Institute Cargo Clause A (All risks), Institute Cargo Clause B and Institute Cargo Clause C are the main types of cargo insurance types used in international trade

But which cargo clause is the most suitable one for letter of credit transactions?

How to eliminate non-delivery risks, war and strike risks in international trade?

Question Comes from Lus Miguel, Porto, Portugal:

Dear sirs,

First of all, congratulations for your website, it has been a great help. I’d like to ask you some questions regarding insurance versus letters of credit.

Knowing that if the credit is under the UCP 600 the insurance terms is agreed between exporter and importer (INCOTERMS) the banks sometimes ask for a Clause A plus extra coverage.

I think (and this is my doubt) that the banks at the bottom line can ask a minimum clause insurance (110%) if they trust their client financial capability to support a cargo loss/accident.

It is always a commercial decision.

Am I right at my conclusion?

The reason for my question is that nowadays we usually approve with clause A but if the commercials ask we lower the type of coverage to B or C.

I was looking for case studies, but I believe the risk when the cargo does not arrive to destiny is always on the side of importers/exporters (INCOTERMS chosen) and the bank is always defended since if the documents are good we have to pay them to the exporter.

Do you have knowledge of other situations that banks got “burned” regarding insurance problems when docs were okay?

Sincerely,

Here is the Answer:

Thanks for your question.

Analyses:

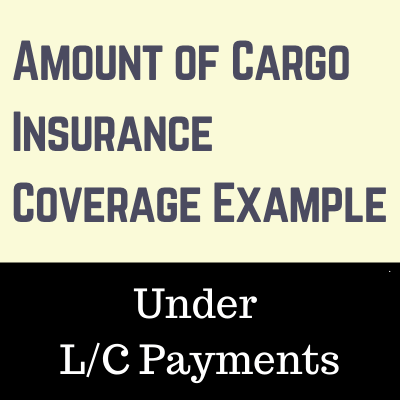

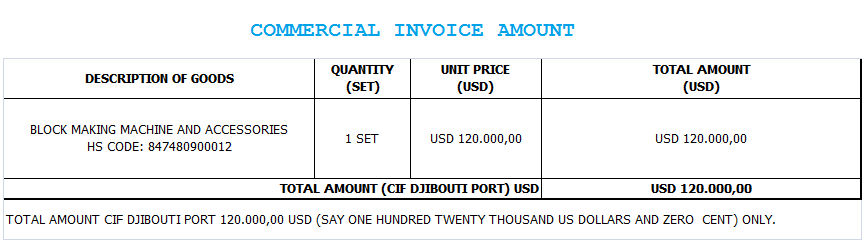

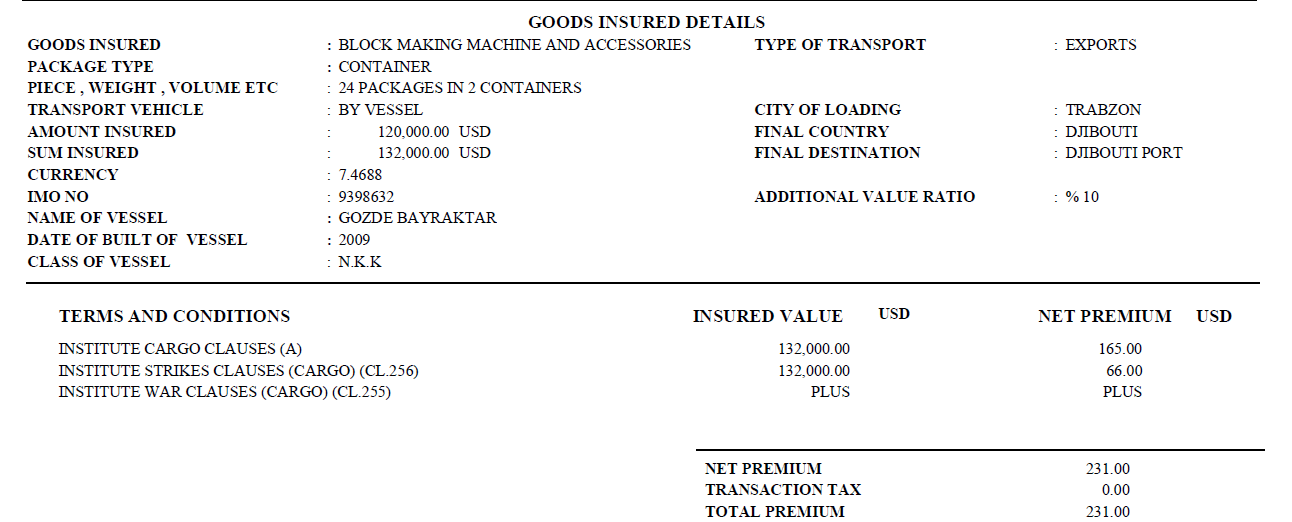

Insurance Coverage Under the Incoterms: According to the Incoterms 2010, seller has to make the insurance agreement with an insurance company and has to supply an insurance policy or certificate by paying the insurance premium under two trade terms:

Both CIF and CIP incoterms outlines a minimum insurance coverage, which is Institute Marine Cargo Clauses, C.

Exporters and importers are free to determine a more detailed insurance coverage such as Institute Marine Cargo Clauses, A (all risks).

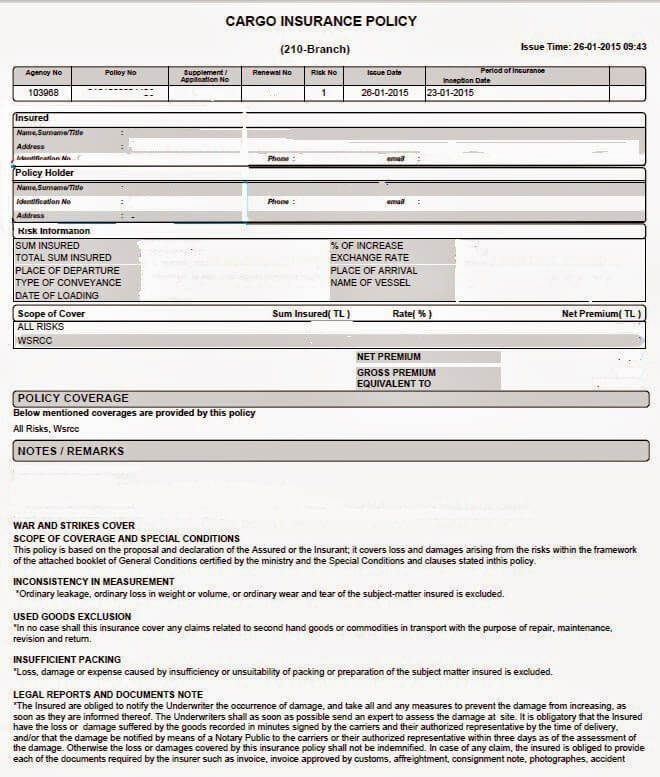

Furthermore they can choose to include additional clauses to an all risk policy such as

- WSRCC (War, strikes, riots and civil commotion) Clause,

- Theft, Pilferage and Non-Delivery clause etc.

All of these extra insurance coverage must be paid by the buyer, unless otherwise determined on the sales contract.

Delivery Place Under CIF incoterms: Most of the international trader think that under CIF incoterms, the seller delivers the goods to the buyer at the port of discharge but this is not correct.

The seller delivers the goods to the buyer at the port of loading once the goods are shipped on board a named vessel under the CIF incoterms.

As a result, non delivery risks of the goods is not different between FOB and CIF incoterms from the point of the issuing bank under a letter of credit transaction.

The exporter delivers the good under both incoterms at the port of loading, and if the issuing bank receives a complying presentation, then it has to honor whether or not the goods arrive to the port of discharge. (Fraudulent shipments are the exemptions)

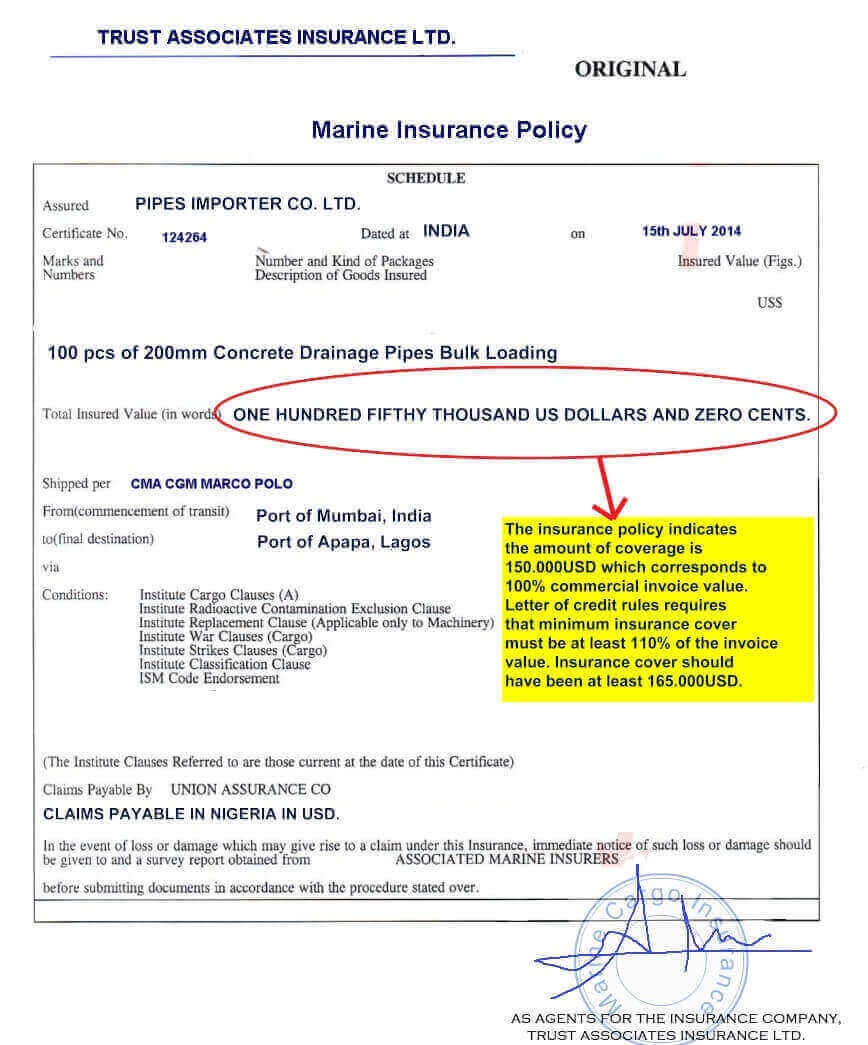

Insurance Coverage Under the Letter of Credit rules: The letter of credit rules, UCP 600, does not give directions either banks or their customers that what type of insurance cover must be selected.

Just on the contrary, the letter of credit rules tell that a credit should state the type of insurance required and, if any, the additional risks to be covered.

Conclusion:

Non-delivery Risk of Goods: As an issuing bank, the non-delivery risks remains unchanged under certain incoterms such as FOB and CIF.

The issuing bank has to honor complying presentations whether or not goods arrive port of discharge.

In practice, in most of the cases, the issuing banks have to decide accepting or rejecting the presentations while goods are still in transit, long before they have completed their journey.

Establishing Internal Standards: Each bank should establish an internal standards against non-delivery of goods risks.

This can be done by requesting all risks insurance policy covering additional clauses such as war, strikes, riots and civil commotion and theft, pilferage and non-delivery under CIF and CIP incoterms.

For the remaining incoterms you may indicate on the letter of credit application form that your bank will be arranging an insurance policy on behalf of your customer in order to secure delivery of goods.

Alternatively you can indemnify yourself against such risks by holding your customer fully responsible against non-delivery of goods under complying presentations.

Implementation: In order to establish a well-structured internal guidelines, an issuing bank could get in touch with local ICC Banking committee.

In our case it is ICC Portugal.

ICC Portugal

Rua das Portas de Santo Antão, 89

1169-022 Lisboa

T: +351 21 346 3304

E-mail: [email protected] Web: www.icc-portugal.com