Consignee field on the multimodal bill of lading must be completed according to the instructions stated in the letter of credit.

In a contract of carriage, the consignee is the person to whom the shipment is to be delivered whether by land, sea or air.

The consignee field can be seen on the following transport documents : Bill of lading, multimodal bill of lading, charter party bill of lading, sea waybill, air transport document (air waybill), road transport document (CMR) and rail transport document etc.

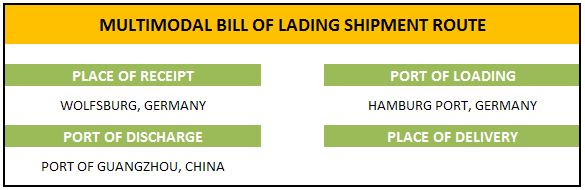

A transport document covering at least two different modes of transport is regarded as a multimodal bill of lading according to the letter of credit rules.

The consignee field on the multimodal bill of lading can be completed mainly in 5 different ways.

- Multimodal bill of lading consigned to the order of the issuing bank

- Multimodal bill of lading consigned to the issuing bank

- Multimodal bill of lading consigned to the order of the applicant

- Multimodal bill of lading consigned to the applicant

- Multimodal bill of lading consigned to order and blank endorsed.

If the issuing bank finds out that the consignee field of a multimodal bill of lading has not been completed as per letter of credit terms, then the issuing bank will issue a discrepancy, which is known as consignee different than letter of credit.

Letter of Credit Discrepancy Example: Consignee Different Than The Letter of Credit on a Multimodal Bill of Lading

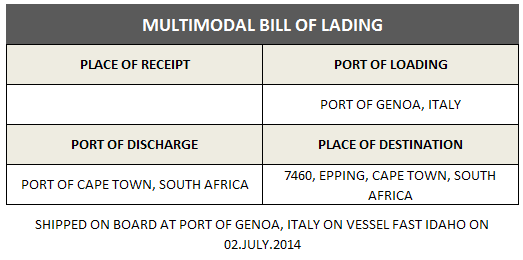

A letter of credit has been issued in SWIFT format, subject to UCP 600, with the following details:

Letter of Credit Conditions

Field 46A: Documents Required: Full set of multimodal bill of lading issued by a shipping company marked freight prepaid made out to COMMERZBANK marked notify applicant indicating that the goods have been dispatched, taken in charge or loaded on board.

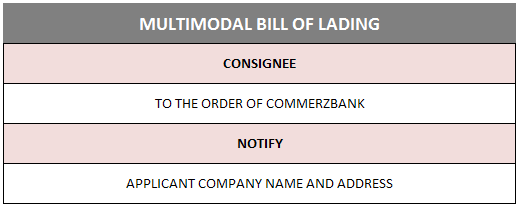

The beneficiary presented a multimodal bill of lading with the following data:

Multimodal Bill of Lading

Consignee: To the order of Commerzbank

Notify: Applicant Company

Discrepancy: Multimodal bill of lading shows a consignee which is different than what is indicated in the letter of credit.

Reason for Discrepancy: If a credit requires a multimodal or combined transport document to show that the goods are consigned to a named party, such as “consigned to the issuing bank” (a straight consignment), rather than “to order” or “to order of the issuing bank”, the multimodal or combined transport document must not contain words such as “to order” or “to order of” that precede the name of that named party, whether typed or pre-printed.