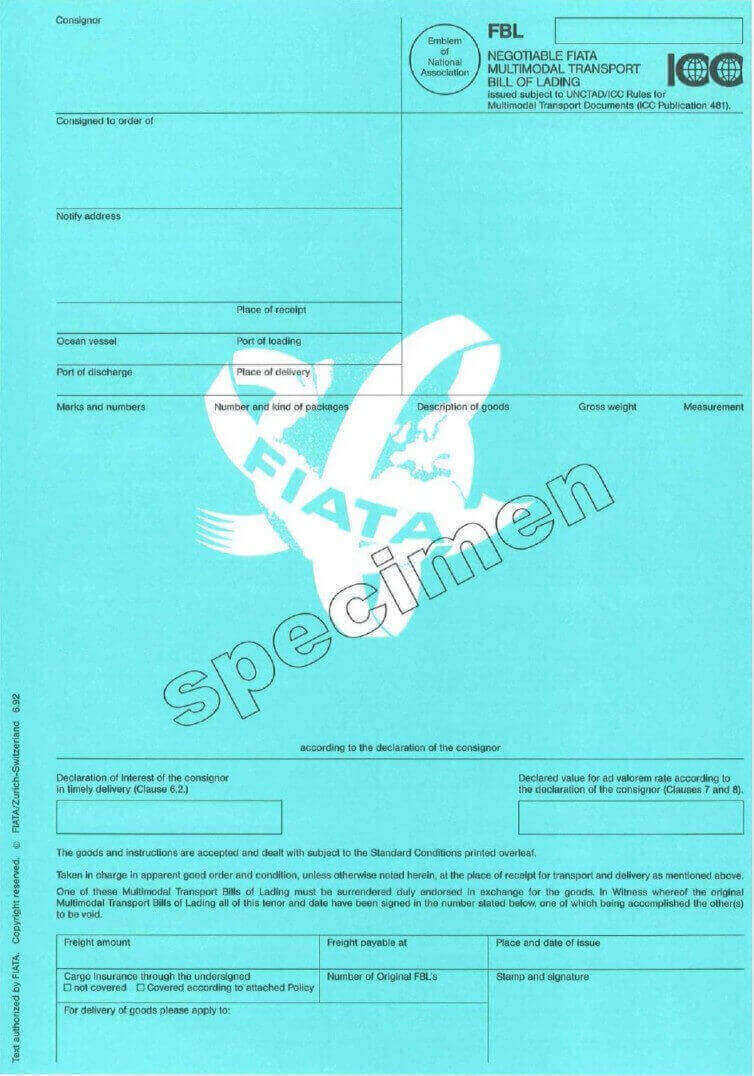

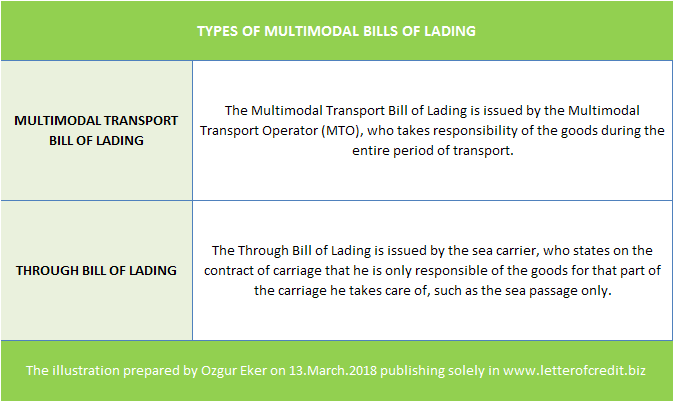

A transport document covering at least two different modes of transport is regarded as a multimodal bill of lading according to the letter of credit rules.

If the letter of credit asks for a multimodal bill of lading or a combined bill of lading, however named, the transport document which will be presented by the beneficiary must be covering at least two different modes of transport.

It is worth mentioning that the title of the transport document is irrelevant according to the letter of credit rules.

The transport document presented needs not to be titled “Multimodal bill of lading” or “Combined bill of lading” or words of similar effect even when the credit so names the required document.

The important point is the content of the transport document not the title.

Single Modes of Transport Examples:

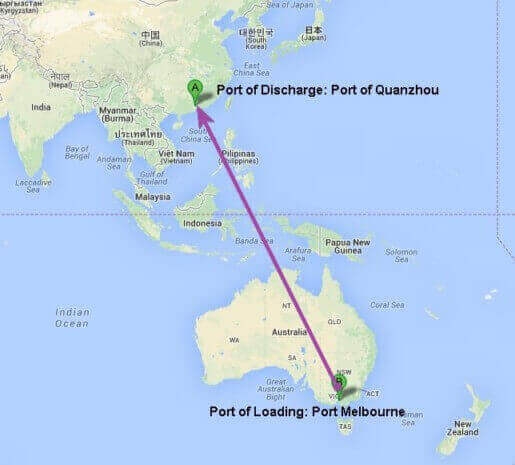

Sample 1 : Shipment Effected From Melbourne Port, Australia to Port of Guangzhou, China

- Transport Document Title: Multimodal Bill of Lading

- Port of Loading: Port Melbourne, Australia

- Port of Discharge: Port of Guangzhou, China

Only sea shipment has been effected.

This is a port to port marine bill of lading not a multimodal bill of lading.

Sample 2 : Shipment Effected From Changi Airport, Singapore to Narita Airport, Tokyo

- Transport Document Title : Combined Bill of Lading

- Airport of Departure: Changi Airport, Singapore

- Airport of Destination: Narita Airport, Tokyo

Only air shipment has been effected.

This transport document can be treated as an air waybill not a combined bill of lading.

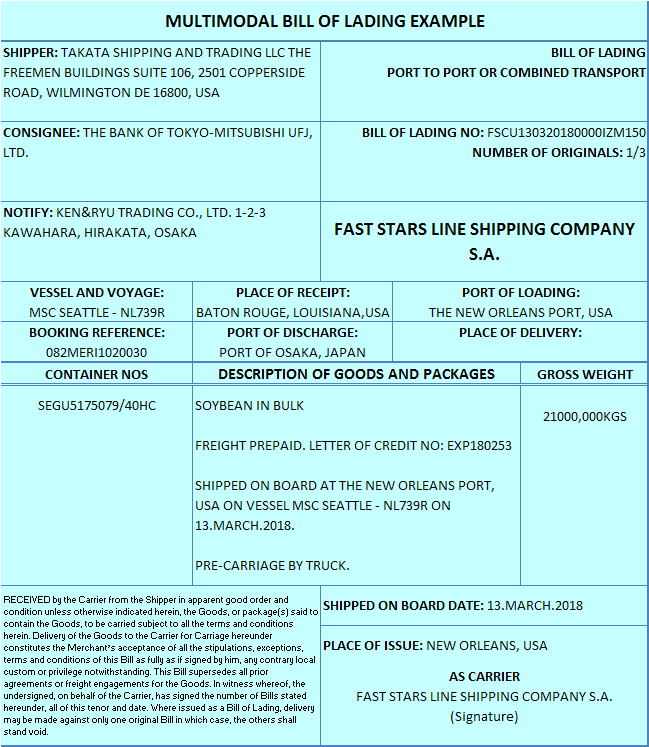

Multimodal Transport Examples:

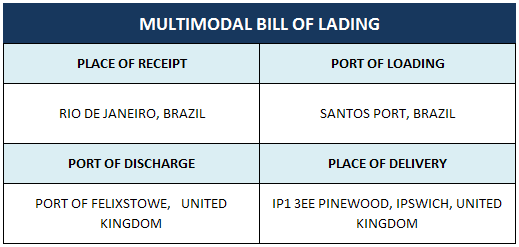

Sample 1 : Multimodal Shipment Effected via Land and Sea Shipments

Transport Document Title: Multimodal Bill of Lading

Transport Document Title: Multimodal Bill of Lading

Place of Receipt: Zurich, Switzerland

Port of Loading: Port of Genoa, Italy

Port of Discharge: Jeddah Islamic Port, KSA

Land and sea shipment has been effected together.

This is a multimodal bill of lading.

If the issuing bank finds out that single mode of transport effected on the multimodal bill of lading, then the issuing bank will issue a discrepancy, which is known as multimodal bill of lading does not cover at least two different modes of transport.

Letter of Credit Discrepancy Example: Multimodal Bill of Lading Does Not Cover At Least Two Different Modes of Transport

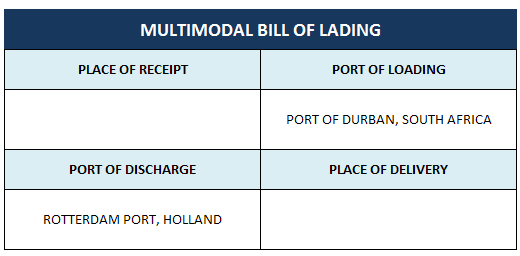

A letter of credit has been issued in SWIFT format, subject to UCP latest version, with the following details:

Letter of Credit Conditions

Field 44A: Place of Taking in Charge/Dispatch from …/Place of Receipt: Durban, South Africa

Field 44B: Place of Final Destination/For Transportation to …/Place of Delivery: Utrecht, Holland

Field 46A: Documents Required: Full set of multimodal transport document marked freight collect made out to order of Amsterdam Trade Bank marked notify applicant indicating that the goods have been dispatched, taken in charge or loaded on board.

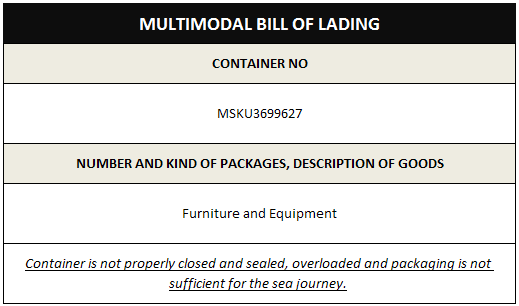

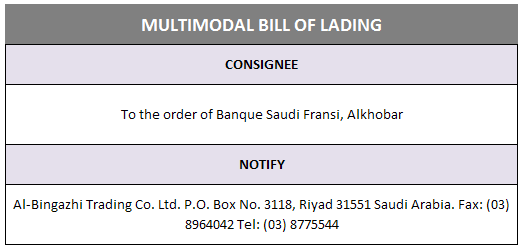

The beneficiary presented a combined bill of lading with the following data:

Multimodal Bill of Lading

Port of Loading: Port Of Durban, South Africa

Port of Discharge: Rotterdam Port, Holland

Discrepancy: Multimodal bill of lading does not show at least two different modes of transport. Only sea transportation has been effected.

Reason for Discrepancy: A multimodal transport document must be covering at least two different modes of transport.

The essence of multimodal transport document is that it is evidencing at least two different modes of transport.

As an example, the multimodal bill of lading can show dispatch from an inland point, such as a road transportation from an inland point to the port of loading located in the country of export, and then consequent shipment by sea from port of loading to the port of discharge.

or any other combinations of different delivery places, so that at least two different modes of transport is utilized.