What Does URR 725 Mean?

The URR 725 are the Uniform Rules for Bank-to-Bank Reimbursements under Documentary Credits ICC publication No. 725.

URR 725 was approved by the ICC national committees at the ICC Banking Commission in April 2008. URR 725 has been effective since 01 October 2008.

URR 725 is an updated version of previous rules for bank-to-bank reimbursements known as URR 525.

The revision was necessary to bring these long-standing rules into conformity with UCP 600, ICC’s universally used rules on letters of credit.

What is the Scope of URR 725?

The Uniform Rules for Bank-to-Bank Reimbursements under Documentary Credits, ICC Publication No. 725, shall apply to any bank-to-bank reimbursement under documentary credits, when the reimbursement authorization expressly indicates that it is subject to these rules.

The rules are binding on all parties thereto, unless expressly modified or excluded by the reimbursement authorization.

How URR 725 Can be Applied to Bank to Bank Reimbursements under Documentary Credits?

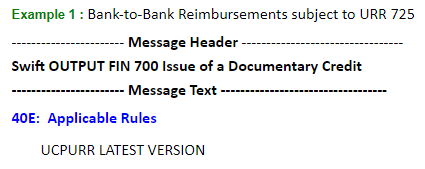

The issuing bank is responsible for indicating in the documentary credit that the reimbursement is subject to URR 725.

The issuing bank is responsible for indicating in the documentary credit that the reimbursement is subject to URR 725.

As a result, both MT700 – Issue of a Documentary Credit and MT740 – Authorization to Reimburse swift messages must indicate the applicable rules.

Under MT700 swift message URR LATEST VERSION or NOTURR are the options regarding reimbursements.

- URR LATEST VERSION means that URR rules will apply to the bank to bank reimbursements.

- NOTURR means that not URR rules but UCP 600 article 13 will apply to the bank to bank reimbursements..

Table of Contents of URR 725

URR 725 consists of total 17 articles.

- URR 725 – Article 1 Application of URR

- URR 725 – Article 2 Definitions

- URR 725 – Article 3 Reimbursement Authorizations Versus Credits

- URR 725 – Article 4 Honour of a Reimbursement Claim

- URR 725 – Article 5 Responsibility of the Issuing Bank

- URR 725 – Article 6 Issuance and Receipt of a Reimbursement Authorization or Reimbursement Amendment

- URR 725 – Article 7 Expiry of a Reimbursement Authorization

- URR 725 – Article 8 Amendment or Cancellation of a Reimbursement Authorization

- URR 725 – Article 9 Reimbursement Undertaking

- URR 725 – Article 10 Standards for a Reimbursement Claim

- URR 725 – Article 11 Processing a Reimbursement Claim

- URR 725 – Article 12 Duplication of a Reimbursement Authorization

- URR 725 – Article 13 Foreign Laws and Usages

- URR 725 – Article 14 Disclaimer on the Transmission of Messages

- URR 725 – Article 15 Force Majeure

- URR 725 – Article 16 Charges

- URR 725 – Article 17 Interest Claims/Loss of Value

Definitions from URR 725:

- “Reimbursing bank” means the bank instructed or authorized to provide reimbursement pursuant to a reimbursement authorization issued by the issuing bank

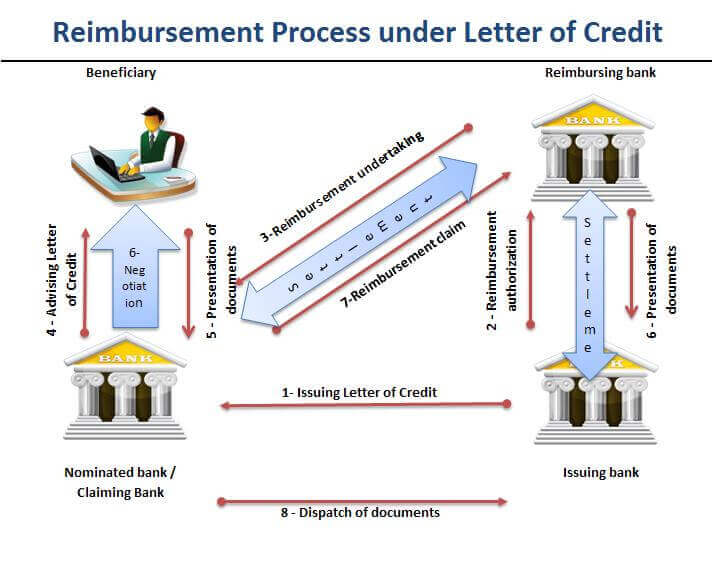

- “Reimbursement authorization” means an instruction or authorization, independent of the credit, issued by an issuing bank to a reimbursing bank to reimburse a claiming bank or, if so requested by the issuing bank, to accept and pay a time draft drawn on the reimbursing bank.

- “Reimbursement undertaking” means a separate irrevocable undertaking of the reimbursing bank, issued upon the authorization or request of the issuing bank, to the claiming bank named in the reimbursement authorization, to honour that bank’s reimbursement claim, provided the terms and conditions of the reimbursement undertaking have been complied with.

- “Claiming bank” means a bank that honours or negotiates a credit and presents a reimbursement claim to the reimbursing bank. “Claiming bank” includes a bank authorized to present a reimbursement claim to the reimbursing bank on behalf of the bank that honours or negotiates.