On this page, I will try to explain “Quality Control Inspections”, “Inspection Certificates” and their applications in letters of credit.

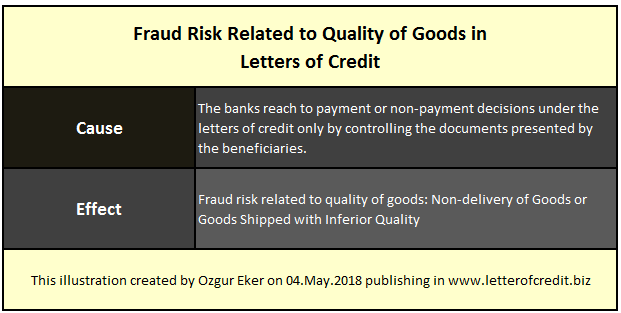

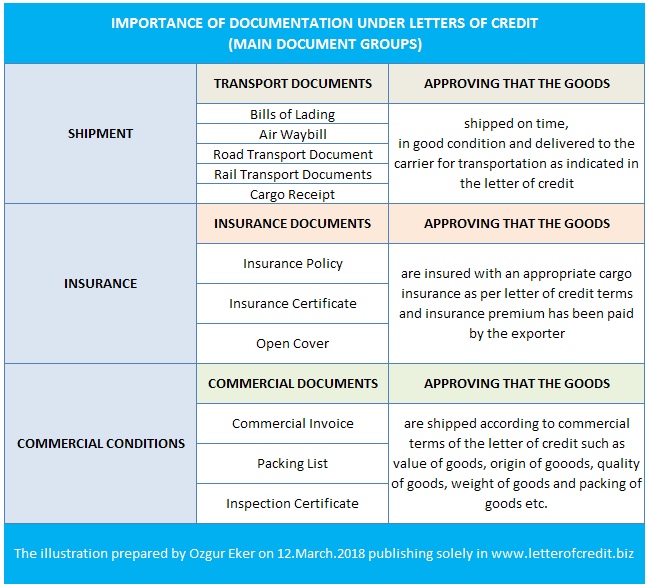

A letter of credit transaction is all about the documents, but not the actual goods or services.

The banks reach to payment or non-payment decisions under the letters of credit only by controlling the documents presented by the beneficiaries.

The banks have no connection with the actual goods or the services.

Above explanation put importers to a serious fraud risk related to quality of goods such as:

- non-delivery of goods or,

- goods shipped with inferior quality.

A third party inspection, that is carried out by a reputable independent inspection company, could eliminate or at least limit the fraud risk related to quality of goods considerably.

Depending on the type and value of the goods, the inspection may be commenced when the goods are in process of being manufactured or packed and until they are on board the means of transport concerned. (1)

Place of inspection can be set either in the country of origin (at the time of loading) or in the country of destination (at the time of unloading or at the warehouses where the imported goods are received).

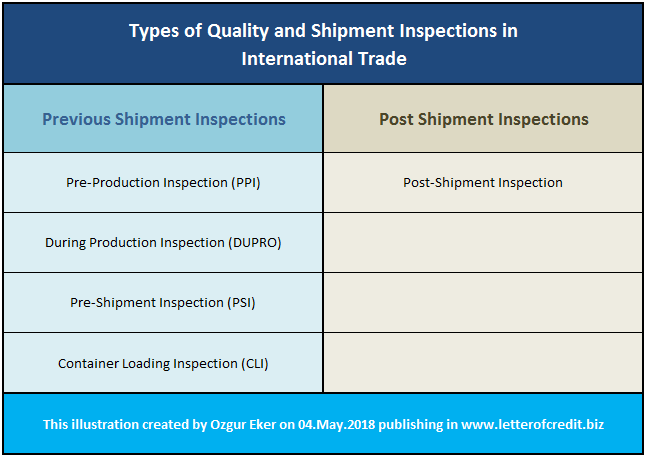

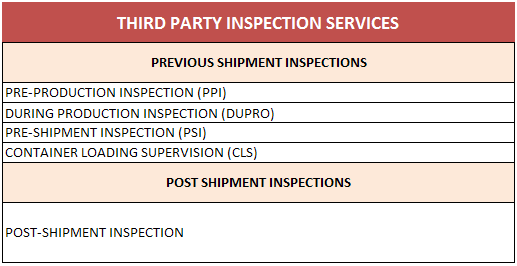

Types of Quality and Shipment Inspections in International Trade:

Third party inspection services can be grouped under two main categories.

- Previous Shipment Inspections, which are performed before the goods are shipped from the exporter’s factory and

- Post Shipment Inspections, which are performed after the goods are shipped from the exporter’s factory. (2)

Previous Shipment Inspections are as follows:

- Pre-Production Inspection (PPI)

- During Production Inspection (DUPRO)

- Pre-Shipment Inspection (PSI)

- Container Loading Inspection (CLI)

Post Shipment Inspections are as follows:

- Post-Shipment Inspection

The most frequently used inspection type in international trade is the pre-shipment inspection, PSI, is a reliable quality control method for checking goods’ quality.

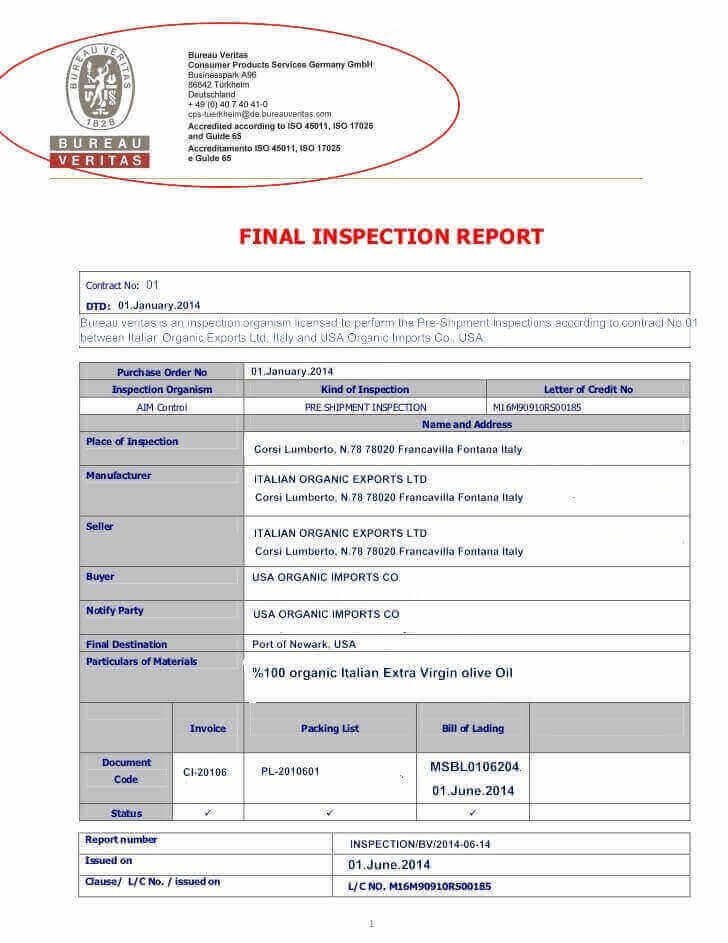

What is an Inspection Certificate?

An inspection certificate, sometimes called as certificate of inspection or pre-shipment inspection certificate, is a trade document used in international trade transactions, issued generally by an independent inspection company after conducting a related inspection, certifying whether or not the goods are in question are in conformity with the specifications stated on the sales contract. (3)

What are the Types of Inspection Certificates:

The certificates delivered by the inspection companies are basically of two different types:

- Clean Report of Findings (CRF): This is a document required by the importing (sometimes, exporting) country, as some developing countries have a large part or all of their imports (exports) inspected prior to shipment in the country of origin, as to quantity, quality and price (Pre-Shipment Inspection – PSI). These PSI schemes, entrusted to international inspection agencies, have been established by the authorities for custom, fiscal or foreign exchange control purposes and are compulsory.

- Commercial Certificate of Inspection: Stating the quantity and quality ( any measurable quality parameter requested by the principals). These Certificates are issued by an inspection agency acting as a neutral third party assessing the actual condition of a traded cargo between a seller and a buyer. A commercial certificate of inspection is necessary to build up a long-term relation between buyers and sellers. Bad quality of goods in trade can lead to loss of market share in the long run.

What are the Benefits of Inspection Certificates:

Main objective of the inspection certificate is to satisfy the importer or the government body that the goods are in conformity with the indicated specifications on the sales contract or proforma invoice.

- Inspections are important tools to reduce trade risks and avoid fraud.

- Shipment of low quality goods prevented.

- Non-delivery fraud with fake bill of lading or any other transport document prevented.

- Another fraud risk factor is the possibility of replacement inspected goods with the fraudulent ones after the inspection: basically the cargo inspected would not go into the shipment. This can be prevented by adding a numerical link on the inspection certificate to the transport document. For example, inspection certificate that is indicating the container number can prevent such a fraudulent action.

How to Demand an Effective Inspection Certificate in a Letter of Credit Transaction?

- Add at least one original copy of an inspection certificate to field 46-A Documents Required as one of the necessary documents under the letter of credit.

- Make sure that inspection certificate is issued by one of the well known inspection companies around the world. The most well known inspection companies are : SGS, Bivac/Bureau Veritas, Cotecna, Intertek.

- Clearly indicate on the letter of credit text that inspection certificate is complying with the specifications indicated on the sales contract or proforma invoice.

- Make sure that values indicated on the inspection certificate does not conflict with the values indicated on the letter of credit or other documents.

- Do not forget to add a numerical link on the inspection certificate to the transport document.

References:

- Documentary Credits, Nordea Trade Finance, Page:175

- What is a Pre-Production Inspection (PPI)?, www.advancedontrade.com, Retrieved: 05.May.2018

- What is an Inspection Certificate or Certificate of Inspection?, www.advancedontrade.com, Retrieved: 05.May.2018