If you would like to export your goods to one of the high risk countries and you would like to eliminate default risk of the importer’s bank, then you may seek to have your letter of credit confirmed by one of the prime banks.

Confirmation is a security tool, which is develop to reduce exporters risks in letters of credit transactions.

In theory, an exporter should be able to get his money from the confirming bank against a complying presentation.

However, in real life, in some cases even the confirming banks do not pay the credit amount to the exporters, until they have been reimbursed by the issuing banks. (For further information regarding confirming banks behavior, even if the presentation is complying, please read my article titled : Confirmed L/C at Sight.)

On this post I will try to explain you one of the most frequently used term in international letter of credit transactions: Confirming Bank.

Here are the headlines of the article:

- What is a confirming bank?

- What are the responsibilities of the confirming bank?

- Which UCP 600 article regulates the confirming banks responsibilities?

- What are the differences between the confirming bank and advising bank?

- What are the differences between the nominated bank and confirming bank?

- Case Study: Confirming bank’s payment responsibility when documents are presented with discrepancies.

What is a Confirming Bank?

Confirming bank means the bank that adds its confirmation to a credit upon the issuing bank’s authorization or request.

What are the Responsibilities of the Confirming Bank?

According to the latest version letter of credit rules, if the stipulated documents are presented to the confirming bank or to any other nominated bank and that they constitute a complying presentation, the confirming bank must:

- honour, if the credit is available by sight payment, deferred payment or acceptance with the confirming bank;

- honour, if the credit is available by sight payment with another nominated bank and that nominated bank does not pay;

- honour, if the credit is available by deferred payment with another nominated bank and that nominated bank does not incur its deferred payment undertaking or, having incurred its deferred payment undertaking, does not pay at maturity;

- honour, if the credit is available by acceptance with another nominated bank and that nominated bank does not accept a draft drawn on it or, having accepted a draft drawn on it, does not pay at maturity;

- honour, if the credit is available by negotiation with another nominated bank and that nominated bank does not negotiate.

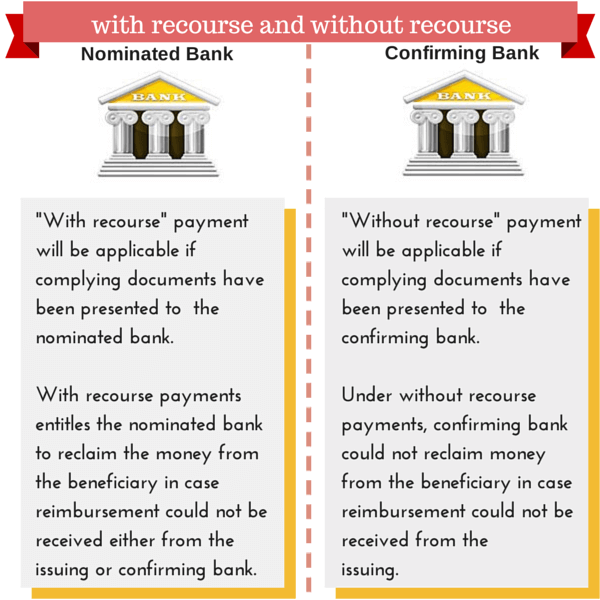

negotiate, without recourse, if the credit is available by negotiation with the confirming bank.

Which UCP 600 Articles Regulate the Confirming Bank’s Responsibilities?

UCP 600 article 8 defines the roles and responsibilities of the confirming bank. Additionally confirming bank’s liabilities have been described in numerous articles under UCP 600.

What are the Differences Between the Confirming Bank and the Advising Bank?

The advising bank has no payment obligations under the letter of credit rules. The advising bank has two main responsibilities: authenticating incoming letters of credit and transmitting them to the beneficiaries as a whole, intact.

Additionally, an advising bank has no connection with the letter of credit availability or the place of letter of credit expiry.

On the other hand the confirming bank has to pay the letter of credit amount to the beneficiary against a complying presentation, even if nominated bank or issuing bank refrain to pay.

In case the credit is issued that is available by negotiation with the confirming bank, then the confirming bank must negotiate, without recourse.

What are the Differences Between the Nominated Bank and the Confirming Bank?

First of all, please kindly be noted that according to the letter of credit rules it is possible that the nominated bank and the confirming bank could be different banks.

But in practice a bank would not add its confirmation to the letter of credit, if it is not available with itself.

As per the letter of credit rules, the confirming bank has clear payment obligations. If the presentation is complying, then the confirming bank must honor.

It is a very straight forward definition.

But nominated banks may or may not pay against complying presentations. If they do not, then either the confirming bank or the issuing bank must pay.

Query:

A German exporter ships 2 containers of process pumps to an importer located in Libya. Due to the internal turmoil in Libya, the issuing bank face difficulties to honor the presentation.

The letter of credit was confirmed by another bank in UK, but due to the discrepancies found on the documents the confirming bank refrain to pay the L/C amount.

The exporter explains the situation and asks the following question: “We think that a confirmed letter of credit means that the confirming bank gives his definitive undertaking in addition to that of the issuing bank, provided that the stipulated documents are presented to the confirming bank and that the terms and conditions of the documentary credit are complied with, either to pay at sight, or to accept drafts and to pay them at their maturity, or to pay on a determinable date if there is a deferred payment.”

But what happens;

1-) if documents are presented with discrepancies to the confirming bank, and the confirming bank notifies advice of refusal to the beneficiary/presenter in regards of the discrepancies, does the definitive undertaking of confirming bank cease to exist?

2-) if these documents are sent to issuing bank on an approval basis and the discrepancies are waived, does the confirming bank have to pay with its resources (or accept drafts or incur a deferred payment undertaking), or does it have to wait until it receives the funds from the issuing bank and then pay the beneficiary?

Analysis of the Case Study:

A confirmation of a letter of credit is, as you indicated, an undertaking from a bank in addition to the undertaking provided by the issuing bank. The UCP 600 states that the undertaking (confirmation) is subject to presentation of complying documents under the letter of credit.

Where documents are presented to the confirming bank, within the validity of their undertaking, and found to be discrepant, and the confirming bank provides a notice of refusal in accordance with the UCP, its undertaking would no longer exist in respect of that presentation (subject to the beneficiary being unable to correct the discrepancy(ies) within the credit timelines).

If the documents, on instructions of the beneficiary, are subsequently sent to the issuing bank on an approval basis and the discrepancies are waived, the confirming bank has no obligation to make payment unless it has indicated its willingness to do so at the time of providing its notice of refusal.

The presentation of discrepant documents to the confirming bank would end its obligation under the credit unless it has stated otherwise, and the fact that the issuing bank accepts a waiver of discrepancies would not further obligate the confirming bank. (Source:Official Opinion R520 / TA543 rev2)

Can the Confirming Bank Cancel Its Confirmation by Himself?

The confirming bank could not cancel its confirmation by himself, because the confirmation is an irrevocable undertaking of the confirming bank against the beneficiary of the letter of credit and another nominated bank, if it exists.

A confirming bank is irrevocably bound to honour or negotiate as of the time it adds its confirmation to the credit unless,

- the beneficiary will not be making presentation withing the allowed time frame as stated in the credit, or

- the beneficiary presented discrepant documents and could not remove discrepancy within the presentation period, or

- the beneficiary is confirmed by a written statement with the confirming bank that the beneficiary will not be utilizing the letter of credit.

Must the Confirming Bank and the Beneficiary Locate in the Same Country?

Usually the confirming bank and the beneficiary are located within the same country, but there is no governing rule in the letter of credit rules that is forcing these two parties must be located in the same country.

As a result the beneficiary and the confirming bank may be located in different countries.

In practice, German banks confirm the credits issued in African countries such as Ethiopia, Nigeria, etc. for Non-German beneficiaries. The same structure applies for the French banks for the letters of credit issued in Senegal, Morocco, Algeria etc.

Does a Confirming Bank Must Add Its Confirmation to a Letter of Credit?

Adding a confirmation to a letter of credit is a commercial decision for the confirming bank.

As a result a confirming bank may or may not be adding its confirmation to a given letter of credit, based on solely its own decision.

But if the confirming bank decides to confirm, it will be irrevocably bound to honour or negotiate as of the time it adds its confirmation to the credit.

What Happens When a Confirmed Letter of Credit is Amended?

A confirming bank may extend its confirmation to an amendment and will be irrevocably bound as of the time it advises the amendment.

A confirming bank may, however, choose to advise an amendment without extending its confirmation and, if so, it must inform the issuing bank without delay and inform the beneficiary in its advice.

What Does Silent Confirmation Mean?

Under normal conditions, the confirming bank could add its confirmation to a letter of credit upon the issuing bank’s authorization or request.

If the confirming bank adds its confirmation to the credit without any request from the issuing bank, then this procedure will be called as a silent confirmation or unauthorized confirmation.

It is worth mentioning that silent confirmation is not covered under letter of credit rules.

Confirming banks pay letter of credit amount to the beneficiaries without recourse basis. Do you want to know more about without recourse term? Please click here for more information.