It is a common practice in the commercial world to insure goods in transit. Briefly, the following reasons compel traders to contract transport insurance:

- Protection against financial losses resulting from damage, pilferage, theft and non-receipt of entire or part of a consignment; and

- Protection against financial claims that can be made against the owner of goods on board a vessel in case of a “declared general average” (the goods themselves being undamaged). (1)

According to the Incoterms rules, if the parties agreed on CIF or CIP trade terms, the exporter must provide an insurance policy or an insurance certificate to the importer at his own expense.

Consequently, if letter of credit has been chosen as a payment method with an underlining sales contract that had been established either with CIF or CIP incoterms, then the issuing bank adds an insurance document to the required documents list.

On this page you can find most common letter of credit discrepancies related to insurance documents, such as insurance policies or insurance certificates.

Insurance Policy Discrepancies

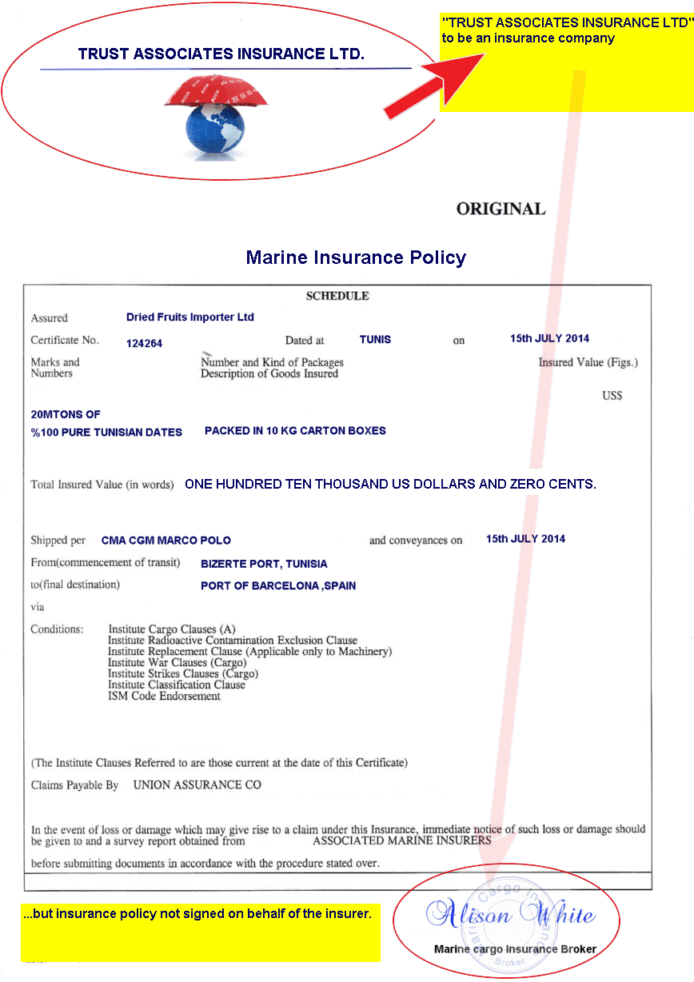

- Insurance Policy not Issued and Signed by an Insurance Company or its Agent

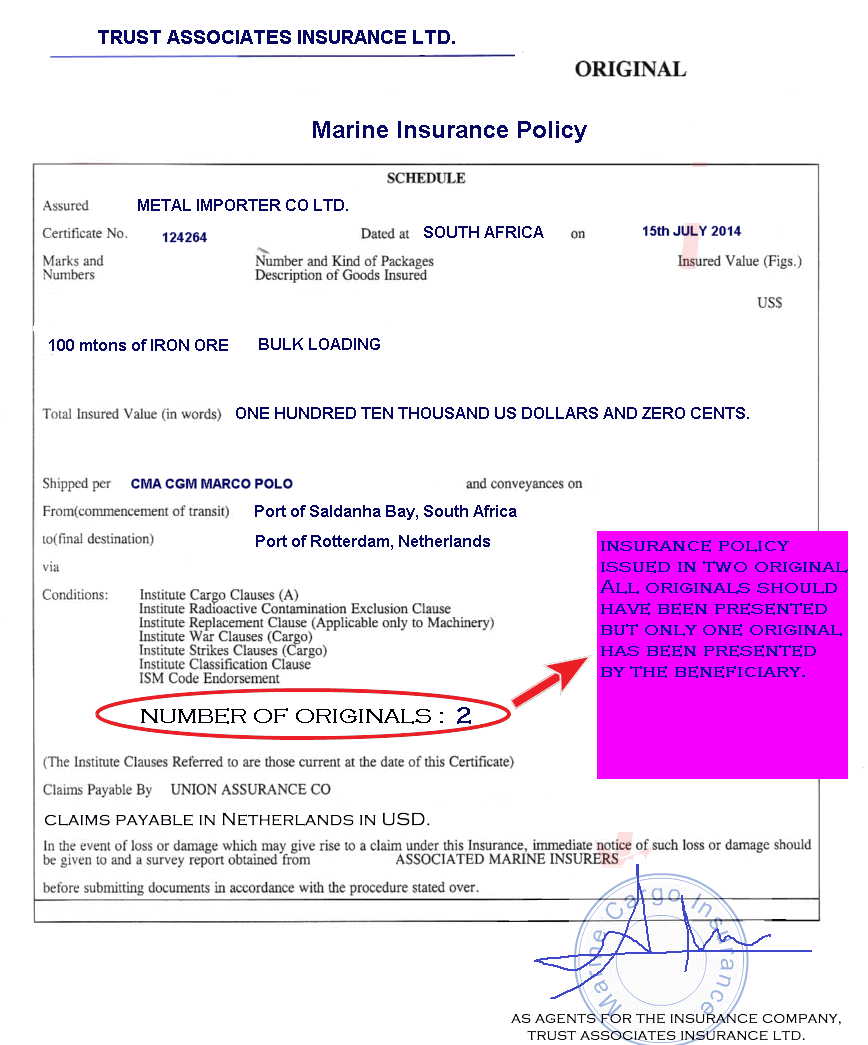

- All Originals of Insurance Policies Have Not Been Presented

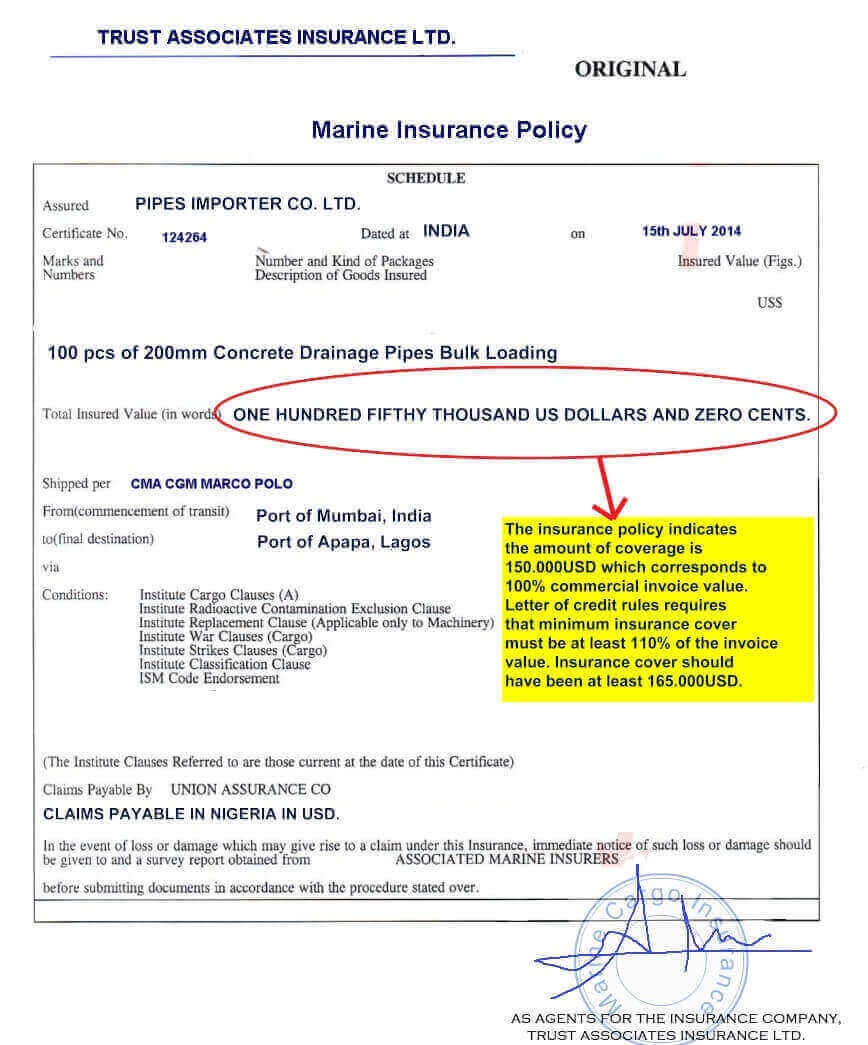

- Insurance Coverage is Insufficient

- Insurance Policy does not Include the Risks Specified by the L/C

- Insurance Policy is not Endorsed

- Insurance Policy Shows Date of Issue to a Later Date than Date of Shipment

- Insurance Policy Show Different Currency than the Commercial Invoice

- Correction/Alteration on the Insurance Policy is not Authenticated Properly

- Insurance Certificate Shows that Insurance Cover Subject to a Franchise or an Excess

Important Definitions Regarding the Insurance Documents under Latest Letter of Credit Rules:

- An insurance policy, insurance certificate or declaration under an open cover will be examined by banks as per UCP 600 article 28.

- An insurance policy, an insurance certificate or a declaration under an open cover, must appear to be issued by an insurance company, an underwriter or their agents or their proxies.

- An insurance policy, an insurance certificate or a declaration under an open cover, must appear to be signed by an insurance company, an underwriter or their agents or their proxies.

- Presentation of cover notes will not be accepted instead of presentation of insurance policies, insurance certificates or declarations under an open cover.

- An insurance policy is acceptable in lieu of an insurance certificate or a declaration under an open cover.

- The date of the insurance document must be no later than the date of shipment, unless it appears from the insurance document that the cover is effective from a date not later than the date of shipment.

- The insurance document must indicate the amount of insurance coverage and be in the same currency as the credit.

- The insurance document must indicate that risks are covered at least between the place of taking in charge or shipment and the place of discharge or final destination as stated in the credit.

References:

- Shipping and Incoterms, Practice Guide, UNDP Practice Series, Page:18