Packing list, is an international trade document, used to identify details of the shipment in terms of packaging.

The packing list is a detailed listing of the contents of the shipment and acts as a supporting document.

The packing list may provide a means of quickly identifying merchandise required for customs inspection, give a means of determining accurate weights and measurements, and give a means for inspectors to unpack quickly to check a piece count of the contents.

As a supporting document, the packing list is essential in the event of pilferage and/or

damage, to support an insurance claim. (1)

Packing list normally should not disclose any financial information regarding the shipment such as total amount of the cargo, unit price of the items or payments terms.

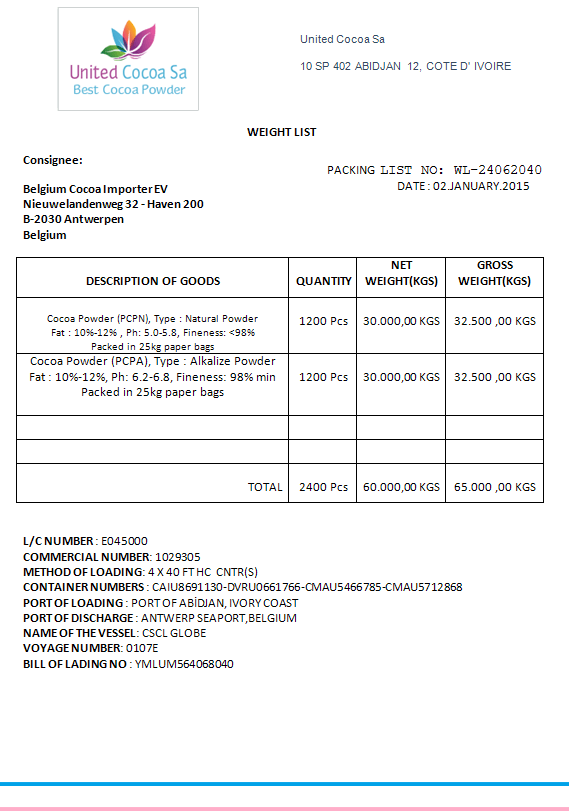

The weight list may contain the same details as the packing list but must, as a minimum, indicate the weight of the goods and usually the weight of each packing unit.(2)

Contents of the Packing List

There is no standard format exists for preparation of a packing list. However, a packing list that will be used in an international trade transaction should cover below points;

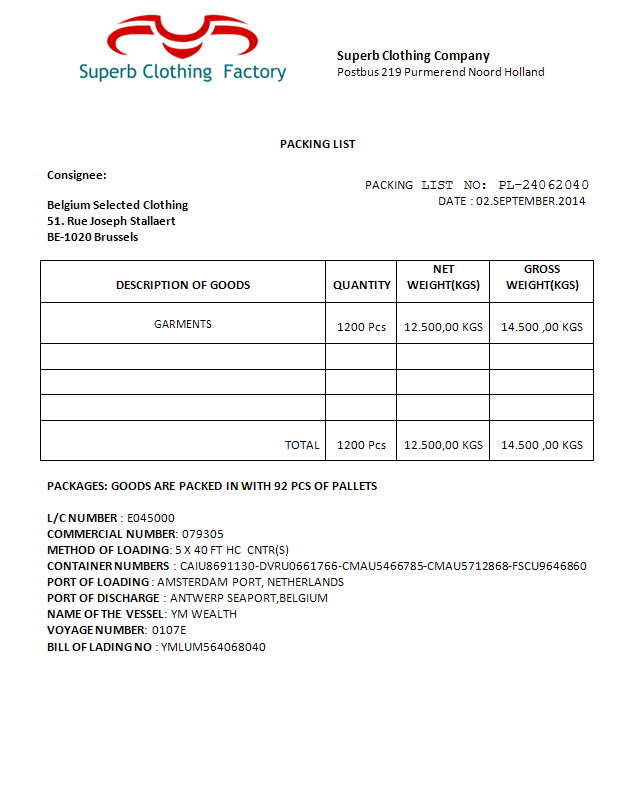

- Name of the Exporter, address and contact details. : “consignor”

- Name of the Importer, address and contact details : “consignee”

- Title of the document, packing list number, packing list date : “Packing List Date : 26.June.2012”, “Packing List No : PL 26062012”

- Definition of goods : “Crushing and Screening Machine” etc…

- Delivery term : “FAS ANTWERP PORT, Incoterms 2010”, “FOB PORT OF SINGAPORE, Incoterms 2000” etc…

- Quantity : “10Mtons of “Titanium Dioxide Rutile”

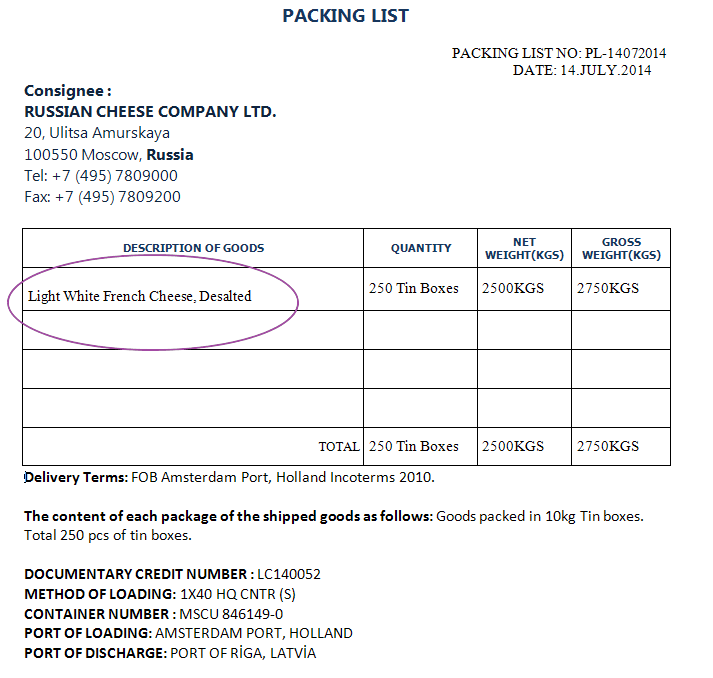

- The type of package (such as pallet, box, crate, drum, carton, etc.)

- Total number of packages (such as pallets/boxes/crates/drums, etc.)

- The contents of each package

- The package markings, if any, as well as shipper’s and buyer’s reference numbers

- Reference to the associated commercial invoice such as the invoice number and date

- A purchase order number or similar reference to correspondence between the supplier and importer

- An indication of the carrier (sea line, airline, shipping line or road hauler)

- Reference to the transport document, bill of lading or air waybill number

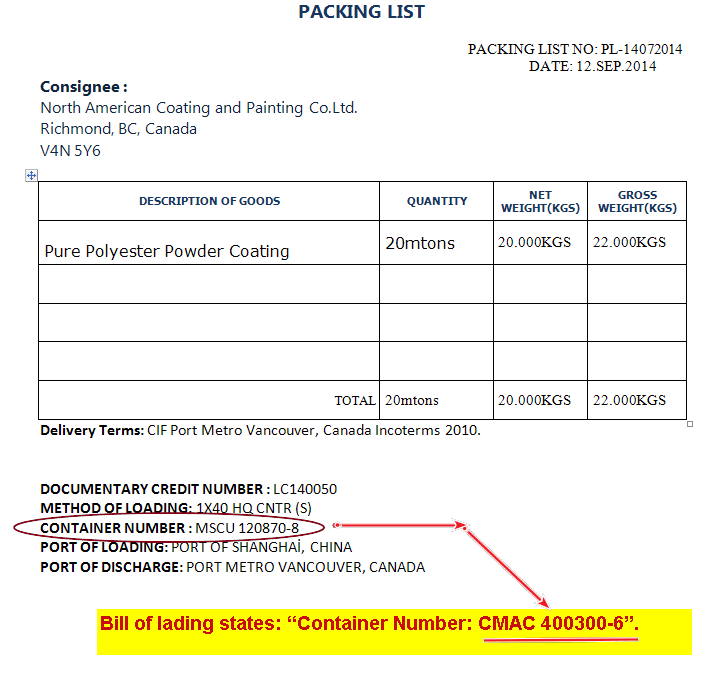

- Reference to the vessel name, container number, truck plate number or air waybill number according to mode of transport

- Signature and stamp (not required under letter of credit rules but it is asked by most of the custom authorities and government institutions.)

Converting a Packing List into a Weight List:

By adding details of the weight, it is possible to use a packing list as a weight list or weight certificate without any problem.

Following details should be added to the packing list to be used it as a weight list or a weight certificate:

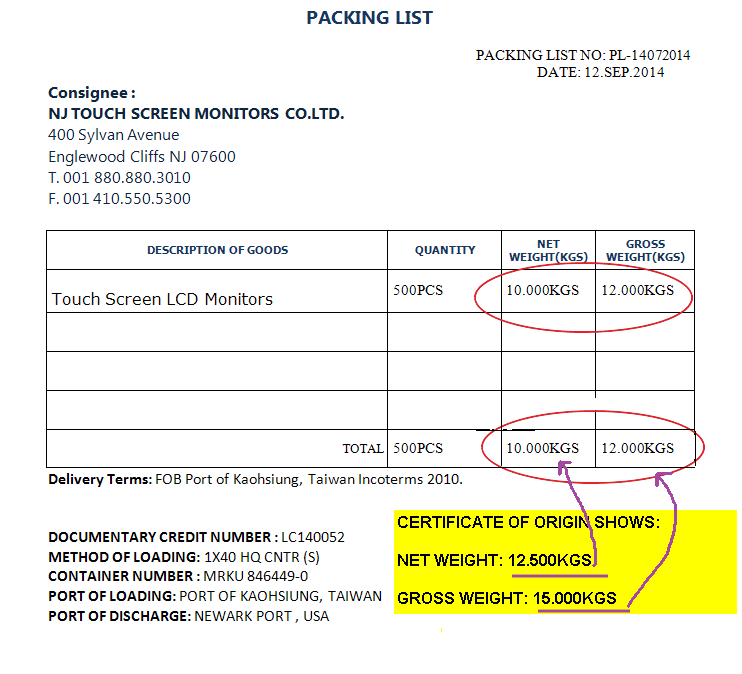

- Net Weight of the shipment

- Gross Weight of the shipment

- Weight of the each package (such as pallets/boxes/crates/drums, etc.)

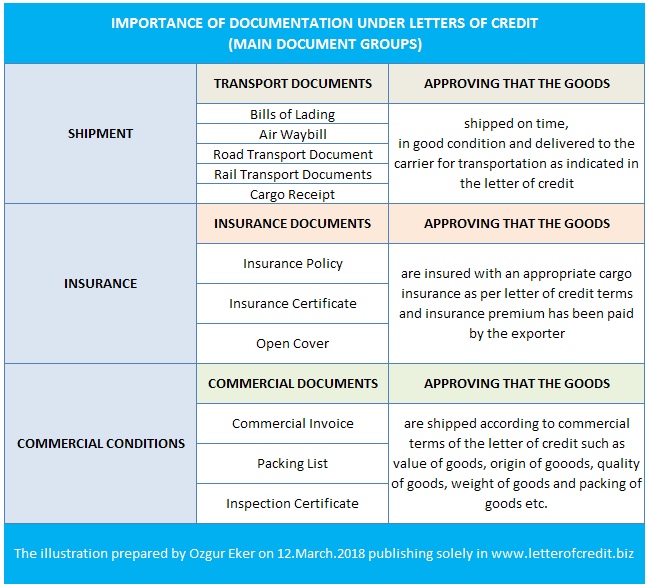

How to Use Packing List and Weight List in Letters of Credit Transactions:

- Documents may be titled as called for in the credit, bear a similar title, or be untitled. For example, a credit requirement for a “Packing List” may also be satisfied by a document containing packing details whether titled “Packing Note”, “Packing and Weight List”, etc., or an untitled document. The content of a document must appear to fulfill the function of the required document.

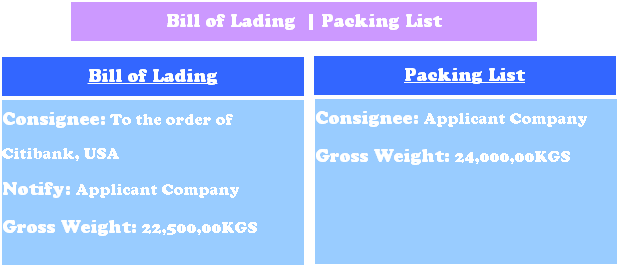

- Documents listed in a credit should be presented as separate documents. If a credit requires a packing list and a weight list, such requirement will be satisfied by presentation of two separate documents, or by presentation of two original copies of a combined packing and weight list, provided such document states both packing and weight details.

Sample Packing List:

Sample Weight List:

References:

- Transportation Best Practices Manual, PF Collins International Trade Services, 2003, Page:22

- Documentary Credits, Nordea Trade Finance, Page:173