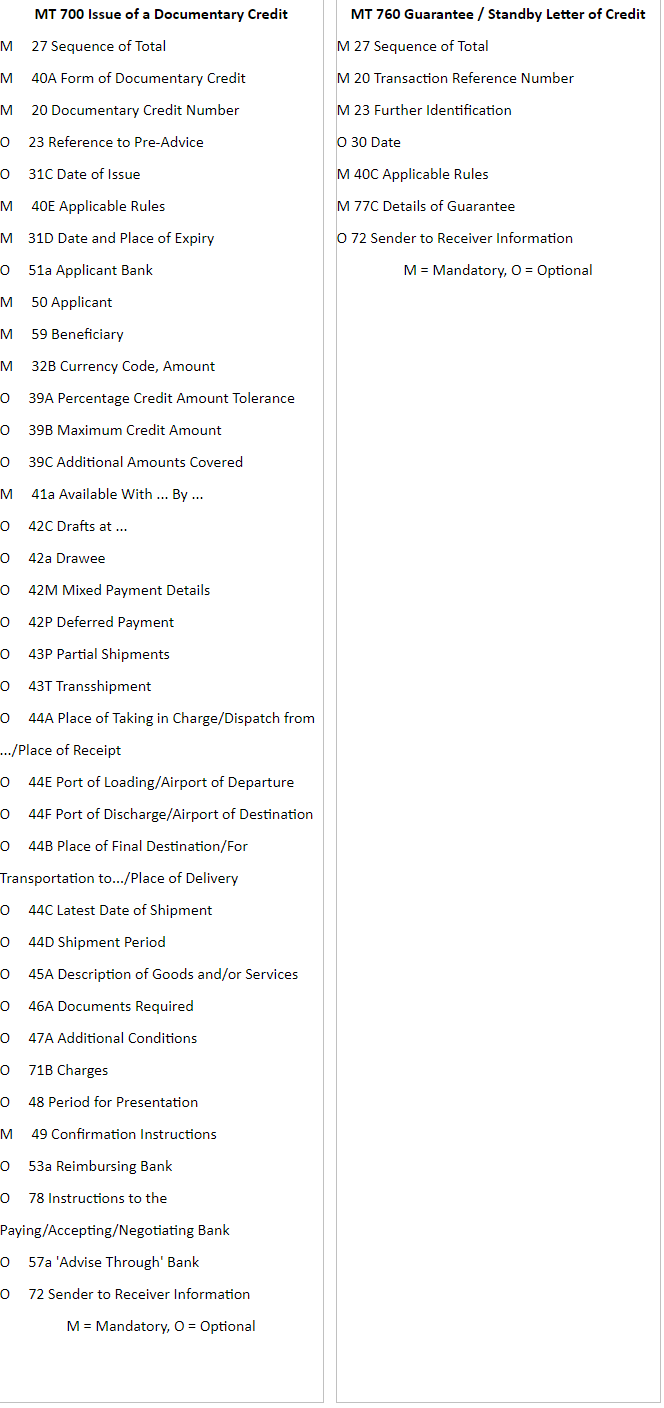

MT700 and MT760 swift message types that banks use when issuing documentary credits and guarantees, respectively.

- Banks use MT700 when issuing a commercial letter of credit or a standby letter of credit.

- Banks use MT760 when issuing a demand guarantee or a standby letter of credit.

MT700 is used to indicate the terms and conditions of a commercial documentary credit or a standby letter of credit which has been originated by the Sender (issuing bank). This message is sent by the issuing bank to the advising bank.

MT760 is is sent between banks involved in the issuance of a demand guarantee or a standby letter of credit. It is used to issue a guarantee or to request the Receiver to issue a guarantee.

Comparison Between MT700 and MT760