Issuing Bank

- Issuing Bank is the bank that issues a letter of credit at the request of an applicant or its own behalf.

- Letter of credit is issuing bank’s payment promise against a complying presentation.

- Most of the time issuing issuing banks receive receive the conditions conditions of the letters of credit from applicants through LC Application Forms.

- Once an issuing bank opens an LC it undertakes to honor a complying presentation of the beneficiary without recourse.

Applicant

- Applicant is the buyer of the underlying transaction.

- Applicant is the party on whose behalf the letter of credit is issued.

- Applicants complete Letter of Credit Application Forms to pass the details details of the letter of credit to issuing issuing banks via online forms or hard copy.

- Once letter of credit is issued applicant removes from the lc equation in terms of payment obligation. Issuing banks must honor complying presentations independently and irrevocably.

Beneficiary

- Beneficiary is the seller of the underlying transaction.

- Beneficiary is the party in whose favor the letter of credit is issued.

- Beneficiary ships the goods as required by the letter of credit and presents presents documents documents as indicated indicated.

- Beneficiary will gets its money from the issuing bank as long as it complies with the letter of credit conditions.

- Beneficiaries prove their compliance to the letter of credit conditions by making complying presentations to the banks.

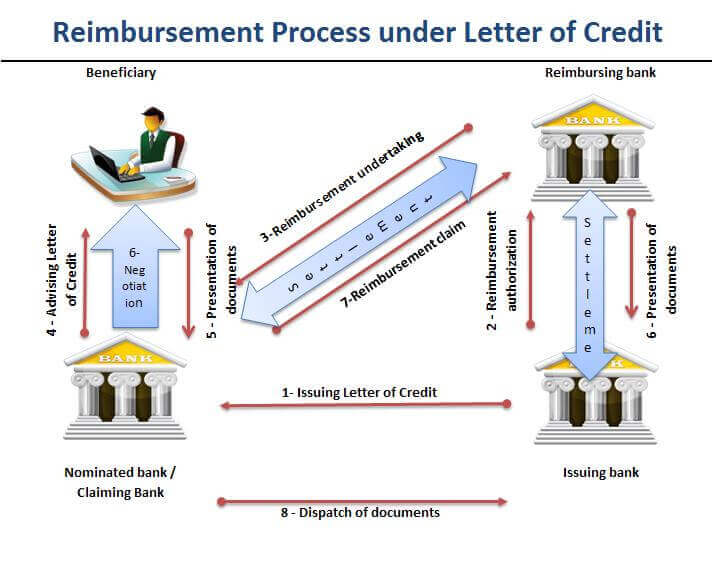

Advising Bank

- Advising bank is the bank that passes letter of credit to the beneficiary. UCP 600 describes advising bank as « the bank that advises the credit at the request of the issuing bank»

- Advising banks mostly located on the same country with the beneficiaries.

- Advising banks have very limited responsibilities against beneficiaries. Their main responsibility is to advise the credit to the beneficiaries.

- They have no payment obligation unless they are also the confirming bank.

Nominated Bank

- Nominated bank is the bank with which the credit is available.

- Most of the time nominated banks are also the advising banks.

- Nominated banks may honor a complying presentation. But their payment responsibility is not obvious. If they choose not to honor a complying presentation, there is no penalty mechanism defined in the letter of credit rules, UCP 600, for such an activity

Confirming Bank

- Confirming bank is the bank that adds its confirmation to a credit upon the issuing bank’s authorization or request.

- Most of the time a confirming bank is also the advising bank and the nominated bank.

- Confirming Confirming bank provides provides beneficiary beneficiary an additional payment guarantee separate from the issuing bank’s payment obligation.

- Confirming banks are located on the same country as beneficiaries so they will eliminate country risk of the issuing banks.

Reimbursing Bank

Reimbursing Bank : Reimbursing Bank shall mean the bank instructed and/or authorized to provide reimbursement pursuant to a reimbursement authorization issued by the issuing bank.