Commercial invoice is one of the key documents in a letter of credit transaction.

Almost all documentary credits, either commercial or standby, requesting a commercial invoice from the beneficiaries.

On this article I would like to highlight 5 most common commercial invoice mistakes.

Description Of Goods On The Commercial Invoice Does Not Correspond With The Letter of Credit:

This is one of the most frequently seen discrepancies on commercial invoices.

According to the latest letters of credit rules the description of the goods, services or performance in a commercial invoice must correspond with that appearing in the credit.

As a result beneficiaries must be very careful when completing the description of goods on commercial invoices.

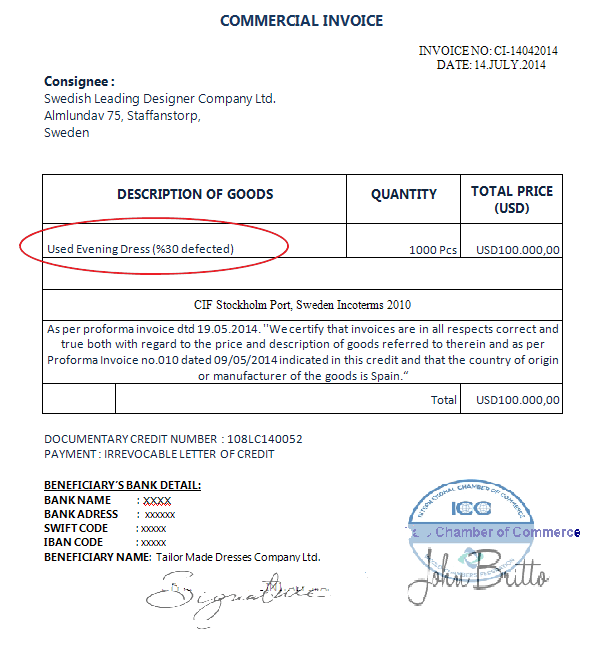

Example of a Description of Goods Discrepancy:

Letter of credit:

45A: Description of Goods &/or Services

Crushing plant. As per proforma invoice no. :P-111-7 R02 dated 03/07/2012 CFR, Bahrain.

Commercial Invoice

Second Hand Crushing Plant. As per proforma invoice No.: P-111-7 R02 dated 03/07/2012 CFR, Bahrain.

Reason for Discrepancy: Description in the commercial invoice would represent a change in nature, classification or category of the goods.

Commercial Invoice Does Not Show Trade Terms (Incoterms):

When importers and exporters mutually agreed on international trade terms (Incoterms) by stipulating them in a letter of credit, they are bound by these international trade terms as a material part of the contract.

This means that if letter of credit stipulates international trade term under the description of goods section, exporters have to mention this trade term on the commercial invoice as indicated in the credit.

Example of a Trade Term Discrepancy:

Letter of Credit:

45A: Description of Goods &/or Services

420 pcs. of black tires size 275/70R225TL148/145J (152e) MC85 model 2011 as per pro. Inv. No. 011 dated 9/6/2011 FOB: Rotterdam Port – Netherlands Incoterms 2010

Commercial Invoice

420 pcs. of black tires size 275/70R225TL148/145J (152e) MC85 model 2011 as per pro. Inv. No. 011 dated 9/6/2011 FOB: Rotterdam Port – Netherlands Incoterms 2000

Reason for Discrepancy: Incoterms not mentioned correctly. Letter of credit stipulates FOB: Rotterdam Port – Netherlands Incoterms 2010 whereas commercial invoice indicates the trade term as FOB: Rotterdam Port – Netherlands Incoterms 2000.

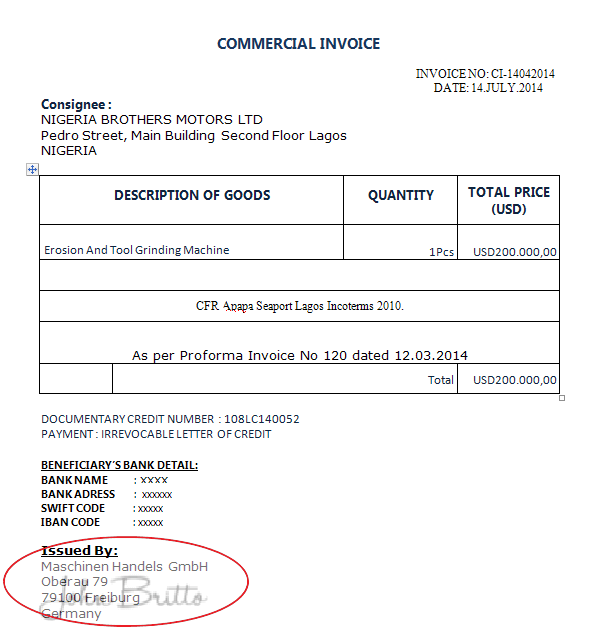

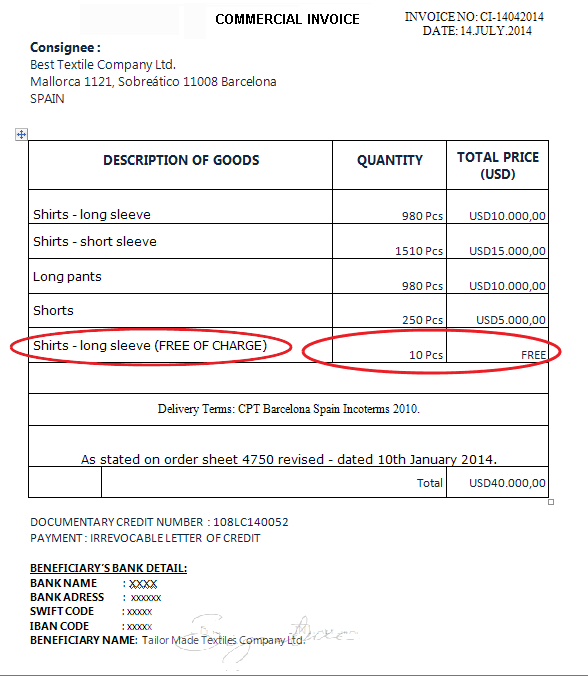

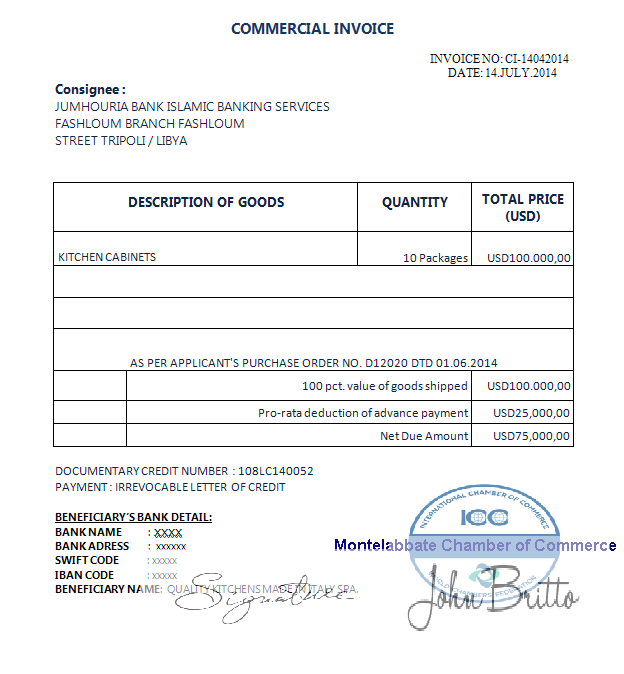

Commercial Invoice Indicates Goods Which Are Not Mentioned In The Letter Of Credit:

An invoice is not to indicate goods, services or performance not called for in the credit.

This applies even when the invoice includes additional quantities of goods, services or performance as required by the credit or samples and advertising material and are stated to be free of charge.

Example of a Commercial Invoice Indicates Goods Which are not Mentioned in the Letter of Credit Discrepancy:

Letter of Credit:

45A: Description of Goods &/or Services

Power Transformer offload 1 Unit Onan 3phs Cu/cu Dyn11 50hz

Commercial Invoice

Power Transformer offload 1 Unit Onan 3phs Cu/cu Dyn11 50hz

Transformer Spare Parts (Free of Charge)

Reason for Discrepancy: Transformer Spare Parts are not called in the letter of credit. Mentioning these goods on the commercial invoice even if free of charge creates a discrepancy.

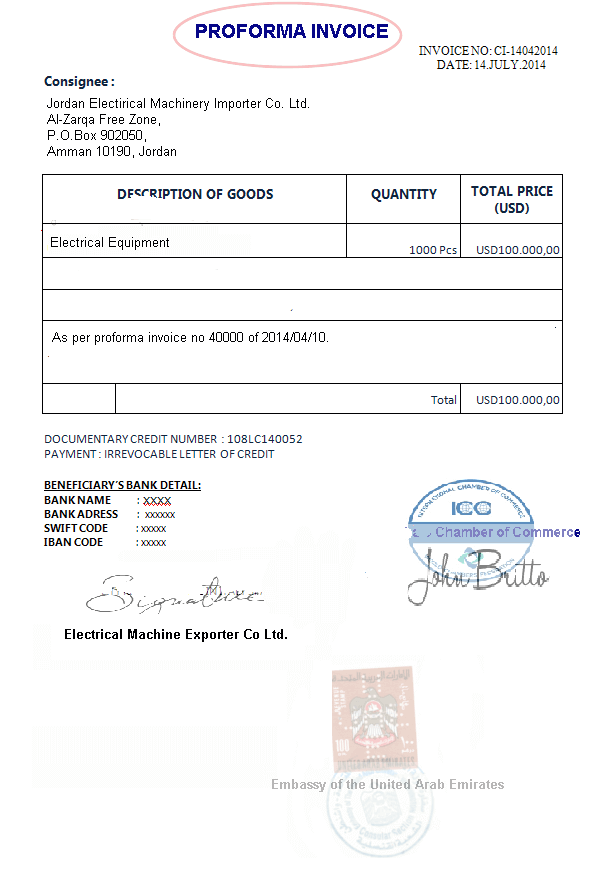

Proforma Invoice Presented Instead of a Commercial Invoice:

When a credit requires presentation of an “invoice” without further description, this will be satisfied by the presentation of any type of invoice (commercial invoice, customs invoice, tax invoice, final invoice, consular invoice, etc.).

However, an invoice is not to be identified as “provisional”, “pro‐forma” or the like.

Exporters should not present a proforma invoice instead of a commercial invoice.

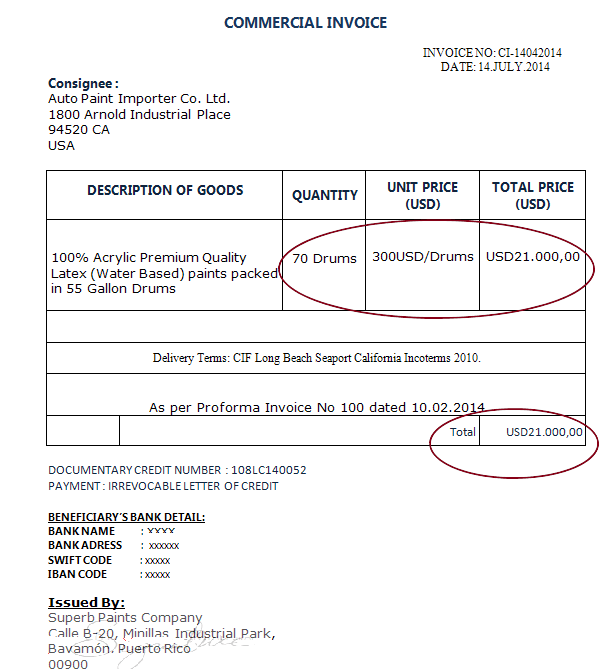

Quantity of Goods Not Consistent With Other Documents:

Any total quantity of goods and their weights or measurements shown on the invoice is not to conflict with the same data appearing on other documents.