Date of shipment is used to determine;

- whether shipment made on time or not (in other words a late shipment has been effected or not),

- whether documents presented within the presentation period or not (in other words a late presentation has been effected or not),

- maturity date of the time draft,

- maturity date of a deferred payment letter of credit.

Using Date of Shipment in Order to Determine Whether Shipment Has Been Made on Time or Not:

If a letter of credit calls for an original transport document, it is also expected that the letter of credit indicates a latest date of shipment.

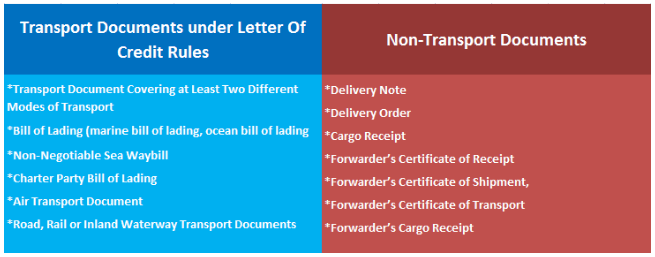

In this regard, it is of paramount importance to clarify which documents are considered as a transport document under the letter of credit rules:

Transport Documents Under the Letter Of Credit Rules: Below you can find the transport documents defined under the letter of credit rules.

- Transport Document Covering at Least Two Different Modes of Transport (multimodal bill of lading or combined transport document etc…)

- Bill of Lading (marine bill of lading, ocean bill of lading etc..)

- Non-Negotiable Sea Waybill

- Charter Party Bill of Lading

- Air Transport Document (Air Waybill)

- Road, Rail or Inland Waterway Transport Documents

- Courier Receipt, Post Receipt or Certificate of Posting

If one of the transport documents is requested in the credit, the beneficiary must complete the shipment before the latest date of shipment. Otherwise the issuing bank finds the presentation not complying and raises a late shipment discrepancy.

Using Date of Shipment in Order to Determine Whether Documents Have Been Presented Within the Presentation Period or Not:

A presentation including at least one original transport document, which can be a multimodal bill of lading, combined transport document, bill of lading, non-negotiable sea waybill, charter party bill of lading, air transport document, road transport document, rail transport document, inland waterway transport document, courier receipt, post receipt or certificate of posting, must be made not later than 21 calendar days after the date of shipment.

In any case presentation must be made not later than the expiry date of the credit.

Using Date of Shipment to Determine Maturity Date of the Time Draft:

Letter of credit that has been issued available by acceptance of a time draft may specify a maturity date which will be calculated with the help of the date of shipment.

Let me give you a couple of examples:

- at 60 days after the bill of lading date

- at 90 days after bill of lading

- after 30 days from date of bill of lading

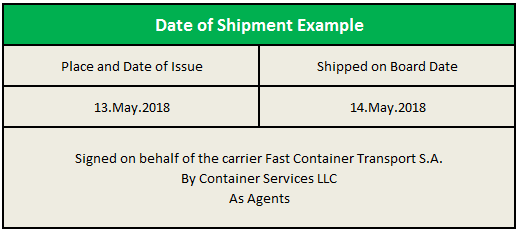

When the tenor of the bill of exchange refers to, for example, 30 days after the bill of lading date, the on board date is deemed to be the bill of lading date.

On this occasion the on board date could be prior to or later than the issuance date of the bill of lading.

Using Date of Shipment to Determine Maturity Date of a Deferred Payment Letter of Credit:

Letter of credit that has been issued available by deferred payment may specify a maturity date which will be calculated with the help of the date of shipment.

Let me give you couple of examples as follows:

- deferred payment at 60 days after the bill of lading date

- deferred payment at 90 days after bill of lading

- deferred payment after 30 days from date of bill of lading

When tenor or maturity date of the deferred payment refers to, for example, 30 days after the bill of lading date, the on board date is deemed to be the bill of lading date.

On this occasion the on board date could be prior to or later than the issuance date of the bill of lading.