The transport document covering the carriage of goods by sea is called a bill of lading. B/L is the most frequently used abbreviation of the bill of lading.

Actually, the bill of lading is the generic name of the transport document, which is used in sea shipments.

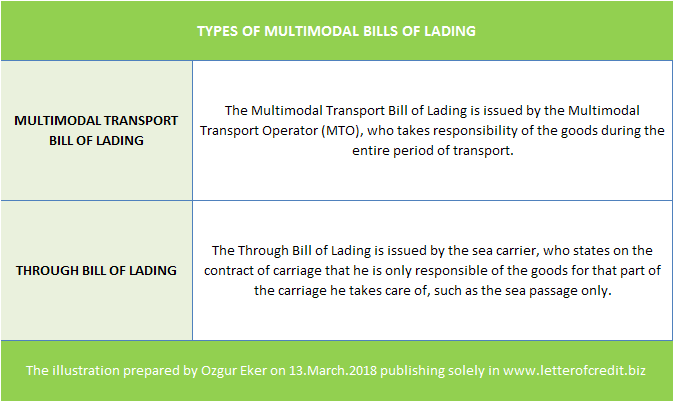

There are several types of bills of lading in circulation such as multimodal bill of lading, charter party bill of lading and non-negotiable bill of lading etc. Each type of bill of lading has unique characteristics.

On this page you can find information regarding the bill of lading that is mostly used containerized, port to port shipments.

Although most banks define this type of bill of lading as marine bill of lading or ocean bill of lading, we better to use the exact definition from the letter of credit rules and call this transport document simply as bill of lading.

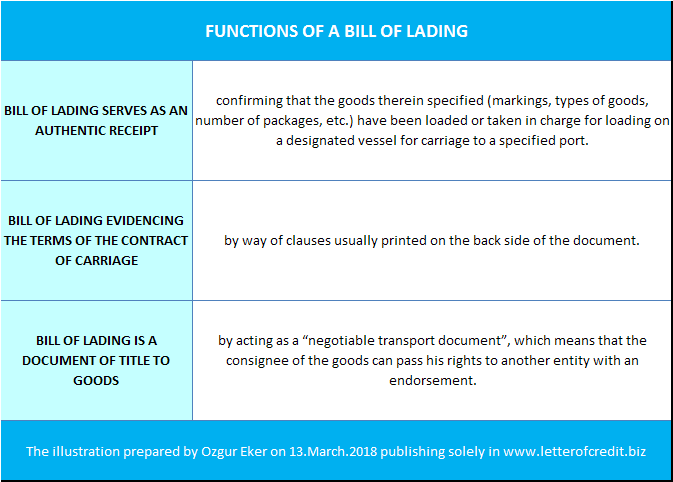

What are the Functions of a Bill of Lading?

The bill of lading is the authentic receipt delivered by a carrier, confirming that the goods therein specified (markings, types of goods, number of packages, etc.) have been loaded or taken in charge for loading on a designated vessel for carriage to a specified port. (1)

A bill of lading is an instrument in writing, signed by a carrier or his agent, describing the freight so as to identify it, stating the name of the consignor, the terms of the contract for carriage, and agreeing or directing that the freight be delivered to the order or assigns of a specified person at a specified place. (2)

The bill of lading fulfills three basic functions :

- bills of lading are receipts for the goods;

- bills of lading evidence the terms of the contract of carriage (by way of clauses usually printed on one side of the document);

- they are said to be “negotiable documents of title” (except for the nominative or “straight” bill of lading) (3)

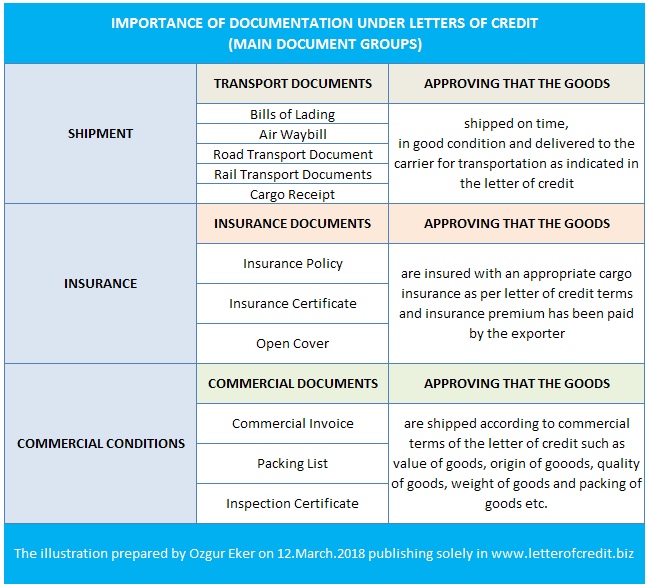

Important Note: Letter of credit rules, UCP 600, define the bill of lading as a transport document used only port-to-port sea shipments. Which means that you can not use the bill of lading with air or land shipments. Also if transportation take place more than one mode of transport, then letter of credit should call for a multimodal bill of lading or combined bill of lading.

How to Use Bill of Lading in Letters of Credit Transactions:

The rules related to the multimodal bill of lading can be found under article 20 of UCP 600.

A bill of lading, however named, must appear to:

- indicate the name of the carrier and be signed by:

- the carrier or a named agent for or on behalf of the carrier, or

- the master or a named agent for or on behalf of the master.

- indicate that the goods have been shipped on board a named vessel at the port of loading stated in the credit by:

- pre-printed wording, or

- an on board notation indicating the date on which the goods have been shipped on board.

- indicate shipment from the port of loading to the port of discharge stated in the credit.

- be the sole original bill of lading or, if issued in more than one original, be the full set as indicated on the bill of lading.

- contain terms and conditions of carriage or make reference to another source containing the terms and conditions of carriage (short form or blank back bill of lading).

- contain no indication that it is subject to a charter party. (4)

Special Hints Regarding the Bill of Lading From ISBP (International Standard Banking Practice):

- To comply with UCP 600 article 20, a bill of lading must appear to cover a port-to-port shipment but need not be titled “marine bill of lading”, “ocean bill of lading”, “port-to-port bill of lading” or similar.

- If a credit requires presentation of a bill of lading (“marine”, “ocean” or “port-to-port” or similar) covering sea shipment only, UCP 600 article 20 is applicable.

- If a credit states “Freight Forwarder’s Bill of Lading is acceptable” or uses a similar phrase, then the bill of lading may be signed by a freight forwarder in the capacity of a freight forwarder, without the need to identify itself as carrier or agent for the named carrier. In this event, it is not necessary to show the name of the carrier.

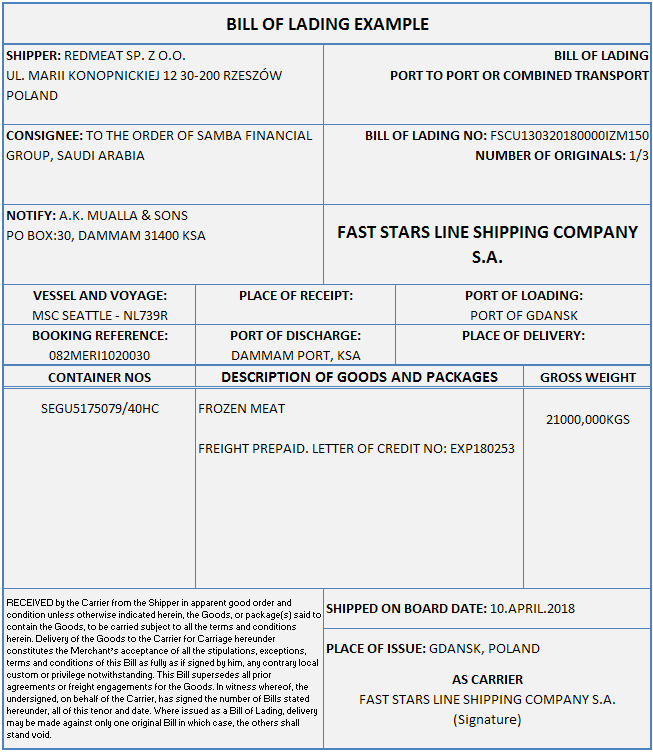

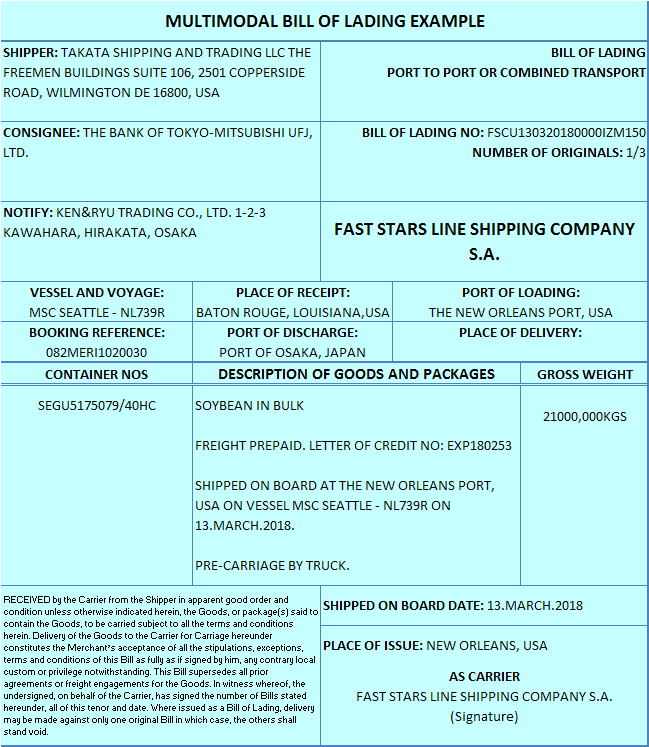

Bill of Lading Example?

You can find a bill of lading example below, that is evidencing a frozen meat shipment from Poland to Saudi Arabia.