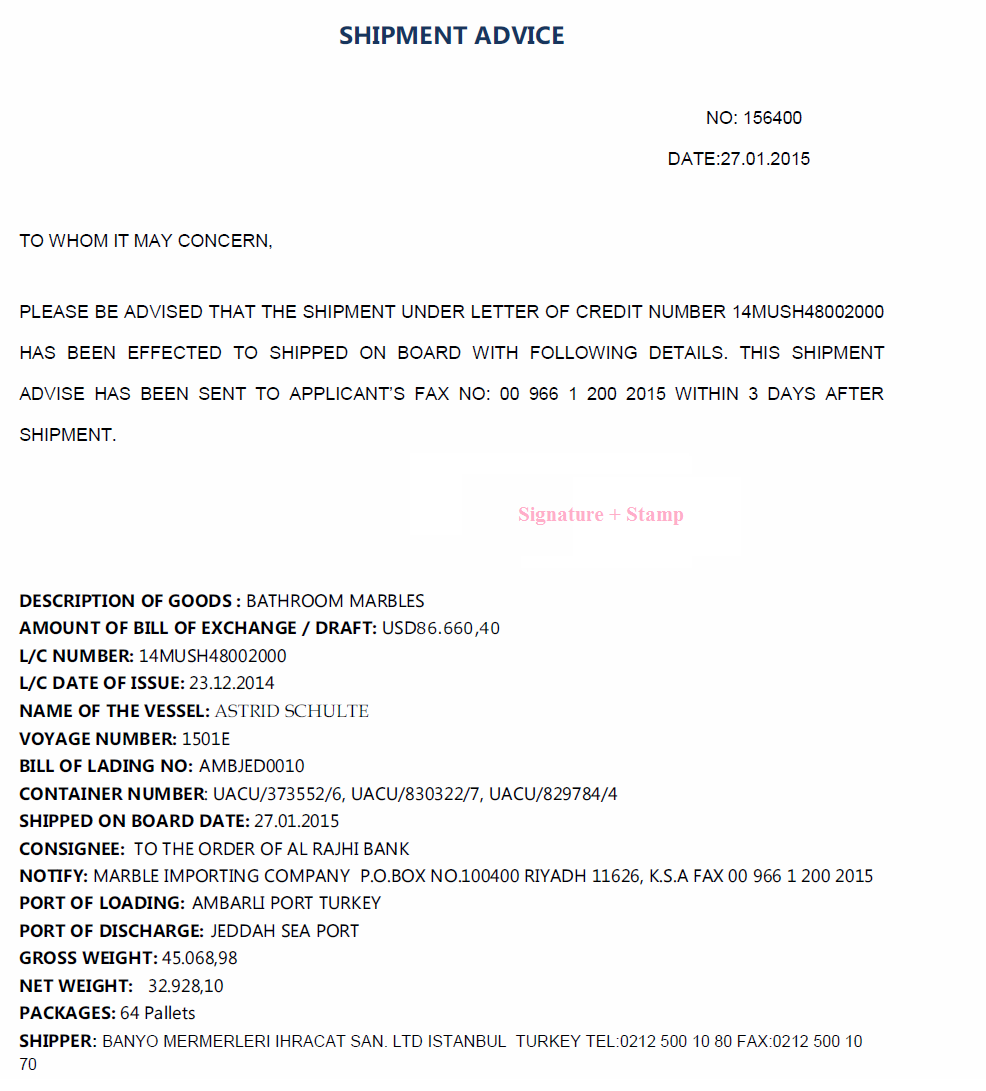

Proforma Invoice

- In international trade transactions, a proforma invoice is a trade document which states a commitment from the seller (exporter) to sell goods to the buyer (importer) at specified conditions.

- A proforma invoice is not a valid invoice in terms of accounting.

- Proforma invoices are widely used in today’s international trade transactions in substitution of sales contracts.

- For detailed information please visit our proforma invoice page.

Commercial Invoice

- Commercial invoice is a type trade document which is used mostly in international trade transactions.

- It is a compulsory document that is requested by customs to determine true value of the imported goods, for assessment of duties and taxes.

- The description of the goods, services or performance in the invoice must correspond with the description in the letter of credit.

- For detailed information please visit our commercial invoice page.

International Sales Contract

- Contract of sale is defined as “formal contract by which a seller agrees to sell and a

buyer agrees to buy, under certain terms and conditions spelled out in writing in the

document signed by both parties. - Also called agreement of sale, contract for sale, sale agreement, or sale contract.

- A sales contract can cover any kind of sales action such as sales of intellectual

property rights, sales of real estate etc… We will be focusing only on international

contracts for sale of goods. - For detailed information please visit our international sales contract page.

Packing List

- Packing list, is an international trade document, used to identify details of the shipment

in terms of packaging. - Packing list normally should not disclose any financial information regarding the shipment such as the total amount of the cargo, unit price of the items or payment terms.

- By adding details of the weight you can use a packing list as a weight list or weight certificate without any problem.

- For detailed information please visit our packing list page.

Bill of Exchange / Draft

- Bill of exchange and draft have the same meaning and it is a financial document.

- Bill of exchange defined as an unconditional order in writing, addressed by one person to

another, signed by the person giving it, requiring the person to whom it is addressed to pay on demand or at a fixed or determinable future time a sum certain in money to or to the order of a specified specified person, person, or to bearer. - There are two main international law exist that govern the bill of exchange as a financial

instrument in international trade transactions. Bills of Exchange Act (1882) and Geneva

Conventions (1930). - For detailed information please visit our bill of exchange page.

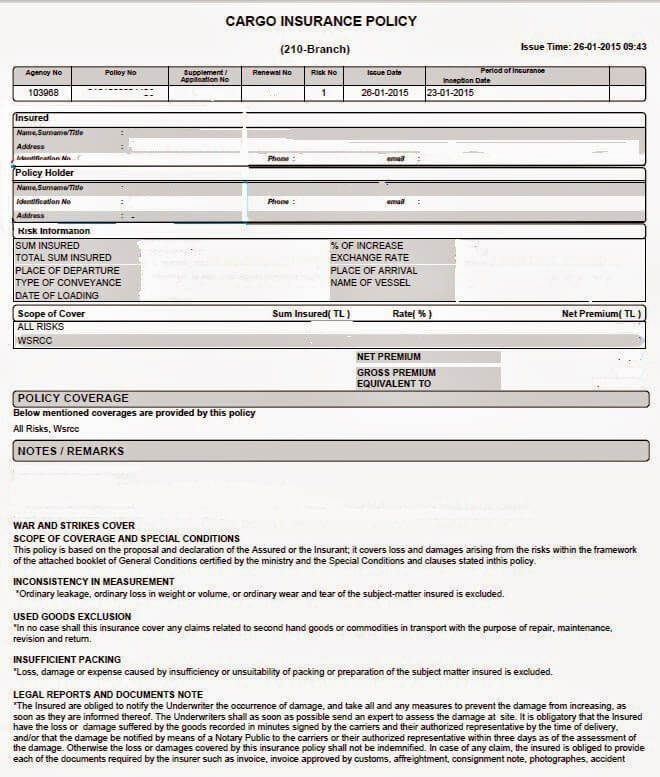

Insurance Documents

- Cargo insurance is defined as an insurance policy taken up to protect insurance

holder against loss of or damage to the goods during the transportation. - There are 3 main cargo insurance types available for sea and road shipments.

- Institute Cargo Clauses (A) => widest protection coverage

- Institute Cargo Clauses (B)

- Institute Cargo Clauses (C) => minimum insurance coverage

- Institute Cargo Clauses (Air) used in air shipments.

- For detailed information please visit our cargo insurance documents page.

Inspection Certificate

- Pre-shipment inspection, PSI, is a part of supply chain management and an important and reliable quality control method for checking goods’ quality while clients buy from the suppliers.

- Main objective objective of the inspection certificate is to satisfy the importer or the

government body that the goods are in conformity with the indicated specifications

on the sales contract or proforma invoice. - Inspections are important tools to reduce trade risks and avoid fraud.

- For detailed information please visit our Inspection Certificate page.

Multimodal Bill of Lading

- Both multimodal bills of lading are transport documents covering transportation completed by more than one mode of transport.

- Multimodal bills of lading are mostly printed on standard forms supplied by International Federation of Freight Forwarders Associations (FIATA) .

- Multimodal Bills of Lading and Combined Transport Bills of Lading has the same meaning and application in terms of letters of credit rules.

- For detailed information please visit our Multimodal Bill of Lading page.

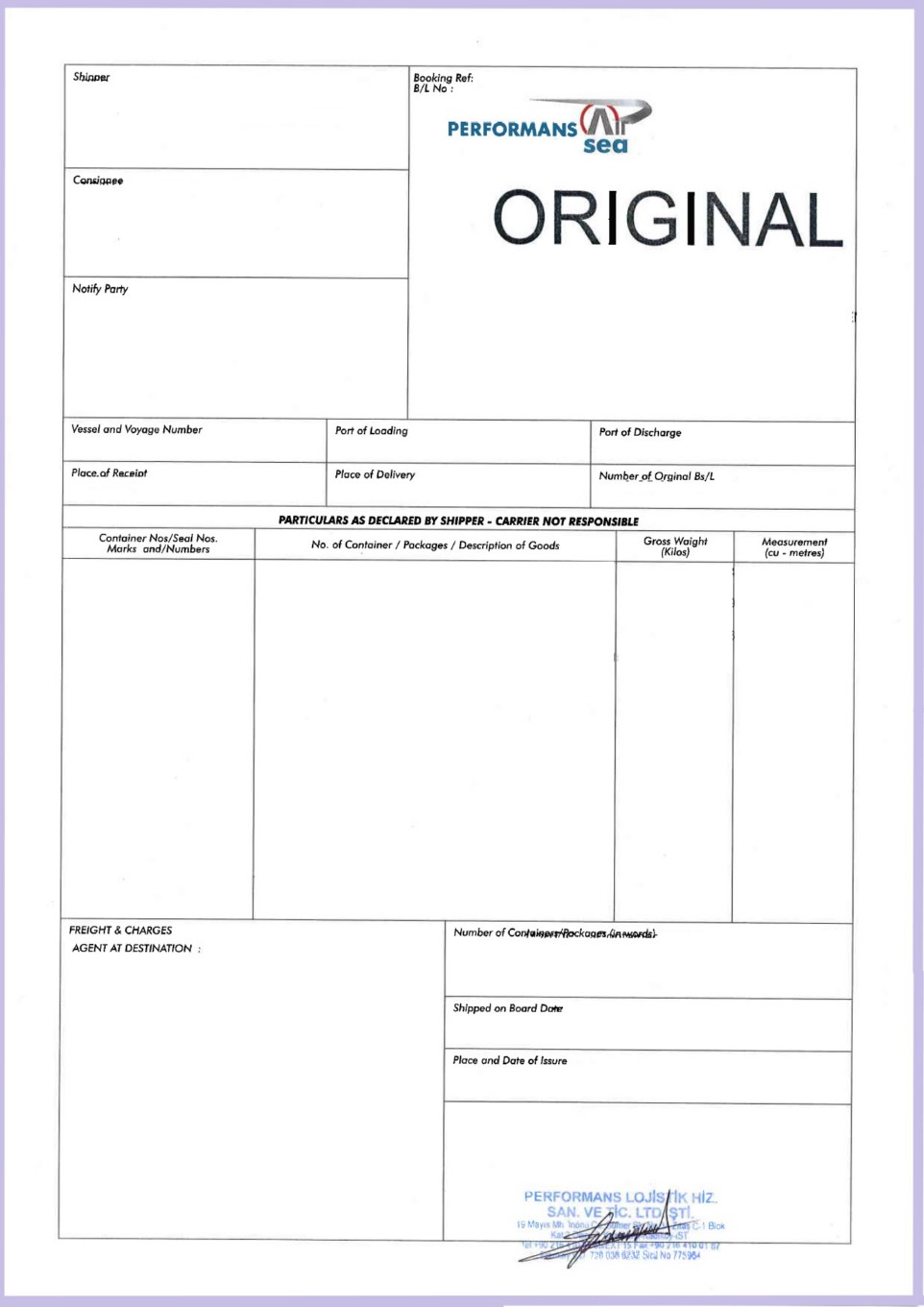

Bill of Lading

- Bill of lading is a transport documents used in sea shipments.

- A bill of lading is an instrument in writing, signed by a carrier or his agent, describing the freight so as to identify it, stating the name of the consignor. The terms of the contract for carriage, and agreeing or directing that the freight be delivered to the order or assigns of a specified person at a specified place.

- Bills of lading fulfill three basic functions :

- bills of lading are receipts for the goods;

- bills of lading evidence the terms of the contract of carriage

- they are said to be “negotiable documents of title”

- For detailed information please visit our Bill of Lading page.

Non-Negotiable Sea Waybill

- Non-negotiable sea waybill or Non-Negotiable Bill of Lading is a transport document used in sea shipments.

- A sea waybill is non-negotiable, which means that the consignee cannot endorse the sea waybill and transfer it to another person to take delivery delivery of the cargo.

- Non-negotiable sea waybill is covered under article 21 of the UCP 600.

- To comply with UCP 600 article 21, a non-negotiable sea waybill must appear to cover a port-to-port shipment but need not be titled “Non-negotiable Sea Waybill” or similar.

- For detailed information please visit our Non-Negotiable Sea Waybill page

Charter Party Bill of Lading

- Container transportation may not be suitable for some occasions such as bulk commodity trades and heavy lift/out of gauge movements. On these occasions, in which liner services could not be utilized, shippers may choose to hire a vessel as an alternative.

- Hiring a vessel is called “Charter Party” in maritime terminology.

- Transport document issued by the hiring party of the vessel, or charterer as we call them, is called “Charter Party Bill of Lading“.

- Charter party bill of lading is covered under article 22 of the UCP 600.

- For detailed information please visit our Charter Party Bill of Lading page

Air Transport Document

- Air transport document or air waybill (AWB) is a transport document used in air shipments.

- Air waybill is “the shipping document used for the transportation of air freight. It includes conditions, limitations of liability, shipping instructions, description of commodity, and applicable transportation charges.

- Air transport document is not a document title of goods, which means that air waybill is a non-negotiable transport document.

- If a letter of credit requires presentation of an air transport document covering an airport-to airport shipment, UCP 600 article 23 is applicable.

- For detailed information please visit our Air Transport Document page.

Road Transport Document

- Road transport document or road consignment note is a transport document used in land shipments.

- Road transport document is “the shipping document used for the transportation of land

freight. Road transport document that confirms that the carrier (ie the road haulage company) has received the goods and that a contract of carriage exists between the trader and the carrier. - Road transport document is not a document title of goods, which means that road transport document is a non-negotiable transport document.

- “CMR International Consignment Note” is the transport document created in standard forms according to CMR convention. CMR Convention is signed by most of the EUROPEAN countries.

- For detailed information please visit our Road Transport Document page.

Rail Transport Document

- Rail transport document or rail consignment note is a transport document used in

rail shipments. Rail consignment note confirms that the rail carrier has received the

goods and that a contract of carriage exists between trader and carrier. - Rail transport document is not a document title of goods, which means that rail

transport document is a non-negotiable transport document. - “CIM Rail Consignment Note” is the transport document created in standard forms

according to CIM convention rules. CIM Convention is signed by around 50

countries. - For detailed information please visit our Rail Transport Document page.