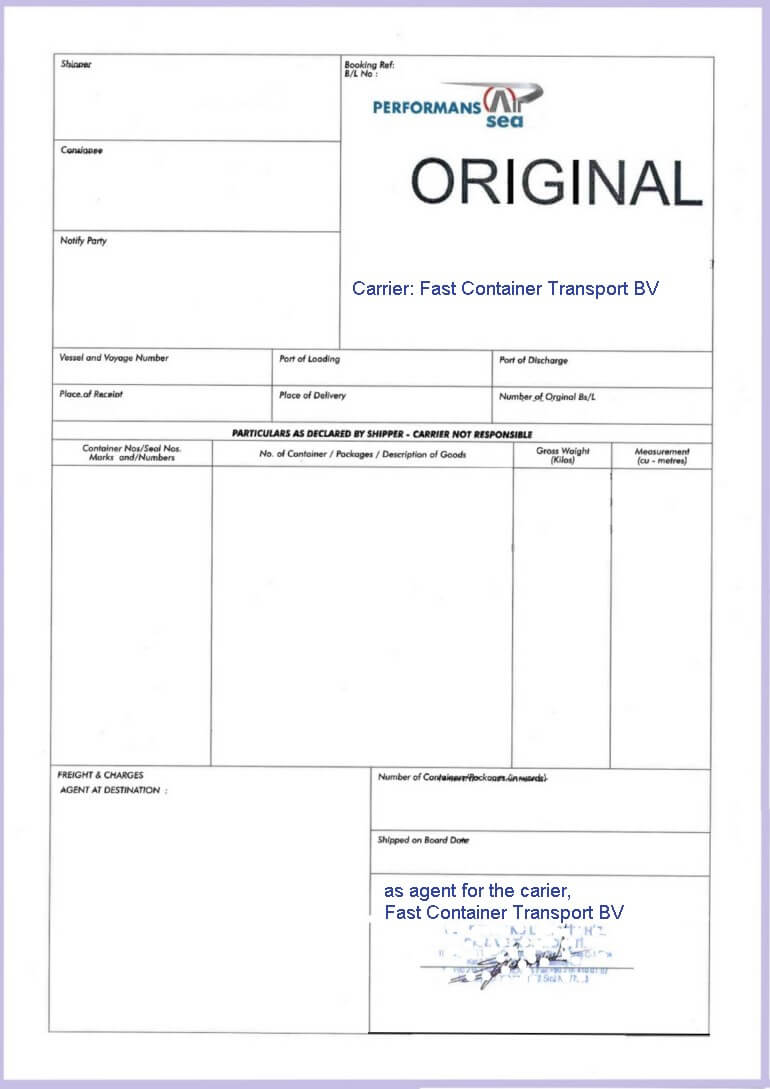

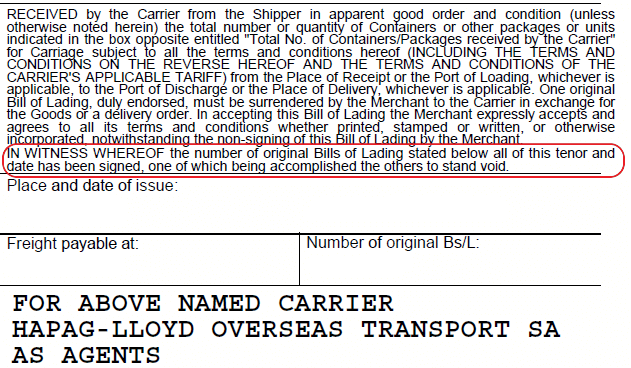

Each shipping line has a pre-printed form of bills of lading.

Some shipping lines are using ocean bills of lading and others are using marine bill(s) of lading.

It is highly likely to be working with a shipping company who has a marine bill(s) of lading pre-printed form where credit calls for an ocean bill of lading or vice versa.

According to latest letter of credit rules

“A bill of lading need not be titled “marine bill of lading”, “ocean bill of lading”, “port‐to‐port bill of lading” or words of similar effect even when the credit so names the required document.”

As a result title of the bill of lading is not important when checking the documents under the letter of credit transactions.