No matter how many advantages letters of credit have, they have one big disadvantage. They are expensive.

As a result, you should understand your costs before finalizing a letter of credit deal.

Letter of credit is a secure payment method in foreign trade. But this comfort of security comes with a price.

Letters of credit are one of the most expensive international payment methods available on the market.

As a result, exporters find themselves in a dilemma, when negotiating the terms of the business conditions.

Question is simple but not easy to answer; either choosing an expensive but relatively secure payment method or choosing a risky but less expensive payment method.

What are the Main Letter of Credit Fees That Exporters Have to Pay?

It is really hard to answer this question. Because what rules say is different than what the daily practice dictates.

- According to the Rules: The issuing bank must pay all banking commissions as per UCP 600, which is the latest ICC rules of documentary credits.

- Real Life Situations: The applicant pays the letter of credit issuance charges, but all other l/c costs will be collected from the beneficiary.

Bank Commissions That Exporters Normally Have to Pay:

- Courier Fee / Postage Fee

- Advising Fee

- Discrepancy Fee

- Handling Fee / Negotiation Fee

- Amendment Commission

- Confirmation Fee

- Reimbursing Bank Charges

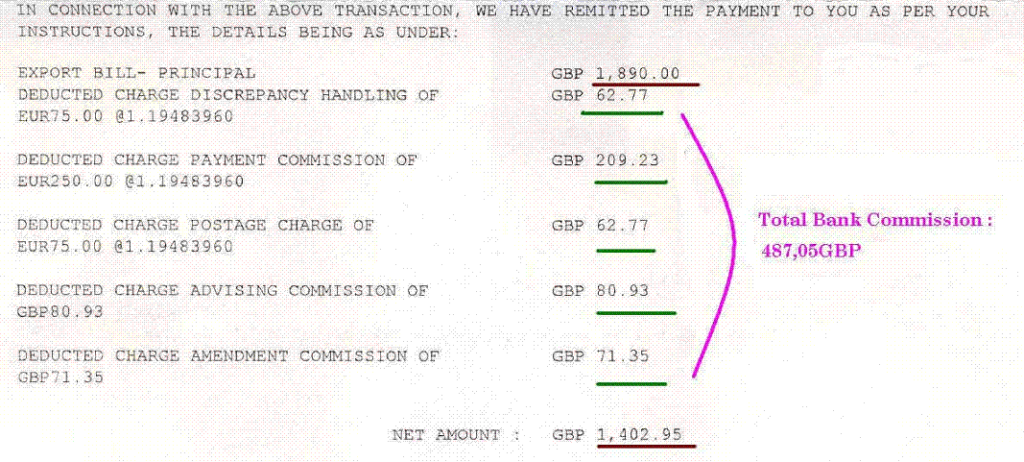

Real Life Example :

I would like to share a real life bank commissions example below.

These bank fees were collected from a British exporter under a letter of credit transaction. As you can see, the exporter had to pay 487 GBP to the banks as letter of credit fees.

Total transaction amount was only 1890 GBP. Letter of credit fees comprised 25% of all transaction amount, and this is unacceptable.

Suggestions to Eliminate High Banking Commissions Under Letters of Credit Transactions for Exporters:

- Suggestion 1: Do not use letters of credit in low value transactions. As a general rule of thumb, transaction amounts below 10.000 USD to 15.000 USD can be considered as a low value businesses. Try to use alternative payment methods, instead of letters of credit on these occasions.

- Suggestion 2: Try to convince your customer, so that the letter of credit fees will be paid by the applicant. Remember, letter of credit rules are on your side.

- Suggestion 3: The worst case scenario may be is that, you can not find an alternative payment option and your customer does not want to pay letter of credit charges, except for the l/c issuance costs. If this is the situation, then try to learn approximate bank commissions and make sure that you have included at least some of them on your price offer.