A Certificate of Origin (often abbreviated to CO, C/O, COO) is a trade document, which identifies the origin of goods that is being exported and required by almost all of the export and import shipments in international trade.

Certificate of origin is a document used in international trade transactions, certifies that goods in a particular export shipment are originated in a particular country either by wholly obtained principle or substantial transformation principle.

What are the Functions of a Certificate of Origin in Export / Import Transactions?

Certificates of origins are requested by the importing country administrations for the following reasons:

- Determining whether or not the goods being imported are eligible for any preferential custom tariffs,

- Determining the exact import customs duties to the goods,

- Determining whether or not the goods come from a country against which the importing country has trade restrictions.

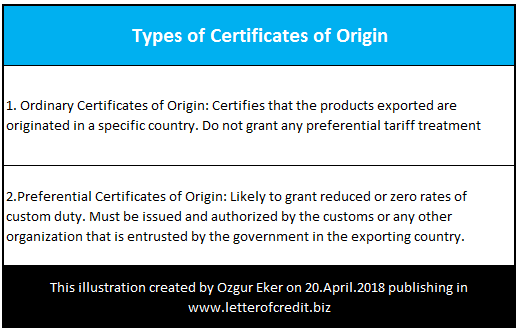

What are the Types of Certificates of Origin?

Certificates of origin can be classified under two main groups:

Ordinary Certificates of Origin: An Ordinary certificate of origin is a document that can be used to satisfy importing country’s custom authorities that the products exported are originated in a specific country.

Ordinary certificates of origin do not grant any preferential tariff treatment during the importation of goods.

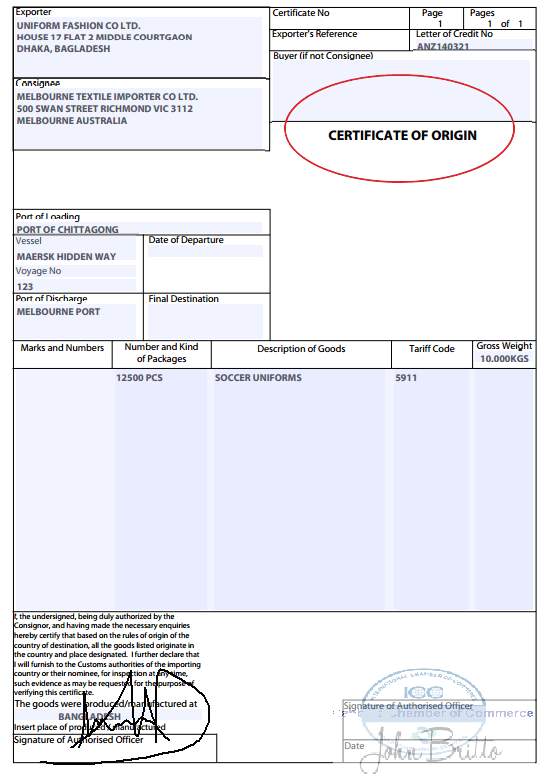

Issuing Bodies of Ordinary Certificates of Origin: Ordinary certificates of origin can be issued and certified by chambers of commerce, chambers of industry and chambers of commerce and industry.

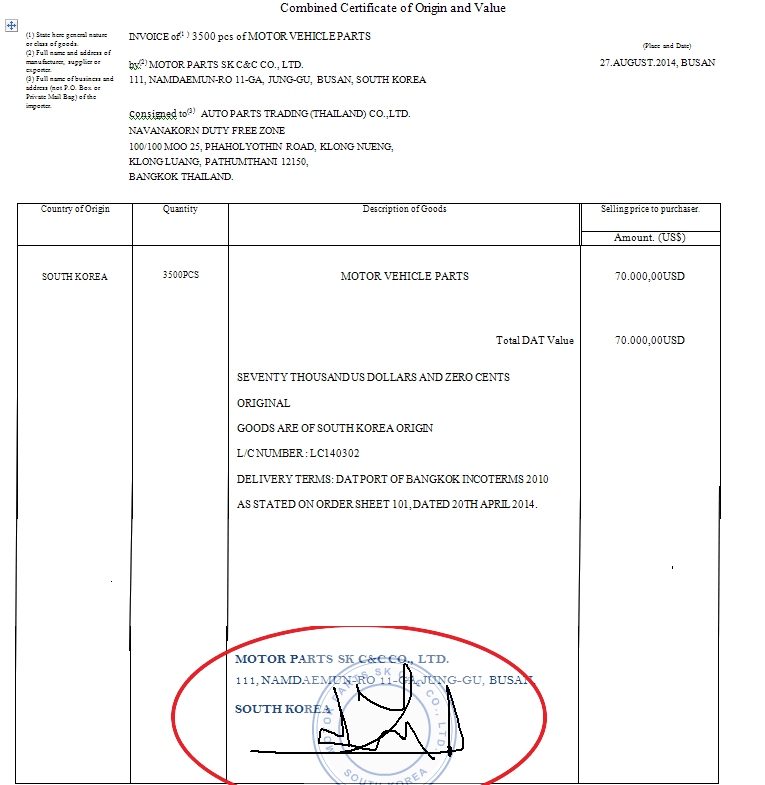

In some occasions exporting companies can also prepare ordinary certificates of origin by themselves in a separate document form or adding a statement on this effect on to the commercial invoices.

Ordinary certificates of origin do not need any endorsement or legalization from the custom authorities.

Preferential Certificates of Origin: Preferential Certificates of Origin likely to grant reduced or zero rates of custom duty when export goods are entering into importer’s country as a Preferential Certificate of Origin (PCO) proves that the product originates from a Free Trade Agreement Partner Country under stipulated Rules of Origin (ROO) and hence, qualifies the product for tariff concessions provided under the specific FTA.

Issuing Bodies of Preferential Certificates of Origin: Preferential certificates of origin must be issued and authorized by the customs or any other organization that is entrusted by the government in the exporting country.

Some Examples of Preferential Certificates of Origin:

- Certificate of Origin GSP Form A

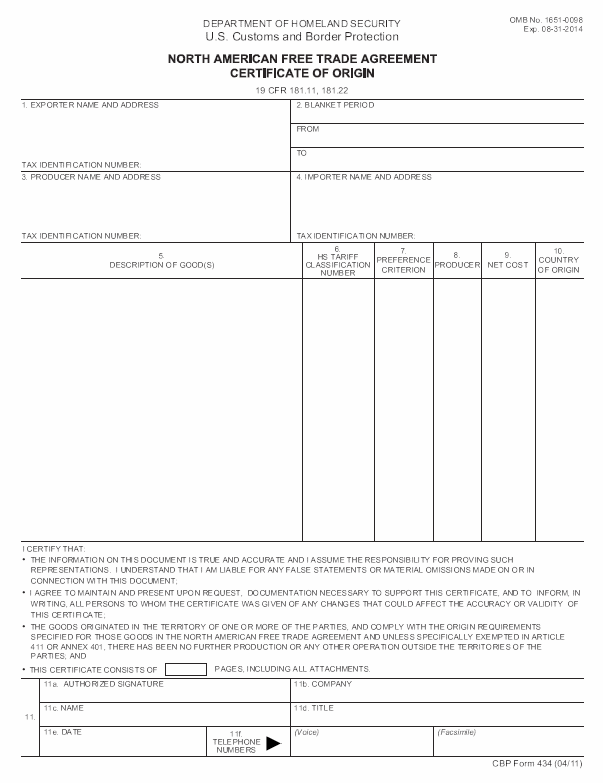

- North American Free Trade Agreement (NAFTA) Certificate of Origin

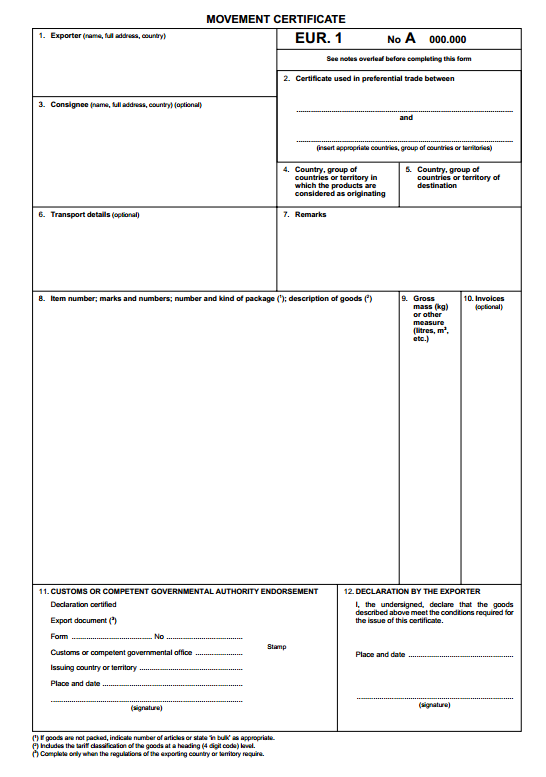

- EUR1 Form Movement Certificate

- ATR Movement Certificate

How to Use Certificates of Origin in Letters of Credit Transactions:

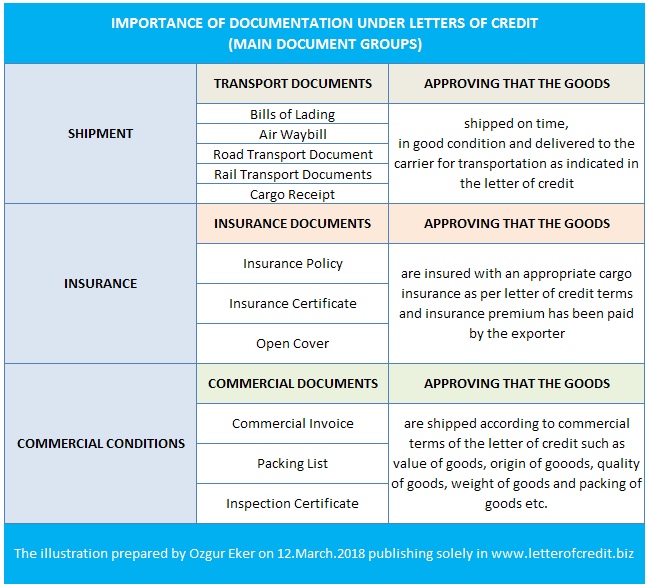

Letter of credit rules do not cover certificates of origin under specific articles, unlike transport and insurance documents; as a result certificates of origin will be treated like any other ordinary document under the letter of credit rules.

This having been said, we need to emphasize that the specific requirements regarding the certificates of origin must be indicated in the letters of credit by the issuing banks.

- If no specific requirement exists in the letter of credit for the certificates of origin, then the presentation of a certificate of origin will be satisfied by the presentation of a signed document that appears to relate to the invoiced goods and certifies their origin.

- When a credit requires the presentation of a preferential certificates of origin such as a Certificate of Origin GSP Form A or EUR1 Form Movement Certificate, only a document in that specific form should be presented by the beneficiary.

- A certificate of origin should be issued by the entity stated in the credit such as Chamber of Commerce, Chamber of Industry, Customs Authorities etc.

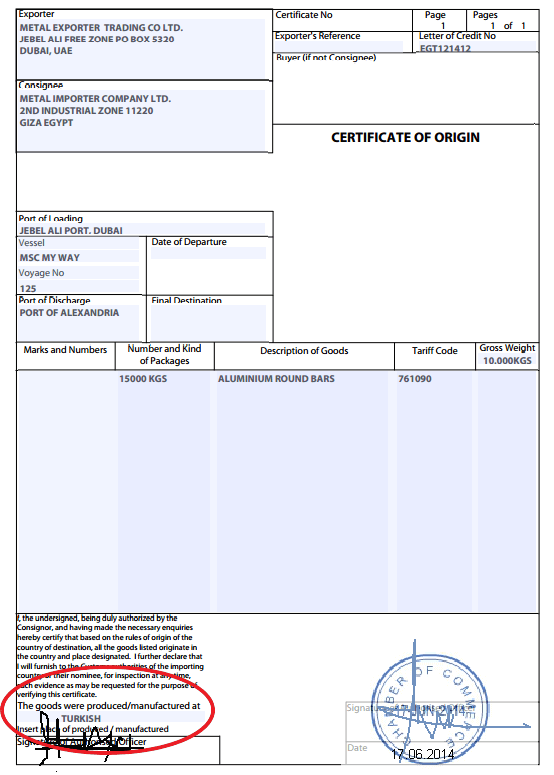

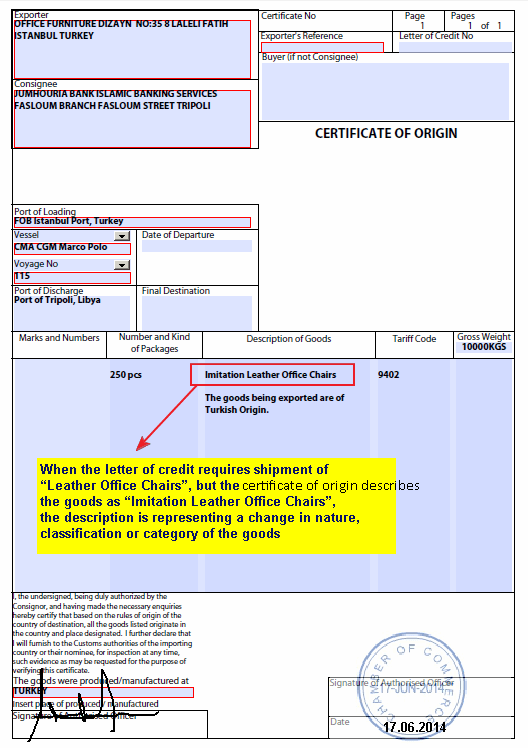

Certificates of Origin Samples:

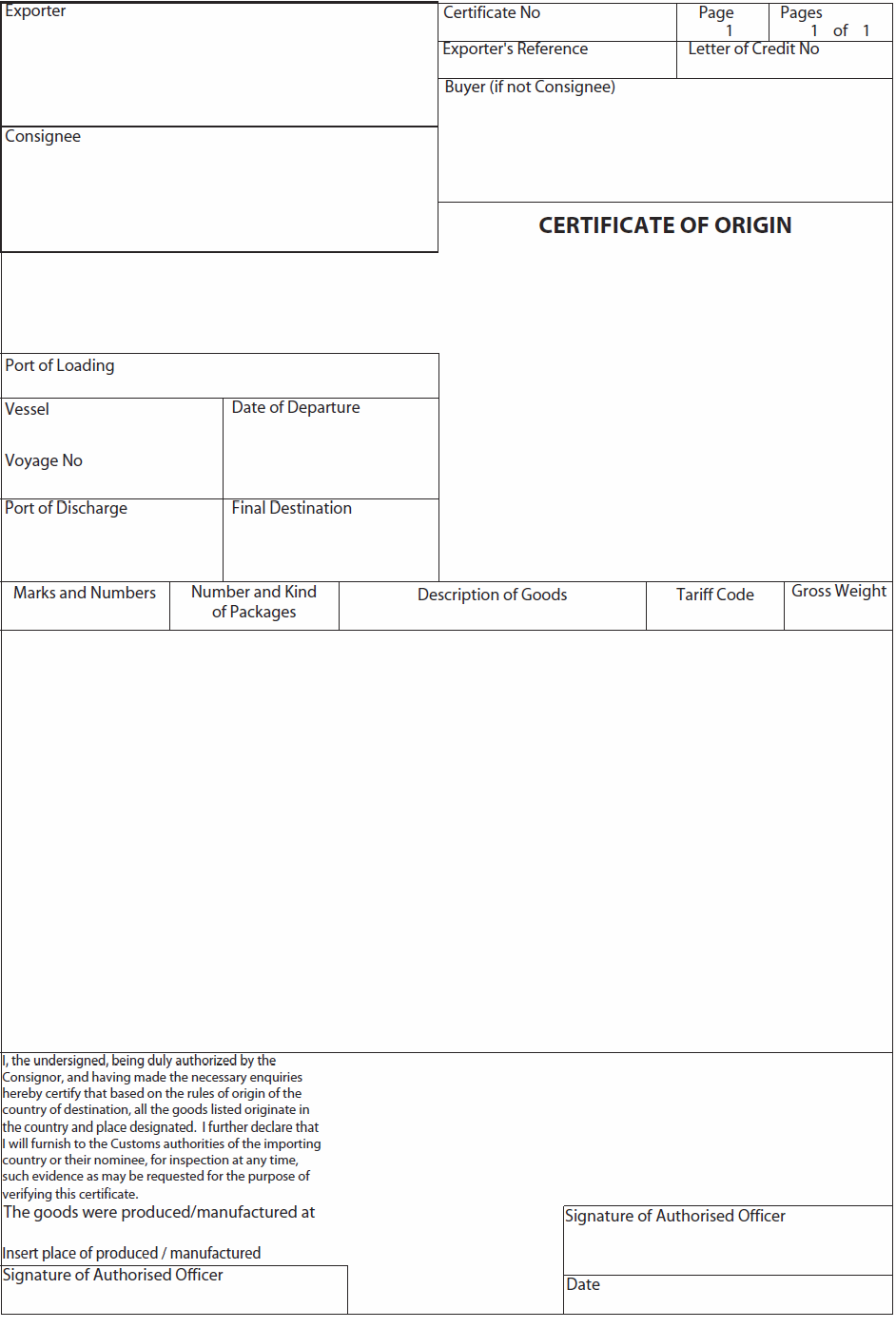

Ordinary Certificate of Origin:

EUR1 Certificate of Origin: